Prepare for a stumble on Trumponomics

Summary: The GOP will accept tax cuts but it's less clear how successful Trump will be pursuing protectionism and infrastructure spending. |

Key take-out: Trump's infrastructure program - and the resultant commodity spike - will likely prove to be short-lived. |

Key beneficiaries: General investors. Category: Economics. |

An incoming Donald Trump administration has the potential to dramatically change the global economy and financial markets. The underlying problem is that there remains considerable uncertainty surrounding what he will or won't do. Not to mention what a Republican controlled Congress will allow him to do.

Trump's economic policies are an unusual mix of Republican-style ‘trickle-down economics', socialist protectionist policies and traditional Keynesian stimulus. Tax cuts will be immediately accepted by Republicans in the House of Representatives and the Senate, though there may be some disagreement on the size, but it's less clear how successful Trump will be pursuing protectionism and infrastructure spending.

Infrastructure spending will likely appeal to Democrats – many of whom pushed for stimulus throughout the initial stages of the global financial crisis – but it may fall on deaf ears among Trump's Republican peers. Protectionism will find pockets of support – particularly among those members from the states hardest hit by globalisation – but would be criticised extensively both within and outside the United States.

Much like ‘Brexit' earlier this year, a Trump administration is an economic and financial shock that will take years to play out. The current market reactions provide as much noise as they do signal; bouncing around as investors try to position themselves for an event they cannot truly comprehend.

A lot of what we are seeing right now, whether it be in equities or the sell-off in bonds or the weakness in gold, reflect transitory market behaviour that could easily change next week, next month or next year. Only when Trump's platform becomes clear will we get a real sense of whether his administration can deliver on his economic policies.

Nevertheless, it is worth discussing the potential impact of Trump's economic plan. Understanding his economic platform, particularly with an eye to whether there will be obstruction within Congress, may provide some insight into how successful his economic plan might be.

Tax cuts

Let's start with the policy that is most likely to sail through Congress: the Trump tax plan. Trump plans to "collapse the current seven tax brackets to three brackets" of 12 per cent for married joint-filers earning less than $75,000 a year; 25 per cent for those earning more than $75,000 but less than $225,000 a year; and 33 per cent on those earning more than $225,000 a year.

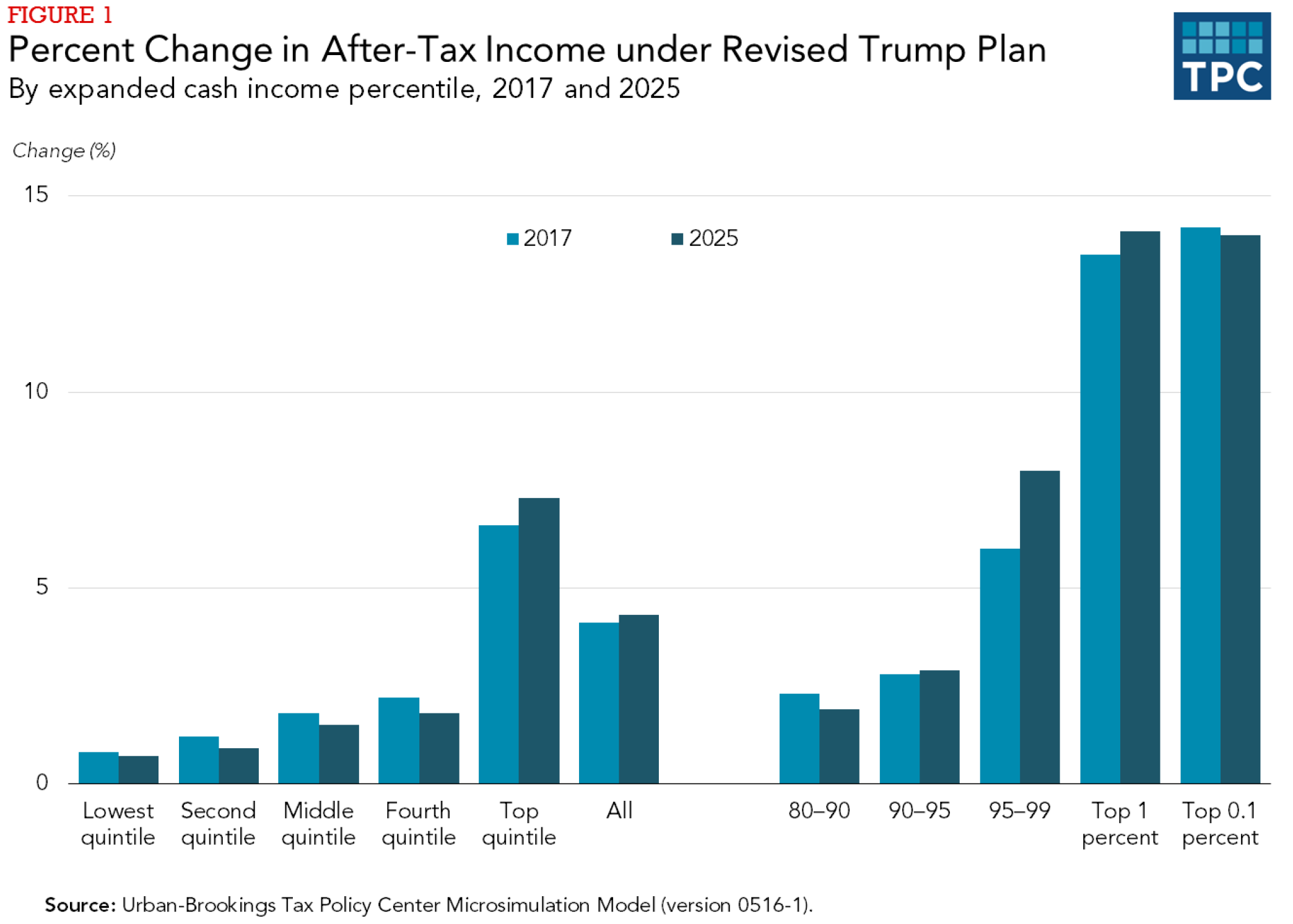

The graph below considers the impact of these tax cuts on low, middle and high-income earners. The benefits of Trump's tax plan overwhelmingly accrue to people like Donald Trump. The benefits for lower-income earners are modest by comparison.

