The 'average' retiree is now self-funded. What's their annual income?

Back in 2019, the Association of Superannuation Funds of Australia (ASFA) estimated that close to one in two (43%) Australians of retirement age would be self-funded by 2023, up from 22% 2000[1].

Today, around two million Australians are either fully or partly self-funded in their retirement[2]. Most of these people are not uber-rich. Nonetheless, there can be a tendency to look at self-funded retirement as a second best choice – something often viewed as “unfair” because others receive a guaranteed government-funded pension. A lot of people deliberately spend assets prior to age 67 to maximise their pension entitlements.

There is no doubt that growing our super savings means giving up spending today, especially if you make personal contributions. And yes, the Federal Government’s decision to increase tax on super balances above $3 million may have rattled the confidence of some Australians. However, it’s been thoroughly flagged that the additional tax only applies to about 0.5% of super accounts.

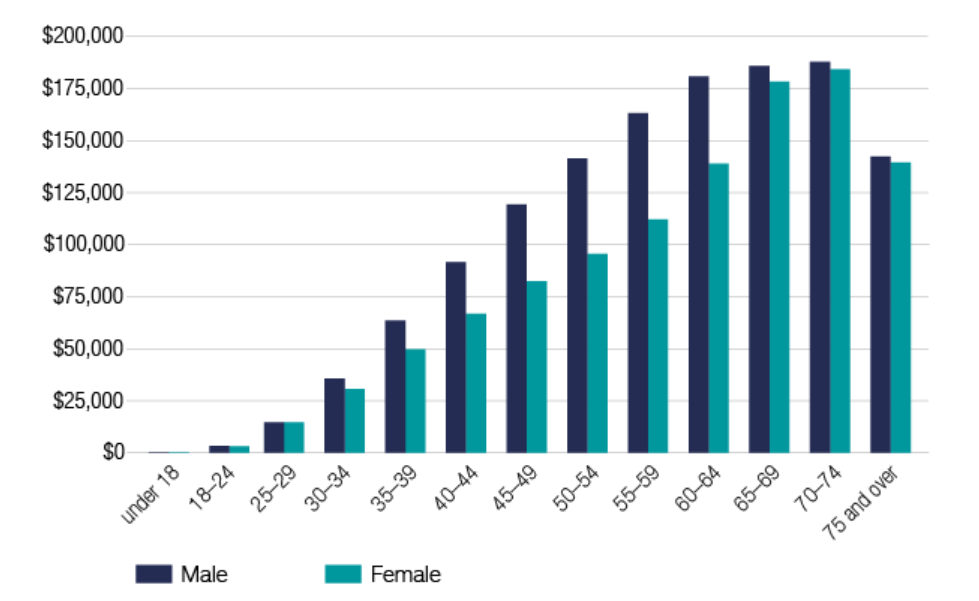

Most people have far more modest super balances. Tax Office data shows that in 2019/20 the median balance for men and women aged 65-69 was just over $175,000[3] (see graph below). This begs the question, how is it possible for so many retirees to be seen as “self-funded”?

|

Individual median super balance, by age and gender, 2019–20 financial year |

|

|

|

Source: Australian Taxation Office[4] |

What is “self-funded” exactly?

Retirees are regarded as self-funded if they are not eligible for an age pension or any other type of government-funded income support.

There is no level of super savings that sets a benchmark for being self-funded. That’s because retirees need to meet both an income and assets test in order to qualify for an age pension.

To be eligible for the full age pension, a single homeowner can own up to $280,000 in assets (excluding the family home), or up to $622,250 for a part-pension. These limits take superannuation savings into account. The equivalent range for a couple who own their home is $419,000 in assets (combined) for a full pension or up to $935,000 for a part-pension.

How much do self-funded retirees earn?

While there are no definitive figures on the average annual incomes of self-funded retirees, data from super regulator APRA shows that super is used in retirement to purchase a variety of income streams. In 2020/21, account-based income streams were by far the most popular option, and delivered an average annual payment of $19,490[5]. Annuities were only used by about 100,000 retirees, and paid average income of $45,943 annually. Other types of pensions (not specified by APRA) returned income averaging $23,826 annually.

