Property Point: What will it take?

Welcome to Property Point.

This week on the show we have Tim Lawless, the Asia Pacific Research Director at CoreLogic.

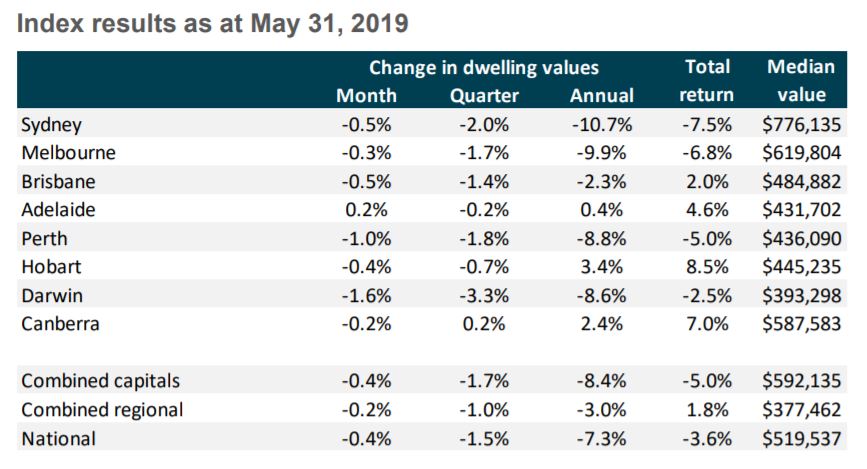

The CoreLogic May 2019 Home Value Index showed that national dwelling values were down 0.4 per cent over the month, which is the smallest month-on-month fall in a year. But does that mean good news is right around the corner?

Tim, we have just seen the smallest month-on-month fall in dwelling prices in a year, with national values down 0.4 per cent over the month. Last time we spoke you were hypothesising what the adjustment period would look like post-election. But you didn't think it would look quite like this. Does this mark a meaningful readjustment in house and unit prices?

I think it provides a firm hint that we are moving towards the bottom of the cycle a bit earlier than what we would have expected. We're still seeing values falling, no doubt, but that rate of decline has been consistently improving and that's before we've really seen the impact of the latest raft of announcements. This has been much more of an organic, I suppose, improvement in the rate of decline, at least through to the middle of May of this year.

Realistically, I think considering we are seeing somewhat positive news coming from the market now, we probably will see a continuation in this trend where housing markets do level out over the second half of 2019.

Like we said, smallest month-on-month falls nationally in a year and there has been an uptick in auction clearance rates, and I noticed that Sydney broke the 60 per cent mark for the first time in a year. But like you said, it's early days and I'm wondering what kind of sample we're talking about, what the level of stock actually is on the market, and as a portion of that, how much stock is actually going to auction even?

That's a really good point and we are seeing less properties being taken to auction. Now auctions work really well when a market's vibrant, when there's a really competitive bidding atmosphere at the auctions. No doubt we have seen fewer properties being taken to auction, more going to private treaty.

But week-to-week we're still seeing upwards of 1,500 properties being taken to auction across the major auction markets. And that's probably the other point, is that auctions or auction statistics are really important for Sydney, Melbourne and Canberra as well, because these are the markets where there is still a large proportion of properties being sold via that method. If you go to somewhere like Perth, for example, we only see about 2 per cent of properties are taken to auction week-to-week. In Melbourne, it's more like about 33 per cent, sort of about a third of the market. In Sydney, it's just a little bit less than a third. But when the market was racing along, in those areas we were seeing generally upwards of 45 per cent to nearly 50 per cent of the market was being taken to auction.

I asked you, Tim, last time we spoke whether rate cuts would fire up housing again. In short, you said no. The RBA has just cut, and after a bit of an arm wrestle, most of our banks have decided to pass the cut on from mid-June. Has your view changed?

Well, I think rate cuts are always stimulatory to the market, and together with the fact that we are seeing serviceability improvements are likely by the end of June, thanks to APRA’s announcement a bit earlier on that they would review the interest rate serviceability tests, as well as the federal government stability, I think we are probably seeing some signs that the market is improving, and that's in part thanks to lower interest rates.

But there are still some headwinds and I think the comment I made last time we spoke was that rate cuts are generally going to be stimulatory but not quite as stimulatory this time around, simply because we do still have some fairly significant credit levers are being pulled. Specifically, what I'm talking about there is that lenders are becoming much less reliant on HEM benchmarks, which means that they are focusing very much on individual incomes and expenses and verifying those much more carefully than they have in the past and we're also seeing lenders becoming much more, I suppose, looking at borrowing debt levels with a lot more transparency now.

So, we do have comprehensive credit reporting rolling through so lenders can see with much more detail now how much debt borrowers actually have, either on credit cards or automobile debt, and very soon for cross-collateralised debt from other housing loans as well. What that means is, even though we are seeing rates coming down and serviceability tests improving, we're still seeing borrowers being confronted with a lot more scrutiny around their incomes and expenses, and lenders also very cautious around lending on high debt to income ratios as well.

