Property Point: Does the stress match the search?

Welcome to Property Point. This week we're talking to Nerida Conisbee, the Chief Economist at REA Group. This past week we've seen a pick up in severe mortgage stress in affluent areas. We're talking suburbs like, Sydney's Bondi and Randwick, Brighton in Melbourne, and Broadbeach and Mermaid Beach, on the Gold Coast. All up, the number of Australian borrowers in severe stress, rose from 27,775 in March, to over 30,000 in April.

This is extremely comprehensive research comprising DFA data from 52,000 household surveys, as well data from the RBA, ABS, and APRA. But, does this correspond with search data from realestate.com.au, specifically where potential buyers are looking right now. Is there still a focus on the blue chips?

Nerida traverses all sorts of issues related to residential property, including the changing Chinese buyer profile, what we're now seeing with satellite cities outside of Sydney and Melbourne, and also pins down the biggest handbrakes on housing in Australia.

So Nerida, I'd like to mainly talk about residential today as I think it's the most pressing area of the market right now. I think we should probably talk about mortgage stress a little bit, considering it's a situation that more than one million Aussies are currently in apparently, and severe stress has ticked up. The list for severe stress goes Bondi, Clovelly, Randwick, Brighton, Broadbeach and Mermaid Beach, feature high up there too – so there’s obviously a rise in affluent stress. Would that ultimately crack the top end of the market, which we have seen as protected until now?

Yes, mortgage stress is defined as spending more than 30% of your income on your mortgage and, if you have a look at places like Bondi and Clovelly, you can see that the pricing/people’s incomes would suggest that a lot of people are likely spending more than 30% on their mortgages. So it doesn't necessarily mean people are distressed, but it does mean from a numerical perspective, they are defined as being in housing stress.

What's interesting at the moment is that a lot the premium suburbs of Sydney, and Melbourne as well, are actually seeing elevated levels of search activity on realestate.com.au. We're seeing this situation where, when the market was red hot people were moving away from premium suburbs and they were looking in far cheaper locations, we we're starting to see a lot of search activity in Central Coast, in Western Sydney, in Melbourne it was the outer North East, that we were search lots of search activity. So people were really looking for affordable options, they were I guess a little bit nervous buying in premium suburbs, they felt they couldn't afford them, perhaps they were unable to get finance; we're not quite sure exactly what was happening.

But what we're seeing now that prices have come back, that people are again looking in these premium locations. So, I guess on one hand, we do have this situation where people are highly likely to be under housing stress, but on the other hand there's a lot of people still looking to buy in these areas.

Mortgage stress chips away at the blue-chips:

| Postcode | State | Location | Borrowers in 'severe' mortgage stress | Borrowers in mortgage stress |

|---|---|---|---|---|

| 2026 | NSW | Bondi Beach | 1078 | 1339 |

| 2131 | NSW | Randwick, Clovelly | 876 | 1371 |

| 2030 | NSW | Dover Heights | 686 | 686 |

| 2066 | NSW | Lane Cove | 657 | 1081 |

| 2065 | NSW | Naremburn | 648 | 1171 |

| 3186 | Vic | Brighton | 625 | 751 |

| 2090 | NSW | Cremorne | 613 | 712 |

| 2075 | NSW | St Ives | 595 | 595 |

| 2088 | NSW | Mosman | 504 | 640 |

| 2069 | NSW | Roseville Chase | 482 | 676 |

Source: Digital Finance Analytics

I'm wondering if you have perhaps seen a pick up of search in the suburbs because people are becoming nosier neighbours, and wanting to see what their neighbours are getting when they're selling. Or is it coming from outside of these suburbs, because you can obviously track where people are searching from, like to the IP address.

Yeah, look we don't know exactly what they're doing on the site. I mean, we do know that it does seem to be a pretty good leading indicator of price growth, so when we've looked historically at areas that have seen elevated levels of search activity they have tended to out perform the market. We can say that with relative certainty.

