Should you consider investing in commercial property?

Summary: The commercial property space is a different proposition to residential, with many property types and quite different factors that drive performance. |

Key take-out: Right now there is a lot of difference in tenant demand and this may influence where you decide to buy. |

Key beneficiaries: Property investors. Category: Commercial property. |

Residential property continues to be one of the most popular forms of investment in Australia but far fewer venture into commercial property. Is it something that you should be considering?

Like residential, the performance of commercial can be highly variable between capital cities and between suburbs.

Right now, there is a lot of money targeting commercial, including money from overseas. Hence, yields are declining across most asset types.

However, there is a lot of difference in tenant demand and this may influence where you decide to buy. For office and industrial space, rental growth primarily depends on the state of the economy. High levels of development also make a difference.

The city with the strongest office and industrial demand right now is, not surprisingly, Sydney. Although it is an expensive city for occupiers, a prolonged period of under-building has meant that the surge in tenant demand has left not enough space and resulted in strong rental growth as tenants compete to occupy the best properties. For both office and industrial, Sydney now has the lowest vacancy.

Melbourne is seeing similar levels of demand but because it's an easier city in which to add more floorspace, rental increases tend to not be as marked. Office space tends to do better than industrial in Melbourne for rental growth. Industrial can do well, however it does depend on location. Older grade stock can be unattractive for many occupiers because it is so easy to build new space.

Brisbane saw a slowing of tenant demand following the resources boom and at the same time added a lot of stock. It is now close to peak vacancy and rental growth is looking more positive for both industrial and office. Perth still has some way to go to reach peak vacancy and may be a market to consider if you are a higher-risk investor, looking to buy counter-cyclically.

The performance of retail property tends to be more variable and not necessarily linked to a state's economic growth. You need to consider the local trade area and surrounding competition, instead. Expansion of large shopping centres can make a big difference to the performance of small shopping centres. Similarly, population increases can lead to greater sales for a centre.

Chart 1: Office tenant demand in Sydney and Melbourne is back, more mixed elsewhere (office vacancy rate, January 2017)

Source: Property Council Office Market Report

Some regional areas are also worth looking at. Central Coast in NSW is currently seeing high levels of tenant demand from office users on the back of white collar migration because of Sydney's affordability problems. In Victoria, places like Geelong, Ballarat and Bendigo are also worth considering. Small shopping centres pretty much anywhere are worth considering, even in very remote locations.

Asset types

While a large regional shopping centre is clearly out of reach but for a handful of investors, there are a lot of options to consider. One reason investors decide to invest in commercial is to get access to higher-yielding investments, a challenge for many residential investors. Diversification can also be a driver with many people moving on from residential investment to commercial. For many commercial property types, performance can often be linked to quite different factors that drive residential performance.

A shop on a retail strip is one of the more popular forms of commercial investment. Buyers tend to like the ability to see their investment operating and feel some control over the type of tenant that they lease to. As a result, yields for this sort of investment tend to be lower, similar to residential levels. This type of investment can also be impacted by expansions of nearby shopping centres, as well as the location of the shop within the retail strip. Ideally choose somewhere with high traffic.

Small industrial properties are also popular with high yields making these popular. If you are familiar with an industrial precinct and the types of tenants that typically occupy the precinct, then this is worth considering. Some investors have done very well buying inner urban industrial, holding and then getting a permit for residential. Changes to planning rules in places like south Sydney and inner Melbourne have meant that many owners have done very well over time.

While an entire office building is generally out of reach for many private investors, strata offices can perform well and attract high yields. In places like inner Sydney at the moment, tenant demand for this is particularly high, as well as outer suburban areas of Melbourne and Sydney.

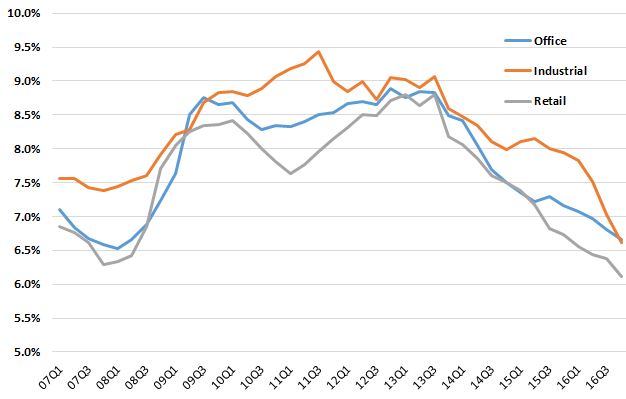

Chart 2: Commercial yields on a national level, 2007 to end-2016

Given the high average cost of commercial property, forming a syndicate can allow you to move into higher price points which can sometimes perform better. Neighbourhood centres, a shopping centre anchored with a supermarket and specialty shops, is generally one of the better performing property types, particularly in growth areas. The price of these is however generally well over $15 million, which is out of reach of many private investors.

For experienced residential investors, commercial property is definitely worth considering. But just like any property investment, understanding the drivers of demand and doing your research is critical to getting the best yield and capital growth.

Nerida Conisbee is chief economist at REA Group.