Weighing Up the Latest on What's Needed for Retirement

There are fewer more important questions around the financial planning process than deciding how much is needed to fund your retirement.

The Association of Super Funds Australia (ASFA) has for some time produced a standard designed to give people insight into the level of funds they might need for a modest or comfortable lifestyle. There is now a second set of financial modelling, produced by Super Consumers Australia, that looks to set out how much is needed to support low, medium and high levels of spending in retirement.

A good place to start is with the big picture, comparing what each report says about spending and superannuation needs for retirement:

ASFA – Retirees Around Age 67 who own their own home

|

|

Single |

Couple |

|

Modest Income |

$29,632 |

$42,621 |

|

Savings to Provide Modest Income |

$70,000 |

$70,000 |

|

Comfortable Income |

$46,494 |

$65,445 |

|

Savings to Provide Comfortable Income |

$545,000 |

$640,000 |

Super Consumers Australia Retirees Age 67 who own their own home

|

|

Single |

Couple |

|

Low Income Retirement |

$29,000 |

$42,000 |

|

Savings to Provide Low Income |

$73,000 |

$95,000 |

|

Medium Income Retirement |

$38,000 |

$56,000 |

|

Savings to Provide Medium Income |

$258,000 |

$352,000 |

|

High Income Retirement |

$51,000 |

$75,000 |

|

Savings to Provide High Income |

$748,000 |

$1,021,000 |

(source: Retirement Targets — Super Consumers Australia)

Both calculations are based on the person or couple owning their own home in retirement. The Super Consumers Australia report cites data from the Retirement Income Review that showed retirees who rent have higher rates of income poverty and financial stress – owning a home appears to be a useful asset in supporting a better retirement.

While there are different methodologies behind the two sets of figures and retirement targets, and while they arrive at differing figures, considering the two sets of figures together provides some interesting insights.

Low/Modest Income

Let’s start at the modest or low retirement income projection for both models. The level of savings for both singles and couples that own their home to have a modest or low income is less than $100,000. This is because the majority of income is provided by the age pension and allows a homeowner to have a modest or low-income retirement.

This is an interesting base from which to start building a retirement picture. Someone heading toward retirement with a small accumulation of assets can still expect a modest retirement income. And, if the retiree is able to accumulate assets above this level, they are at a position that their income will increase without those additional assets reducing the age pension, until they get to assets around $280,000 for a single homeowner or $419,000 for a homeowning couple. This is a critical message for anyone intimidated by the high estimates of what is sometimes presented for retirement – owning a home with a small superannuation/saving level provides a modest retirement, and every extra dollar saved will help improve that situation.

Super Consumers Australia – Medium Retirement Income

The Super Consumers Australia report includes three spending targets, while the ASFA report provides only two. The middle Super Consumers Australia spending level is the medium spending level, which they describe as approximating the spending of the average recently retired single or couple. It is $38,000 for a single homeowning retiree and $56,000 for a homeowning retired couple. They calculate that $258,000 is required for the single retiree and $352,000 for the couple.

Interestingly, this is close to the level of assets at where the age pension assets test starts to reduce the age pension ($280,000 for a single homeowner and $419,000 for a homeowning couple, and this test will include lifestyle assets).

Effectively, the medium retirement income seems to coincide with the sweet spot of a combination of access to the age pension and additional income from investment/superannuation assets.

A High Spending Level/Comfortable Retirement Income

The ASFA retirement standard suggests a comfortable income is $46,494 for a homeowning single and requires around $545,000 of assets, while a comfortable income for a homeowning couple is $65,445 and requires $640,000 of assets. The ASFA describe a comfortable standard of living as: “involvement in a broad range of leisure and recreational activities and to have a good standard of living.”

Super Consumers Australia outlines a high retirement income as $51,000 for a homeowning single requiring $748,000 of assets, while a high retirement income for a homeowning couple is $75,000 and requires $1,021,000 of assets. They outline a high spending level as “spending at this level means spending more than 70% of all retirees.”

The Super Consumers Australia figures hint at a challenging decision that retirees have to make. Someone having accumulated the level of assets to draw a high retirement income will not have the support of any age pension with the required level of assets. In this model the single retireee is drawing on their assets at a rate of 6.8 per cent per annum (51000/748,000) and the couple at a rate of 7.3 per cent (75000/1021000). This is above the expected rate of return from an average balanced portfolio after fees and inflation, although if the value of the portfolio falls over time, eventually the retiree will have their income from investments supplemented by some age pension.

