Trawling the Ranks of Crypto's Top 10

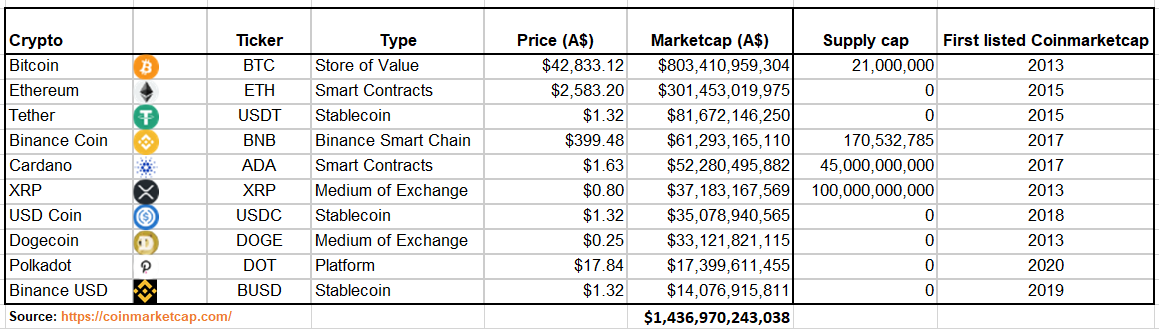

The top-10 crypto assets by market cap illustrate the innovation taking place in the digital asset space.

The total market cap of the top 10 cryptocurrencies is now $1.5 trillion -- less than silver’s total global market cap but significantly more than Facebook’s. Whether this signals the emergence of a new asset class is a question for investors, regulators, and maybe even nation states given El Salvador’s recent decision to adopt Bitcoin as legal tender.

Either way, investors who increase their knowledge of the top-10 crypto assets will be better informed.

The chart below shows the first mover advantage of Bitcoin and Ethereum, the emergence of newer smart contract platforms, the rise of USD stablecoins and, in Doge, the influence of social media and personality cults on market sentiment.

Bitcoin remains the undisputed leader with 56 per cent share of the top-10 by market cap, more than twice that of next-placed Ethereum. The next eight make up the remaining 23 per cent.

Bitcoin

Bitcoin’s market cap dominance remains intact even after the significant price drop from 2021’s all-time-high. Its market cap is still more than twice that of Ethereum, its closest rival. Bitcoin “maximilists” proclaim Bitcoin as the proven store-of-value asset due to its predictable and fixed supply schedule and de-centralised proof-of-work consensus mechanism. It currently has the longest track record, greatest brand awareness and the widest exposure to institutional investors.

Its pseudonymous founder Satoshi Nakamoto is long silent, and there is no one person or group that controls it or determines its future. Its latest controversy is concern about its environmental, social and governance (ESG) credentials, spurred on by Elon Musk’s tweets, and the Chinese state’s ban on Bitcoin mining. Still, it remains often the first and usually the main exposure to crypto assets for most investors.

Ethereum

Ethereum has pole position as the smart contracts / applications platform with ether (ETH) as its crypto currency and is the second overall to Bitcoin in market-cap terms. Ethereum has a large and active blockchain ecosystem and its ERC-20 token standard has become the market leading technical standard for smart contract solutions. But competitors are emerging, such as Cardano, Polkadot, Solano, Cosmos, and others.

It is sometimes called crypto oil in comparison to Bitcoin’s digital gold in that it is really a platform to support the development and execution of web applications. (Ethereum’s network processing fee is called “gas”, which compensates miners for their computational efforts to process transactions).

Ethereum is being used as a platform for a variety of use cases including smart contracts, de-centralised finance (DeFI), de-centralised exchanges, non-fungible tokens (NFTs), gaming, virtual worlds, digital ledgers, and enterprise applications.

Ethereum currently has a proof-of-work consensus mechanism like Bitcoin, but unlike Bitcoin has no fixed supply cap. Ethereum also plans to migrate to an alternative proof-of-stake consensus mechanism as part of its Ethereum 2.0 transition, to improve energy spend efficiency, increase decentralisation and make the energy cost to attack the network significantly more expensive for the attacker.