For many Australians in the workforce, these figures would raise an eyebrow as they are well below average full-time wages. But there are a few things going on here.

First up, super is often just one source of income. Investments held outside of super can – and should – provide additional retirement funding.

Bear in mind too, retirees opting for an account-based pension can choose how much they draw down from their super each year within government-mandated limits. I’ve previously spoken about how people often select the lowest possible draw down out of concerns of exhausting their super prematurely – fears that can be unfounded.

What’s special about super is the powerful tax benefits it provides in retirement. Not only are contributions and investment returns lightly taxed for the vast majority of Australians, from age 60 super-based income streams are tax free. So annual income of, say, $40,000 derived from super as a retiree goes a lot further than before-tax employment income of $40,000.

The upshot is that super continues to be a great way to save for retirement. It offers the magic of compounding during our working years – and the impact of compounding continues through retirement thanks to lightly taxed investment returns.

A full age pension offers none of these benefits. It provides only a basic level of income, and pension recipients face limits around how much they can work, and have the hassle of dealing with Centrelink.

On balance, it makes self-funded retirement look pretty attractive, and it’s certainly not something to be disappointed or bitter about.

As you head into retirement, check how well-diversified your investment portfolio is, and whether it has a level of risk you’re comfortable with. Importantly, be sure to review the fees you are paying on investments to be confident you are not paying too much. High fees can be just as damaging to your long term wealth as poor returns, and paying more is no guarantee of higher returns.

Another good idea is to spend a little more in the early part of your retirement using your own funds. As your assets fall, your pension entitlement will likely increase, and as we age, we tend to spend less. The main point is to enjoy the investments you’ve worked hard to build up. There’s no point being the richest person in the graveyard.

[1] Association of Superannuation Funds of Australia Limited (ASFA)

[2]https://treasury.gov.au/sites/default/files/2019-03/association_of_independent_retirees.pdf

[3] https://www.ato.gov.au/About-ATO/Research-and-statistics/In-detail/Taxation-statistics/Taxation-statistics-2019-20/?anchor=IndividualsStatistics

[4] https://www.ato.gov.au/About-ATO/Research-and-statistics/In-detail/Taxation-statistics/Taxation-statistics-2019-20/?anchor=IndividualsStatistics

[5]https://www.superannuation.asn.au/ArticleDocuments/402/2205_Super_stats_V2.pdf.aspx?Embed=Y" \t "_blank

Frequently Asked Questions about this Article…

A self-funded retiree in Australia is someone who does not qualify for an age pension or any other government-funded income support. This means they rely on their own savings and investments, such as superannuation, to fund their retirement.

As of now, around two million Australians are either fully or partly self-funded in their retirement. This number has increased significantly from previous years.

The average annual income for self-funded retirees varies. Account-based income streams are popular and deliver an average annual payment of $19,490. Annuities provide an average income of $45,943 annually, while other types of pensions average $23,826 annually.

Self-funded retirement can be attractive due to the tax benefits associated with superannuation. Super-based income streams are tax-free from age 60, and the investment returns are lightly taxed, making retirement savings go further.

Superannuation provides a powerful way to save for retirement, offering tax benefits and the magic of compounding. In retirement, super can be used to purchase income streams that supplement other investments and savings.

To qualify for a full age pension, a single homeowner can own up to $280,000 in assets, excluding the family home, or up to $622,250 for a part-pension. For a couple who own their home, the limits are $419,000 for a full pension and up to $935,000 for a part-pension.

Effective retirement income management includes diversifying your investment portfolio, reviewing investment fees, and considering spending more in the early part of retirement. As assets decrease, pension entitlements may increase, and spending tends to decrease with age.

Reviewing investment fees is crucial because high fees can significantly impact long-term wealth, just like poor returns. Ensuring you are not overpaying for investment management can help preserve your retirement savings.