We saw that ANZ and Westpac were eager to move ahead of the RBA this week, and Westpac seemed to send some more signs it was open for business, cutting interest-only loans by 35 basis points. So maybe it's sending the sign that majors are inching back into the investor game again. I'm not sure. There's better conditions now than in the recent past. But will piquing investor interest through these kinds of things be enough to meaningfully move the market?

Well, investors are well underrepresented in the marketplace at the moment, for obvious reasons. We're still seeing investors paying a premium on their mortgages, typically around about 55 basis points, at least at the end of May. There’s about a 55-basis-point premium. Investors also are confronted with fairly dim prospects for capital gains, although that's starting to change a little bit, and generally low rental yields as well, although rental yields and now rising as well.

I think the outlook for investors is probably they will start to step up a little bit in the marketplace. When you consider the rates are coming down for investors, it does look like lenders are becoming more willing to lend to that investment cohort as well. There's no longer the macroprudential measures in place – they were the 10 per cent spend limit on investment credit growth and a 30 per cent origination limit on interest only lending. They were lifted at the end of last year. So lenders, they really are able to play in this space much more actively than what they were last year. And it does look like, as you say, from some of the moves that we're seeing in both fixed rates and variable rates for investors and interest-only rates are really coming down now, which does suggest that we probably will see investors becoming a little bit more active than what they have been in the past.

Rental growth has picked up, like you said. And actually, every regional area has seen flat-to-positive rental growth, I noted, over the last year. I'd like to pluck out a few areas of interest apart from our usual suspects, Melbourne and Sydney. Why are Queensland rents going up when house and unit prices are going down? Is it a seasonal thing there off the backend of summer, or is it something else in your view?

I think this is something else entirely and what we're seeing in Queensland, for example, is very strong population growth. You can see a real ramp up in interstate migration rates, which is fuelling housing demand into that market. And it's also a market where investors have been quite substantially underrepresented over the past five or so years. So there really hasn't been very much new rental stock being introduced to the marketplace. So I think it's that combination of supply, in the sense that there hasn't been much new supply being added to that marketplace over the past five or so years, coupled with stronger demand as we see interstate migration really ramping up and overseas migration holding quite firm at high levels.

And what about the lower Australian dollar for those kind of holiday towns?

That's always going to be a positive, and the dollar is pretty hard to pick where it's going. You would have thought the dollar would have come down a bit further after the latest rate cut, but it's actually risen a little bit. But no doubt, the dollar holding around the 70c-mark, if not down around the high-60s, then I think that really is an incentive for foreign buyers to become more active. Of course, it does support tourism, it does support the export markets for the resources sector as well. So many of those very hard-hit resource centres around Queensland and WA, the Bowen Basin, which is mostly coal up in the north western Queensland and the Pilbara in WA around iron ore, we are seeing consistent signs of those markets are now bouncing back, but after extremely large declines. So sometimes upwards of 50 per cent in values from the market peak in many of those mining areas.

So is that the same story for Perth and Darwin, broadly speaking, as well?

A little bit different in those markets. You know, Perth and Darwin are well into a very long, entrenched downturn. It's largely been fuelled by very weak economic conditions, rather than the rest of the market around the country, which has generally been weakened by credit conditions. In Perth and Darwin, we've seen this overlay of very weak economic factors. Unemployment's still generally up above 6 per cent in WA, lower in Northern Territory, but jobs growth in the NT is negative, and across WA it's only been half a percent year-on-year. So we are seeing weaker economic condition. Migration patterns into both WA and NT seem to have turned a corner, but are still extremely weak as well.

In that sense we do have these ongoing weak economic conditions overlaid with very tight credit conditions impacting on Perth and Darwin. Not really seeing any signs of those markets turning just yet, but we are seeing some signs that exploration dollars are now ramping up. That generally flows through to a stronger infrastructure spend. And you can see that particularly for WA, the Federal Government announcement around infrastructure spending and the redistribution of the GST should help to support a massive infrastructure spend that's going on in WA – $4 billion over four years for the Metronet over there is just one example of the strong infrastructure spend that should help to support the market.

Now on to other policy, which may or may not help. All the political chat around housing pre-election centred clearly on negative gearing and capital gains tax. With the re-elected Liberal government, I'd like to focus on what they're bringing to the table, for first-home buyers in particular. What's your view on that policy?