He also plans on reducing the business tax rate from 35 per cent to 15 per cent. This rate will be available to both small and large businesses.

By historical standards, tax cuts of this magnitude are largely unprecedented. Trump's tax plan will cost $6.2 trillion over the next 10 years, around twice the size of the cuts proposed by Republicans in the House of Representatives, and after adjusting for the cost of interest and growth effects would increase national debt by around $US7.2 trillion over the next decade.

These tax cuts will lift corporate profitability, supporting equity prices, but the personal tax cuts will offer only a modest boost to growth. While lower-income earners spend most of the tax cuts they receive, higher-income earners tend to spend very little of it. These personal tax cuts may boost asset prices but are less likely to boost retail spending and the real economy.

Even the notorious small-government advocates within the Republican Party may be reluctant to agree to tax cuts of this magnitude, particularly given that Trump is also advocating greater spending on infrastructure. Some compromise will likely be met that requires cost cutting in other areas of the budget such as education, health or welfare.

This offers a nice segue into Trump's infrastructure program.

Infrastructure

“We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, schools, hospitals,” Trump said on election night. “We're going to rebuild our infrastructure, which will become, by the way, second to none, and we will put millions of our people to work as we rebuild it.”

It's a nice sentiment and one that appeals to Democrats and economists alike. For generations the US has under-invested in infrastructure, creating significant shortfalls that have undermined productivity and growth. With interest rates near historical lows it makes sense to invest in America's future.

According to the American Society of Civil Engineers, it will cost in excess of $US3.3 trillion to merely maintain existing infrastructure over the next decade. Based on current projections, the US will fall $US1.4 trillion short of meeting those repair costs. This doesn't even include the need to invest in new infrastructure to meet the needs of a growing population and changing technology.

Trump has committed to a $US1 trillion investment in infrastructure over the next decade. There is, however, some uncertainty surrounding these estimates.

His policy documents indicate that this policy will be revenue neutral, which suggests that the federal government will basically act as guarantor as part of a public-private partnership, allowing private companies to borrow at a cheaper rate but not officially use the public balance sheet. Alternatively the scheme will operate via tax credits, with the federal government effectively subsidising private infrastructure.

Public-private partnerships can be a useful way of financing infrastructure but historically they haven't proved popular in the US. According to the Congressional Budget Office, in the past quarter-century there have been 36 privately funded road projects, with just 14 completed. Three went bankrupt and one required a public bailout.

Public infrastructure may prove less appealing to the private sector, even at low interest rates, than president Trump expects. Not to mention that other forms of public infrastructure, outside of roads, can be more difficult to monetise.

Public infrastructure is often necessary for a well-functioning society and economy but does not always make financial sense for a corporation. State and federal governments are often better placed to absorb the risks associated with public infrastructure and there can be real dangers in relying on private corporations to fill the infrastructure gap.

Any attempt by the federal government to take on more debt to finance infrastructure will also be met with resistance by a Republican-controlled Congress.

“Conservatives do not view infrastructure spending as an economic stimulus and congressional Republicans rightly rejected that approach in 2009,” said Dan Holler, spokesman for the influential conservative lobby-group Heritage Action for America.

Now, there is little empirical support for that position; an economy can barely function without public infrastructure and infrastructure investment has long been associated with productivity growth, which remains the only source of long-term sustainable growth. Nevertheless, it points to the opposition that any infrastructure plan may receive in Congress.

At this stage, I expect that Trump's infrastructure boom will fall well short of expectations.

Interest rates

Markets are currently pricing in significant stimulus arising from Trump's election win. Ten-year treasury yields in the US have increased by 32 basis points since Tuesday, which indicates that the market expects the Federal Reserve to hike rates more quickly than they did pre-election. Ten-year government bonds in Australia have increased as well.

Federal government debt will increase significantly under a Trump presidency, that much is clear, which may put upward pressure on interest rates and justifies at least some of the recent selling across the US bond market. The federal budget has deteriorated under the past three Republic presidents and I don't expect Trump to be any exception.

Default isn't a serious consideration for the US, so the main risk with rising government debt is that it crowds out more productive private investment. Finding the right balance between stimulating the US economy and overburdening it with debt is difficult.

Australia will benefit from a stronger US dollar, which has already pushed the Australian dollar down around 2 per cent since the election. The infrastructure plan has also pushed key commodity prices higher, though if I am correct regarding Trump's infrastructure program then that will prove to be short-lived. The market is also pricing in a reduced probability of further rate cuts by the Reserve Bank of Australia.

My view is that the markets have oversold bonds to some extent. Politics will ensure that Trump's tax policies and infrastructure program are not as stimulatory as they appear at first glance. Trump's protectionist positions on globalisation could prove to be damaging to both US and global growth but unfortunately Trump's positions are not clear enough to make a sound assessment.

As I said earlier a Trump administration, like the ‘Brexit' before it, is an economic and financial shock that will play out over a number of years.

We will see volatility, and markets will react and over-react to everything that Trump says. Only when his policies begin to move through Congress can we get a genuine sense of whether they will stimulate US demand, fuel inflation and push interest rates higher. Only then will investors be able to determine the signal from the noise.