Tossing the Crypto Keys to a Fund Manager

Investors seeking exposure to crypto and digital asset investments but fearful of self-custody may wish to consider professionally managed exposure as an alternative or even as a complementary diversification. Although self-custody is very much a crypto mantra (“not your keys, not your coins”), not all investors want to manage the technical challenges involved such as wallets, private keys, seed phrases or carry the associated security risks.

Furthermore, investors might be drawn to professionally-managed exposure by an investment manager with expertise in highly risky and volatile markets.

MHC Digital Group provides Australian and New Zealand investors with access to two funds offering professionally managed exposure to both crypto markets and emerging web 3.0 technology plays. MHC Digital Group was founded by Australian entrepreneur, venture capitalist and corporate advisor Mark Carnegie in early 2021. After running the two funds alongside Portfolio Manager Andrew Palmer with their own money, the two funds were opened up to other private investors in the second quarter of that year.

(Carnegie spoke to Alan Kohler about the fund and his approach to cryptocurrencies back in May of that year and you can read or listen to that interview here.)

Crypto markets multiply risk for investors as they trade 24x7 and are prone to periods of intense and rapid volatility. A well-managed investment insulates investors from the challenges of constant vigilance.

MHC Digital offers two managed fund strategies and they are presently targeted towards sophisticated investors (defined as investors who have at least $250,000 in pre-tax income in each of the two previous years or have net assets of $2.5 million, which can include the family home and superannuation) such as higher net worth individuals and family offices.

Sophisticated investors forgo the normal legal protections offered to retail investors around disclosure, dispute resolution, product design, and conduct. As a result, MHC Digital has no legal obligation to provide either a prospectus, product disclosure statement, target market determination document, or a statement of advice, so the usual caveats apply for interested investors.

So, that’s where this article might be useful if you’re considering investing.

Digital Asset Fund

The Digital Asset Fund (DAF) is an actively managed fund that aims to “combine traditional funds management and digital asset expertise to invest across the spectrum of opportunities available in the digital ecosystem”. The fund:

- invests in digital assets and protocols across a range of products (including spot and derivatives) through a range of liquidity providers ranging from centralised exchanges, decentralised exchanges and over the counter providers; and

- sources and executes other opportunities with correlation or exposure to identified themes within the sector available through traditional financial investment products.

Its portfolio composition is:

- 40-75%: Larger, more liquid cryptocurrencies such as Bitcoin (BTC) and/or Ethereum (ETH).

- 20-60%: Stablecoin and denominated staking strategies, fixed income investing and market neutral trading.

- 0-20%: Alternative opportunities.

The fund’s digital assets are stored in several ways depending on how the assets are being invested to generate returns including staking pools, exchange wallets, cold storage, multi-signature wallets or approved third-party custodial services.

Digital Market Neutral Fund

The Market Neutral Fund (MNF) is actively managed to “deliver attractive returns for investors whilst insulating from cryptocurrency market conditions by identifying and exploiting inefficiencies within the digital asset space, with the aim of providing largely non-directional, diversified exposure to opportunities in the sector”. Its strategy includes:

- Arbitrage strategies across liquidity providers, interest rate curves and various markets to generate returns via long and short exposure to spot, perpetual swaps, futures, options, and structured.

- Fixed income strategies focussed on yield from on-chain staking pools to investments in listed company debt issued by businesses involved in the digital asset space.

The fund’s Information Memorandum doesn’t state any target compositions but says “the strategy aims to provide an attractive, diversified risk-return profile providing an asymmetrical exposure and alternative allocation for investors looking to product from largely non-directional opportunities in the digital ecosystem”.

So, in plain English, this fund aims to squeeze profits out of the myriad ways cryptocurrencies are traded and used in markets today.

Minimum Investment

The minimum investment in each fund is $A50,000.

The DAF’s current Information Memorandum says that the manager will charge a 2 per cent fee of the net asset value of units in the fund (excluding “management units”) paid quarterly, as well as a 25 per cent share of the return on net assets subject to meeting a performance threshold of 10 per cent internal rate of return for investors. The Market Neutral Fund charges 20 per cent with a 6 per cent internal rate of return, with the same management fee.

Investors are ultimately hoping that the fund manager can achieve a risk-adjusted return that is better than what the investor could achieve alone. Unlike more traditional investments, the investor is also outsourcing the logistical and operational challenges associated with crypto tokens, especially around private key security, and in managing other crypto and digital asset service providers such as exchanges, custodians, liquidity pools and the like.

Performance

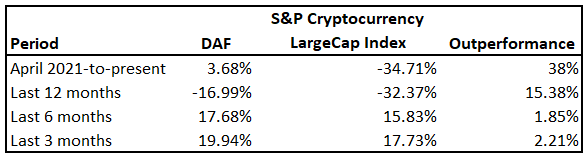

The MHC Digital Asset Fund’s return profile is illustrated below relative to its benchmark, the S&P Cryptocurrency LargeCap Index in AUD terms.

The DAF has performed very well compared to its benchmark, especially during the very high volatility period in 2021-22 where its outperformance was material. It even managed to eke out a positive absolute return from inception to present compared to an absolute -34 per cent return for the benchmark.

Its absolute performance over the last six months has slightly outperformed the benchmark, largely driven by the corresponding rise in the price of BTC and ETH from cycle lows in late 2022.

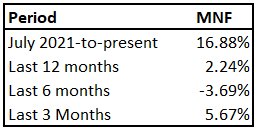

The Digital Market Neutral Fund is an absolute return fund and is benchmark unaware according to its mandate. Its absolute performance since inception in mid-2021 has surpassed the DAF and achieved a respectable 16.88 per cent over that period. Its absolute performance over the last few months to a year has been moderate, likely due to a lower exposure to BTC and ETH.

Investors are ultimately hoping that the managers of such funds can achieve a risk-adjusted return that is better than what the investor could achieve alone. Unlike more traditional investments, the investor is also outsourcing the logistical and operational challenges associated with crypto tokens, especially around private key security, and in managing other crypto and digital asset service providers such as exchanges, custodians, liquidity pools and the like.

MHC Digital is one of a small but growing pool of fund managers looking to service emerging investor interest in accessing crypto and digital asset related investments. As with any investment, but especially a managed investment, the onus remains on the investor to assess whether the funds meet their risk profile, objectives and comfort zone.

Disclosure: James Ling owns units in the MHC Digital Asset Fund.

Frequently Asked Questions about this Article…

Investing in a professionally managed crypto fund, like those offered by MHC Digital Group, can provide exposure to the crypto market without the technical challenges of self-custody. These funds are managed by experts who handle the complexities of wallets, private keys, and security risks, allowing investors to focus on potential returns.

MHC Digital Group's crypto funds are targeted towards sophisticated investors, which typically include individuals with a pre-tax income of at least $250,000 for the past two years or net assets of $2.5 million. These investors forgo some of the legal protections offered to retail investors.

The minimum investment required for each of MHC Digital Group's funds is $A50,000. This allows investors to gain access to professionally managed exposure to the crypto market and emerging web 3.0 technologies.

MHC Digital Group's funds, such as the Digital Asset Fund and the Market Neutral Fund, employ strategies like diversification, arbitrage, and fixed income investments to manage risk. These strategies aim to provide attractive returns while insulating investors from the volatility of the crypto market.

The MHC Digital Asset Fund has outperformed its benchmark, the S&P Cryptocurrency LargeCap Index, especially during high volatility periods. The Digital Market Neutral Fund, which is benchmark unaware, has achieved a respectable 16.88% return since inception, surpassing the Digital Asset Fund's performance over the same period.