What are the best international share ETFs?

The case for investing globally has never been stronger. With Australian shares making up just 1.9% of the global share market, this leaves 98.1% of global equities existing beyond our shores. Owning only ASX listed shares, can put an investor at a disadvantage, especially when many of the world’s best companies are domiciled overseas. Think Apple, Unilever and Samsung.

The best and easiest way of gaining international exposure is via an international ETF. However, choosing the best international ETF can be a challenge.

Five international ETFs that could be great additions to a long-term investment portfolio.

Global ETFs are hugely popular with Australian investors. As of July 31, 2023 there is $70.7 billion invested in ETFs that track global share markets, in the Australian ETF market.

The top five International ETFs:

-

VGS – Vanguard MSCI Index International Shares ETF

-

IVV – iShares S&P 500 ETF

-

IOO – iShares Global 100 ETF AUD

-

QUAL – VanEck MSCI International Quality ETF

-

VESG – Vanguard Ethically Conscious International Shares Index ETF

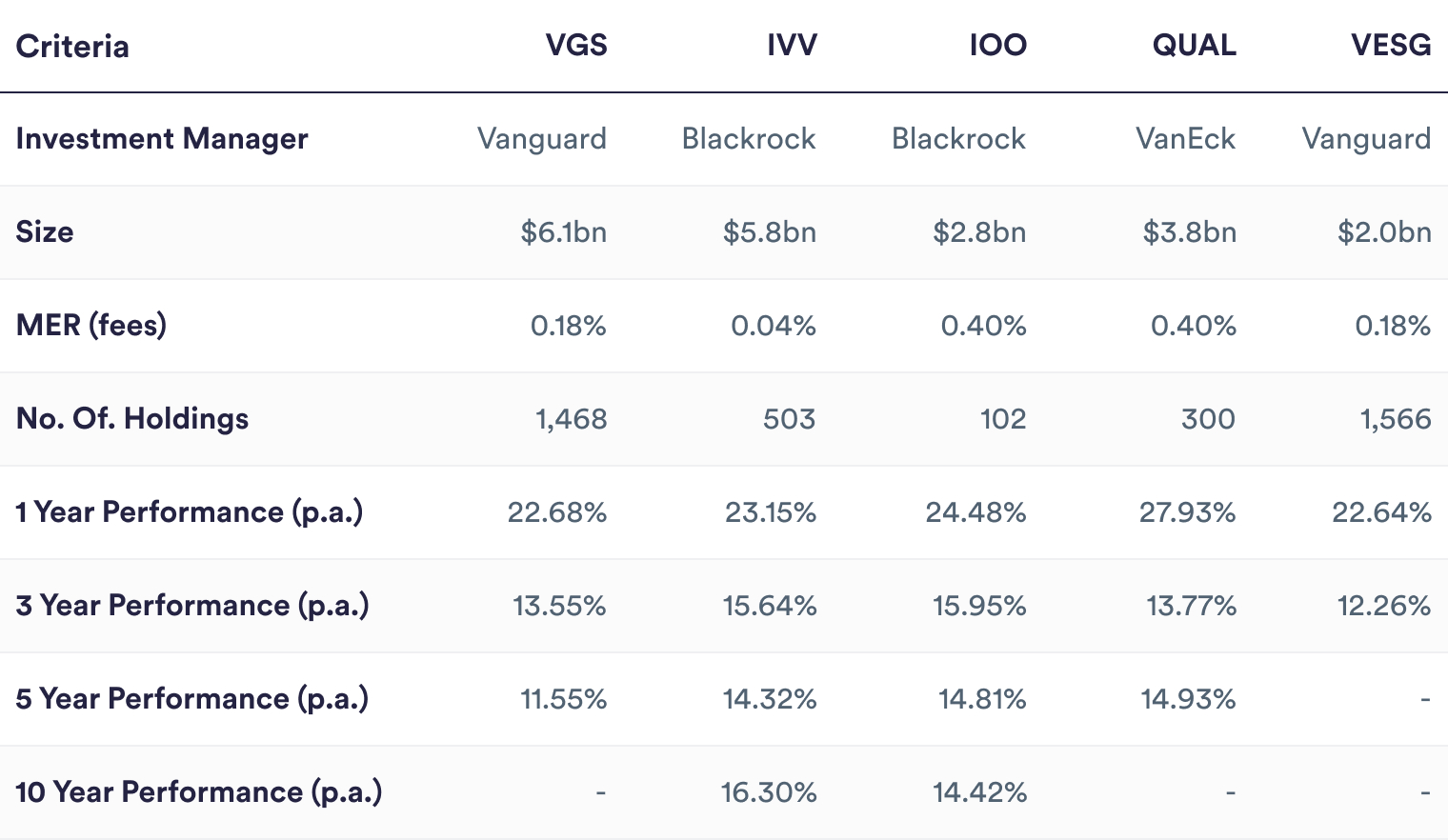

The following table summarises the five ETFs chosen.

