Portfolio Update October 2019: White Knights saving us from what again?

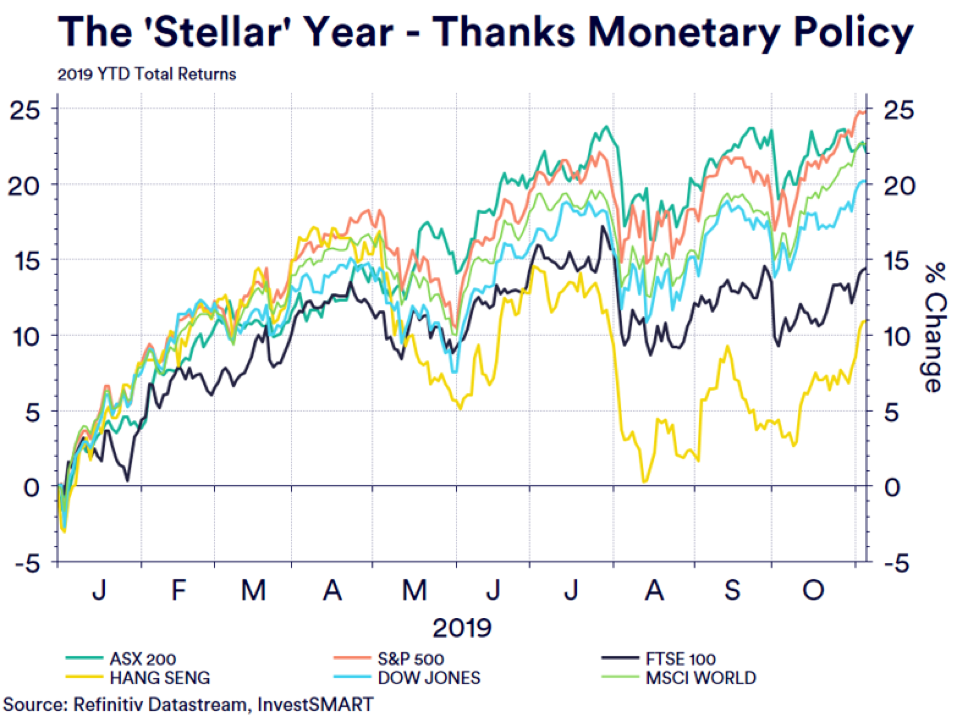

With less than two months to the end of the calendar year, it is worth pointing out just how strong a year 2019 has been. The equity-led appreciation is on track to be double the yearly average in Australia. The US is on track for its best year of the last three and has led all comers once again in 2019.

The boon in equity markets is happening with a backdrop of ‘consumer worry’, ‘growth conundrums’ and geopolitics at the ‘worst level since World War II’ according to the former Speaker of the House Commons (regarding Brexit) but could also be levelled at the issues in Hong Kong and the US-China trade tensions.

All year we have been at pains to point out this has been a consistent theme across all markets. We have described it as the ‘malaise’ and ‘cure’ of the global economy, where bonds were reacting to the ‘malaise’ of the global economic growth issues, equities the ‘cure’ through monetary policy stimulus.

That ‘great white knight’ in monetary policy has well and truly ridden in on its steed, with five of the eight largest central banks cutting their respective cash rates in 2019. In October the Reserve Bank of Australia (RBA) and the Federal Reserve both enacted a further 25-basis points (bps) cut to their respective cash rates. October was the RBA’s third 25bps cut in five months, it was the Federal Reserve’s third 25bps cut in three consecutive meetings.

These actions have flushed markets with cash once again and is backstopping any sell offs in equities in particular.

What is rather interesting about the ‘action’ is the ‘proactiveness’ of it. As we have to ask: are things really going to get that slow in the coming years?

The RBA certainly thinks so and has ‘tried to get ahead of the curve’ with its rate cuts in 2019. The same argument has been put forward by the Federal Reserve, the European Central Bank and in a surprise move to start November, the Bank of England, although they are yet to pull the monetary policy lever.

Yes, there are clear signs of slowing in certain areas like consumption, and wage growth is flattening out.

But, and this may explain why markets are starting to latch onto the next market wave, what if the slowdown is temporary, things reflate in 2020 and the global recession that has been forecasted for almost 12 months now, never materialise? The reaction in equities will be that of strength as markets know it is backstopped by central bank monetary accommodation coupled with better economic data and higher corporate earnings.

In fact, market movements to start November could actually suggest this idea is starting to take hold given record all-time highs are being printed in the US.

