Wading into riskier waters

Ironically, the swan dive is exactly what many term deposit holders are considering. With term deposit rates a fraction over 2% p.a. and inflation at 1.6%, this leaves you with a real return of 0.4% p.a. Those with maturing term deposits face a difficult dilemma. Do you stick with so-called safety or dive into riskier assets?

The thought of moving into a stock market hitting all-time highs is paralysing. You need to remember, it doesn’t have to be all or nothing. You do not have to jump 100% into the market. You can take a sensible, balanced approach to the problem.

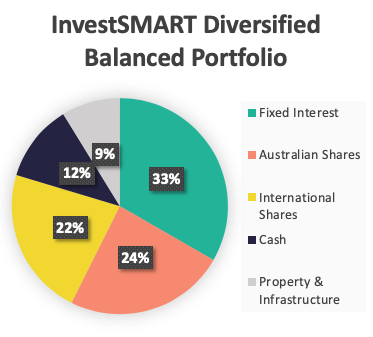

Consider a balanced fund or portfolio. With a balanced fund you are still maintaining the safety of a large cash and fixed interest position, but also blending in the potential of capital growth and dividends through Australian shares, international shares and property. This blend can help you earn a better return than term deposits while not jumping 100% into the riskiest end of the asset class pool.

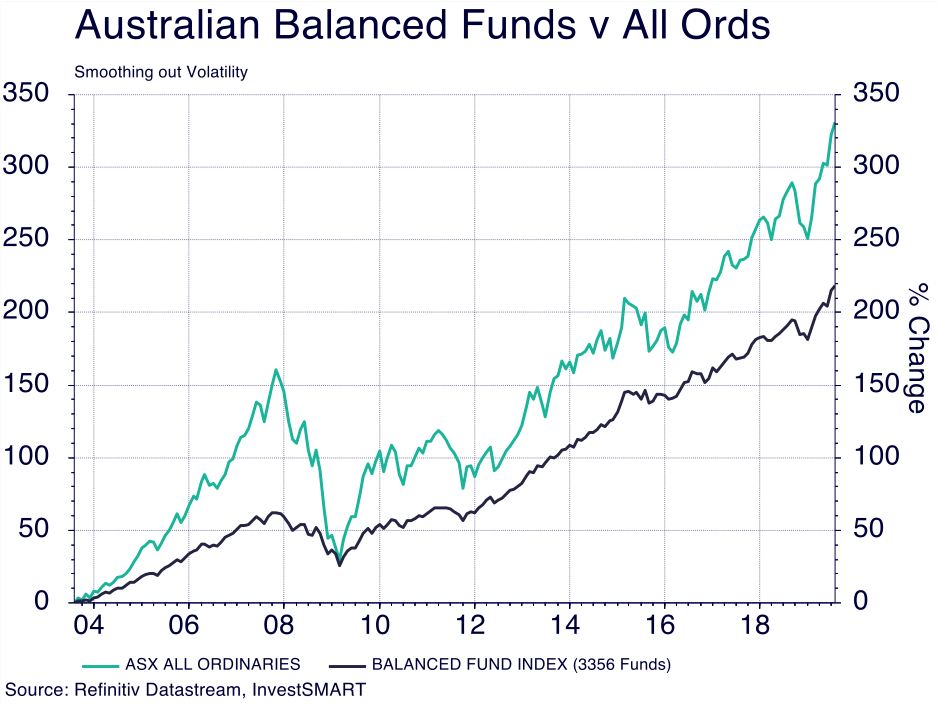

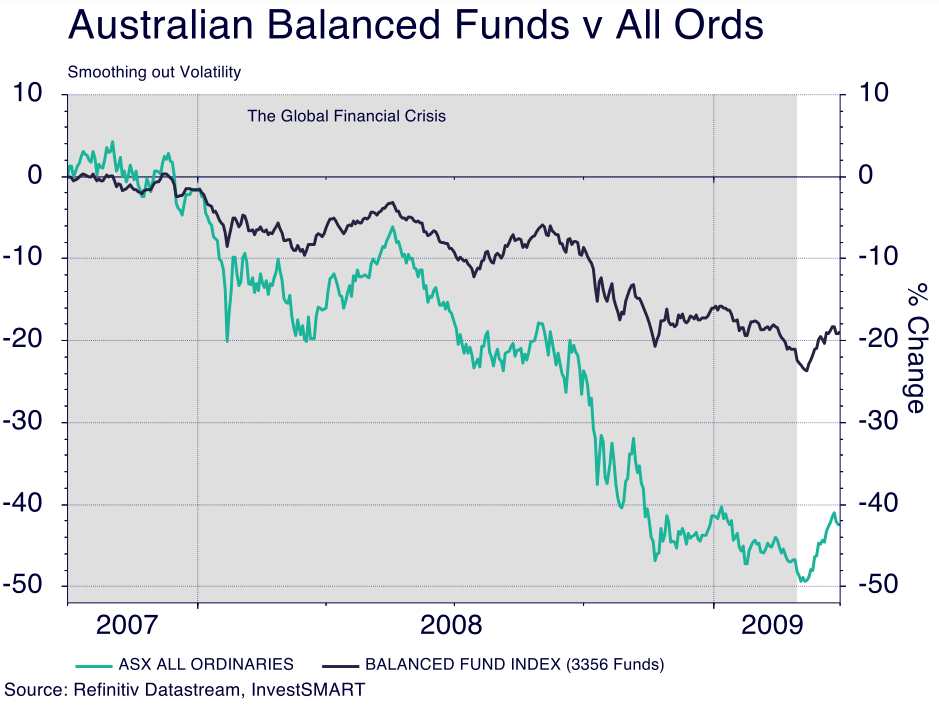

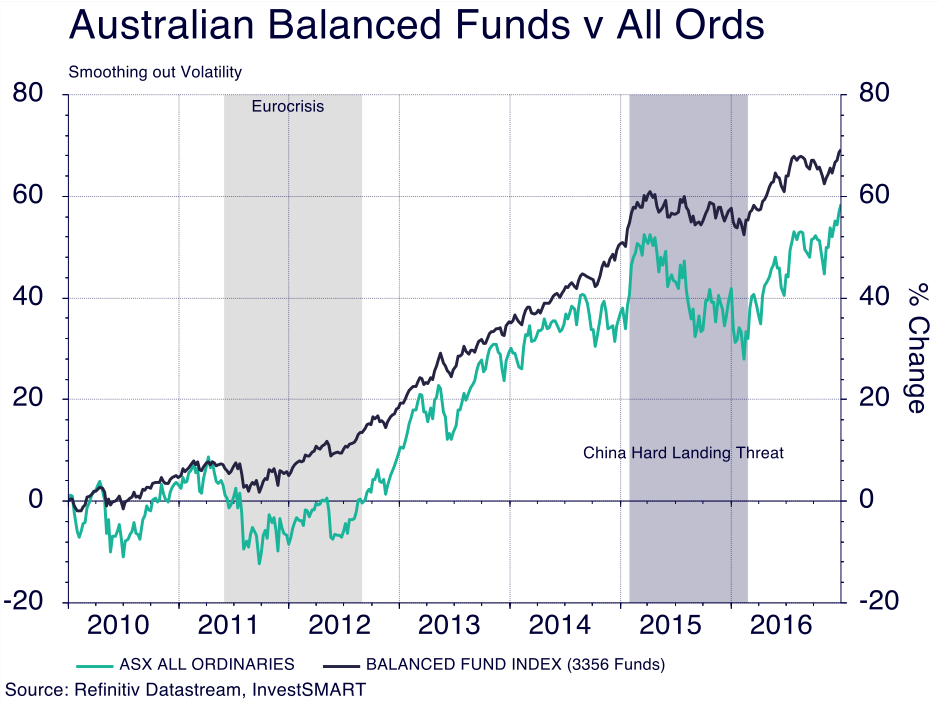

The graph below shows the total returns (capital growth plus dividends) of the average balanced fund compared to the All Ordinaries Index. While the stock market has beaten that, what is interesting to note is the lack of volatility through some of the markets most extreme downturns.

The first thing you will notice about the below chart is the difference between the two returns. Yes, the market has substantially beaten a balanced portfolio over this timeframe, however, the balanced portfolio is a far smoother ride.

The cash and fixed interest component acts as an anchor in bull markets and as a buoy in negative markets. The feeling of contentment when you’re living off your portfolio and sleeping well at nigh is far better than the fleeting excitement of a stock market rally. And the fear of missing out is dwarfed by the fear of permanent loss.

Diving head first into murky waters isn’t brave. It’s stupid. Going 100% from capital-guaranteed term deposits into riskier asset classes is similar. The water might be just fine but you can enjoy it all the same by gently wading in.

Click here to find out more about the InvestSMART Diversified Balanced portfolio, part of our capped fee range.

