The forces holding back US rates

First, I would like to start my weekend commentary with an apology. In what was a fascinating Eureka Report three-way Advisor Q&A conversation on residential property trends broadcast via video, I got a little emotional.

I am really angry at what our ignorant politicians and public servants have done to the retirement structure and the long-term cost base of the nation. But, I should not show that anger. More of that later.

The long-term view on rates

For a long time now I have been saying to Eureka readers that while I expected American interest rates to rise I didn't expect we would see a big increase in rates unless there was some totally unforeseen force.

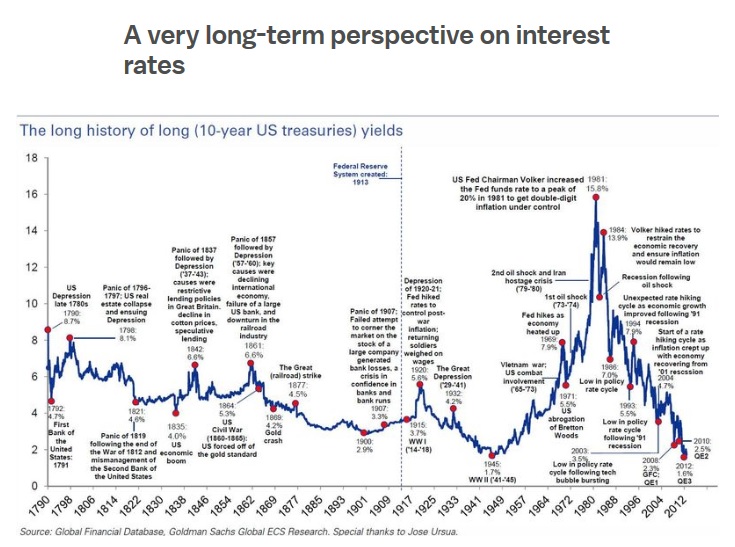

And then, during the week, a graph crossed my desk which was part of a long presentation by Tim Lee in Vox Topics. I saw a fascinating confirmation of my view, which I couldn't wait to share with you.

The graph was produced by Goldman Sachs and takes US interest rates back to the 18th century and the establishment of the first bank of the US. When you look at the graph below you can see that while there were a couple of times when interest rates reached 8 per cent, they rarely rose above 6 per cent and after the World War II slumped to levels that equate to our current rates.

But between 1945 and 1981 interest rates went through the roof – boosted by the Vietnam War, the inflation that came out of the oil shocks and other forces. They finally peaked at 15.6 per cent in 1981. From then until now, although there have been plenty of ups and downs, the trend has been sharply lower and has now almost reached the 1945 low point – although Thursday night's fall in bond prices shows higher rates are just around the corner.

The message of the graph is that we have just been through an aberration in the long-term structure of American interest rates and they may stay at relatively low levels for an extended period. The market clearly expects a rate increase before 2017 and probably one or two more during 2017 and 2018. But that still leaves American interest rates at very low levels.

While the American economy is recovering it simply doesn't have the firepower to stand big rate increases, and if they were to take place the effect on the American dollar would do great damage to the world economy.

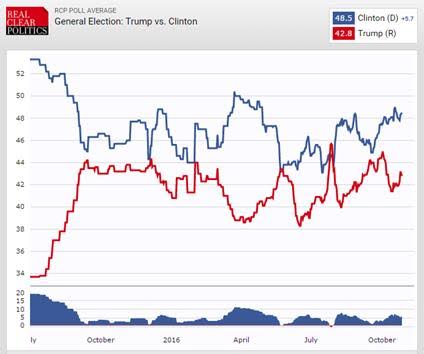

Federal Reserve chief Janet Yellen is just too smart to do that. Given what has happened to the Donald Trump election campaign the likelihood of him being the 45th president has been lowered. Hillary Clinton is planning to lift the minimum wage and take other measures that will increase the cost of low paid workers. In turn that will put upward pressure on the US inflation rate and in turn American interest rates.

But the rapid developments in technology are lowering the cost of businesses across the US and Americans will use the additional technology power at their disposal to counteract the higher wages to lower paid workers.

If the US restrains rises in interest rates then its flow-on will ripple around the world, including Australia. At the moment the markets are taking a tough line on stocks valued on yields, including property trusts and infrastructure assets, in the expectation that higher global interest rates will spill over into Australia.

If my thesis is right, then some of the interest rate experts expecting big rises in American rates will be proved wrong. But no-one knows exactly what is going to happen because there are too many uncertainties.