With seven weeks left in 2019, there is still every chance this year could return 2.5 times the yearly average. With our portfolios designed specially to capture market performance, as well as the most important part of investing – total returns, this could be a very good year indeed for all investors.

Diversified Portfolios

Individual capital performance of the securities held by the Diversified Portfolios, with weightings varying depending on risk appetite.

Conservative

- Contracted 0.24% after fees in October after falling strongly in the early part of the month before recovering late

- Domestic equities attributed 0.01%, International Equities 0.04%, fixed interest detracted 0.3%

- All facets barring fixed interest contributed to the portfolio

Balanced

- Contracted 0.32% after fees in October after falling strongly in the early part of the month before recovering late

- Domestic equities attributed 0.02%, International Equities 0.04%, fixed interest detracted 0.27%

- All facets barring fixed interest and infrastructure contributed to the portfolio

Growth

- Contracted 0.22% after fees in October after falling strongly in the early part of the month before recovering later in the month

- Domestic equities attributed 0.02% while International Equities attributed 0.1%, fixed interest detracted 0.16%

- All facets barring fixed interest and infrastructure contributed to the portfolio

High Growth

- Contracted 0.09% after fees in October after falling strongly in the early part of the month before recovering later in the month

- Domestic equities attributed 0.03% while International Equities attributed 0.15%

- All facets barring fixed interest and infrastructure contributed to the portfolio

Satellite Portfolios

International Equities

- Added 0.46% after fees in October on the record prints in US equities and Asian indices rallied hard

- S&P 500 (IVV) attributed 0.03% while the global holding VGS attributed 0.14%

- All facets of the portfolio contributed to the portfolio

Interest Income

- Contracted 0.67% after fees in October as treasuries unwound from their record highs

- Treasuries contracted 0.63% while floating rate notes were flat.

- Mixed performance across the portfolio in October

Property and Infrastructure

- Added 0.58% after fees in October as domestic property and infrastructure rallied on bond-proxy set up

- Domestic property attributed 0.21%, SYD attributed 0.49% while international property contracted down 0.13%, international infrastructure contracted 0.15%.

Hybrid Income

Commentary by Portfolio Manager, Alastair Davidson

- The total portfolio return was -1.48% for the month, following the write-down of the position in AXLHA which had been held at cost. As mentioned to investors in an email in October, this had been held at cost until there was clarity of the wind-up process for these Notes.

- We expect investors to be paid approximately 33 cents for each Note held in February 2020. This will add approximately 0.45% to the return noted above.

- Please note: Only hybrid model investors who invested prior to 12 September 2018 through the SMA have exposure to this Note

- Since inception the total portfolio return is 4.42%%, which is 0.08% over its return objective.

- October was a low-income month with no securities trading ex-distribution.

- Commonwealth Bank will price its new hybrid issue – CBA PERLS XII – at the lower end of expectations at around 3.80% including franking credits. Given the lack of new hybrids recently, we expected this to be a popular issue, and issue size has increased from $750 mill to $1.25 billion

For more information on our Diversified Portfolios, click here.

To download this article as a PDF, click here.

Frequently Asked Questions about this Article…

2019 was a strong year for equity markets, with Australia on track to double its yearly average and the US experiencing its best year in the last three. This growth occurred despite global economic concerns and geopolitical tensions.

Central banks played a significant role by cutting cash rates, which provided monetary policy stimulus. This action helped to backstop any sell-offs in equities and supported market growth.

Central banks, including the Reserve Bank of Australia and the Federal Reserve, cut interest rates to get ahead of potential economic slowdowns and to stimulate growth. These proactive measures aim to support the economy amidst signs of slowing consumption and wage growth.

There is optimism that the slowdown might be temporary and that the global economy could reflate in 2020. If this happens, coupled with central bank support and better economic data, markets could continue to strengthen.

In October 2019, diversified portfolios experienced slight contractions after fees, with conservative, balanced, growth, and high growth portfolios all recovering from early month declines. Satellite portfolios like International Equities and Property and Infrastructure saw positive returns.

The International Equities portfolio added 0.46% after fees in October, driven by record highs in US equities and strong rallies in Asian indices. Contributions came from holdings like the S&P 500 (IVV) and global holding VGS.

The Hybrid Income portfolio saw a total return of -1.48% in October due to the write-down of the AXLHA position. However, investors are expected to receive approximately 33 cents per Note in February 2020, which will positively impact returns.

The CBA PERLS XII hybrid issue is significant due to its pricing at the lower end of expectations, around 3.80% including franking credits. The issue size increased from $750 million to $1.25 billion, reflecting strong demand in the market.