The cost of being underweight international shares

Home country bias is the tendency for us as investors to favour investing in companies from our homeland. You may have been a Telstra customer since the days of the Post Master General (PMG) or have been a Commonwealth Bank customer since your original Dollarmite account and the chances are you share portfolio shares this bias.

This lifelong familiarity, aided by the historical complexity, expense of buying international shares and our domestic tax incentives, has seen Australian investors overweight in both local shares and property. We don’t need to look far to see this. InvestSMART Portfolio Manager users, on average, are 90% underweight international shares when compared to their chosen risk profile.

|

Timeframe |

Risk Profile |

International Shares |

Aus. Shares % |

Prop & Infra % |

Fixed Interest % |

Cash % |

|

2 years |

Conservative |

12.50% |

11% |

5% |

43.50% |

28% |

|

3 – 5 years |

Balanced |

26% |

18% |

4% |

31.50% |

20.50% |

|

5 years |

Growth |

32% |

28% |

6% |

20% |

14% |

|

7 years |

High Growth |

46.50% |

34% |

5% |

6.50% |

8% |

Opportunity Cost

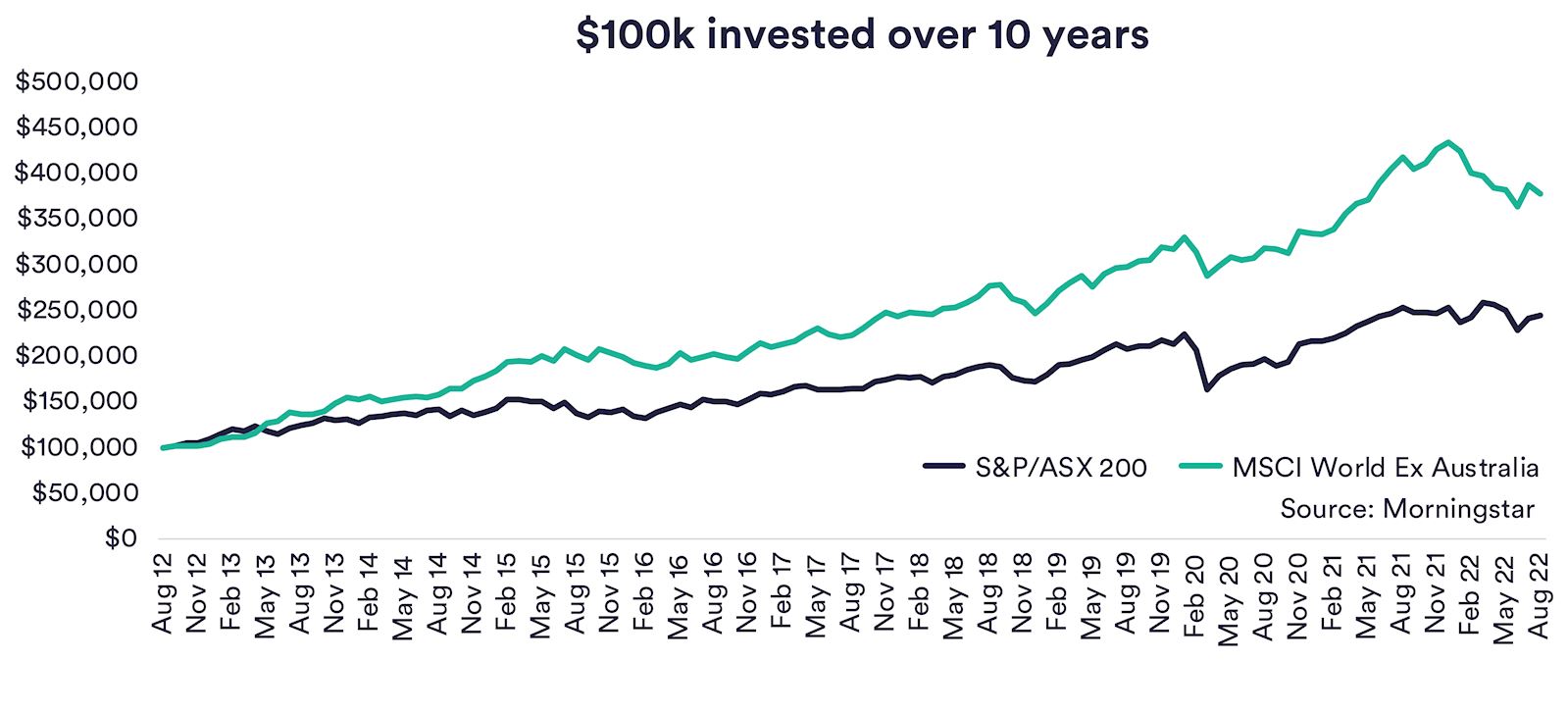

The cost of being underweight international shares is staggering. For example, an investment of $100K into the ASX 200 ten years ago would now be worth just over $244K, compared to over $377K if invested in the MSCI All World Ex-Australia index. This includes dividends, despite the incentive of franking credits keeping many investors anchored to home, the long-term growth benefits could see your portfolio better off.

A part of the underperformance can be attributed to our local markets’ heavy weighting to cyclical businesses such as materials and the big banks. A lack of diversification also plays a role.

Let’s look at the US market which makes up over 60% of the MSCI All World Ex-Australia index. We see a market that is 27% IT, 14% Healthcare and 11.4% Consumer Discretionary compared to the ASX 200 with 3%, 10% and 6.5% respectively.

Comparing the opportunity for businesses to grow here vs the US, it’s hard to ignore the fact that many domestic companies will hit a natural ceiling. Australia’s population of approximately 25 million is dwarfed by the US, with a population of 329 million providing the average US business with a much longer growth runway.

We’re not downplaying investing in Australian businesses. We have many companies that punch well above their weight globally, like CSL, Dominos and Afterpay. Still, we do believe a healthy portfolio, even if conservatively positioned, should have some international exposure.

A simple, cost-effective, diversified approach

As I’ve mentioned above, the complexity and the cost may have historically deterred investors from gaining international exposure, but this is no longer the case. There are dozens of international ETFs to purchase on the ASX.

InvestSMART’s ETF filter can help whittle them down. Alternatively, the InvestSMART International Equities Portfolio provides you with our analyst’s selection of ETFs to provide global diversification. All the ETFs are Australian domiciled and pay quarterly distributions. The InvestSMART team will automatically rebalance the portfolio and provide comprehensive tax reporting for a low management fee of 0.55%pa capped at $550.

We love our sunburnt country, but we also love diversification and total returns.