What is diversification?

Diversification is one of the most important principles of successful investing. In its simplest form, diversification is the practice of spreading your money across different types of investments. It helps to reduce risk in your investment portfolio and smooth out the highs and lows of investment markets.

What is diversification?

There are a lot of analogies used to describe how diversification works in investing. Eggs in baskets is a common one, but we're opting for the weekly grocery shop.

Picture this...You've selected a punnet of fresh strawberries at the supermarket. You bring your shopping home and start to unpack. Hungry, you bite into a strawberry and realise it's sour. Bummer. Fortunately, the rest of the punnet is beautifully sweet, so you don't feel too bad.

Over the course of multiple supermarket shops, some strawberries will be sour. Sometimes, what appears fresh on the outside, will be rotten on the inside. But for the most part, the strawberries will be luscious and one bad one won't ruin the whole punnet. This demonstrates why diversification is important.

How diversification can help reduce risk

Now, let's link our strawberry analogy with investing.

Diversification lowers risk by spreading your savings across several investments. That way, if one asset performs poorly, you have other investments that help bolster the overall portfolio.

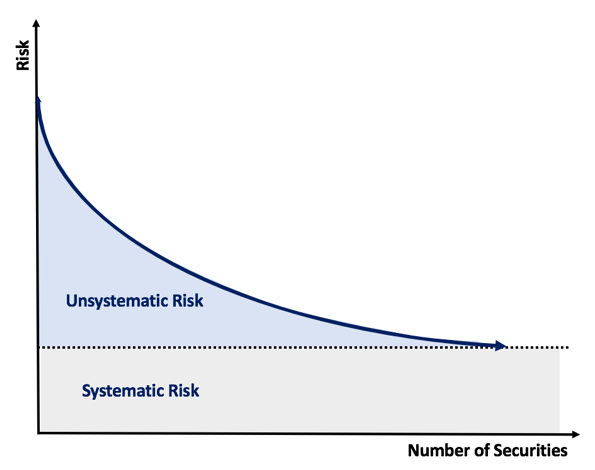

In financial markets, there are two overarching risk categories: systematic risk and unsystematic risk.

Systematic risk refers to something that has the potential to impact all types of investments. These risks are usually macroeconomic in nature and include global conflicts, inflation, natural disasters and interest rates. Regardless of what you're invested in, it's difficult to avoid these risks. As a result, systematic risk is often referred to as the price of admission.

Fortunately, there are some risks you can avoid. Unsystematic risks are specific to assets or corners of the market, but they generally won't impact the entire financial system. Using our grocery example, a new competitor, a regulatory ban on $1 milk or a product recall would all impact the profits of a supermarket but have little impact on other businesses.

The best way to avoid these risks is to diversify. If you invest across a range of different assets and asset classes, you are less likely to be negatively impacted by one strawberry in your fruit basket underperforming.

It's also worth noting that only around 4% of companies account for all of the excess returns in the share market. Instead of trying to pick the winners, why not purchase the entire market and guarantee ownership of the best-performing companies?

As you can see in the graph below, risk generally decreases as the number of securities in a portfolio increases. Because diversification doesn't cost anything or require any great skill, Nobel Prize laureate Harry Markowitz coined diversification as the only free lunch in investing.

|

To reduce unsystematic risk, investors want to own assets that have low or negative correlations with one another. That way if one asset decreases in value, the other asset will increase and offset some or all of the decline.

How do you diversify your portfolio?

The simplest way to diversify is to own a variety of asset classes such as shares, property, bonds and cash. Typically shares/property and bonds/cash have a low correlation to one another, and therefore smooth out portfolio returns.

Investors can also diversify across geographies or sectors. The Australian market is dominated by miners and banks, whereas overseas markets such as the United States have higher allocations to technology companies. This provides more diversification than simply sticking with Australian shares.

Even though diversification is a free lunch, it can be hard to achieve as an individual investor. Fortunately, there is a solution: exchange-traded funds (ETFs). They can provide instant diversification for investors in a low-cost and simple product.

Ready to start investing? InvestSMART has a range of diversified portfolios that all come with a capped management fee. If you'd like help selecting the right style of portfolio for you check out our free statement of advice quiz. It will show you which InvestSMART ETF portfolio may best suit your goals and investment timeframe.

Frequently Asked Questions about this Article…

Diversification in investing is the practice of spreading your money across different types of investments to reduce risk and smooth out the highs and lows of investment markets.

Diversification helps reduce investment risk by spreading your savings across several investments. If one asset performs poorly, other investments can help bolster the overall portfolio, reducing the impact of any single underperforming asset.

Systematic risks are macroeconomic factors that impact all types of investments, such as global conflicts and inflation. Unsystematic risks are specific to certain assets or market sectors and can be mitigated through diversification.

You can diversify your portfolio by owning a variety of asset classes like shares, property, bonds, and cash. Additionally, diversifying across geographies and sectors can further reduce risk.

Diversification is called the 'only free lunch' in investing because it doesn't cost anything or require great skill, yet it effectively reduces risk by spreading investments across various assets.

ETFs provide instant diversification for investors by offering exposure to a wide range of assets in a low-cost and simple product, making it easier for individual investors to achieve diversification.

Owning assets with low or negative correlations is important because if one asset decreases in value, another may increase, offsetting some or all of the decline and stabilizing the portfolio.

InvestSMART offers a range of diversified portfolios with capped management fees. They also provide a free statement of advice quiz to help you select the right ETF portfolio based on your goals and investment timeframe.