What a Blackrock ETF Can Mean for Bitcoin

Crypto markets are buzzing with the recent flurry of applications for spot Bitcoin ETFs in the US, even as the US Securities and Exchange Commission (SEC) continues to scrutinise crypto native companies like Coinbase and Binance (the US’s and world’s largest crypto exchanges respectively) and declaring many popular crypto tokens as unregistered securities.

Recent applications for spot Bitcoin ETFs by Wisdom Tree, Invesco, Valkyrie, Bitwise and Blackrock have contributed to a surge in Bitcoin’s price over the last two weeks:

Source: https://coinmarketcap.com/

BTC has risen from $A36,000 back on 16 June to just under $A46,000 as of writing, a rise of 28 per cent in under two weeks.

Blackrock’s application is perhaps the most noteworthy given its remarkable track record in successful ETF applications (just one rejection in more than 575 successful applications). It’s also the worlds largest asset manager with the institutional track-record, reputation, and influence that the SEC is likely to favour.

Spot Bitcoin ETF

While several futures Bitcoin ETFs have been green-lit, no spot Bitcoin ETFs have made the grade so far. Futures Bitcoin ETFs allow investors to invest in futures Bitcoin contracts without needing to manage the hassle and risk of custody. But as a futures contract is a derivative of the underlying asset, investors aren’t getting exposure to the underlying asset at its spot (aka market) price.

A spot Bitcoin ETF provides investors with exposure to the underlying BTC token at its market traded price, just like holding the asset in self-custody or on an exchange. It’s very likely that market demand for a spot Bitcoin ETF will significantly outweigh that for the current futures versions.

If Blackrock is successful, it might help to reverse the fortunes of the Grayscale Bitcoin Trust (GBTC), one of the world’s largest corporate holders of Bitcoin whose repeated attempts to convert their vehicle to a spot Bitcoin ETF have been stymied by the SEC at every turn. This led Grayscale to contest the SEC decision in court (the case is ongoing as of writing), and its chances may be significantly improved if Blackrock gets its Bitcoin ETF.

GBTC is like a closed-end trust, meaning that its unit price can vary from its net asset value (NAV), leading to premiums and discounts depending on the mood of the market, a feature or a curse, depending on your perspective, and one that Aussie Listed Investment Company (LIC) investors are familiar with.

GBTC has traded at a significant discount in recent times due to the uncertainty over its attempt to convert to a spot Bitcoin ETF, but Blackrock’s application has narrowed that discount as investors punt on Grayscale’s ambitions ultimately succeeding.

Institutional Asset Managers

For Bitcoin investors, the arrival of institutional asset managers like Blackrock is a game changer, and likely to be a pivotal moment, for Bitcoin at least. An “iShares Bitcoin Fund” would attract considerable interest from investors wanting exposure to BTC as an asset (aka store of value) as opposed to using it as a medium of exchange. The Blackrock marketing juggernaut would ensure exposure to an investor base that is largely ambivalent, hesitant, or ignorant about the pros and cons of Bitcoin specifically, and crypto/digital assets in general.

Bitcoin is a scarce asset, in the sense that its inflation rate is based on a fixed and predictable supply schedule and is almost certainly limited to 21 million tokens for eternity. Unlike fiat currencies, Bitcoin cannot be debased through “money printing”, and so, if market demand increases, mathematics and the network protocol ensure that its price must go up.

It’s possible that derivatives based on spot Bitcoin ETFs might also arise which could have uncertain consequences for BTC’s market price. But the prevailing consensus is that spot Bitcoin ETFs are likely to stimulate demand for Bitcoin overall, and therefore drive the price given limited supply.

Investors and traders looking to gain or add to their Bitcoin exposure should consider the timing of the wave of spot Bitcoin ETF applications. While Bitcoin price has bounced off its bottom, it remains well down on its all-time-high and observers may well ponder whether it will ever scale the heights of its earlier run.

