Making hay while the dividends stream

There is a tremendous opportunity for small business owners to benefit from a ‘dividend streaming’ strategy, particularly if they're over Age Pension age and retired.

Dividend streaming can be a very tax-effective strategy to extract wealth from your private company, and many business owners are ‘making hay while the sun shines’ – fully aware that there may be a sunset within the next decade or so. There are many others, however, who are unaware of the benefits which could be gained.

Before going further, I should point out that I am cognisant of the macro-economic issues for the federal budget in the wide-scale use of this strategy. As a business owner, however, I would advocate taking the opportunity to reap the micro-economic benefits which are currently legally, and morally, available.

In the following case study, there is the potential to make annual tax savings of $15,424, based on the example of a couple, both retired and over Age Pension age, who both nominate to take the mandated minimum Account Based Pension income, to ensure their ABP balances have the potential to last for as long as possible. Based on maximising their current $1.6m Transfer Balance Cap, as well as being over age 60, this translates to tax-exempt income of $80,000 per person.

In addition, everyone older than Age Pension age (currently 66 but soon to be 67) is entitled to the following tax offsets:

- Low-Income Tax Offset

- Low and Middle-Income

- Seniors and Pensioners

These offsets mean that in addition to the tax-exempt ABP income of $80,000 per person, this couple is also each able to generate ‘taxable’ income of $28,974.

Why $28,974? Because technically, whilst some of these various tax offsets are not fully utilised with a taxable income of $28,974, a taxable income IN EXCESS of $28,974 sees tax offsets start to ‘shade out’.

This, for couples, is the sweet spot. It means that by utilising the optimal ‘taxable’ income of $28,974 per person, you will maximise tax offsets of $1,602 per person and ensure the payment of NIL tax on this taxable income also!

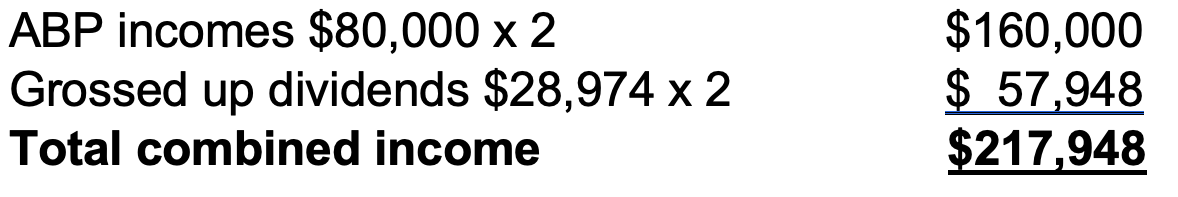

Within this scenario, each person can have gross income of $108,974 which is NOT subject to tax. That equates to a combined annual income of almost $218,000 without tax, super or Medicare levy being deducted – roughly the equivalent of gross annual taxable earnings of $400,000.

But wait, there is more – as they say in the late-night TV ads!

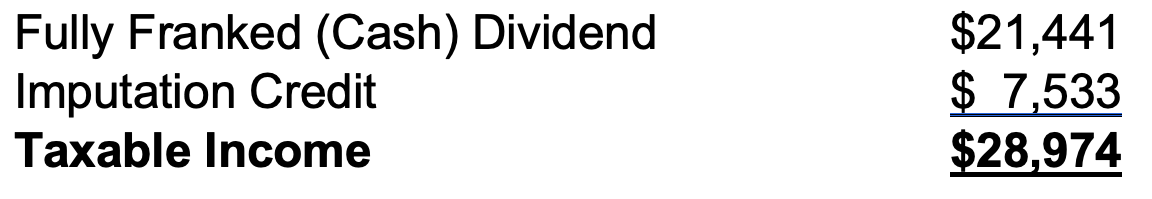

If this couple can pay themselves fully franked dividends from their private company account to take advantage of their nil tax taxable income of $28,974, they will each receive a fully franked (cash) dividend of $21,441 – to which is attached imputation credits of $7,533.

They would each have the following tax position:

Apart from there being no tax payable, they will, in fact, pay ‘negative’ tax – their imputation credits of $7,533 being fully refundable on lodgement of their individual tax returns.

