Paul Clitheroe's Making Money. Should I leave my money in savings if it's making 5% or invest it?

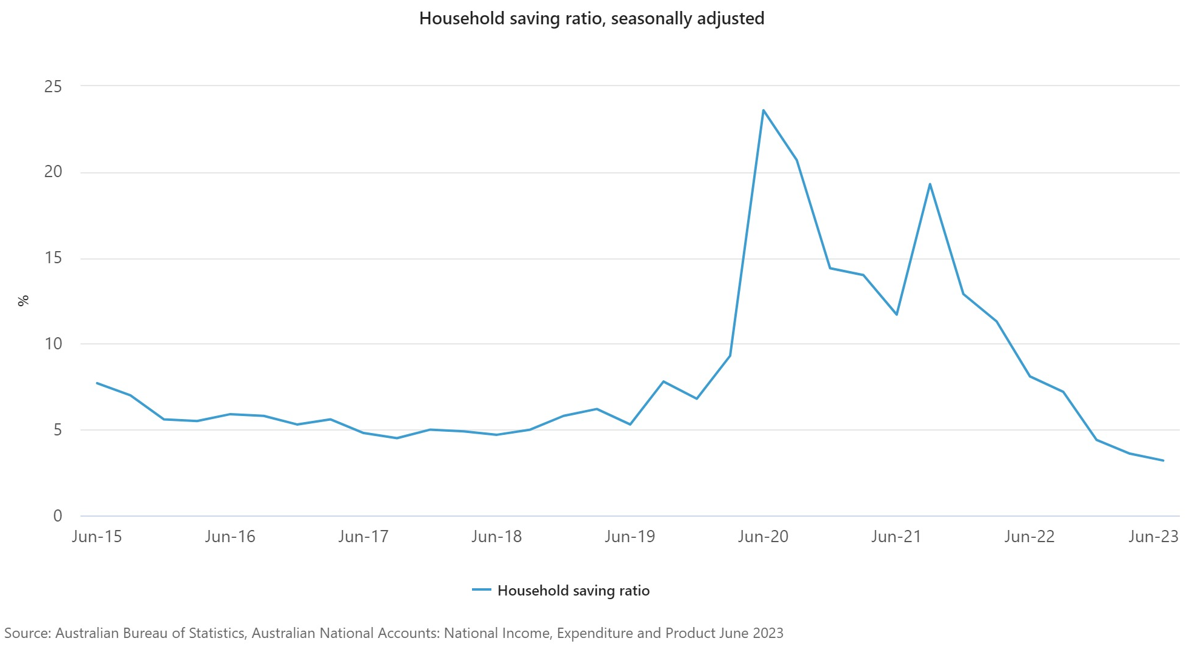

High interest rates and rising living costs are battering the savings of some Australians. Our national household saving rate has plunged from a high of 23.6% in the middle of the pandemic, down to 3.2% at present – far lower even than pre-pandemic levels[1].

That’s not to say plenty of people aren’t sitting on a decent stash of cash. Figures from bank regulator APRA show we collectively have close to $1.4 trillion in savings accounts[2].

At a time when high home loan rates are making headlines, and savings accounts are paying rates of 5%-plus, it’s reasonable to ask:

“Am I better leaving my money in a savings account or investing?”

The answer is not black and white. Here’s what to weigh up.

Do you have rainy day savings?

We all need a backstop of cash to handle those inevitable unexpected bills. If you don’t have a pool of emergency savings, it’s worth focusing on getting some spare cash under your belt before you start investing.

How do you feel about risk?

Savings accounts are very safe. In fact, they don’t get much safer than a government guarantee. That’s what you get with deposits of up to $250,000 per account holder, per bank.

This level of security is great for people who would feel serious financial pain if they lost money. I’m thinking here of retirees who can struggle to replace lost capital.

Do you need the money in the short term?

Investments like shares and exchange traded funds (ETFs) don’t experience linear returns. In some years the capital growth can be impressive, in others the value of your investment can fall. This risk means these investments are better suited to long term goals, giving your investment time to recover from markets dips.

For someone like a first home buyer, who may be planning to buy a place of their own in the next 12-18 months, a savings account can be a better option.

On the other hand, if you’re aged in your 40s and saving for retirement at age 60, you have a far longer horizon to work towards, and plenty of time for your investments to regain the lost ground of any negative returns.

3 good reasons to invest

If you already have emergency savings, you feel ready to invest for the longer term (at least 5-years-plus) and you are comfortable taking on more risk, there are good reasons to explore investments beyond savings accounts.

1. You’re likely to earn higher long term returns

Savings accounts may be paying interest of 5% right now, but that’s still a lot less than the long term returns on investments like Australian and international shares.

