The Ticker: Modern business life

Three days into The Ticker and we're still going strong. As always, we are keen for your input and feedback. Send me an email or reach me on Twitter. The details are below. On today's blog:

Our peak Hong Kong business body's controversial reply to the protests

- 1 in 6 Aus properties bought by foreign buyers

- This video may rekindle international attention on the Hong Kong protests

- Two charts on Australia's booming number of millionaires

- A quick wrap of who is capitalising on Ebola

- And here's who is expected to lose money from Ebola

- Does this report fly in the face of Australia's anti-poverty week?

- Three things you need to know this morning

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.55pm - Our peak Hong Kong business body's controversial reply to the protests

Here's an excerpt from our China correspondent Fergus Ryan's latest post on Hong Kong protests:

A day after police used tear-gas and pepper spray, the Australian Chamber of Commerce in Hong Kong and Macau put out a press release that has prompted a backlash from Australians in the city.

"The present situation is damaging to Hong Kong's international reputation, may harm Hong Kong's international competitiveness, and is creating an uncertain environment that may be detrimental to investment, to job creation and to Hong Kong's prosperity into the future," the statement read.

“It reads like an article in the People's Daily” one Chinese Twitter user remarked.

…

One Austcham member, who wished to remain anonymous, said the most frustrating thing about the statement was that none of the members were consulted.

“We're still not sure about the internal corporate governance steps that were taken for how the media release was drafted,” they said.

“It was nothing more than cowardly kowtowing to perceived CCP backlash.”

The chamber has declined repeated attempts by China Spectator to clarify how the statement was formulated. When pressed if they would respond to the query, one board member replied, “What are you offering in return?”

2.25pm - 1 in 6 new Aus properties bought by foreign buyers

By Chris Kohler, BusinessNow

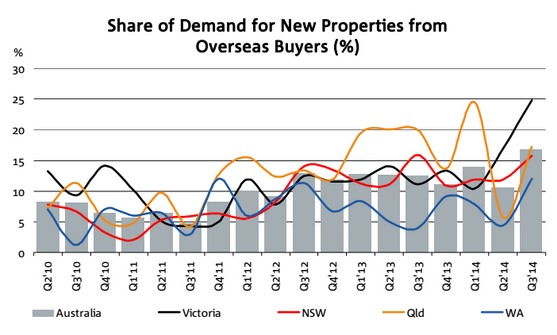

Foreign buyers now account for a large and growing share of Australian property purchases, according to new NAB research.

“Foreign buyers accounted for 16.8 per cent of total demand (about 1 in 6 of all buyers), and this share is tipped to rise further next year (17.3 per cent),” the research said.

“Foreign buyers were more active in all states, especially in Victoria where they accounted for an estimated 24.8 per cent of demand (or 1 in 4 sales).”

“In contrast, local investors were less active in Q3, with their share of national demand falling to 27 per cent (32.5 per cent in Q2). Local investors accounted for a smaller share of demand in all states (see state sheets for detail).”

While NAB expects average capital city house prices to cool to around 4 per cent over the year to September 2015 and around 2 per cent in the following year, the continued strength of overseas interest points to the longevity of Australia's housing boom.

“We don't believe we have a housing bubble, but our outlook is that increasing house prices will be more modest than they have been in recent times because of rising unemployment, sluggish household income growth, affordability concerns, cost of living pressures and high levels of household debt,” the bank said.

1.45pm - This video may rekindle international attention on the Hong Kong protests

The ongoing pro-democracy protests in Hong Kong may hit headlines in Australian again tomorrow after a recent push from police to clear demonstrators.

The Washington Post reports that up to 45 arrests have been made in this recent clash. Police used pepper spray to suppress protestors.

As news from this clash continues to break, the New York Times Beijing correspondent, Edward Wong tweeted out this video from Hong Kong news station TVB.

This footage is going viral in Hong Kong: Cops kick and beat an unarmed protestor lying on ground. http://t.co/2fdtln10La

— Edward Wong (@comradewong) October 15, 2014This latest clash marks the third week of the Hong Kong protests. Up until now, a stalemate between the Chinese government and the protestors has largely seen the event fade out of the Australian media spotlight.