Tether

Tether (USDT) is a stablecoin designed to peg to the USD 1:1. Originally created to run on Bitcoin’s blockchain, it now also runs on multiple blockchains including Tron, Ethereum, Solana and Eos.

It has a controversial history due to regulatory issues, missing coins, rumours about manipulation, and the nature of the reserves backing the coin. Recent data revealed by Tether shows that in addition to USD, it is backed by cash equivalents, loans, bonds, metals, and other investments including $US30 billion in commercial paper. Its cash backing was only $US3 billion.

Despite the controversies, its price action since January 2020 has been stable and its market cap means it occupies the third position, albeit a long way short of Ethereum. It is widely used as liquidity to trade other crypto assets without having to convert back to fiat.

Investors should note that Tether’s supply isn’t enforced and control of Tether resides in the owners of Bitfinex, a crypto exchange. Tether continues to attract interest from regulators and law enforcement agencies, so investors beware.

Binance Coin

Binance Coin (BNB) is a token created by Binance, the world’s largest crypto assets exchange by volume. BNB was originally created in 2017 to trade and pay fees on the Binance exchange. It has since evolved to encompass other use cases such as payments, travel booking payments, loyalty and financial services. It is the token on the Binance Chain, and the Binance Smart Chain (BSC) which is Binance’s separate blockchain for smart contract and other distributed applications.

Half of the total supply of 200 million BNB coins were initially allocated to the founders and angel investors and some market observers believe that the percentage of all BNB coins controlled by the Binance team could be as high as 80 per cent. Such centralisation may create risks for longer-term investors, but Binance is buying back coins and destroying them until 100 million (half of the supply) are destroyed.

Investors in BNB are essentially betting on the ongoing success and growth of Binance’s ecosystem, including BSC. Binance’s centralisation is the trade-off for its scalability.

Cardano

Development of Cardano began in 2015 by a team led by Charles Hoskinson, a co-founder of Ethereum. Hoskinson and an ex-Ethereum colleague Jeremy Wood created IOHK as a crypto research and engineering company whose main project is the ongoing development of Cardano. Cardano is considered a third-generation crypto solution that aims to address the limitations of the first-generation Bitcoin and second-generation Ethereum. These limitations include scalability, transaction fees, interoperability and ESG concerns.

Cardano also uses a proof-of-stake consensus mechanism which is significantly less energy intensive that proof-of-work which Bitcoin employs. Its native crypto currency is ADA, which has a market cap of some $52 billion as of writing (having launched in 2017 with an $800 million market cap debut).

Cardano is differentiating itself via its relationships with academia, an R&D focus, and a business strategy to tap into emerging market growth opportunities. It’s interested in Africa in particular, given Africa’s underdeveloped banking system and growing awareness of crypto currencies, especially amongst the young. Cardano also plans to aggressively pursue Fortune 500 companies wanting to leverage the growth in emerging markets for crypto and DeFI solutions.

Cardano is one of the claimants to Ethereum’s throne. Its opportunity is to eat into Ethereum lead while holding off newer emerging challengers.

XRP

XRP is a token used on the Ripple blockchain digital payment network, Ripple also being the name of the company that develops the Ripple ecosystem and controls the XRP supply. Ripple’s initial aim was to position itself as an alternative to the legacy SWIFT payment network used traditionally by financial institutions worldwide to settle funds between each other.

XRP was once the third largest crypto currency by market cap but has since fallen out of favour. The US Financial Crimes Enforcement Network (FinCEN) fined Ripple in 2015 for compliance breaches of anti-money laundering laws, resulting in financial penalties. In 2020, the Securities and Exchange Commission (SEC) filed an action against Ripple, its current CEO and founder/ex-CEO alleging that they conducted an unregistered securities offering to raise capital. In January 2021, Coinbase suspended trading of XRP due to the SEC action.

The SEC’s legal action potentially casts a shadow over XRP’s prospects as an investible token although that didn’t stop its price from rising to A$2.50 in April 2021, falling back to a base of around A$1.00 as of writing. Investors may consider that more certainty about its legal status is warranted before further investment.

