Connecting with NextDC

Recommendation

You won't go far wrong in investing by ignoring stocks with price-earnings ratios in three figures. Or so you might think, for looks can be deceiving.

One of the best-performing stocks of the past 20 years has been Amazon, and it has rarely had a PER below three figures. Closer to home, we've had Xero, which is priced at 200 times its earnings for 2019 – the first year it's expected to deliver any.

Somewhat less dazzling than these power stocks, though perhaps no less interesting as an investment, is data centre operator NextDC.

A $1.2bn market capitalisation may seem excessive for a company that reported a net profit of just $2m in 2016, but the high multiple obscures more than it reveals. The business's earning power isn't reflected in the reported numbers now, but that will come. Before we can explain why, though, we need to ask a more basic question: what makes data centres attractive?

Key Points

-

Business quality not evident in numbers

-

Revenue is sticky and growing

-

Watch for weakness

Why the data centre?

If you have watched a series on Netflix, used Google or bought anything online, you have more than likely used a data centre. It is in these enormous buildings that the physical internet – a collection of servers, connections and switches – is housed.

This isn't new: using servers to store and retrieve data has been part of modern life for decades. The change comes from how data is managed.

Whereas businesses once housed data on their premises or in individually owned centres, they are now outsourcing this function to larger, specialised facilities. There are two main reasons for the change.

The first comes down to the explosive growth in data generation. The past two years has seen more data generated that the previous 5,000 years of human history. The sheer volume of data needs to be matched by ways of storing and retrieving it which brings us to the second factor: the increased use of data stored in the 'cloud'.

As more services like video, music and business software are delivered over the internet, the need to secure and store that data grows. Although the cloud has been around for at least a decade, Amazon Web Services and Microsoft Azure have made it mainstream.

This is as true in Australia as anywhere. Domestic data consumption has been growing at 50% per year and is a significant driver of data centre services.

BYO server

Here is how it works: NextDC scouts for locations and builds a data centre which it owns and operates.

It then leases out space in said data centre to clients who pay upfront fees, ongoing rental fees and connection charges. All this is harder than it appears.

Site selection is crucial. The ideal location is free of fire, weather and seismic risks, well connected with fibre and ample power and relatively close to customers.

NextDC must build layers of security, cooling and power redundancy into each facility. Sydney's S1 facility, for example, houses body scanners, gas for fighting fires, water for cooling air and huge diesel generators. Power is cleaned before being used and constantly monitored for outages.

A large facility can cost up to $150m to build and the cost is spent upfront while utilisation takes time to grow. This mismatch – spending large licks of cash upfront and earning revenue later – makes returns appear unflattering but operating margins increase as utilisation rises.

Additional customers don't cost much to serve but generate steady recurring revenue that grows with inflation. About 90% of revenue is recurring and churn across the industry is just 2%, suggesting the only customers to leave data centres are those that go bust.

NextDC's earliest data centre in Brisbane, named B1, offers a glimpse of the potential returns. Here, utilisation is about 93% and it is the oldest asset in the portfolio.

As you can see from Table 1, earnings before interest, tax, depreciation and amortisation (EBITDA) margins of 55% expand to over 75% as utilisation grows from 40% to 90%. We expect margins to continue to expand slowly for two reasons: contracted revenues rise with inflation and revenue from connecting servers together will grow over time.

| 2H13 | 1H14 | 2H14 | 1H15 | 2H15 | 1H16 | 2H16 | 1H17 | |

| Billed utilisation (%) | 43 | 52 | 66 | 71 | 78 | 90 | 93 | 93 |

| Revenue ($m) | 2.1 | 3.3 | 4.3 | 5.0 | 5.7 | 6.9 | 6.9 | 7.4 |

| EBITDA ($m) | 1.2 | 2.2 | 3.1 | 3.7 | 4.2 | 5.3 | 5.1 | 5.6 |

| EBITDA margin (%) | 55 | 65 | 72 | 74 | 73 | 77 | 74 | 76 |

The last point is crucial to the success of the model.

The Westfield model

Physically connecting servers in the same data centre promises greater speed, security and lower costs to customers. It has arguably been the key benefit driving customers to ‘co-location' data centres, or centres with many different customers.

An internet service provider can offer unmetered Netflix because servers are connected in a data centre; a law firm may want to connect to servers of clients for secure, private connections. There are thousands of reasons to connect servers and, as more customers enter the data centre network, connection possibilities grow.

These direct server connections, known as ‘cross connects' create a key competitive advantage.

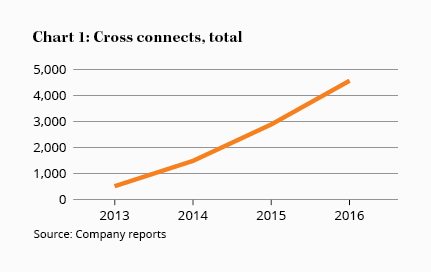

There are now about 5,500 cross connections across the NextDC portfolio and this is growing swiftly (see Chart 1). Two years ago, NextDC's average customer had five cross connects; they now have seven and each connection generates about $100 per month in revenue.

Connections increase as utilisation grows. Equinix, which has more mature centres collects 15% of its revenue from connection fees compared to NextDC's 6% and an even higher proportion of profit.

Cross connects not only provide glorious margins, they discourage customers from leaving. More connections are harder to abandon so encouraging them is good for both profits and retention.