In terms of who's looking, there's some interesting trends happening in Sydney at the moment, that we've got places like the North Shore which is a very expensive area, but was also an area that did attract a lot interest particularly from Asian buyers; and so right now the North Shore isn't seeing much search activity whereas, Northern Beaches and the Eastern suburbs of Sydney, are seeing a lot of search activity. I think there's definitely a change from that dynamic. In terms of who's searching in places like Bondi, we know how popular that area is, in terms of views per listing, so to give you an idea, somewhere like Bondi is probably seeing around 10,000 views per listing. It would be a mix of people just having a bit of sticky beak, but when you're starting to get to those sorts of volumes, it would also be potential buyers as well.

Have you seen a noticeable pull back from China, in terms of searches? Or are they just shifting where they're looking? I don't know how granular you can get with how you're tracking the data from there.

Yeah, we can get very granular, I mean, we can get to the suburb level. There's been quite a shift. I mean, it's interesting that they're still looking, so I guess that's the first thing that we have seen, a big drop off in FIRB activity. If you talk to any developer, they're saying it is really hard to get Chinese buyers at the moment. There's no doubt that they're no transacting and there's lots of different reasons why that's not the case but they're certainly searching.

We have seen a decline in some locations. Sydney is the most dramatic, and I think a lot of it just had to do with pricing. Sydney got too expensive for a lot of them; a lot of them are looking sub-$750,000 so trying to buy something new in Sydney, because they're restricted to buying new, is almost impossible. Melbourne, continues to hold up. Around half the searches out of China looking in Australia, they're looking at Melbourne. Brisbane's actually seen quite a significant increase, and actually not just Chinese, but if we look at Singaporean, Malaysian, even UK property seekers, there seems to be quite a big jump in Brisbane. For whatever reason, again we don't quite know what's happening there, but it is probably related to affordability, perhaps the fact the Brisbane is holding up better than Melbourne and Sydney has also been a factor.

The other big shift though, we have seen Chinese buyers move away from a lot of the university suburbs to areas where they have looked prior to the boom. So a good Melbourne example is Glen Waverley, so Glen Waverley regularly topped out as the most searched location for Chinese property seekers, but when things got red hot, we started to see a lot of property seekers look to places like, Carlton, and Clayton, and very much looking at places potentially they're looking to send their kids to university, but they gone back to Glen Waverley. So, places like Glen Waverley, Box Hill, Doncaster, Chatswood at the moment.

Affordability related, do you think?

I don't think so. I think it's family and friends, and when we have a look at any property seeker, when we look at UK property seekers, the number one searched location is always Manly. Manly has a very high proportion of UK residents. If we look at South Africans, it’s St. Ives in Sydney, and that has a very high proportion of South Africans. It seems to be switching back to that, they're looking back to where their friends and family are, and seeing them as great places potentially to buy.