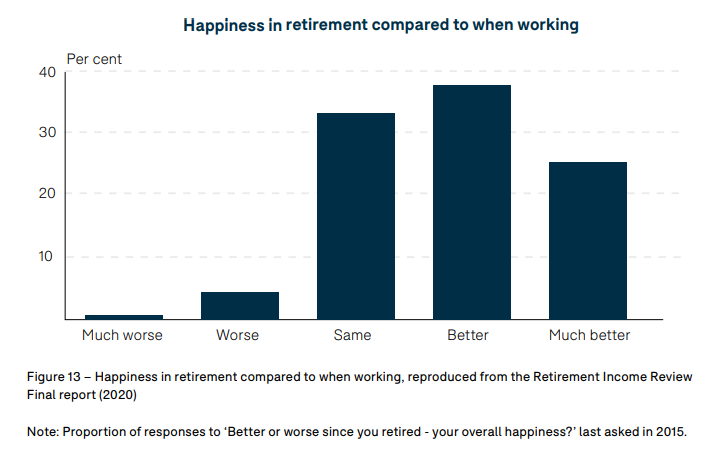

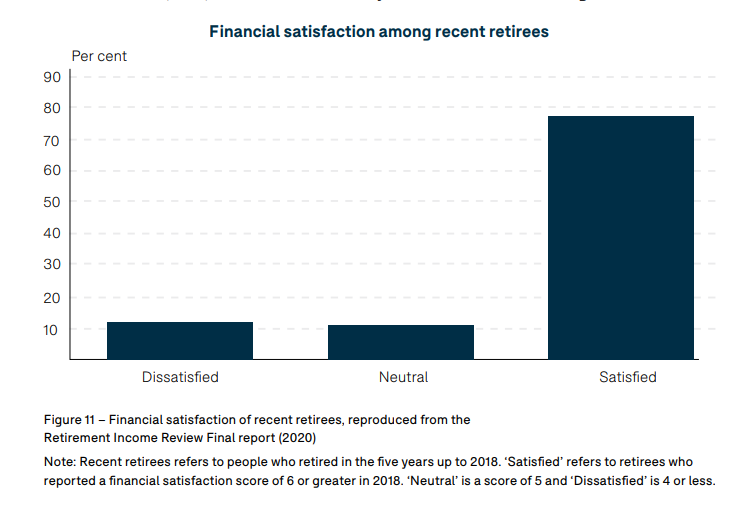

Financial and General Satisfaction in Retirement

The following two figures are drawn directly from the Super Consumers Australia report and provide an interesting insight into the high level of happiness in retirement, and the high level of financial satisfaction amongst retirees – answering two of the big questions that people consider when contemplating retirement.

Doing Your Own Calculations

Both of these reports, by the Association of Super Funds Australia (the link is here) and Super Consumers Australia (link here) are worth reading for the way they approach the question of how much is needed to fund your retirement.

However, having a clear understanding of your own retirement spending ambitions, and your own likely position at retirement, makes sense.

The limit of any financial model lies in the assumptions and forecasts. A model dealing with retirement incomes as to model key elements including;

-

How high will inflation be?

-

What will investment earnings be?

-

Will there be changes to the superannuation rules or taxation rules?

-

How long will I live?

-

Will I reduce my drawings in poor years of returns to help my portfolio last longer?

The accuracy of your own modelling, the Association of Super Funds Australia modelling, and the Super Consumers Australia modelling is limited by these important assumptions and forecasts. If we want a real-life example of how challenging forecasting is, we only need to go back six months to see how few people were forecasting an RBA cash rate today of 1.35 per cent and inflation above 5 per cent.

Conclusion

It remains one of the big personal finance questions – how much will I need to retire?

Having the ASFA retirement standards and now the Super Consumers Australia retirement spending levels and saving targets helps people planning for retirement start to build a picture of what income a given level of assets might provide them in retirement, and whether they are on track for the retirement that they hope for themselves.

This article was originally posted on the Eureka Report - For more articles like this click here