The oil balancing act

And one of those uncertainties is the oil price. Global demand for oil continues to rise and it is eating into the world oil surpluses. Russian President Vladimir Putin has managed to bring Saudi Arabia, Syria and Iran into rough harmony and the world seems set for production restraint.

But Iraq, which has large amounts of oil and a very big restoration bill, wants to be able to produce more oil. Accordingly, there is a chance the latest OPEC accord will break down and that will depress oil prices.

Fears that Iraq will disrupt the accord are already having a reaction and we are already seeing oil slip back. Iraq has a substantial quantity of oil that has not been fully developed. Although everyone will deny it, there is no doubt in my mind that when George Bush invaded Iraq it was Iraq's oil production base that attracted him. (The US had not worked out how to develop its shale oil at that time.)

In the war against Islamic State the various forces in Iraq are not as well aligned as they might be, and clearly Iraq can see itself with not enough oil revenue to restore the country. I have always believed that before any lasting accord on oil could take place there needs to be some degree of stability in Iraq, and an important part of that theory will be the acquisition of Mosul.

If the war against Islamic State achieves some form of ‘victory' (and that might take some time), then the way will be clear to limit Iraqi production, albeit it's likely there will be an increase in the current rate.

Flawed changes to the asset test

Now back to my beef with the public servants and politicians. It is not easy to save $816,000 in superannuation over a working lifetime, and even tougher to get it to $1 million-plus. In most cases a couple will need a second income. When the Government first announced the proposed changes to the assets test it was a trade-off – in other words, a transfer of wealth from retirees mixing income from their savings with the pension to those that have small savings and receive the full pension.

But when you look closely at what the Government has done, it goes way beyond that base policy principle. Basically, if a couple have a substantial sum, say $1.6 million in superannuation and non-dwelling retirement assets, they can start to think about a life without relying on a Government pension. But once a couple's non-dwelling investment base gets down to $816,000, those assets become a distraction.

As I explained last week, in Pension pinch: The assets test challenge, as you run down your assets your pension rises at a rate equal to a 7.8 per cent return. In effect it means that unless you have assets outside superannuation of more than $816,000, financially you are much better to cash in your savings and rely on the pension.

What the Government has effectively done has made it uneconomic for couples with a dwelling to save via superannuation and other means between $375,000 and $816,000. And yet it is extremely difficult for most people in the general population to save $816,000 outside their family home. (There are different triggers for single pensioners and those without a dwelling but they are all based on the same principle).

Previous treasurers have understood that the Government saved money by sharing the cost of retirement with a person when they had put aside substantial funds. Frankly, on a pure income basis (the feeling of well-being is a different issue) for those couples in retirement, it is not worth saving amounts around the $500,000 to $800,000 mark. I can understand the motivation of the Government to have people to meet the costs of most of their retirement, but this is certainly not the way to do it.

BHP and Samarco

Finally, a small word about BHP Billiton. The big Australian expected to be sued by Brazil for large amounts, but it did not expect its people to be sued for murder over the Samarco affair.

What it has done is to provide a steel-like determination to fight for their former and current employees. I am fearful that before all this is over BHP will pay more money than it expected, but the murder charges will turn this into a long-running saga.

Readings & Viewings

For your reading and viewing pleasure, here's a few articles and videos we spotted during the week. As always, there's plenty going on around the world.

The UK's first post-Brexit GDP print came in better-than-expected this week. But things are likely to get harder from here, says the Independent.

If you're one of the thousands of Australians who have received a bogus call from a “representative” from the Australian Tax Office, this may help you sleep more soundly.

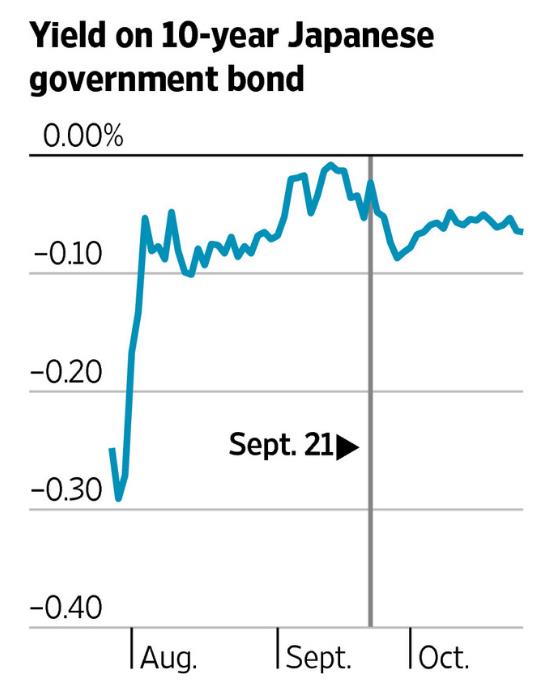

As The Wall Street Journal chart below suggests, the Bank of Japan has put away the bazooka and is opting for a more patient approach.