USD Coin

USD Coin (USDC) is another stablecoin pegged to the US dollar, managed by a consortium called Centre, founded by Circle and Coinbase and launched in 2018. USDC is currently the fastest growing stablecoin with nearly A$32b in circulation as of writing and is available on the Ethereum, Algorand and Solana blockchains.

A distinguishing feature of USDC is that its dollar reserves are attested to each month by business advisory firm Grant Thornton to standards defined by the American Institute of Certified Public Accountants, with the attestation report published on Circle’s website. This transparency about USDC’s dollar reserve backing was likely a factor in Visa’s decision to adopt USDC as a settlement currency on its payment network, initially to support Crypto.com’s Visa card product. It’s likely to provide greater confidence to regulated entities to use USDC as a digital asset with a stable market value and may result in USDC continuing to take market share from USDT.

Dogecoin

Dogecoin began in 2013 as a joke and is now the sixth largest crypto asset by market cap as of writing despite a storied history including theft of coins, wild price gyrations, and pumps by celebrities including rapper Snoop Dog, KISS front-man Gene Simmons and Elon Musk. With a price per coin of less than $0.01 in January 2021, Doge rose to A$0.93 by May spurred on by retail traders using the Robinhood trading platform and Reddit forums. As of writing, Doge is trading around A$0.41 per coin.

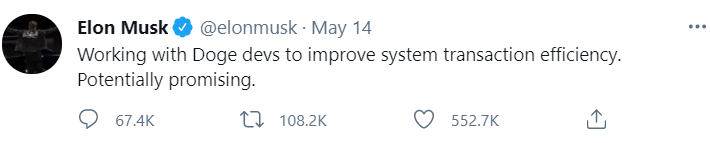

In May, Elon Musk tweeted that he was working with Doge developers, although Doge founders Billy Markus and Jackson Palmer don’t appear to be involved in ongoing software development. Whether Elon Musk is really supporting Doge development or simply tweeting about Doge as entertainment remains to be seen.

Some commentators have called Doge a pyramid scheme and a scam, but this hasn’t stopped Doge’s market cap from rising to $53 billion as of writing. But Doge remains a risky trade with a single Doge wallet controlling almost 30 per cent of Doge coins and the top five wallets holding 40 per cent of all supply. Investors should probably tread carefully.

Polkadot

Polkadot is an open-source multi-blockchain network that aims to allow other blockchains to interoperate while sharing Polkadot’s security framework. Created by Gavin Wood, the co-founder of Ethereum, Polkadot launched in May 2020 and in less than a year, its token DOT has become a top-10 crypto.

Like Cardano, Polkadot is another potential “Ethereum killer” created by an Ethereum co-founder. It hopes to overcome some of Ethereum’s perceived weaknesses such as network congestion and high gas fees. Some have called Polkadot a “blockchain for blockchains”, and the expanding ecosystem of blockchains means that developers can take advantage of functionalities and services developed by others.

Polkadot even has a development environment called Substrate which allows developers to create custom, purpose-built blockchains very rapidly. It also has a growing library of templates that can be used as starting blocks for blockchain development. These features provide real benefits for developers who have already created over 300 decentralised applications as of writing.

Can it overtake Cardano and steal Ethereum’s crown? Investors holding DOT no doubt hope so.

Binance USD

Binance USD is yet another USD stablecoin, this time created by Binance and Paxos, the New York based regulated blockchain infrastructure business. BUSB is the first stablecoin to be approved by the New York State Department of Financial Services. Its asset backing is audited and published monthly to meet compliance obligations, and this statutory regulatory oversight gives BUSB an air of credibility for professional investors.

Being an ERC-20 based token, it can easily operate with other ERC-20 based applications, platforms and DeFI initiatives. BUSB is also now tradeable against virtually every other crypto asset, giving it considerable utility.

While it has some way to go to catch USDC or Tether, its association with Binance and Paxos could see its market cap continue to grow. It recently entered the top-10 crypto assets by marketcap, having doubled since April 2021.

Summary

Like traditional equity indices, the crypto top-10 offers an insight into where investor interest lies and where the money is headed. Doge might suggest it isn’t always the smart money, but perhaps Elon Musk knows something that the rest of us don’t. Monitoring the crypto top-10 is a useful way to read the state of the market at a glance.