Paul Clitheroe on the ESG, volatility and a hurdle to buying your first home

Australian Ethical walks away from Lendlease over koala development

ESG-focused fund manager – Australian Ethical, has sold its $11 million stake in Lendlease Group over a planned development at Mt Gilead in Sydney’s south-west.

Australian Ethical believes the development could threaten the survival of one of the last remaining healthy koala colonies in NSW.

In December, Australian Ethical warned it would divest its shareholdings in Lendlease if it proceeded with Stage 2 of the project without details of planned wildlife corridors needed to provide koalas safe passage across the site.

Australian Ethical, which manages $5.8 billion worth of assets, says it has lost faith after recent talks with Lendlease stalled.

A spokesperson for the investment manager said, “We’ve been clear that Australian Ethical would continue to advocate until we have exhausted all avenues with Lendlease to improve koala protections, and we’ve now reached that point.”

Two steps to beat market volatility

2023 is delivering a bumpy ride to investors – and we’re only in March!

The ASX 200 started the year at 6,946, climbed to 7,558 in February, and dropped back down to 7,008 by mid-March.

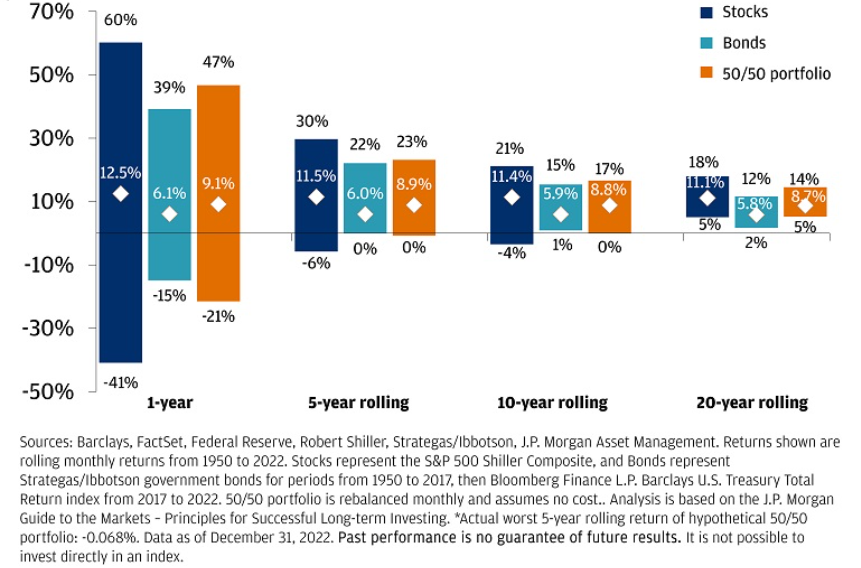

Volatility is never much fun to deal with. However, analysis by JP Morgan in the US[1] shows there are two key steps investors can take to minimise the impact of market highs and lows – a long term approach, and spreading your money over a variety of asset class.

Markets will always have bad days, weeks, even years, but as the graph below indicates, investors are less likely to suffer losses over longer periods – especially when they hold a diversified portfolio.

|

Rolling annualised returns |

|

|

HECS debt stands between uni grads and home buying

Many families invest for their child’s schooling, but it can be worth thinking about extending that investment to cover tertiary education.

Futurity Investments surveyed more than 1,000 Australians who attended university, and found having a HECS-HELP debt can impact a graduate’s ability to tick off major life goals.

Over three million people have a HECS/HELP debt left over from their uni days, with the collective balance sitting at a whopping $74.3 billion.

While the average HECS debt is currently $22,636, it can go a lot higher for grads with more expensive degrees in, say, law or medicine – or for those who fail a few subjects.

There was a time when we could afford to be complacent about paying off HECS/HELP as the debt is interest-free.

The catch is that the balance is indexed annually in line with inflation. And in today’s high inflation world, that’s making a big difference to the debt owed.

According to 2022 federal budget papers, inflation piled more than $1.9 billion of extra debt onto students last year. That's expected to jump by another $1.6 billion in 2023.

Not surprisingly, Futurity found 59% of respondents said their HECS/HELP debt impacted their ability to buy a home. It’s not just about debt repayments capping a graduate’s ability to grow a home-buying deposit. Lenders will look at an outstanding HECS/HELP debt because it can affect a borrower’s ability to service a mortgage.

On the plus side, a uni degree is an investment in our personal earning potential, and a 2020 study by Deloitte[2] confirmed that a degree can deliver lasting benefits including higher average wages and greater likelihood of employment.

After crunching the numbers, Deloitte found that for the average bachelor-level student, their lifetime net benefits – in the form of additional after-tax earnings – can add up to $674,000 (undiscounted). Relative to other workers, this represents an earnings premium of more than 30% associated with the average bachelor level qualification. That sort of extra income can ease the pain of paying off a degree.