Please note that all of the above ETFs are unhedged, which means that there is some currency risk (which may be positive or negative, depending on the direction of the currency). If hedged products are your preference, all of the above ETFs have hedged equivalents, though the expense ratio will be slightly higher.

We selected our top five global ETFs based on their performance as well as the following key criteria:

1. Management Expenses Ratio (Fees): The management fee charged by all ETF providers. The lower the fee, the less you pay for your investment.

2. High liquidity on exchange: The ease of which an ETF can be bought or sold due to there being a large number of buyers and sellers.

3. Price point: The price paid for each ETF unit. Used to better manage weightings in the portfolios.

4. Market capitalisation: The size of the ETF. A higher market capitalisation generally means an ETF has high liquidity and lower fees.

5. Tracking error: The difference between the performance of an ETF and the index it tracks. The lower the tracking error, the more closely the ETF tracks the index.

These five international ETFs provide wide diversification, low fees, and have good performance records. The ETFs are also managed by some of the world’s best investment managers.

Vanguard MSCI Index International Shares ETF (VGS)

VGS provides wide diversification across 1,468 stocks from 23 developed countries. Of these countries, the US has the largest representation in the ETF with 70.7%, followed by Japan, UK, France and Canada.

The five biggest companies in the ETF are Apple with 5.5%, Microsoft with 4.3%, Alphabet with 2.5%, Amazon with 2.2%, and NVIDIA with 1.9%.

One of the big advantages of owning an ETF from a large investment manager such as Vanguard, is that its size enables economies of scale, which allows the management expense ratio (ie fees) to be kept at a reasonably low 0.18%.

VGS is InvestSMART’s main international ETF of choice because of its low cost, it high liquidity, and volume of shares available for trading – meaning the ETF can be traded easily.

iShares S&P 500 ETF (ASX:IVV)

If you are after an ETF that simply tracks the S&P 500, then this ETF is for you.

With super-low fees of 0.04%, this means that very little of your investment is lost, enabling better compounding over the long-term.

This ETF holds funds exclusively in the iShares Core S&P 500 ETF, which tracks the S&P 500 Index.

IVV is managed by Blackrock, the largest investment manager in the world.

InvestSMART holds IVV in our single asset class international ETF portfolio. We like it for this portfolio because it’s very low cost, has great diversification with a strong tech focus, whereas the ASX is heavily weighted towards miners and banks.

iShares Global 100 ETF AUD (ASX:IOO)

If you want to own a broad range of the 100 largest companies in the world, then look no further than IOO.

The key reason why an investor may choose IOO, is that it holds the biggest and possibly the most important companies in the world. These are companies that would arguably have a better chance of weathering economic storms, than say mid-caps or small-caps.

One downside to this ETF is its slightly higher expense ratio of 0.40%, however its five-year performance has still been very good. We don’t include IOO in our portfolios as VGS is cheaper and it provides greater diversification across a thousand stocks.

VanEck MSCI International Quality ETF (ASX:QUAL)

VanEck’s QUAL ETF gives investors exposure to quality international stocks from around the globe (ex-Australia).

The aim of QUAL is to track the MSCI World ex Australia Quality Index which attempts to capture and track only the quality stocks from its parent index, the MSCI World ex Australia Index.

Quality stocks are defined as stocks that score highly, based on three key factors: high return on equity; stable year-on-year earnings growth; and low financial leverage.

A small downside to this ETF is that its management fees are also higher than its peers at 0.40%. QUAL has delivered a return of 14.93% p.a. over the last 5 years. It is an active ETF and its high costs (relative to other international ETFs) excludes it from InvestSMART’s investment criteria.

Vanguard Ethically Conscious International Shares Index ETF (ASX:VESG)

VESG is perfect for those wanting an ethical focus, wide diversification, high performance, and a relatively low management fees of 0.18%.

VESG seeks to track the returns of the FTSE Developed ex Australia Choice Index, by investing in a broad range of 1,566 stocks from developed countries.

