The invisible ETF traders who set the rules

The steady rise in popularity of exchange-traded funds is evidence investors are becoming more sophisticated. The easy sharemarket gains of decades past are long gone, and the odds of picking stocks that outperform the market is devilishly hard. When cash deposits are returning nothing after inflation, it makes sense to use ETFs for easy, low-cost diversification and equities-level income.

The first experience of hopping from trading large cap shares to index funds, however, can be a bit of an eye-opener. An investor who is used to seeing buy and sell orders lined up to the horizon for a top 20 ASX-listed company might get a surprise to see the market depth for many ETFs is comparatively shallow.

But here’s the big difference between the markets for direct shares in listed companies and units of exchange-traded funds: the market for stocks is a secondary market, where buyers and sellers trade shares that were created once upon a time when the company floated or issued new equity, whereas the market for ETFs is far more dynamic.

WAITING IN THE WINGS

If Mary comes along and wants to buy a few million dollars worth of an ETF, for whatever reason, and the screen of her online broker only shows a few offers sitting there for nowhere near the volume of units she wants, she can phone the ETF provider and ask it to create new units. If her bidding price is close to the net asset value of the ETF unit, the provider will ensure the transaction takes place.

In the world of direct shares, of course, demand for more shares than were offered in the market would only drive the price up.

Examples of ETF units being created (or absorbed) by a provider to meet demand are hard to uncover because they happen away from the market. That’s not to say there’s anything shady about the practice. In November last year the Financial Review reported an investor had made a profit of nearly $350,000 (before costs) over two occasions by placing trades of nearly $10 on iShares’ ETF over the S&P500 index.

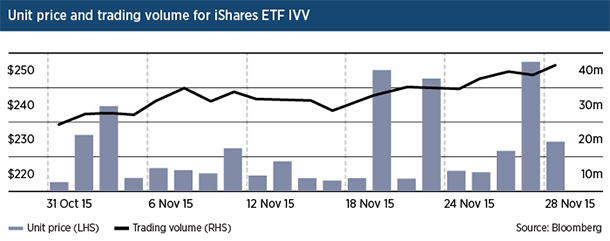

The chart shows daily trading volume for the ETF, with the code IVV, and the unit price over the period.

On November 4, orders of more than $10.6 million were placed for 45,520 units in the ETF. On November 19, the units were sold — for a profit of around $7 per unit, before costs.

On November 21, orders were placed for 39,000 units of IVV — or about $9.36 million — which were sold on November 27 for a $3 profit.

In both cases the transactions could not have happened without the intervention of the provider, which of course created the units at net asset value.

ON THE SIDELINES

There are other players acting in the fringes of the ETFs market, and investors may have already noticed them on their screens. When looking at columns of bids and offers it’s common to see identical large round-numbered orders in the buy and sell queues that just sit there. Who are these people who seemingly never actually want to transact? They are market makers, whose job it is to jump to action and “provide liquidity” where it’s needed, and also to make a profit for themselves.

Much of the growth in the local ETF market is linked to the cheap and simple access they offer to global markets, where trading direct stocks would involve higher brokerage costs and staying awake to transact in the dead of night. A locally-listed ETF is a far better option for international exposure.

When Australians are trading ETFs over global markets that are shut, however, someone has to make sure prices don’t swerve away from the value of the underlying assets. In Australia, a group of about six market makers (professional traders working for specialist institutions) have contracts to oversee defined lists of ETFs and transact on bids or offers that cannot be met in the secondary market or that stray from net asset values.

This makes the apparent illiquidity in the Australian ETFs market a bit of an illusion.

A DAY IN THE LIFE OF A MARKET MAKER

Market makers are the obsessive mechanics of the retail ETFs market. Well before the ASX opens at 10am (eastern time) market makers will check overnight offshore events and trading activity. Dividends for ASX-listed companies are also factored into ETF prices in time for the market to open.

In the case of an ETF over the local index, the market maker has to be prepared to buy or sell stocks to satisfy demand for units that can’t be absorbed in the market. If the difference between bid and offer price, known as the spread, starts to widen the market maker will buy or sell units so that the spread tightens. If traded prices for the ETF vary from net asset value for the underlying securities, the market maker will happily take an arbitrage opportunity … and a profit.

OVER THE HORIZON

The difficulty is determining prices for ASX-listed ETFs over global assets, when markets for those assets are closed. In that case, spreads can widen. Market makers get around this by using the futures market, which is open 24 hours, to determine prices.

The wider bid-offer spread for global ETFs is justified by the fact market makers have to use futures prices as a proxy for real prices, when the international markets are closed.

As the Australian market nears its 4pm close, spreads for all ETFs — of local and international assets — can widen as market makers have less time to transact to fulfill orders or satisfy opportunities.

If it sounds as though market makers are trading against retail investors, to take profits where they are available, rest assured they are also in the case of many ETFs trading against each other.

As the market for ETFs grows in Australia, it follows that market makers will have less of a job to do. Retail investors will trade more among themselves, unaware that in some cases they may have been transacting with a professional trader. But the gatekeepers will always be there, making sure the lines on the tennis court are freshly painted and that the game never gets out of hand.

Frequently Asked Questions about this Article…

ETFs are popular because they offer easy, low-cost diversification and equities-level income, especially in a market where picking individual stocks that outperform is challenging. They provide a simple way to gain exposure to a broad range of assets without the need for extensive research or high fees.

Unlike direct shares, which are traded in a secondary market, ETFs have a more dynamic market. If there's demand for more ETF units than available, providers can create new units to meet this demand, ensuring transactions occur close to the net asset value.

Market makers are professional traders who provide liquidity in the ETF market. They ensure that prices remain close to the net asset value of the underlying assets, even when global markets are closed, by using futures markets to determine prices.

The market depth for ETFs might seem shallow because the visible buy and sell orders are fewer compared to large cap shares. However, this is often an illusion as market makers and ETF providers can create or absorb units to meet demand, maintaining liquidity.

Market makers use the futures market, which operates 24 hours, to determine prices for ETFs over global assets when those markets are closed. This helps keep ETF prices aligned with the value of the underlying assets.

When demand for ETF units exceeds supply, the ETF provider can create new units to meet this demand, as long as the bidding price is close to the net asset value. This process ensures that large transactions can occur without significantly impacting the market price.

Bid-offer spreads for global ETFs can widen when the underlying markets are closed, as market makers rely on futures prices as proxies. Spreads may also widen near the market close as market makers have less time to fulfill orders.

As the ETF market grows, retail investors will likely trade more among themselves, reducing the need for market makers. However, market makers will still play a crucial role in ensuring liquidity and stability in the market.