This family will have the following tax-free take-home pay position:

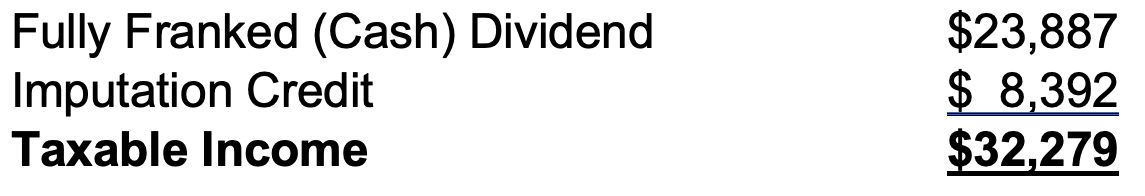

Note that in the case of a single person, the same sweet spot is $32,279 of taxable income.

The tax position for the single pensioner translates as follows:

It means that a single pensioner (aged under 75, with exactly $1.6m in an Account Based Pension and drawing the minimum 5 per cent) will receive ABP income of $80,000, plus $32,279 in grossed up dividends – and will pay NO tax. Again, the tax position is one of NEGATIVE tax on $112,279 per annum, after an imputation credit refund of $8,392 (ie, no tax paid but a refund even when you don’t pay any tax).

Whilst these scenarios may seem overly generous, bear in mind that the imputation credit refunds relate to tax which has been paid previously – possibly many years ago. It reflects the same position as everyone else who has imputation credits fully refunded to them (either into their tax exempt ABPs, or to their personal bank accounts) in respect of their shareholdings in all publicly listed companies.

There are many people, including those over 60 who, to some extent, pay ‘negative’ tax. Most of that comes from the refund of imputation credits from shares in all large, listed companies… (as opposed to small private, unlisted companies).

Whilst the current ‘fully refundable dividend imputation’ system is not great for the broader economy and government revenues, in particular (as we heard at the last election, the total cost to revenue for the federal government was approximately $8 billion per year) it is for now – law.

Nevertheless, I do not recommend that anyone skew their allocation to equities within their investment portfolio to Aussie shares in order to receive higher franking credit refunds, as explained in my April 2018 InvestSMART contribution “Addicts abound in investment.”

I am also of the view that the refund of franking credits will continue to be available only in the short to medium term.

Whilst the ALP will not take the same kamikaze tax plan to the next federal election (given that it almost certainly cost them in 2019) it is logical that at some time the refundability of dividend imputation will be repealed – ironically, perhaps by a future Coalition government.

In the meantime, dividend streaming for small business owners remains an appropriate tax strategy.

Talk to your accountant to check if you are eligible now, or at some time in the not-too-distant future.

Theo Marinis is Managing Director of Marinis Financial Group.

Disclaimer: Performance data quoted represents past performance and does not guarantee future results. The information in this article is general information only. It is not intended as financial advice and should not be relied upon as such. The information is not, nor is intended to be comprehensive or a substitute for professional advice on specific circumstances. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional on whether the information is appropriate for your particular needs, financial situation and investment objectives. The information provided is correct at the time of its creation and may not be up to date; please contact Marinis Financial Group for the most up to date information.

Frequently Asked Questions about this Article…

Dividend streaming is a strategy where private company owners pay fully franked dividends to shareholders (often family members) so retirees over Age Pension age can receive tax-advantaged income. According to the article, it can be a very tax-effective way to extract wealth from a private company today, especially for small business owners who are retired, but you should check eligibility with your accountant before acting.

When ABP balances are maximised to the current $1.6m Transfer Balance Cap, a person over age 60 drawing the mandated minimum ABP income can receive tax-exempt ABP income of about $80,000. The article uses a case study of a couple each maximising a $1.6m cap to show how dividend streaming on top of that ABP income can be structured to be tax-efficient.

For couples over Age Pension age the article identifies a taxable income sweet spot of $28,974 per person: at that level key offsets (Low-Income, Low and Middle-Income, Seniors and Pensioners) are maximised and no tax is payable, producing an effective tax-free gross income of about $108,974 per person when combined with $80,000 of tax-exempt ABP income. For a single pensioner the sweet spot is $32,279 of taxable income.

The article explains that if retirees receive fully franked dividends sized to fit their nil-tax taxable income, they get attached imputation credits that can be refundable. In the case study each person receives a fully franked cash dividend of $21,441 with $7,533 of imputation credits, which are refundable on tax return lodgement — producing a net refund and effectively a 'negative' tax outcome (a refund rather than tax payable).

The article warns this strategy has macro-economic and budget implications (the refundable dividend imputation system costs the federal government roughly $8 billion a year) and that refundability may be repealed in the short to medium term. It also cautions not to skew your investment portfolio into Australian shares solely to chase franking credit refunds. The author recommends talking to an accountant to check eligibility and timing.