Vanguard looked at the average annual returns on the major asset classes over the 30 years to mid-2023 – these are shown in the table below. As you can see, leaving your money in cash over the long term means shortchanging yourself on returns – by a solid margin.

|

Market returns – 1 July 1993 to 30 June 2023* |

|||||

|

|

1 year |

5 years |

10 years |

20 years |

30 years |

|

Australian shares |

14.8% |

7.3% |

8.8% |

9.0% |

9.2% |

|

International shares |

22.6% |

11.5% |

13.2% |

8.4% |

7.5% |

|

Australian listed property |

8.1% |

3.5% |

7.7% |

5.2% |

7.3% |

|

Australian bonds |

1.2% |

0.5% |

2.4% |

4.2% |

5.5% |

|

Cash |

2.9% |

1.2% |

1.7% |

3.5% |

4.2% |

|

Source: 2023 Vanguard Index Chart *Average returns per annum |

|||||

This difference in returns can have a significant impact on the value of your investment over time thanks to compounding.

According to Vanguard, $10,000 deposited into a savings account 30 years ago would have grown to be worth $34,737 today assuming interest earnings were fully reinvested.

If you’d put that same $10,000 in Aussie shares, and reinvested all the dividends, your investment would be worth $138,778 by mid-2023.

2. The value of your wealth should outpace inflation

Put a dollar in a savings account today, and it will still be there in a year’s time. What will change is the purchasing power of that dollar, which will decline thanks to inflation.

Without the capital growth of shares and ETFs, money sitting in a savings account loses its purchasing power over time.

Thankfully, we are seeing a softening in cost of living increases. But inflation is still sitting at 6.0%[3], so every dollar in a savings account buys 6% less today than it did last year. It’s not hard to see how over time this can seriously erode your wealth.

3. Interest earnings are fully taxed

Shares and ETFs typically offer tax breaks, both on ongoing income (dividends and distributions) as well as on any capital gains made when you sell the investment.

That’s not the case with savings accounts.

Interest earned on savings accounts are fully taxed. So, a high income earner can lose almost half their interest to the tax man. It’s like axing a 5% return down to 2.5%.

The bottom line

Cash always has a place in our portfolios, and happily, returns on savings are attractive right now. That said, it’s important to shop around for a decent rate, and know the conditions you need to meet to earn a high return. Deposit accounts often have a raft of rules in place to earn bonus interest. Fail to meet these conditions, and you could earn a far less attractive base rate.

For anything other than short term goals though, it is worth looking beyond savings accounts. The reward is higher long term returns that not only help you beat rising living costs, but which exponentially grow the value of your investment over time through compounding.

Yes, investing in shares and ETFs brings more risk than a savings account. This risk can be reduced simply by aiming for a balanced portfolio so that a downswing in one asset class can be compensated for by an upturn in another.

[1] https://www.abs.gov.au/statistics/economy/national-accounts/australian-national-accounts-national-income-expenditure-and-product/latest-release

[2] https://www.apra.gov.au/monthly-authorised-deposit-taking-institution-statistics

[3] https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release

Frequently Asked Questions about this Article…

Deciding whether to keep your money in a savings account or invest it depends on your financial goals, risk tolerance, and time horizon. Savings accounts offer safety and liquidity, ideal for short-term needs or emergency funds. However, investing can provide higher long-term returns, which can help grow your wealth over time.

Investing offers the potential for higher long-term returns compared to savings accounts. While savings accounts provide safety and liquidity, investments like shares and ETFs can outpace inflation and offer tax advantages, helping to grow your wealth significantly over time.

Inflation erodes the purchasing power of money in a savings account. Even if your savings grow with interest, if the inflation rate is higher than your interest rate, your money's real value decreases over time, meaning you can buy less with the same amount of money.

Having emergency savings is crucial because it provides a financial safety net for unexpected expenses. This ensures that you don't have to sell investments at a loss during market downturns to cover immediate financial needs.

Investing involves market risk, meaning the value of your investments can fluctuate and potentially decrease. In contrast, savings accounts are low-risk and offer guaranteed returns, making them safer but with typically lower returns compared to investments.

Interest earned on savings accounts is fully taxed, which can significantly reduce your net return. Investments like shares and ETFs often provide tax advantages, such as franking credits on dividends and capital gains tax discounts, potentially enhancing your after-tax returns.

If you need access to your money in the short term, a savings account is generally a better option due to its liquidity and stability. Investments are more suitable for long-term goals, as they can be volatile in the short term and may not provide immediate access to funds.

You can reduce investment risk by diversifying your portfolio across different asset classes. This means that if one asset class underperforms, gains in another can help offset the losses, providing a more balanced and stable investment approach.