Mobileye: Pioneering automated driving

Mobileye NV is a pure play in machine vision (necessary for an autonomous car) and a major player in advanced driver assistance technology or ADAS.

Mobileye has a market capitalisation of $US8.9 billion and currently has an 80 per cent market share of what may be the most powerful trend to hit the automotive industry.

Whether you believe that self-driving automobiles are on their way or not, vehicles with advanced driver assistance systems (ADAS) are proliferating rapidly. That's why I like Mobileye.

Mobileye is an Israeli company, headquartered in the Netherlands and trades on NASDAQ in the US under the symbol MBLY. Mobileye NV has developed leading edge automated driver assistance technologies. Its monocular vision platform helps drivers improve safety, avoid accidents, and revolutionizes the way individuals drive. The company's products contain proprietary software algorithms bundled on its revolutionary EyeQ system-on-chip (or IC) and are integrated into vehicle electronic and control systems.

Mounted at eye level, these systems recognize signage, roadway features, other vehicles, and of course objects such as cyclists, pedestrians and road hazards.

All of Mobileye's proprietary image-processing algorithms run on the EyeQ chip which took eight years to develop. The IC and software algorithms are sold as commercial products to original equipment manufacturer (OEM) customers. The company's first clients were automotive manufacturers such as BMW, General Motors and Volvo, whose electronics suppliers integrated Mobileye's technology into their cars, first as an optional accessory, and later as a standard fit in some new cars.

Now over 28 global auto manufacturers and suppliers are using Mobileye's products including Audi, BMW, Toyota, GM, Ford, Honda, Peugeot Citroen, and Hyundai as well as the Chinese OEMs.

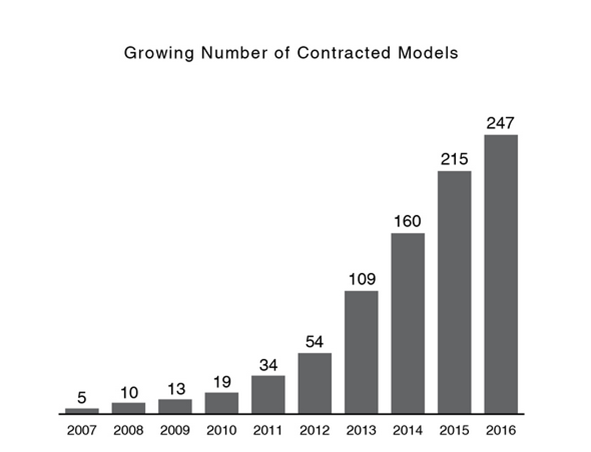

Mobileye technology is now available in over 160 car models and the company has flagged up to 247 car models by 2016.

Mobileye's strategy is centred on the use of monocular cameras but will also introduce a “tri-focal” system (the EyeQ3) as automobiles continue to evolve from semi to fully autonomous and need perfect recognition of all objects on the road.

The company's products operate with the many and varied ADAS technology applications for drivers include adaptive cruise control, adaptive high beam control, autonomous emergency braking or AEB and dynamic brake support, forward collision warning, headway monitoring and warning, lane departure warning, lane keeping, and construction zone assistance.

Mobileye went public in July 2014 priced at $US25 and was trading at $US60 by October. Subsequently the shares have retraced a good part of that gain as many hot initial public offerings (IPOs) usually do. I believe where it is now – in the low $US40s – is a good point to pick up some shares.

Why? Well, other than the proprietary disruptive machine vision technology, the company has been hitting a number of important milestones as a public company.

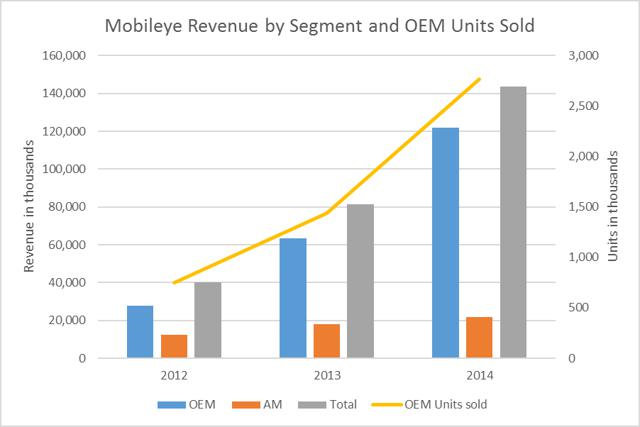

First, Mobileye's financial performance has exceeded original IPO expectations and analysts' estimates. Its fourth quarter results released on February 26, 2015 – which marked its second earnings release as a public company – beat consensus estimates.

More importantly, the guidance for 2015 was also above market expectations. Mobileye flagged revenues for 2015 would be $US217-218 million, up 51 per cent compared to the previous year, and earnings per share (EPS) of US39 cents, up 90 per cent.

