The emotional rollercoaster of investing, and how not to lose your stomach

According to Psychologist Robert Plutchik, there are over 34,000 distinguishable emotions in the human experience, with eight primary emotions. They are joy, sadness, trust, disgust, fear, anger, surprise, and anticipation.

Emotions are what makes us human, and studies have shown that experiencing the full range of emotions is actually very healthy. This is because emotions help us to evaluate our experiences and adapt. Emotions are made up of both a mental state and a physical state and are responses to events that are either internal or external.

Spending money

Emotions effect how we spend our money. Studies have shown that when we’re sad, we are willing to pay higher prices. And when we’re in a state of disgust, we will only buy things if they are priced less than what we expect.

During times of sadness or stress, many turn to emotional buying (a.k.a. retail therapy), which often provides a pick-me-up. This is because research has shown that shopping releases hormones, such as endorphins and dopamine, that give momentary feelings of pleasure and happiness.

According to Harvard professor Gerald Zaltman, 95% of our purchase decision-making takes place in our subconscious mind. His research shows that consumer spending is largely shaped by emotional urges, and it is emotions that dictate the vast majority of our decision-making.

Investing

There are many emotions that are associated with investing. The two biggest ones are fear and greed. Over the history of investing, fear and greed have caused havoc with markets and economies. They can also cause havoc with one’s investment portfolio.

By definition, fear is an unpleasant emotion caused by the threat of danger, pain, or harm. And greed is an intense and selfish desire for wealth. On the share market, fear can push a market well below fair value, and greed can push it much higher than fair value. This is why Warren Buffett said, ‘Be fearful when others are greedy, and be greedy when others are fearful’.

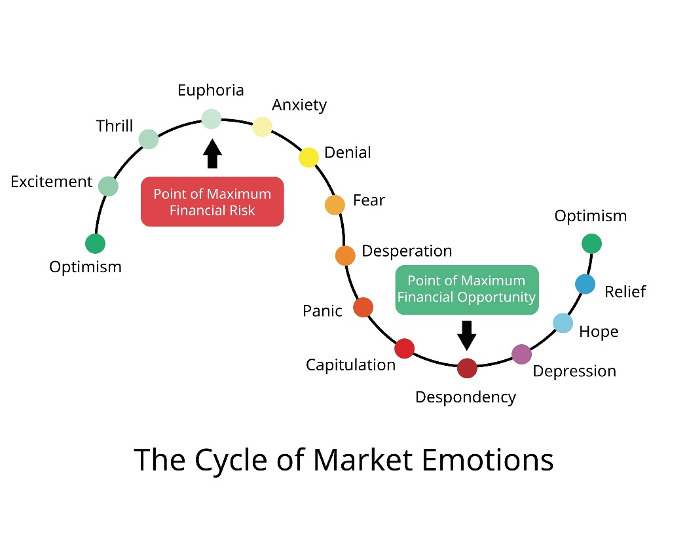

There are however many other emotions that investors can experience. This diagram shows a range of investor emotions that span what is called the ‘Cycle of Market Emotions’.

The cycle begins with optimism of good returns. As markets move up, we become excited and thrilled at the gains we’re making. Euphoria hits, and we start to think that we’re really good at investing. At this point, we may even invest more.

As the markets begin to turn downwards, we start to feel anxiety, then denial, and then fear sets in, which may lead us to sell some of our portfolio. We also start doubting our investment abilities.

As the markets sinks further, desperation sets in, followed by panic, and then capitulation. At this point we may exit the market completely, which will be at exactly the wrong time. We then feel despondent and depressed.

As the share market moves up again, a glimmer of hope appears, and then relief that our portfolio is recovering. We then feel optimism again, thinking that we could make some great returns. And the cycle continues.

How to tame your emotions

There are a number of ways for investors to manage their emotions. Here are six:

- Understand the cycle of emotions. The better prepared we are, the better we’ll be able to control our emotions when the time arrives. Familiarise yourself with stock market history and realise that all market falls are eventually followed by new highs.

- Diversify your portfolio. A diversified portfolio helps to reduce risk by minimising the impact of a fall in any one stock. It also helps to smooth out investment returns.

- Invest rather than speculate. Have an investment plan, invest for the long-term, and minimise risky investments.

- Stay away from leverage. Although a margin loan can increase your gains, it can also magnify your losses. If you want a good night’s sleep, avoid leverage.

- Dollar-cost averaging. Invest at regular intervals into the market. This encourages you to buy stocks during all stages of the market cycle including when fear is high, and prices are cheap. It also takes the emotion out of trying to time the market.

Think long-term. Warren Buffett says that we should view buying stocks as similar to buying a farm, in that we should be prepared to hold for long periods, without the burning need to look at prices daily.

Explore the psychological side of investing. Learn about biases, how to avoid common mistakes, and when it’s the right time to pounce on an opportunity. Start our Bootcamp course today.

Frequently Asked Questions about this Article…

Emotions like fear and greed can significantly influence investment decisions. Fear can lead to selling stocks at a loss, while greed might push investors to buy at inflated prices. Understanding these emotions can help investors make more rational decisions.

The 'Cycle of Market Emotions' describes the emotional journey investors experience as markets fluctuate. It starts with optimism, moves through excitement and euphoria, and can spiral into anxiety, fear, and panic as markets decline, before eventually returning to hope and optimism.

Diversification is crucial because it reduces risk by spreading investments across various assets. This minimizes the impact of a poor-performing stock on your overall portfolio, helping to smooth out returns over time.

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps investors buy more shares when prices are low and fewer when prices are high, reducing the emotional impact of market volatility.

Investors can manage emotions by understanding the cycle of emotions, diversifying their portfolio, avoiding leverage, and focusing on long-term investment goals. These strategies help mitigate the emotional impact of market ups and downs.

Leverage can amplify both gains and losses, making it a risky strategy. Avoiding leverage helps investors sleep better at night by reducing the potential for significant financial losses.

According to research, 95% of purchase decision-making occurs in the subconscious mind, driven largely by emotional urges. Recognizing this can help investors understand the emotional influences on their investment choices.

Familiarizing yourself with stock market history can prepare you for market fluctuations, helping you realize that downturns are often followed by recoveries. This knowledge can reduce panic and encourage more rational investment decisions.