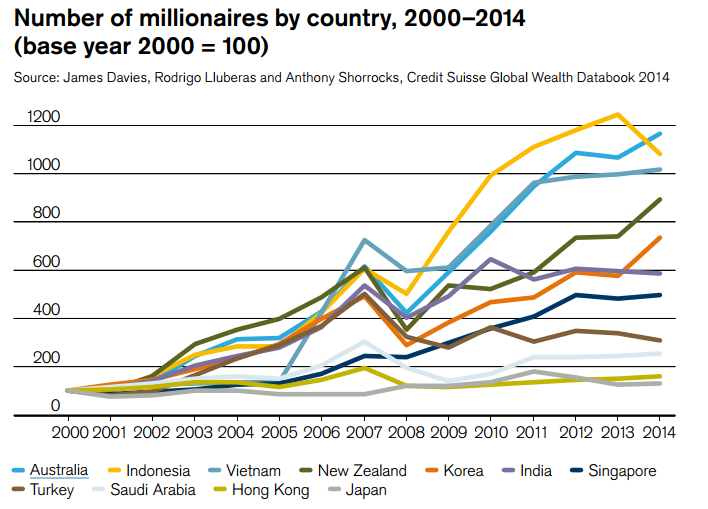

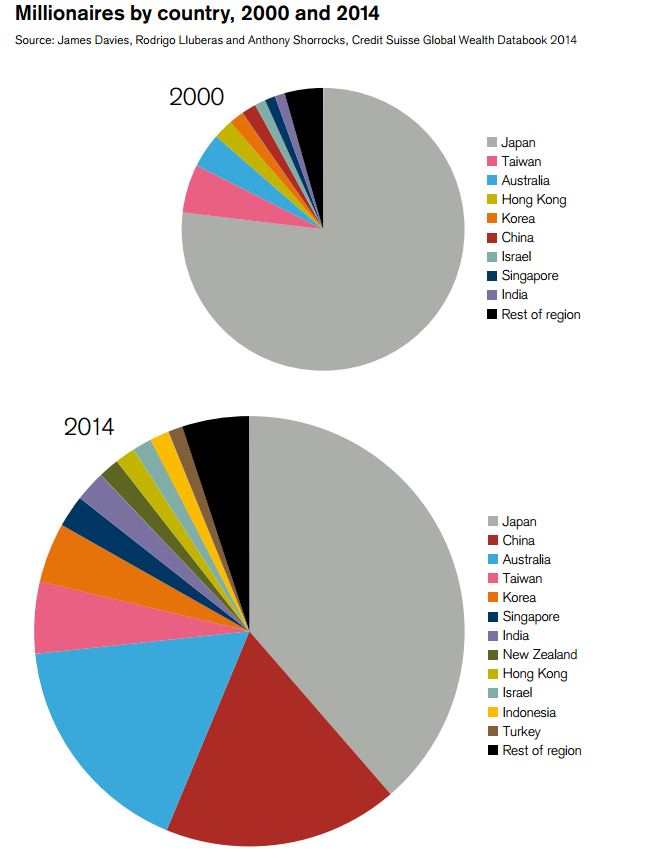

12.30pm - Two charts on Australia's booming number of millionaires

Say hello to another byproduct of our recent property boom. Since 2002, the number of millionaires in Australia has exploded.

We've pulled these charts straight from the 2014 Credit Suisse Wealth report. You can read the full report here (pdf).

We've also posted an article on the unfortunate timing of this report given its global anti-poverty week. You can read it here. We also up a news story offering some context on the report here.

12.10pm - And here's who is expected to lose money from Ebola

By Chris Kohler, BusinessNow

Macquarie has said it expects the outbreak of Ebola to hurt the airline industry, despite commentary from health authorities.

“Authorities have emphasised that transmission of the virus is difficult unless symptoms are showing, however if the number of cases in developed countries increases, in our view confidence in flying will start to diminish, irrespective of any commentary from health authorities,” Macquarie said.

Qantas shares are currently trading 2.5 per cent higher at $1.32, while shares in Flight Centre are up 0.2 per cent at $40.86.

11.20am - A quick wrap of who is capitalising on Ebola

— Lauren Weinstein (@laurenweinstein) October 14, 2014It's a strange coincidence that on the same day that Facebook founder and CEO Mark Zuckerberg donated $US25 million towards fighting Ebola, there have also been reports of companies and individuals that are inadvertently profiting from the outbreak.

Some are even attempting to cash in on deadly disease's headline-making status. Web domain company founder Jon Schultz, who bought the domain name Ebola.com in 2008, is a case in point.

"Ebola.com would be a great domain for a pharmaceutical company working on a vaccine or cure, a company selling pandemic or disaster-preparedness supplies, or a medical company wishing to provide information and advertise services," he told CNBC.

Continued fear of the virus has also seen some stocks skyrocket. For the past couple of weeks,MarketWatch has been running a popular series on the US medical protective gear stocks that have boomed as a result of Ebola: Lakeland Industries and Alpha Pro Tech. Here's an annotated graph with Lakeland's share price.

The latest from the World Health Organisation is that Ebola has claimed 4,447 lives and there are over 9000 reported cases around the world. The good news: the WHO suspects the rate of new infections is slowing.

10.10am - Does this global report fly in the face of Australia's anti-poverty week?

It's an unfortunate case of poor timing. This week, organisations around the world are rallying to highlight the scourge of global poverty. According to various reports, poverty and wealth inequality is an escalating issue both in Australia and the developed world.