Second, in spite of being in a hyper-growth phase with operating expenses growing some 25 per cent per annum, the business remains cash generative with $US50.8m (up 98 per cent year-on-year) of free cash flow in 2014 – above net income of $US46.8m.

Third, more auto original equipment manufacturers (OEMs) and suppliers continue to added with Valeo, one of the world's largest automotive component suppliers and a leader in driver assistance systems, entering into a technology sharing agreement under which it will use Mobileye's EyeQ product family in any front facing cameras. The two companies also plan to develop a joint product for automated driving.

ADAS demand will be driven as much by regulators as consumers over the next decade. The EU new car assessment program (NCAP) is awarding higher ratings (4 and 5 stars) to cars with automatic emergency braking. It is expected that by 2017 all cars will need ADAS to achieve a 4 star rating. In the US the National Highway Traffic Safety Administration recently announced it was adding two automatic emergency braking systems to its recommended safety features.

While not a regulatory mandate, that's a strong endorsement. Consumers and auto makers will take note. Mobileye is the clear leader in this application and is about to launch camera only full automatic braking with Audi.

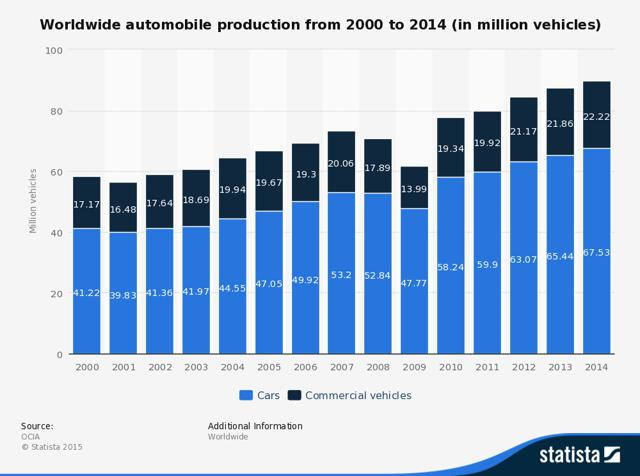

Needless to say the ADAS addressable market (essentially the global automotive market) for Mobileye is huge and growing.

Mobileye sold 2.5 million units to OEMs in 2014 – roughly 4 per cent of models manufactured in 2014. Conceivably, Mobileye could capture up to 15-20 per cent of the market over the next decade. The aftermarket (AM) is still a small percentage (but profitable) of total units sold.

Management

In 1999 Mobileye was founded in Israel by Amnon Shashua (currently chief technical officer and chairman), professor of computing science at Tel Aviv University and an expert in computer vision and machine learning, and Ziv Aviram (President, chief executive and director) an experienced Israeli entrepreneur. Today they both still own 8 per cent of the outstanding shares of the company.

Financials and Valuation

Mobileye is a high (or hyper as I prefer) growth company. During 2013/2014 it grew revenues 77 per cent.

From 2014 to 2017 revenues are expected to grow 55 per cent each year to $US528m and EPS 77 per cent a year to $US1.17.

Consensus 2017 earnings give a forward multiple of 29 times which suggests that analysts believe future growth will normalise in the 25-30 per cent range. However, total ADAS penetration is less than 20 per cent so many of these safety features will “trickle down” from premium brands to mass market cars. Given the absolute necessity for products like Mobileye to be part of fully autonomous vehicles, this multiple is probably too low.

Using a discounted cash flow (DCF) valuation with $US1.6bn of terminal free cash flows by 2025 yields a price of $US62 (discount rate of 10 per cent).

A target price of $US62 (50 per cent above current levels) would reflect core earnings power of roughly $US2.25. That's a 27 times multiple – not excessive in my opinion.

Risks

- Technology adoption: Mobileye depends on the adoption of ADAS/autonomous vehicles and the use of monocular cameras (followed by trifocal). Slower ADAS penetration and changes in regulation or better technology from competitors are risks.

- Reliance on STM as sole manufacturer: Mobileye relies solely on STMicroelectronics NV to manufacture the EyeQ chips. STM manufactures chips at one factory in France.

- Liabilities related to ADAS/autonomous: The ADAS and autonomous markets are still in the earlier phase of development, and so are any related legal precedents. Mobileye could incur material costs as a result of alleged product defects, product liability suits, as well as warranty and recall claims.

- Dependency on founders: Mobileye is highly dependent on the expertise and leadership of its founders, Professor Amnon Shashua and Mr Ziv Aviram.

- Macroeconomic: Despite its attractive secular growth attributes, Mobileye still sells products into a cyclical industry that can be exposed to macro and/or geopolitical shocks.

To see Mobileye's forecasts and financial summary, click here.