To that end, NextDC runs a model copied straight from Westfield. That business doesn't make much margin from large anchor tenants like Woolworths and Myer but uses those brands to drive traffic that allow it to demand higher margins from small retailers.

NextDC does the same thing, encouraging desirable connectors into their centre at cheaper rates to attract customers wanting to connect to their servers.

What's it worth?

Valuing this type of business can be tricky. The business is not yet at scale, so simply sticking a multiple on last year's earnings is not the right way to value it.

To complicate matters, NextDC is investing heavily in new data centres and is currently building three additional facilities. To fund these developments, it will take on debt so the current net cash position will reverse to about $300m in debt in a few years.

That need not be a bad thing. As returns from the Brisbane facility illustrate, the business can generate returns on capital of over 20%. No wonder the business is flat out building as many as it can.

One way to think about the valuation is to consider the value of the current portfolio of five assets and use the value of new assets to bake in a margin of safety (see Table 2).

| M1 | S1 | P1 | C1 | B1 | |

| Startup | 2012 | 2013 | 2014 | 2012 | 2011 |

| Capacity, (MW) | 15 | 14 | 6 | 5 | 2.25 |

| Fit out capex, ($m) | 120 | 114 | 45 | 15 | 30 |

| Utili. Built capacity (%) | 86 | 82 | 33 | 29 | 93 |

| Utili. Planned capacity (%) | 86 | 82 | 15 | 4 | 93 |

| Revenue ($m) | 43 | 26 | 5 | 1 | 14 |

| EBITDA ($m) | 31 | 15 | (0.2) | (3) | 10 |

| EBITDA margin (%) | 72 | 58 | – | – | 75 |

| Asset value ($m) | 104 | 102 | 40 | 13 | 27 |

| Return on assets (%) | 29 | 15 | 0 | (20) | (39) |

Revenue is contracted on a power output basis. The company has a current capacity of 43 megawatts (MW) and is building a further 61MW over the next three years. We will only focus on the value of the existing portfolio.

Using historic data, the business generates average annualised revenue of $4m per MW which translates to about $160m in revenue if we assume a utilisation rate of 90%.

Margins of 70% would deliver $110m in EBITDA. If we assume a further 20% of revenue is needed for asset maintenance, we should expect EBIT of about $80m from the five existing data centres.

NextDC currently carries net cash but we will add some debt into the structure for an enterprise value of $1.3bn at the current share price of $4.50. That suggests we are paying an EV/EBITDA multiple of 12 times, or an EV/EBIT multiple of 16 times for the current portfolio at 90% utilisation.

Even considering the stability and quality of earnings, that isn't cheap. The current price appears to bake in growth from new developments or, in the parlance of value investors, there is little margin of safety.

An asset valuation comes to the same conclusion. Using balance sheet assets of $360m and a 25% rate of return, we think the existing portfolio might be worth a little over $1bn, or about $3.80 per share.

These are imperfect estimators but they both suggests that NextDC is not yet cheap enough to buy.

There are several risks that are not compensated for. The most pressing is that high demand and high rates of return could lead to excess industry capacity and falling rates of return.

We are also relying on the capital allocation skills of management and, as we have seen in other capital intensive sectors, upfront costs combined with delayed revenue can create problems.

NextDC is a high-quality business where the strengths of its economics are not yet clear in its accounts. It is a worthy addition to our coverage list but not yet cheap enough to add to the buy list. We will watch, wait and hope for lower prices. HOLD.

Join the Conversation...

There are 12 comments posted so far.

If you'd like to join this conversation, please login or sign up here

Interesting Facts and Q&As about this topic...

analysts@intelligentinvestor.com.au

Data centers are attractive investments because they house the physical infrastructure of the internet, such as servers and connections. With the explosive growth in data generation and the increased use of cloud services, the demand for secure and efficient data storage and retrieval has skyrocketed. This trend is driving the need for specialized data centers like those operated by NextDC.

NextDC generates revenue by leasing out space in its data centers to clients. Clients pay upfront fees, ongoing rental fees, and connection charges. About 90% of NextDC's revenue is recurring, which provides a steady income stream. Additionally, the company earns from 'cross connects,' which are direct server connections within the data center, offering greater speed, security, and lower costs to customers.

The high PER of NextDC can be misleading because it doesn't fully reflect the company's earning power. The business is still in a growth phase, investing heavily in new data centers. As these facilities become fully utilized, operating margins are expected to increase significantly, making the current PER less relevant for long-term investors.

Investing in NextDC comes with several risks. High demand and high rates of return could lead to excess industry capacity and falling rates of return. Additionally, the company relies heavily on the capital allocation skills of its management. The upfront costs combined with delayed revenue can create financial challenges, especially in a capital-intensive sector like data centers.

NextDC's business model is similar to Westfield's in that it uses large, desirable tenants to attract smaller customers. Just as Westfield uses anchor tenants like Woolworths to drive traffic to its malls, NextDC attracts key connectors to its data centers at cheaper rates to draw in other customers who want to connect to those servers. This strategy helps in generating higher margins and retaining customers.

'Cross connects' are direct server connections within a data center that offer greater speed, security, and lower costs to customers. They are a key competitive advantage for NextDC, as they not only provide high margins but also make it harder for customers to leave. More connections mean better retention and higher profitability.

While NextDC is a high-quality business with strong growth potential, its current price may not offer a sufficient margin of safety for value investors. The stock appears to be priced with future growth already factored in, making it not yet cheap enough to buy. Investors are advised to watch and wait for lower prices before considering an investment.

Recommendation