Medibank Private: The great divide

Summary: Medibank Private's share price has performed well since listing, but brokers have divergent views on the stock's future. The most bullish analysts say the attractive private health insurance industry and the opportunities for the business to become more efficient could drive its share price as high as $3. The most bearish say Medibank is already overpriced and warn of spiralling claims inflation. |

Key take-out: Analysts differ on the key questions of whether Medibank has more scope to trim its costs, and whether it will be able to grow revenue. |

Key beneficiaries: General investors. Category: Shares. |

Since its float on November 25, Medibank Private's share price has risen steadily. Retail investors bought shares in the health insurer's IPO for $2 each, giving the stock a price-earnings ratio of 21.3x, while institutions paid $2.15 per share.

Before the company was floated, commentators tipped the stock would be supported by demand from institutional investors who needed to add the $5.7 billion company to their index-based portfolios (see Medibank IPO first impressions: Low yielding and not cheap, October 22, 2014). On listing, Medibank immediately traded at $2.205, then closed the day at $2.14, a 7% premium for retail investors.

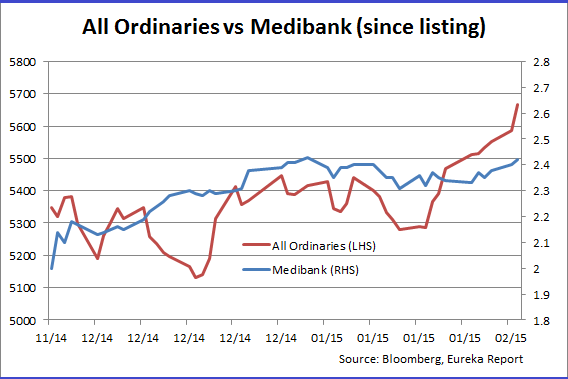

A little over two months later, Medibank shares are trading at $2.41, slightly below their peak of $2.43. The stock's rise, compared to the more volatile performance of the All Ordinaries over the same period, is shown below.

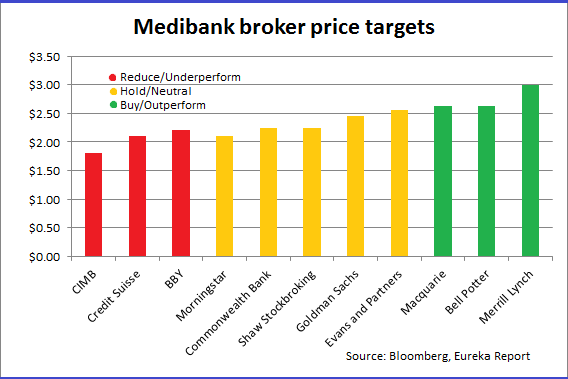

Despite Medibank's strong performance so far that has provided retail investors with paper gains of 20%, analysts hold a wide spread of views on the stock. Price targets range from $1.80, below listing price, up to $3 for the most bullish.

Broker views diverge around the key areas of earnings and costs. Some think there's scope for the private health insurer to trim its costs now that it is no longer operating as a government owned-business, with extra opportunity to increase revenue as the population ages. Other analysts insist that after recent cuts there is little room for further improvement, and warn that price-conscious consumers will reduce their cover if premiums keep rising.

The bullish case

Bank of America Merrill Lynch analyst Toby Langley is among the most optimistic in terms of Medibank's prospects. He has a Buy rating and price target of $3 on the stock. After paying $2 per share at the IPO, retail investors would receive a 50% return if Medibank reached this target.

Meanwhile, Macquarie has an Outperform rating on Medibank, with a slightly less optimistic 12-month price target of $2.62, given “the attractive industry outlook and opportunities for MPL to deliver operational improvement”. Recent Macquarie research noted that Medibank has already started an efficiency program and has further opportunities to improve margins.

The research also noted a supportive policy environment. “MPL is well placed to participate in long-term industry growth driven by demographic factors and government policy,” Macquarie said. “An expanding private health insurance sector helps promote public savings… given the current public health funding pressure, this suggests an expansion of private health insurance is possible.”

Macquarie points out that the private health insurance sector has achieved 8% premium growth since 2008, as the population grows and as policyholders use their cover more, particularly as they age. The bank says for-profit health insurers achieve a net margin of between 4.5% and 6%, or even higher for the best performing funds. Medibank's customers are both healthy and wealthy, Macquarie says.

Macquarie was one of the joint lead managers of Medibank's float, along with Deutsche Bank and Goldman Sachs, but investment banks traditionally keep their research arms separate.

