Low-cost ETF Portfolio Updates - January 2019

InvestSMART Diversified Portfolios

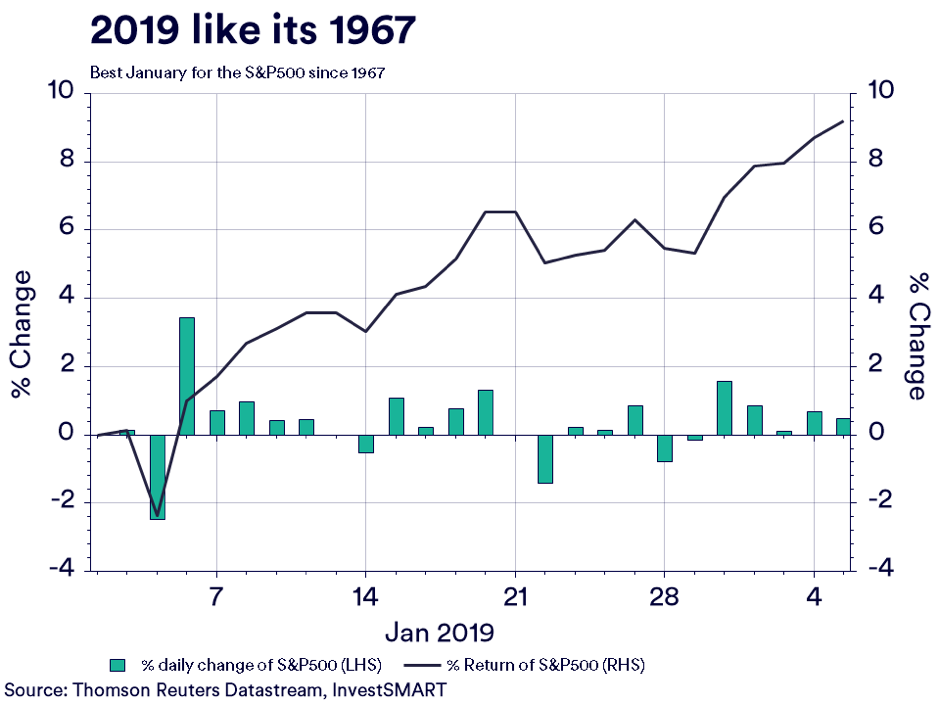

For US equities, 2019 has been a start unlike any other. Or at least since 1967.

It may have been the worst December for the S&P 500 in more than 50 years, but January 2019 was the best start to a year since 1967, with the index adding 9.2%.

The ASX also started 2019 with enthusiasm, up 3.87% for the month. Meanwhile, high growth exposures such as the Asia A50 have actually been bouncing since the start of December as Asia growth concerns faded.

This is in stark contrast to the market’s performance in the final quarter of 2018. Global equity markets were savaged. The MSCI World Index fell over 11.6% as investors began to question global growth, the impact of trade tensions, ongoing political issues associated with Brexit, and the final sitting weeks of the Banking Royal Commission...

| InvestSMART Diversified Income Portfolio | |

| InvestSMART Balanced Portfolio | |

| InvestSMART Core Growth Portfolio | |

| InvestSMART High Growth Portfolio |

InvestSMART International Equities Portfolio

European equities added 6.2% while Asia added 2.3% to continue its rally that started in December.

January is in stark contrast to the performance of international equities in the final quarter of 2018. Global equity markets were savaged. The MSCI World Index fell over 11.6% as investors began to question global growth, the impact of trade tensions, ongoing political issues associated with Brexit, and the final sitting weeks of the Banking Royal Commission.

It begs the question: What changed? Specifically, why have risk assets (equities) bounced so hard and so fast in January? To answer this question, we should look at it in reverse, as in, why the final quarter of 2018 was rather so volatile and so negative...

InvestSMART Interest Income Portfolio

Although riskier assets such as equities had a boon month in January, investors are clearly still positioning themselves towards defensive assets as fixed income continued to climb in January even after a very strong final quarter of 2018.

January trading can be interesting as it’s the only month of a calendar year the Reserve Bank of Australia doesn’t meet. This is important, as the RBA sets Australia’s official interest rates, and from a fixed income point of view, this is important as most corporate bonds have yields based off the cash rates (e.g. RBA cash rate 2%)...

InvestSMART Property & Infrastructure Portfolio

It may have been the worst December for US risk assets in more than 50 years, but January 2019 was the best start to a year for risk assets since 1967.

Australia also started 2019 with enthusiasm, however, it’s the surge in listed property assets that is most interesting.

If we look back at the final quarter of 2018, we saw falling lending growth as credit became more expensive globally, the final sitting weeks of the Banking Royal Commission, and property facing a domestic housing slowdown...

Frequently Asked Questions about this Article…

US equities had an exceptional start in January 2019, with the S&P 500 index adding 9.2%, marking the best start to a year since 1967.

The ASX showed strong performance in January 2019, increasing by 3.87% for the month.

Global equity markets faced challenges in the final quarter of 2018 due to concerns over global growth, trade tensions, political issues like Brexit, and the Banking Royal Commission.

In January 2019, European equities added 6.2% and Asian equities continued their rally with a 2.3% increase.

The volatility in late 2018 was driven by global growth concerns, trade tensions, political uncertainties, and the Banking Royal Commission.

January is unique for fixed income investors in Australia because the Reserve Bank of Australia does not meet, affecting interest rate decisions that influence corporate bond yields.

Listed property assets surged in early 2019, despite challenges like falling lending growth and a domestic housing slowdown in the previous quarter.

Defensive assets, such as fixed income, continued to climb in January 2019, even after a strong final quarter of 2018, as investors positioned themselves cautiously.