Frequently Asked Questions about this Article…

Term deposit holders are considering riskier investments because current term deposit rates are just over 2% p.a., which, when adjusted for inflation at 1.6%, results in a real return of only 0.4% p.a. This low return is prompting investors to explore options that might offer better returns.

No, it's not necessary to invest 100% in the stock market to achieve better returns. You can take a balanced approach by investing in a balanced fund or portfolio, which includes a mix of cash, fixed interest, and growth assets like shares and property, providing potential for higher returns without taking on excessive risk.

A balanced fund is an investment portfolio that combines cash, fixed interest, and growth assets such as Australian and international shares and property. This blend helps investors earn better returns than term deposits while maintaining some level of safety, offering a smoother investment experience with less volatility.

While the stock market has historically outperformed balanced portfolios in terms of total returns, balanced portfolios offer a smoother ride with less volatility. This can be particularly beneficial during extreme market downturns, providing a more stable investment experience.

In a balanced portfolio, cash and fixed interest act as an anchor during bull markets and as a buoy during negative markets. They provide stability and reduce volatility, helping investors feel more secure and sleep better at night, even when markets are turbulent.

Moving 100% from term deposits to riskier assets is not advisable because it exposes investors to significant risk and potential permanent loss. A more prudent approach is to gradually wade into riskier waters, maintaining a balance between safety and growth potential.

The InvestSMART Diversified Balanced portfolio is part of InvestSMART's capped fee range. It offers a balanced mix of cash, fixed interest, and growth assets, designed to provide investors with a stable and potentially higher return than traditional term deposits.

Investors can overcome the fear of missing out on stock market gains by adopting a balanced investment strategy. This approach allows them to participate in market growth while maintaining a level of safety, reducing the anxiety associated with market volatility and potential losses.