An analyst from another brokerage, who declined to be named, pointed to the “very strong” private health insurance industry fundamentals. “There has been very strong growth in health care spend over the last 10 years,” the analyst told Eureka Report. “We think the long-term outlook is likely to sustain that rate of growth… We think strong support from the government, with policies that compel private health insurance, are likely to continue and should translate to increased earnings.”

This analyst suggested that Medibank's growth will come from both increases in the premiums it charges to customers, and the addition of new customers. Although the federal government has the power to review the premium increases that private health insurers request, this analyst expects Medibank will ask for “entirely reasonable” increases that are consistent with the rest of the industry, at around 6%-6.5%.

The analyst says that for investors, Medibank compares favourably to listed rival NIB. “It's a significantly stronger business than NIB because of its market share and brand power. It attracts members more efficiently and the acquisition costs per policyholder are significantly lower.”

The neutral case

A research note from Morningstar published at the end of Medibank's first trading day takes a positive, but more subdued, tone. The analysis estimated fair value for Medibank at $2.10, leading Morningstar to place a Hold recommendation on the stock. At that point, the research house recommended investors hold MPL in a range between $1.89 and $2.31, reduce their holding if the stock rose above $2.31 and sell above $2.84; Morningstar recommended accumulating in a range between $1.47 and $1.89, and buying below $1.47.

Although $1.47 seems comparatively cheap now, the note reminds investors that the original indicative price range for the float was $1.55 to $2 per share, with strong demand boosting the price. This demand also increases pressure on the company's management to deliver long-term growth, Morningstar warns. “While we think the firm should generate strong medium-term earnings growth on regulated price increases and cost improvements, any slip-up by management in delivering on high investor expectations would see downward pressure on the share price.”

Morningstar agrees that Medibank has scope to cut management costs, improve productivity and reduce medical claims costs to boost earnings, but again warns of the market's high expectations: “Over time, Medibank needs to become one of the most efficient operators of the five major private health insurers to justify its lofty valuation.”

The insurer will use its scale to negotiate better deals with private hospitals, Morningstar predicts. “We expect its new shareholders will demand greater commercial discipline, which should boost earnings, even if revenue growth is weak. This is widely dubbed the ‘privatisation dividend' and has been a feature of recent sales of government assets.”

Morningstar says that in a heavily regulated industry, Australian health insurers usually make “stable and defensive” earnings. “In our opinion, Medibank is well placed to produce solid long-term earnings growth.”

The bearish case

Despite positives in the Medibank story, the stock is too expensive, argues CIMB analyst Richard Coles. The investment bank placed a Reduce rating and a below-IPO price target of $1.80 on the stock in research dated November 28, 2014, three days after its float. “We acknowledge that unprecedented public demand for the recent IPO may keep the share price above this level in the near term,” CIMB says. “A multiple materially above 18x looks inflated, in our view.” Medibank's earnings growth profile means it should trade at a premium to general insurers but at a discount to healthcare stocks, according to CIMB.

Coles warns that spiralling claims inflation poses a risk to the private health insurance industry. He says that benefits per member have been increasing at a rate of around 5.5% pa over the five years to 2013, well ahead of CPI. “The ability to lower private health insurance claims costs significantly is likely to be difficult against a backdrop of rising industry claims inflation,” Coles writes.

He also takes a different view on Medibank's negotiations with hospital providers, saying it will be difficult to use Medibank's own size to cut claims expenses as these providers also have significant scale.

Coles says that recent reductions in management expenses have targeted “the low-hanging fruit”. After the cuts forecast in fiscal 2015, the management expense ratio will be only marginally above the industry average, and it will be harder to make further reductions, he says.

On the question of Medibank's revenue, Coles notes a rising level of consumer concern about affordability of health cover, leading to falling coverage levels and the adoption of more “exclusionary” policies. He says that although any favourable regulatory changes could boost the stock in the future, recent changes have reduced the incentive to take out cover – for example, a planned indexation freeze of the private health insurance rebate.

CIMB forecasts mid-single digit net profit growth over the longer term. “While MPL's initial cost-out target should be attainable, we believe material gains beyond FY15 will be more difficult to generate, with ‘easy wins' already addressed.”

Looking forward

The insurer's prospectus forecasts a statutory net profit after tax of $250.9 million for FY15, with total revenue of $6.64 billion, with actual results to be published in August. But Medibank Private is scheduled to release its half-year results as soon as February 20. Investors will be eagerly awaiting the first insights into the health insurer's performance as a listed entity.