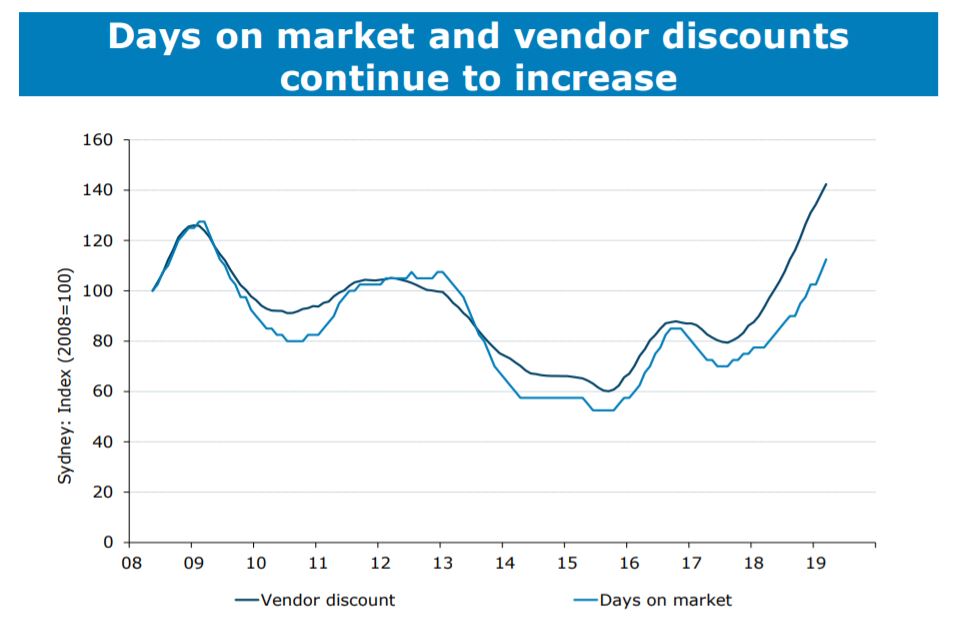

And now from a seller's perspective, what about days on the market? How is that looking as a metric? It's often thought to be an indicator of a market in one way or the other. What are you seeing there?

Yeah, so days on market are increasing. I mean, it's interesting on our site, we are seeing properties stay on site longer, but we're seeing fewer new listings. That means that we are seeing total properties for sale increasing, but we're not getting the refresh of properties coming through. Obviously, frustrating to us as a company, because we do rely on listings, but in terms of the market, it's actually not necessarily bad news, because when see big upticks in new listings, it means that the market is distressed, and people are being forced sell. And, if we look historically when that's been the case, you know, during the global financial crisis, we saw this big jump in new listings, as we saw a lot of people lose their jobs, and have to sell. This time around, that doesn't seem to be happening.

Source: ANZ Research

What seems to be happening is, people are just holding back. And we're seeing property seekers holding back, we're seeing property buyers holding back. And the market, I know there's been a lot of talk, you know, this is the worst downturn in, you know, someone said 100 years; I don't even know how they calculated that number, but there's been a lot of alarmist commentary, but when you look, really, it doesn't feel like most of the market is distressed. What it feels like, is that people kind of got sick of high prices, they couldn't get finance, investors started to find a lot of trouble in the market. So all these things happen that really led to this price decline, particularly in Sydney, and as a result we are where we are now, where the market has changed quite significantly.

Stockland and Mirvac have recently reported their numbers, and Stockland did report that its residential sales fell 26% quarter on quarter in March, and they expect that to remain weak for the 2019 calendar year, with further risk to the downside. How do your expectations compare with that?