I think the policy was very much created on the run and had bipartisan support as well. I think even though it doesn't come into effect until January next year and it does have a quota of only 10,000 first-home buyers, they probably will have some level of stimulus to the marketplace, which will be quite small. When you consider how reactive first-home buyers are to any level of stimulus in the marketplace, I think if history is anything to go by, we will see first-home buyers jumping at the opportunity to take on that incentive from the government. Essentially, if you have a 5 per cent deposit, they'll guarantee you getting a loan and you can miss out on paying lender’s mortgage insurance, which is probably quite a strong incentive for many buyers. But it doesn't kick off until January next year. So potentially we could see first-home buyers just having a little bit of a lull as some wait for that incentive to go live in January next year. But like I said, it's only 10,000 individuals, or borrowers. Unless we see the scope of that scheme expanded quite remarkably, I don't think it's going to have a major impact on the market.

I'm not sure if you have a read on this, but since the election what level of demand have we been seeing from first-home buyers?

It's not something we can measure specifically, but if you just look at the market anecdotally and look at, I suppose, the sentiment at face value, it does look like there's been quite a remarkable shift in how households and prospective buyers and sellers are viewing the market. I think we've seen that the stability in the Federal Government, as you say, we’ve seen some certainty now that taxation reform is off the table. We're seeing some tax cuts coming through for low-to-middle income earners. We're seeing some certainty now around the Federal Budget announcement, particularly the 25 per cent lift in infrastructure spending. Mortgage brokers have the status quo for their commissions. Of course, mortgage brokers are about 60 per cent of mortgage origination, so it's quite important as well. So absolutely, I think there has been quite a palpable change in sentiment across the marketplace in line with the Federal Election announcement outcome, as well as the other news around APRA looking to lower serviceability rates, as well as interest rates coming down and potentially moving further lower over the remainder of the year.

In a post-election environment, we have more relaxed lending standards but a worse outlook for employment. From what I can tell, employment was looking more solid in 2018 when our major housing markets were in a clear downturn than it is now, even though credit availability was tighter. The question is whether the availability of credit or employment is more important to the housing market?

It's a good question and clearly labour markets are starting to show some cracks. The strength of the labour market has very much been emanating out of New South Wales and Victoria. They're the states that have accounted for a little bit more than 80 per cent of jobs growth over the past few years. And with the residential construction sector winding down now and consumption remaining relatively weak, we are seeing unemployment just starting to tick a little bit higher in those markets and jobs growth still strong, but they're starting to ease off a little bit. So definitely a wild card for the market. Generally, if you don't have a job it's hard to get a mortgage, that's for sure. And then you've also got the fact that credit is easing up a little bit in some areas, but remains very tight in others. There's a really interesting statement from Shayne Elliott in the ANZ board report/financial reports last month which showed that probably about 70 per cent of the reduction in the credit slowdown was attributable to lenders removing themselves from HEM reliance as well as income haircuts, and the remaining 30 per cent was more the higher serviceability base. I think those two other headwinds – in a sense, lenders becoming less reliant on HEM and also looking at household incomes with a lot more scrutiny, as well as expenses – are still a major headwind in the marketplace that will continue to dampen market activity.

And we've certainly seen the mortgage belt, things get a lot more tough there in Melbourne and Sydney, and it's always been a bit of a competition between Melbourne and Sydney. It's been a healthy competition, but I don't think this is a race that either city really wants to be running for. In Sydney we've had Ryde and the inner west take over from Melbourne's inner east as being the areas with the steepest price falls over the year, as per your recent data, and that's around 15 per cent. I'm wondering if you can explain to the average investor whether it's good news or bad news that these more expensive parts of the housing market are generally underperforming right now, relative to the more affordable parts of the market? Is that something we should be keeping a closer eye on?

It's certainly something to keep a close eye on. It's looking at the marketplace holistically, gives you a macro view, but drilling down and looking at the different valuation cohorts and geographically what's happening in the market is probably even more important when you're actually making your investment decision. So when we do look at our stats across the sub-regions across Sydney, for example, we are seeing by far the largest falls are in that middle-to-upper end of the marketplace. It's not in the uber high end of the market. It's not in your Point Pipers and your Bellevue Hills. It tends to be in the markets like Ryde, the Hills district, the inner west, even southwest. These are all markets where values have fallen by more than 15 per cent since the market peaked. In fact, in Ryde, values are down by 23 per cent since the market peaked. I think, in that sense. it does set off a few alarm bells that potentially negative equity is becoming a reality, especially in Ryde, where values are down more than 20 per cent. But it probably also suggests that many of these areas, which have traditionally been in high demand and quite aspirational for some buyers, are becoming quite affordable now. These are also the markets that generally showed some of the strongest gains during the growth phase. So maybe the larger declines during the down phase shouldn't be that surprising.

Recently in our May data we have shown that if we look at the top quartile of the market, that does seem to be where the rate of price declines has eased off the most substantially, or the most sharply. Potentially we're starting to see that higher end of the marketplace turning around a little bit earlier than some of the mortgage belts.

Well, we might leave it there for today. Thanks very much, Tim, for the chat.

Pleasure. Thanks for having me.

That was Tim Lawless, Asia Pacific Research Director at CoreLogic.