So your kids want to be millionaires? Show them how with one chart

There's probably no harder paycheque to save than your first. When your friends are all going out, buying new cars and clothes, saving a portion of your wage and investing it can get a bit … old.

So is it worth putting in the extra effort while you're young? You bet.

As an example, let's say it's just you and your sister, Claire. You both studied hard in school, go to uni and work part-time.

But you don't save much and what you do save is usually for a new phone or holiday.

Claire, on the other hand, is good at saving. She's been regularly putting away around $38 a week, or $2,000 a year, since she was 20. She invests it and earns around 9% a year – the 30-year average return for Aussie stocks.

Claire, on the other hand, is good at saving. She's been regularly putting away around $38 a week, or $2,000 a year, since she was 20. She invests it and earns around 9% a year – the 30-year average return for Aussie stocks.

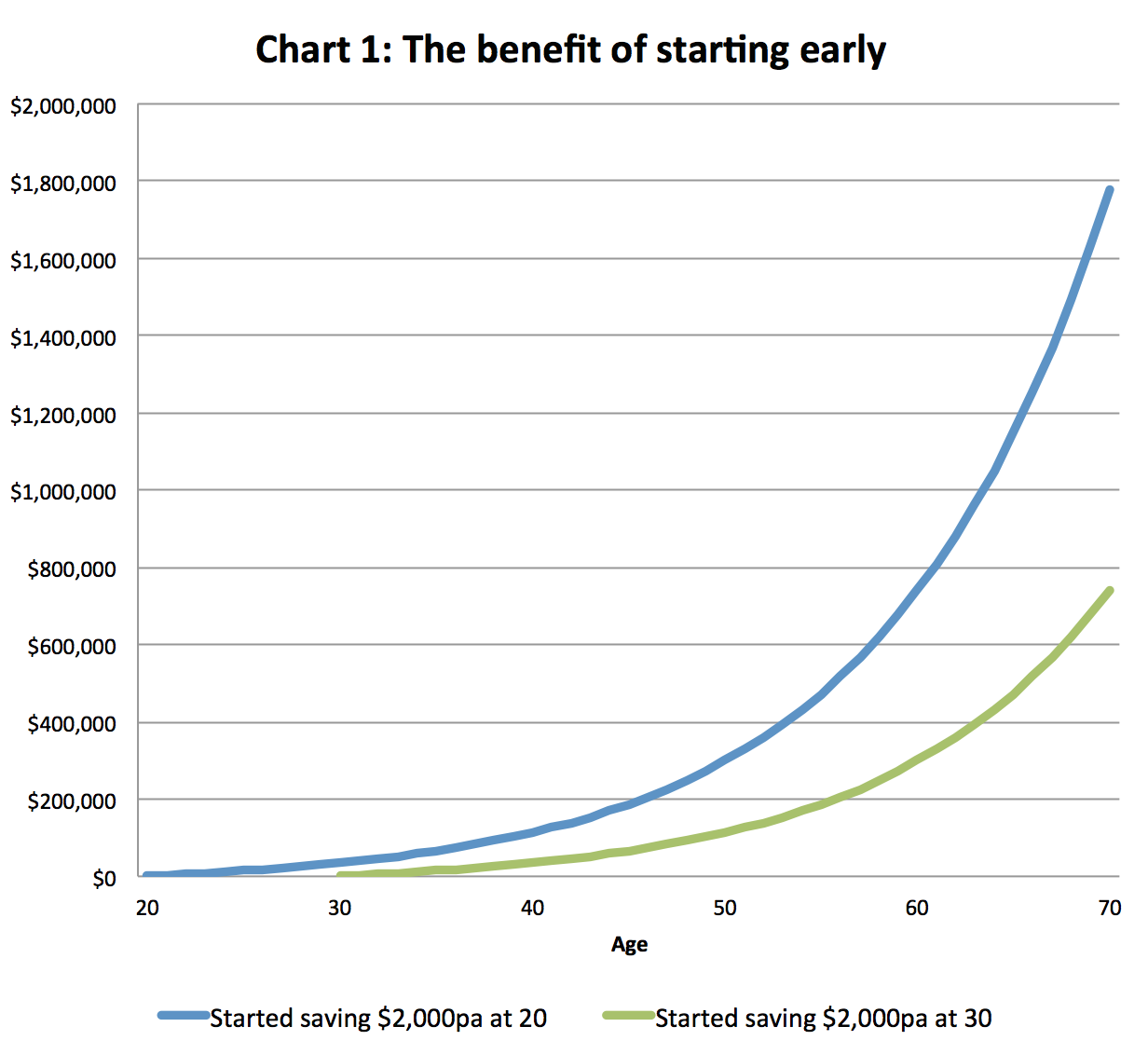

Now let's fast forward to when you're 30. You've also started investing $2,000 a year and earning the same 9% return. After 10 years, Claire has only saved an extra $20,000 – doesn't seem like much of a head start.

But it is. By starting early, Claire will let compound interest do the heavy lifting throughout her life. The interest she earned last year will earn interest for her this year, which adds to what she saves. By 30, she's already accumulated more than $10,000 in interest payments.

And by the time you're both 70, Claire will be more than $1 million richer than you, despite having only saved an extra $20,000. With compound interest, the sooner you start saving, the better.

There are also other benefits to putting money away early. For one thing, decent investment returns are more likely with long horizons as the booms and busts of the stock market tend to even out.

By starting early, you also have time to recover from mistakes. It's more difficult for a 55 year old to recover from a 30% loss than a 25 year old. Better to make any big investing mistakes (like putting all your eggs in one basket or buying overvalued stocks) when your portfolio is relatively small.

Investing is a process of continuous learning. Starting now will give you more time to learn how to invest sensibly and lets you improve your financial discipline before you have a mortgage or family to feed.

Finally, a nest egg provides a sense of security. Knowing you have enough money to weather a storm has emotional benefits. You'll probably feel more confident and less stressed, which is good for your health, relationships, and job.

Albert Einstein called compound interest the “eighth wonder of the world.” The physicist said: “He who understands it, earns it. He who doesn't, pays it.” Let compound interest work for you: Start saving now.