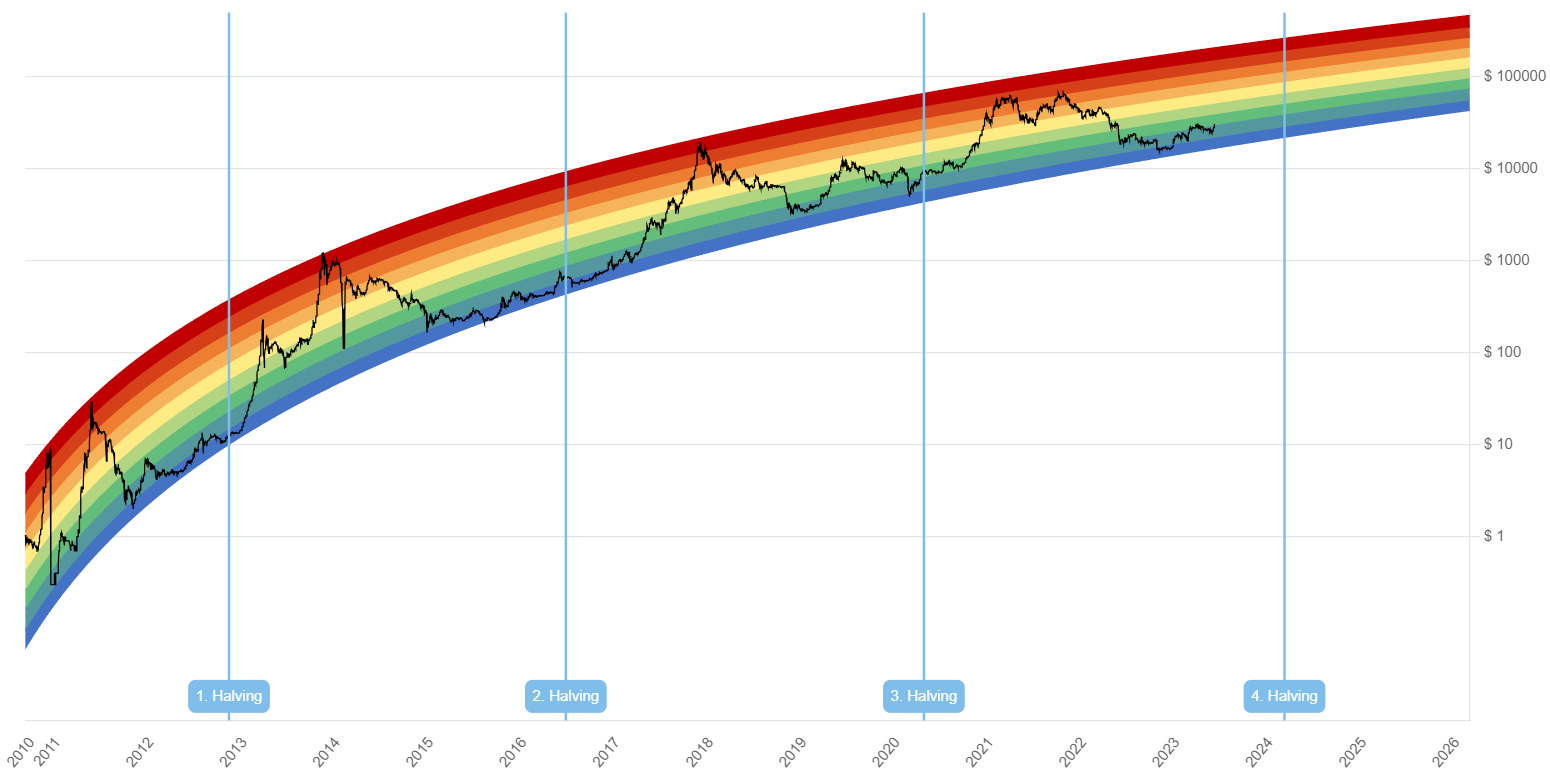

Blackrock and the other asset managers are aware of Bitcoin’s halving cycles and Bitcoin’s historical price history. The price chart below illustrates how price has followed a repeated pattern leading into, and out of each halving. The institutions are getting on board while the Bitcoin price is at a cycle low, and before any bull market run starts in earnest.

Source: https://www.blockchaincenter.net/en/bitcoin-rainbow-chart/

Smart investors who favour Bitcoin might well consider current prices as an opportunity to “front-run” the wave of institutional money that could drive Bitcoin’s price higher if spot Bitcoin ETFs are approved. This also assumes that the cycle repeats into and out of the fourth halving, and there is no assurance that this will happen.

Bitcoin is a nascent digital asset with an uncertain regulatory regime based on technology that could itself be disrupted. Investing in Bitcoin comes with significant risks and investors should only invest in assets that they’re comfortable with and align with their risk profile.

But the imminent arrival of institutional investors like Blackrock is unquestionably a potential turning point that could prove a watershed moment for the crypto king.

Frequently Asked Questions about this Article…

A spot Bitcoin ETF provides investors with exposure to Bitcoin at its current market price, similar to holding the asset directly. In contrast, a futures Bitcoin ETF involves investing in futures contracts, which are derivatives and do not reflect the actual market price of Bitcoin. Spot ETFs are expected to have higher demand due to their direct market exposure.

Blackrock's application is noteworthy because of its impressive track record in ETF applications, with only one rejection out of over 575. As the world's largest asset manager, Blackrock's involvement could influence the SEC's decision and potentially pave the way for other spot Bitcoin ETFs, impacting the market significantly.

The approval of a spot Bitcoin ETF is likely to increase demand for Bitcoin, as it provides a more direct investment option. Given Bitcoin's limited supply, increased demand could drive up its price. This potential price increase is attracting interest from institutional investors and could be a pivotal moment for Bitcoin.

If Blackrock's spot Bitcoin ETF is approved, it might improve the chances for the Grayscale Bitcoin Trust to convert into a spot ETF as well. This could help reduce the significant discount at which GBTC has been trading, as investors anticipate a successful conversion and align with Grayscale's ambitions.

Investors should be aware that Bitcoin is a nascent digital asset with significant risks and an uncertain regulatory environment. It's important to invest only in assets that align with one's risk profile. The potential arrival of institutional investors like Blackrock could be a turning point, but investors should remain cautious and informed.