Not unrelated, the 2015 census showed Japan's population declined – for the first time since 1920.

The Brookings Institution's William Galston suggests a third-way for the Trans-Pacific Partnership and trade-globalisation issues more generally.

A data scientist and former Reserve Bank modeller on how to make Australian housing more affordable. “The answer will make a lot of people unhappy.”

Trump-branded hotels and condos are losing lustre with the affluent.

There's a possibility neither Trump or Clinton will win Utah (or Idaho), with Mormon and former CIA agent Evan McMullin within striking distance. Buzzfeed's McKay Coppins says the independent may build a new party.

And the political ramifications of globalisation in stark relief in the US are playing out in Xi's China, too.

Meanwhile, the bull market for Hollywood movie exporters into the Middle Kingdom is over, with a more discerning Chinese audience now giving some Hollywood blockbusters the cold shoulder.

As more Chinese money looks to find assets overseas, one New York asset manager – Blackstone – has been a key beneficiary, selling $US16 billion worth of property, including hotels, to Chinese companies in the past three years.

Elsewhere ... while China didn't ban LinkedIn, Russia might.

Back at home, it's not just coking coal that has been a boon recently with beef prices also soaring. Now off their peak, Stock and Land asks where will prices settle?

SBS ran an excellent – and chilling – report this week on life under new Philippines president Rodrigo Duterte's extreme law and order program. Here's the link to the Dateline program.

The New Yorker's Andrew Solomon on how people's fear of the mentally ill can have terrible consequences.

This opinion piece was republished around the planet this week. Here at Eureka, we're divided: ‘Plane passengers have every right to recline their seat on a flight'

Happy 60th birthday to Bill Gates! Ahead of his birthday, the Microsoft founder this week sat down with a morning show to talk love, learning, luxury ... and inheritance.

Mitchell Sneddon's recipe of the week: “A staple of the southern and eastern Mediterranean, shakshuka – with feta. Baked eggs are so hot right now.”

Last week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Japanese and Chinese shares up but US shares down slightly and Australian shares having another bad week. Bond yields continued to back up as prospects for a December Federal Reserve rate hike continue to firm and as stronger UK growth diminished prospects for a further Bank of England easing. Commodity prices were mixed but the US dollar continued its ascent and the Australian dollar fell slightly.

Why the recent poor performance from Australian shares? While global shares have been range bound over the last few months (with eurozone and Japanese shares benefiting from falls in their currencies and the US share market down a bit) Australian shares are down 5 per cent from their August high. This relative underperformance reflects a combination of: concerns about the Fed and the US election that seem to be weighing on most share markets at present; a reversal of the huge bond rally that had helped the higher dividend paying Australian share market and sectors like real estate investment trusts up to mid-year; a soft patch in consumer spending weighing on retailers; and stock specific issues. Of these the turn up in bond yields is perhaps most significant taking a huge toll on defensive high yield sectors like REITs. With the Fed on track to hike again in December and the RBA likely to be on hold for now a further back up in bond yields is likely into December. However, while the bond bull market is likely over as global inflation bottoms the back up in yields generally is likely to be gradual as global growth is set to remain constrained, the Fed is likely to remain gradual in raising interest rates and other major central banks including the RBA are likely on hold or skewed to easing further. Meanwhile defensive yield sectors are getting very oversold and due for a bounce and cyclical sectors have more upside if as we expect that global and Australian economies continue to see moderate growth. Bottom line – it's just another correction.

Spain moving out of limbo with the focus shifting to Italy. The political impasse that has hung over Spain following inconclusive elections in December and June looks likely to be resolved with the Socialist party voting to a abstain from voting in a parliamentary confidence vote that will then see Mariano Rajoy confirmed as PM. However, political risk in Europe has shifted to Italy and Austria. Italy will see a referendum on reducing the power of its Senate on December 4 with PM Matteo Renzi seeking to reduce its power in order to proceed with economic reform (something maybe Australia should think about!) and threatening to resign if the referendum is not passed which would then provide a boost to the mostly anti-Euro Five Star Movement. On the same day Austria will see a re-run of its presidential election with the far right candidate being anti-Euro. So if these go the wrong way we could see another bout of eurozone break up fears. Either way I remain of the view that the eurozone will continue to hang together – mainland Europeans are far more attached to the EU and eurozone than the UK ever was, much of the recent rise in populists in Europe is really a backlash against austerity than necessarily the Euro (which remains popular). What's more European shares remain very undervalued.

