What the Reserve Bank of Australia has said and done

Mark the day, 3 May 2022, as the first time 1.2 million Australians were told they would experience a rate rise on their variable home loan due to the RBA. This is the number of first-home owners who have purchased a house or dwelling since November 2010. For some, it may come as a shock.

The RBA moving the cash rate from 0.1 per cent to 0.35 per cent in the scheme of things is marginal. The Bank is correct in pointing out that inflation is higher than expected at 5.1 per cent and on a trimmed-mean (core) rate of 3.7 per cent. This means core inflation is now above its target range of 2 to 3 per cent and heading higher.

It is also true for the Bank to highlight that the employment market is nearing full potential, with the unemployment rate now (just) below 4 per cent. Moreover, according to the RBA’s business liaison, wages are climbing for the first time in many years.

The Board also points to how resilient the Australian economy has been over the COVID pandemic. Economic growth has been stronger than expected and is likely to be at or above 4 per cent come December 2022 before easing into 2023 and 2024, something we didn’t experience in the aftermath of the Global Financial Crisis.

All this was used to justify raising the cash rate from ‘emergency level policy’ and onto a path of ‘normalisation’. Thus, we got a 0.25 per cent rise.

It is important to realise what the RBA also stated about future interest rate rises.

Here is the core line:

“The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead.”

To put that line into context – here is what the bank is forecasting inflation will be over the coming 2.5 years:

“A further rise in inflation is expected in the near term, but as supply-side disruptions are resolved, inflation is expected to decline back towards the target range of 2 to 3 per cent. The central forecast for 2022 is for headline inflation of around 6 per cent and underlying inflation of around 4¾ per cent; by mid 2024, headline and underlying inflation are forecast to have moderated to around 3 per cent. These forecasts are based on an assumption of further increases in interest rates.”

Yes, the Bank believes inflation will hum along at over 3 per cent for the remainder of 2022 to the end of 2024, even with increases in interest rates, which is slightly concerning.

We then heard at the unplanned media conference on Tuesday afternoon that Governor Lowe believes the ‘neutral rate’ – where the cash rate is neither accommodative or tightening economic activity is ‘near to 2.5 per cent’. He stated that he doesn’t want to speculate when that level would be reached but would like to ‘achieve this level into the future’.