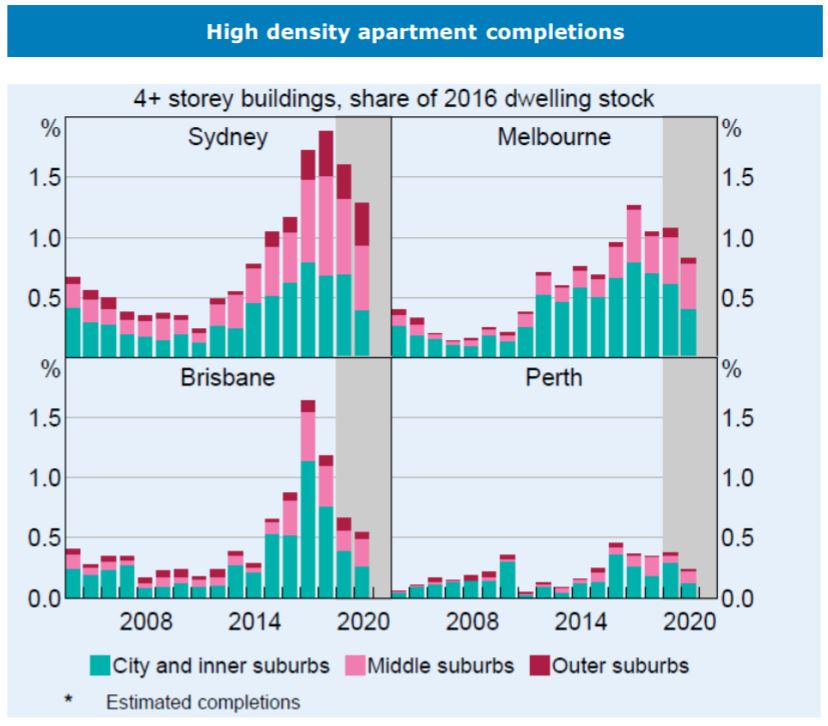

Yeah, so developers are the worst hit, and it's apartment developers that are worst hit. If you think of who was buying apartments, it is primarily investors, you know, the majority of new apartments have been purchased by investors, investors have pulled back; we've seen it in the finance numbers. Foreign investors have pulled back, so they were also a significant buyer of apartments. Apartments are really seeing a big decline.

House and land, as well. Again, not hit quite as hard as we saw apartments hit, because a lot of house and land is purchased by owner-occupiers, as opposed to investors. But, at the same time when you've got somewhere like Melbourne, where there was a lot of land released, and a lot of people were speculating, where we're starting to see problems emerging right now.

Developers, you know, a lot are doing it really tough. I think groups like Stockland, and Mirvac, would have been very well prepared for this. I think anyone who has been building through many cycles is not surprised at what's happened. I don't think any of them would have expected, for example, the Chinese buyers to be around forever, and the level of investor purchasing would be around forever.

Source: Reserve Bank of Australia

It doesn't make it any easier for them. I mean, having to then adjust stock can be quite difficult. So, you're used to selling to investors, who typically want two-bed, two-bath, one garage, or one carpark, and then you're trying to sell to upgraders or downsizers, or first home buyers, it can be quite difficult to change the mix in your development, particularly if you're quite far through the planning of that development.

Many wouldn't be starting to build because they would've done pre-sales, but a lot of developers are left with quite a lot of apartments at the end of the development, because they had enough pre-sales to get it started, and now they're trying to sell off the rest, and they're finding it quite difficult. It's difficult, but it does depend on which developer you're talking to, as to how distressed they are at the moment.

I did see something earlier this week about North of Melbourne, a housing estate there that was empty, and they were comparing that to Ireland, and what happened there a few years ago. And, of course there's always alarmist calls, or maybe they will prove true, who knows. But it did make me think that there is a move to satellite cities, regardless of that, and I'm wondering if you're seeing that in your search data. Second CBDs, satellite cities, have been in the works with Parramatta for some years, and now we're seeing similar attention paid to Liverpool, which is also in South West Sydney. Commercially, there's renewed focus through development on those areas, but residentially these are the areas that have been hammered with house price falls and mortgage stress. Are you still seeing that people are searching those areas, or are they focusing again on the blue-chip areas, like you said before, with the Chinese buyers looking more into Carlton again, and even Eastern suburbs in Sydney?

Yeah. Look, somewhere like Parramatta and Liverpool, they don't typically see high views per listing, and it's even rare, I mean partly because they've seen quite a lot of apartment development, so we don't often see those sorts of areas see high views per listing. We see a few places in Western Sydney, seeing high views per listing for houses, but they tend to be low development areas, so they’re not house and land areas that we see high demand.

When we have a look at the locations seeing high demand for new homes and new land, somewhere like Kellyville is still doing pretty well, partly because there's probably not much land available there anymore, and it's well established, got a new train line, so that seems to be doing pretty well. And then when we move to satellite cities, we've got places like Geelong still doing pretty well. It's slowed, it does seem to be a market that did very well, up until the end of last year; it's starting to slow now. We've got places, you know, Gippsland is doing really well.

What about Box Hill, because that was pegged as the second city at one point, from Melbourne?

The problem is, we kind of deal in extremes, so we're either seeing somewhere that's really popular, somewhere like Middle Park, for example, or very unpopular, so to give you somewhere that's very unpopular at the moment, Sydney Olympic Park, is very unpopular.

After all the apartment troubles as well?

Yeah, so that kind of exacerbated the problem, and very high supply, and then a downturn in Sydney. All these things led to that being ground zero for the apartment downturn.

