Taking a fresh look at SDI

Australian based dental products manufacturer SDI recently reported half-year results roughly in line with expectations.

As a reminder, SDI is run by the Cheetham family, and has a long history of manufacturing and distributing dental products, including amalgam, tooth whitening to dental surgeries and composite restorative products.

Demand for grey amalgam fillings has steadily declined over the years as they are replaced by tooth coloured composite based fillings. Although amalgam remains popular in third-world countries, SDI can benefit from the expected shift towards higher-value restorative products in developed nations. Over the years a huge amount of intellectual property has been developed, with three new products released last year and expectations of more to follow.

The most successful new product has been the glass ionomer cement which now represents about 15 per cent of sales ($10 million). This is a dental restorative material used in dentistry for dental fillings and luting cements.

Tooth whitening has remained a steady earner with it comprising about 20 per cent of company sales. SDI is a leader in many regions for sales direct to the dental surgery. This is a premium $500-$1000 product, and a $500m global market. At this stage the company hasn't entered the lower margin over the counter market that is dominated by Colgate.

3M and Colgate are SDI's two largest competitors. It then has many smaller competitors that vary depending on location.

With the company's improved profitability over recent years, it has been able to step up the sales and marketing efforts overseas. Management has guided to a positive impact from the expanded team with a particular focus on Europe and America. The company is also developing a new facility which will open up sales in Brazil and Latin America.

Half-year result details

A 32.3 per cent increase in profit before tax to $3.7m only translated to a flat net profit after tax result. The reason for this is due to a normalisation in the tax rate after an abnormally low rate last year relating to research and development (R&D) tax concessions. Going forward we are forecasting a 25 per cent tax rate.

Cash flow was weak due to a large inventory build-up which was described by management as a seasonal factor.

With 90 per cent of sales exported to 100 different countries, currency movements are a critical driver of results. In the first half the net effect of currency movements was flat. In the second half we are assuming that the benefits of the lower Australian dollar against the US dollar are offset by movements in the Euro and Brazilian Real.

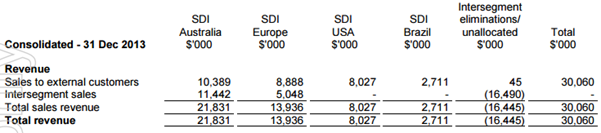

The table above displays the regional breakdown for the first half result. The movement in the Euro particularly is likely to outweigh the benefits of a lower Australian dollar against the US dollar.

The silver price is another large driver as it represents a high percentage of input costs. The company selectively hedges its exposure, but this becomes difficult to manage if there are any sudden sharp movements.

Succession planning

The company has been planning for some time now that Jeffery Cheetham will transition to be chairman and focus on the R&D of new products. Taking over as managing director will be his daughter Samantha, working alongside her three brothers.

The family are large shareholders, and the risk is that they compromise the company's growth potential to maintain control and keep earning a very healthy salary. While the family retains a lot of intellectual property with its years of experience, the uncertainty remains whether there is alignment with minority shareholders and all growth opportunities are being pursued given the global nature of the business.

Earnings outlook and valuation

SDI is on track to grow revenue from $65m in FY14 to $70m this year depending on currency movements. Our FY15 net profit forecast is up from $6.47m in FY14 to $7.1m in FY15. The price-earnings (PE) multiple of 10 is not expensive, but unfortunately it appears the company won't benefit from the lower Australian dollar against the US dollar as we had previously assumed.

The largest uncertainty with SDI is the rate of decline for amalgam and to what extend the company can pick up the slack with new product development. This will involve further R&D costs, as well as investment in the Bayswater manufacturing facility to ensure efficiency improvements.

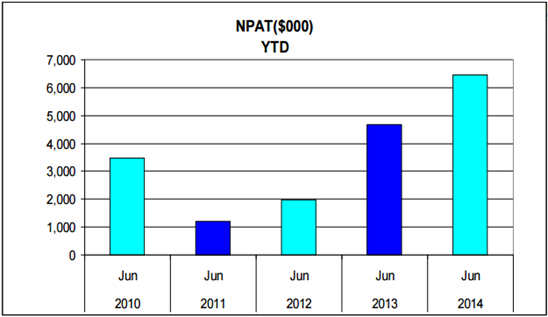

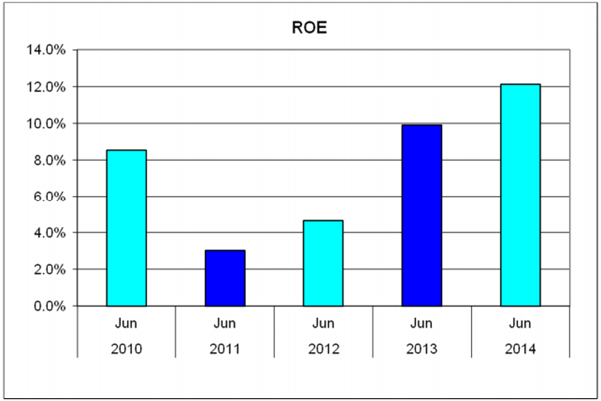

The graphs above display a positive trend in profit growth and return on equity. But it needs to be remembered that part of this is a recovery from operational challenges including a much higher silver price in 2011.

We have slightly downgraded our forecasts and our previous $0.75 discounted cash flow valuation has declined to $0.68. We have also downgraded our “buy” recommendation to “hold”.

To see SDI's forecasts and financial summary, click here.