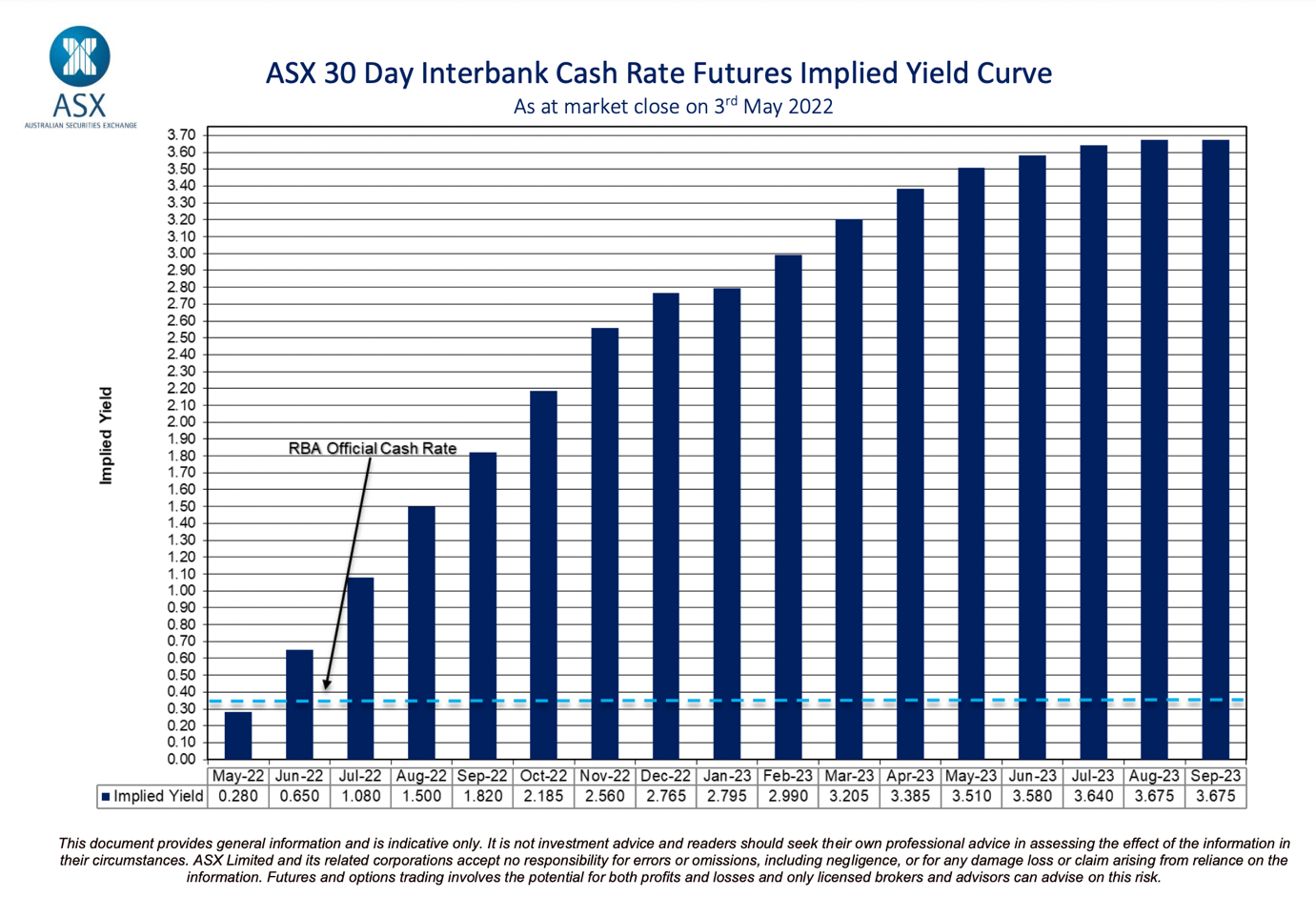

This is how the market took those comments:

Above is the chart of the 30-day interbank market. It is a forward contract trying to predict where the cash rate will be all the way out to September 2023. We need to concentrate on December 2022 as any further ahead probably is too far ahead in the current environment. The implied cash rate for December 2022 is 2.765 per cent. This would suggest that the RBA will raise the cash rate at every remaining meeting in 2022 by 0.4 per cent.

What has the reaction been from the banks?

So far, all Big 4 banks have increased their respective standard variable rates by the 0.25 per cent increase. It will only be a matter of time before other lenders outside of the Big 4 follow suit. This move by the Big 4 has seen the standard variable rate move to 5.1%.

This increase means the interest component of your home loan, or any borrowing you have will increase by 0.25 per cent in the next two weeks, depending on who you bank with. This may lead to increases in your monthly repayments if you have been paying only the minimum amount required.

However, if we take the suggested December cash rate as shown in the chart above, the average standard variable rate would move from 5.1% today to 7.5% by the end of the year.

That would mean an increase of $180 a week for mortgage holder paying principal and interest on a $500,000, 30-year loan. A mortgage holder with a $750,000 30-year loan would see a $307 increase per week, while a mortgage holder with a $1 million 30-year loan would see a $364 increase per week.

This extra bit of interest will slow our spending on goods and services outside of our weekly essentials like food, education, healthcare, energy, and transportation.

The question is: will it slow us down so much that it hurts growth and employment? This is a question that will be asked daily over the next 12 months, and only time will tell us what the answer is.

Whatever the answer the only certain thing is that interest rates will be higher than they now come Christmas and we should budget accordingly.

What is the reaction in the markets?

The initial reaction from the ASX 200 was to fall. The 0.25 per cent rise was larger than forecast but the market did recover this drop in the remaining hours of the trading day.

We should point out that markets are forward-looking and are already pricing in the likely interest rate increases for the rest of 2022 and into 2023. This has seen the ASX 200 ease over the past week as it became clear rates will rise sooner rather than later.

However, one of the ASX 200’s advantages is its high exposure to banking and financial services. This is a sector that actually benefits from higher interest rates and if you look at the performance of this sector in the last few months you can see the market has been buying this space in anticipation – something that may continue as rates increase over the coming year and something that could shield you from declines in other assets you hold.

For more information on savings and building your wealth click here

Frequently Asked Questions about this Article…

The Reserve Bank of Australia raised interest rates in May 2022 to address higher-than-expected inflation, which was at 5.1%, and to begin normalizing rates from emergency levels. The RBA aims to bring inflation back to its target range of 2-3% over time.

With the interest rate increase, the interest component of your home loan will rise by 0.25%. This means your monthly repayments may increase if you're paying only the minimum amount required. For example, a $500,000 loan could see a weekly increase of $180.

The expected cash rate by December 2022 is projected to be 2.765%, suggesting that the RBA may raise the cash rate at every remaining meeting in 2022 by 0.4%.

All Big 4 banks have increased their standard variable rates by 0.25% following the RBA's decision. Other lenders are expected to follow suit, leading to higher interest rates on loans.

Rising interest rates are expected to slow spending on non-essential goods and services, which could impact economic growth and employment. However, the RBA believes this is necessary to control inflation.

The ASX 200 initially fell following the interest rate hike but recovered later in the trading day. The market is forward-looking and has been pricing in expected rate increases, which has led to some easing in the ASX 200.

The banking and financial services sector could benefit from higher interest rates, as these sectors typically perform well in such environments. This has been reflected in recent market activity.

Investors should consider the impact of rising interest rates on their loan repayments and overall spending. It's also important to evaluate how different sectors, like banking, might perform in a higher rate environment and adjust investment strategies accordingly.