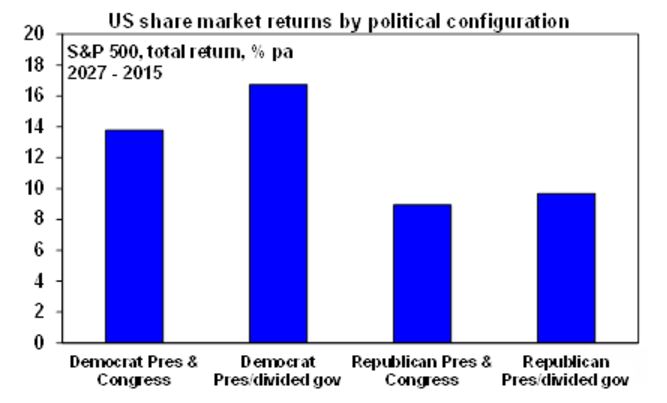

Based on history the best outcome for US shares will be a Clinton victory but with the Republicans retaining control of at least the House of Representatives. Since 1927 US total share returns have been strongest at an average 16.7 per cent, per annum, when there has been a Democrat president and Republican control of the House, the Senate or both. By contrast the return has only averaged 8.9 per cent p.a. when the Republicans controlled the presidency and Congress.

Source: Bloomberg, AMP Capital

A Trump victory would likely trigger an initial bout of 'risk off' with shares down (both in the US and globally), bonds rallying and the US dollar up as investors fret about his economic policies particularly his protectionist trade policies triggering a global trade war. Australian shares and the Australian dollar would be particularly vulnerable to this given our high trade exposure. But a Clinton/Democrat clean sweep of the Presidency and Congress would likely also trigger a bout of nervousness in US shares as it would be easier for Clinton to implement less business friendly tax and regulatory policies that would weigh on US health, energy and financial stocks. This would likely be more focused on US shares though with less of an impact on global/Australian shares. A lot could still happen been now and election day but at this stage while Clinton looks to be ahead with a 5.7 point lead across a range of polls and leading in most battleground states (so we are sticking with a 70 per cent probability of a Clinton victory), there is no sign of a wave of support going towards the Democrats that will see them win the necessary 30 seats to take the House.

Major global economic events and implication

US data was good. Manufacturing and services conditions PMIs are up solidly, home sales are strong and home prices continue to rise and unemployment claims remain low. Durable goods orders are trending sideways though and consumer confidence fell but this looks to be related to election uncertainty. All consistent with a December rate hike.

Despite a few high profile misses, the US September quarter profit reporting season is actually looking pretty good…the profit recession looks to have ended. Of the 275 S&P 500 companies to report so far, 78 per cent have beat on earnings and 59 per cent have beat on sales. Profits are now expected to be up 4 per cent on the June quarter and up 15 per cent from their March quarter low. A 4 per cent, year-on-year, gain in revenue is a key driver.

Eurozone manufacturing and services conditions PMIs also rose strongly in October pointing to continued moderate growth.

Japanese data was also solid with strong manufacturing conditions, a rise in small business confidence, an improvement in household spending and solid labour market indicators. Deflation continued in September though with core inflation falling to zero.

Chinese industrial profits slowed in September to 7.7 per cent y-o-y, but consumer confidence spiked higher in October.

Australian economic events and implications

Inflation remains very low, but maybe not low enough to trigger another RBA rate cut just yet. While September quarter CPI inflation at 0.7 per cent quarter on quarter was a bit higher than expected this was mainly due to prices for fruit & vegetables, electricity, tobacco and property rates while underlying inflation at 0.3 per cent, quarter-on-quarter, was a bit lower than expected with ongoing evidence that deflationary pressures are still working through the economy. However, on balance it is probably not enough to trigger an immediate rate cut as inflation is in line with the RBA's own expectations, economic growth looks to be reasonable and rising commodity prices are set to boost national income. The latter was reflected in the second rise in the goods terms of trade in row in the September quarter with a further rise likely in the December quarter as higher coal and iron ore prices feed through. Meanwhile new home sales rose again in September and remain strong and producer price inflation remains very low.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next week

Savanth Sebastian, Commsec

Data, data, data

A bevy of key indicators are generally released at the start of each month and November is no exception. Around half a dozen indicators are released in Australia in addition to key speeches, reports and an interest rate decision from the Reserve Bank.