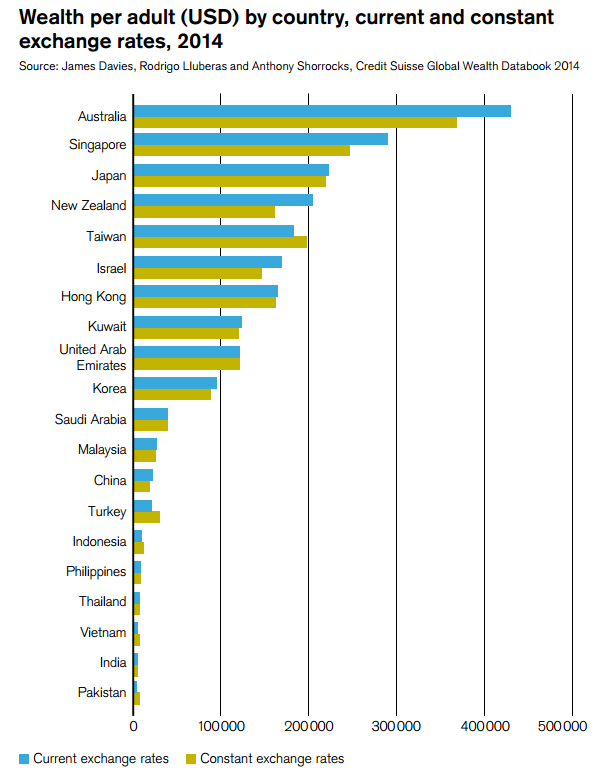

Yet, less than two days after the Australian Council of Social Service (ACOSS) released its report into poverty, Credit Swisse released its own study labelling Australia is the “no worries” country for global wealth.

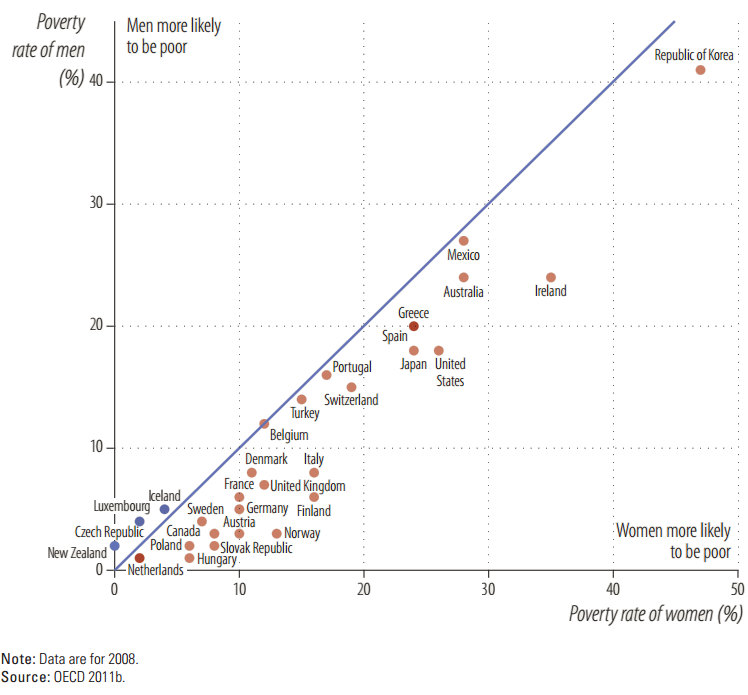

Yet, contrast that to this graph from the UNDP 2014 Human Development Report.

The bank's analysis is sound, though some might argue that it's also poorly timed.

“Only 6 per cent of Australians have net worth below $UDS 10,000,which can be compared to 29 per cent in the USA and 70 per cent for the world as a whole,” the report says.

“The proportion of those with wealth above USD 100,000 is the highest of any country – eight times the world average.”

“With 1,783,000 people in the top 1 per cent of global wealth holders, Australia accounts for 3.8 per cent of this wealthy group, despite having just 0.4 per cent of the world's adult population.”

It also adds that the majority of our wealth is locked up in high real estate prices. No surprises there.

So what can we draw from this? Well, there's nothing to say that both report can't be right. Combined, they indirectly point to a growing level of wealth inequality in Australia. Now all we need is a report on social mobility to determine whether Australian who are stuck in poverty are able to pull themselves out of it.

9am - Three things you need to know this morning

Today's top stories:

1. A robust property market has ensured that Australians, on average, remain the world's richest people, a new study has found.

2. After jetting off to Silicon Valley, Commonwealth Bank chief Ian Narev says that the bank is in the right place to fend off any technological threats to the financial services sector. Case in point: Apple Pay.

3. Harvey Norman head Gerry Harvey has railed against a report which claims the company has the world's most overpriced stock.

From elsewhere

Welcome to the age of vulnerability. Joseph Stiglitz, the former chief economist at the World Bank, weighs in on the global poverty debate.

Get your symptoms ready, Dr Google is coming. Sadly, it's simply a reminder of how badly the internet needs a real doctor.

Disruption in the unlikeliest of places: Google Scholar is equalising the academic journal industry.

Time to consider a standing desk? An increase in work hours and a decrease in exercise are leading to the wrong kind of growth: weight gain.

Why protective gear didn't stop the spread of Ebola in Dallas. A primer on infection control procedure.

Deadly deflation. Here's the one graph that everybody in Europe is watching.

Here's one thing you didn't know about Netflix's CEO Reed Hastings: He's a huge advocate for disruptive educational technology.