But, somewhere like Box Hill, I guess with Melbourne, the issue with decentralising Melbourne, is that if you go somewhere like Sydney, the Sydney CBD is constrained, in terms of development, and the government was very focused on getting Parramatta as the second city; they've got a policy to get three cities, and the third being the new Sydney Airport.

If you have a look at Melbourne, Melbourne has a lot of expansion capacity in the CBD. So, you've got Docklands, which will get built out in the next, probably, 3-4 years, but you can potentially move to E-Gate, you can move down to Fisherman's Bend, there's lots of places in Melbourne. Melbourne's geography allows you to keep expanding.

Somewhere like Box Hill, there's not really the demand from a commercial occupier’s perspective. In terms of residential, it will always be an area that people like to be in but, it's not going to see this massive level of demand for high-rise apartments in the same way – well, not massive demand – but lots of demand for high-rise apartments, that we've seen in Parramatta, for example.

And Nerida, I have to ask you this as the Chief Economist of realestate.com.au, what do you think is the biggest handbrake on the housing market? Is it the tougher loan restrictions, political instability, or is it something else? Because obviously there's something holding it back.

Yeah, and so, I guess at the start of the year, things were looking far worse than they are now. And, at that time there was still a lot of anxiety about what the Royal Commission would lead to and, it was interesting that by the time the Royal Commission came out, results came out; they said very little about housing finance. In the end the big impact came when the Royal Commission was announced in December 17, when banks really started to focus a lot on lending, and who they were lending to, and how much, and all the rest.

You can pretty much time the downturn; things getting really tough from December 17, and the months leading up to that, and the months preceding that. So, the start of the year was the Royal Commission, that people were really looking out for. Now, we've got to a situation, where Royal Commission's out of the way, banks are starting to ease up, they’re starting to pull back a little bit on some interest rates for some products. We may have an interest rate cut; a lot of people were predicting it to occur this week, it didn't happen. It will probably occur in the next month or the month after, depending on what economic data comes out between now and then.

An interest rate cut would be good for property. We can see in terms of search activity, it jumps when interest rates are cut. That flows through to pricing at some point. So, an interest rate cut would be good. Banks are easing up on finance. We're not seeing the rapid rises in interest rates in the US that we were seeing, so that will also ease up the wholesale funding issues for the banks, and so there's not going to be so much pressure on mortgage rates, so that's great news for housing.

The big one really now is the election, and in the lead up to the election, we do see a reduction in people listing on realestate.com.au, so the amount of properties available will be far more limited, as a result of the election. And then of course, we do need to see who wins, and then if we do see an ALP win, then what will happen to negative gearing and capital gains tax concessions could have a very significant impact on the market. That's the next thing. Although we have started to see conditions flatten out, particularly in April, we saw Sydney flatten out and see its first month of no decline since September 17, the election may be something that does lead to further price falls, because of the tax incentive changes.

Maybe slightly negative short-term, but cautiously optimistic long-term, would you say?

Yeah look I think, I suppose the thing is, if you have a look, the really bad times happen when we see rising unemployment, so provided we don't see rising unemployment, things will start to stabilise, and they've started to stabilise, we've already started to see that.

The changes to negative gearing will be another hit on the market, and the long-term implications of that are potentially quite complicated. I've written quite a lot about that; but on one hand you've got mum and dad investors pulling back – will they go to new developments as opposed to existing? It’s uncertain whether they'll make that switch.

You've got tax incentives, greater tax incentives to companies that want to do build to rent, so what will that, what impact will that be. There's lots of different implications, and I think in the end what will happen if they do get the changes through, I think, what will lead to it coming unstuck is – what happens to renters? And if we start to see rapid rises in rents in any location, and there's some markets that are more susceptible to that than others at the moment, that will be the area which they potentially have to change the policy. They may have to wind it back, it will remain to be seen. But it is something that longer term we don't really know what the implications will be.

Yes, so there's a whole range of issues at play, and we just need to keep monitoring the situation, I guess. Thank you so much for coming in today, Nerida, it was great to chat.

Thanks for having me.