As per its ethical focus, stocks from industries such as fossil fuels, nuclear power, alcohol, tobacco, cannabis, gambling, adult entertainment and weapons are excluded from the ETF.

The biggest companies in the ETF are Apple, Microsoft, Alphabet, Amazon and NVIDIA.

VESG is InvestSMART’s international ethical ETF of choice in our ethical growth portfolio.

How much should I invest in international ETFs?

The importance of diversification when you invest cannot be overstated. It would be unwise to invest all your money in international ETFs (or any one single ETF). These ETFs have impressive 12 month returns as international markets have had an excellent run in 2023, but investors need to remember past performance is no guarantee of future performance. Spreading your money across a variety of different investments such as Australian shares, international shares, bonds and property via ETFs, will help reduce the volatility of sharemarkets and smooth out your long-term returns.

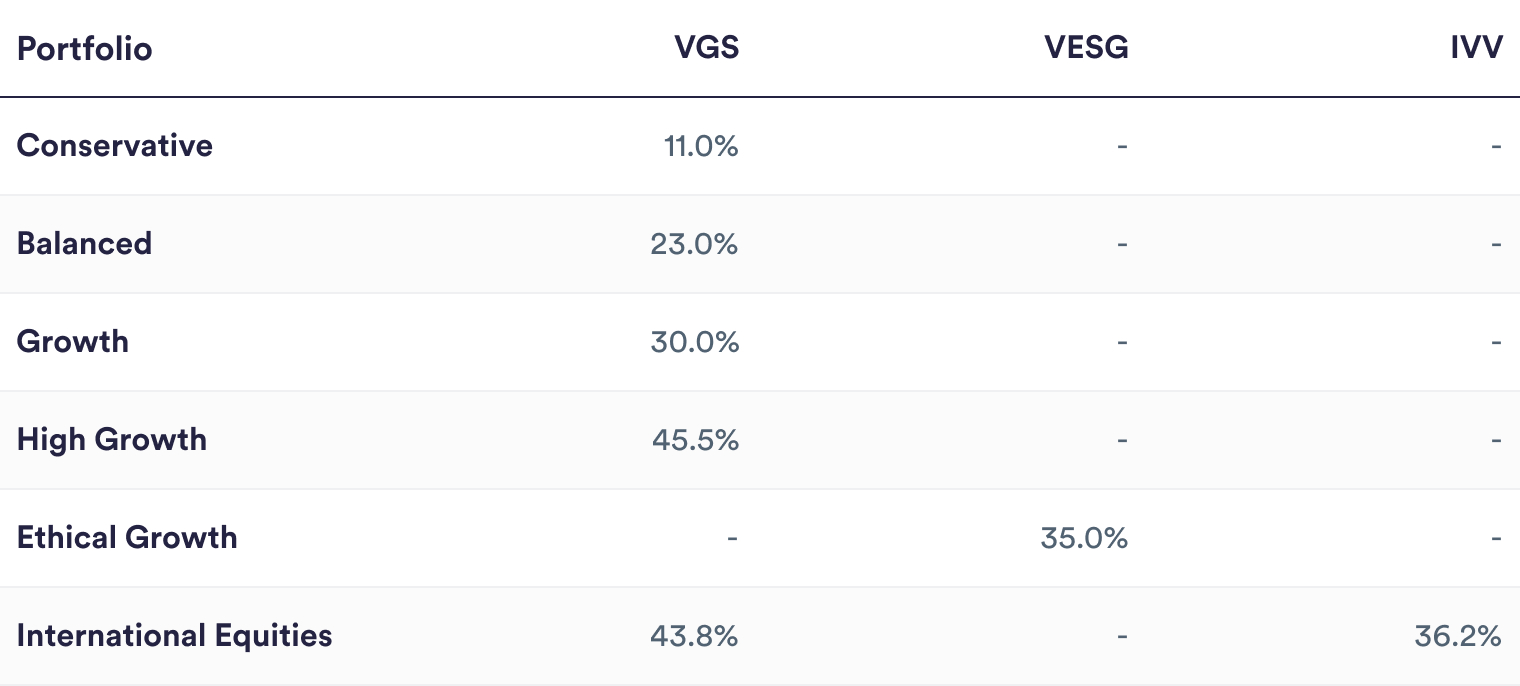

International ETF exposure in InvestSMART portfolios (by %)

Three of the above ETFs: VGS, VESG, and IVV, can be found in 6 of 10 InvestSMART’s portfolios.

In summary, we believe that exposure to international ETFs provides many important benefits for investors, and excellent returns over the long-term.