The week kicks off in Australia on Monday with CommSec releasing the Home Size Trends Report – detailing the size of new homes built in 2015-16. The report provides another perspective on the supply and demand for homes in Australia.

Also on Monday the Reserve Bank releases the “Financial Aggregates” publication for September. We expect that private sector credit (loans outstanding) rose by 0.4 per cent in September, to be up 5.8 per cent on the year.

On Tuesday the Reserve Bank meets to decide interest rate settings. But following the latest inflation data, financial markets have downgraded the chances of a rate cut to just 4 per cent.

Also on Tuesday, key home price figures from Core Logic and the Performance of Manufacturing index are slated for release. The Home Value Index will draw the most interest. Based on figures released to date, Australian home prices may have been flat to slightly negative (down 0.1 per cent) in the month. However healthy price gains have been recorded for Sydney and Perth (both up around 0.5 per cent), and Brisbane (up 0.7 per cent). The drag is a fall in Adelaide home prices (down 2.7 per cent) and Melbourne (down 0.7 per cent).

On Wednesday the Australian Bureau of Statistics (ABS) releases figures on building approvals. Building approvals have been volatile over the past couple of months, falling by 1.8 per cent in August after rising by 12 per cent in July. Importantly the pipeline of new building will continue to support broader-based economic growth over the coming 12-18 months.

On Thursday the ABS releases September figures for international trade (exports and imports). We expect the trade deficit remained significant although it is likely to have narrowed from $2 billion in August to near $1.8 billion in September.

And on Friday the Reserve Bank will issue its quarterly Statement on Monetary Policy. No doubt if interest rates are cut earlier in the week, the report will provide policymakers with an avenue to expand on their decision. But the report will contain the latest forecasts on economic growth and inflation.

It clearly is a big day on Friday. Not only is the central bank in focus but data on retail trade for September and the September quarter will be released. Retail sales lifted by 0.4 per cent in August, but strip out food, and non-food retailing rose by a larger 0.5 per cent. The lift in retail activity was previewed by the Commonwealth Bank Business Sales index. Overall it is still early days, but it does seem like spending plans are healing. For the record, we expect retail sales to lift by a further 0.4 per cent in September.

Overseas: US Federal Reserve meeting and US jobs data dominate interest

There are ‘top shelf' indicators to watch in both China and the United States over the coming week. The highlight is likely to be the employment report (non-farm payrolls) in the US on Friday.

The week kicks off on Monday in the US with the release of influential regional surveys – Dallas Fed Index and the Chicago Purchasing Managers index. In addition personal income and spending figures and also the Federal Reserve's preferred inflation measure – the core PCE – are slated for release. Analysts expect that the annual core PCE will hold around 1.7-1.8 per cent. So inflation is still below the Fed's 2 per cent target rate.

On Tuesday and Wednesday in the US the Federal Reserve Open Market Committee meets to decide on interest rate settings. No change in rates is expected but the wording of the statement will be scrutinised.

In terms of US data on Tuesday, auto sales, construction spending and the ISM manufacturing index are released. Economists expect that the ISM index held steady at 51.5.

In China on Tuesday, the official statistician (National Bureau of Statistics) releases the manufacturing purchasing manager's index while the private sector variant from Caixin will also be issued.

In the US on Wednesday, the ADP survey of private sector employment is issued with the ISM survey for the New York region. Private sector jobs are tipped to have lifted by 163,000 in October, up from the 154,000 gain in September. Also on Wednesday the usual weekly report on mortgage transactions – purchases and refinancing – is scheduled

On Thursday, US data on factory orders is released, alongside the weekly data on claims for unemployment insurance, the ISM services index, the Challenger job layoffs series and preliminary data on both labour costs and productivity.

And on Friday the highlight of the week – the non-farm payrolls or employment report – is released together with international trade data.

In September, job growth disappointed, only lifting by 156,000. Economists tip a stronger result in October with jobs up by 170,000. The unemployment rate is tipped to fall from 5 per cent to 4.9 per cent, while earnings may have lifted by 0.3 per cent. Stronger-than-expected results – particularly on earnings (wages) and the jobless rate would boost chances of a December rate hike.

Financial markets

- The annual general meeting season continues – an opportunity for companies to update investors about how they are tracking. Major banks are reporting earnings – on Thursday ANZ reports with Westpac to follow on Monday November 7.

Savanth Sebastian is an economist at Commsec.