LIC spotlight: Australian United Investment Company (AUI) and Diversified United Investment (DUI)

Summary: Listed investment companies AUI and DUI focus on blue-chip Australian companies. When making investments, they consider the outlook for a company's sector, as well as a company's ability to grow its profits over time. AUI focuses on Australian equities, while DUI offers diversification with a move into international investing through exchange-traded funds. |

Key take out: The key to the outperformance of AUI and DUI is a long-term investment approach with low turnover. |

Key beneficiaries: General Investors. Category: Shares. |

At first glance, listed investment companies Australian United Investment Company and Diversified United Investment appear to be a puzzle. Both have outperformed the S&P/ASX200 index over most time frames. Yet their top holdings are in blue chip Australian equities. It looks like they have beaten the index by investing in the index.

Company secretary for both LICs Sandy Hancock says the key to their success is a patient, long-term investment approach. Hancock notes that his companies have very low turnover, and a resulting low capital gains tax bill. The management expense ratio is also low, at 0.11% for AUI and 0.15% for DUI over the year to June 2014. There are no other performance fees or portfolio management fees as the directors act as the investment committees. He says there are two different types of LICs. First, there are a small number of well-established LICs, including AFIC, Argo, Milton and Whitefield. He distinguishes these from newer LICs, that often try to outperform fund managers and often have a higher management expense ratio. “Warren Buffett once said, as investment managers we're paid for performance, not to make transactions. So patient investing is a key to it,” Hancock says.

Even though the directors focus on blue-chip Australian companies, when trying to pick a good investment, they focus on the outlook for a company's sector, as well as for the economy as a whole. They also consider the company's management and its ability to maintain and grow its profits over the medium term. By contrast, Hancock says it's key to steer clear of bad investments.

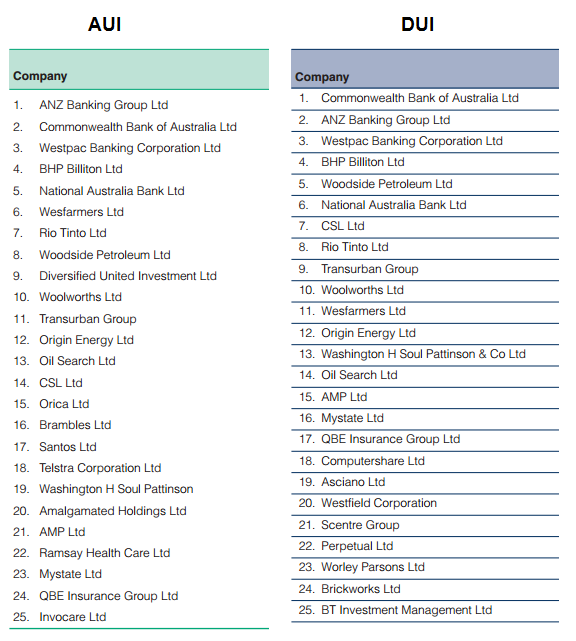

Figure 1: Top 25 holdings for AUI and DUI

Source: AUI and DUI annual reports.

The two companies have certainly been operating over the long term. AUI was formed in 1953 by businessman and philanthropist Ian Potter, and listed on the ASX in 1974. The fund invests in blue chip Australian listed equities and the Ian Potter Foundation is still its largest shareholder. In 1991, DUI was formed with a mandate to invest internationally and in fixed interest, as well as in Australian companies, to offer, as the name suggests, a more diversified option. AUI was a founding shareholder in DUI and still owns about 7%. The Myer family was another cornerstone investor in DUI.

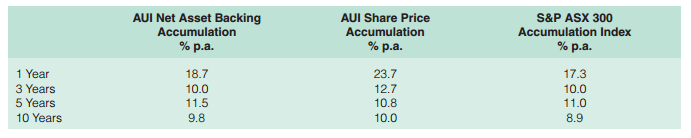

Figure 2: AUI performance

Source: AUI annual report.

Looking offshore

DUI had an allocation to international equities during the 1990s but switched back to concentrating on Australian investments during the 2000s. The board “felt that they wanted to get out of the international markets before the tech boom got too fluffy in the year 2000 and that proved to be a good call. And in the Australian economy the resources sector did very well through the 2000s, which helped us,” Hancock says.

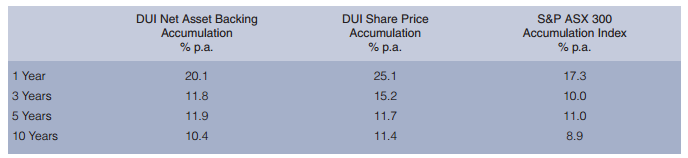

Figure 3: DUI performance

Source: DUI annual report.

DUI has last month raised $102.6 million in a fully subscribed rights issue in order to again allocate some assets internationally. The fund, like the Australian share market, has become very concentrated in banks and resource stocks. “But we've got large capital gains, so we don't particularly want to sell those stocks and pay tax and reinvest, so raising some more money allows us to diversify the portfolio,” Hancock says. “The directors feel the outlook for the Australian economy is perhaps weaker in this decade than it was in the last decade and the currency will accordingly be weaker as well.” He also cites macroeconomic concerns such as the terms of trade weakening as the mining boom ends, the federal budget deficit and weakening national income. “We're cautious about the strength of the US market at the moment so they'll be implementing that strategy quite cautiously.”

In May, DUI announced that it was time to re-establish an allocation to international stocks of up to 5% of the portfolio. In October, chairman Charles Goode, a former chairman of ANZ, told the group's AGM of plans to increase the international allocation towards 10% of the portfolio. DUI has so far invested in two global exchange-traded funds from Vanguard. One covers the US and the other covers the rest of the world. The LIC plans to increase its exposure to global health and technology stocks, but rather than picking stocks, will choose exchange-traded funds that follow technology and health indices. “The directors look at it from a broad perspective and they've said they won't want to pick individual stocks internationally,” Hancock says. (See: How to choose a fund manager for international equities.)

Maintaining dividends

The move into international markets follows the familiar theme of a focus on capital growth rather than franked dividends, which are particularly high in Australia compared to the rest of the world. “To the extent we invest internationally we are likely to invest in securities with lower dividend yields than from the Australian market and our dividends to shareholders are therefore more likely to be steady rather than increasing over the next few years,” Goode told the AGM. “We will however introduce more diversification into the portfolio and the potential for greater capital appreciation.”

The fund maintains its dividend as a priority. AUI increased its dividend during the GFC, while DUI maintained it. “We regard the provision of a stable and increasing fully franked dividend is very important to our shareholders,” Hancock says. “Certainly that's a fundamental principle the directors are mindful of. And they've got a good record in doing that.”

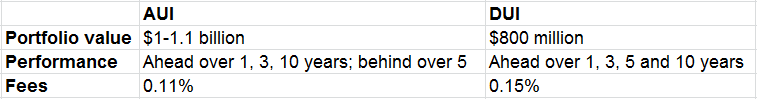

Figure 4: AUI and DUI key details

AUI's portfolio value is between $1 billion and $1.1 billion and DUI's is $800 million after the recent share issue, which includes some gearing. Both companies have a policy of taking on some debt at 10% to 12% of the value of the investments. “The cost of the debt is very low at the moment and we were able to fix in low rates for the long term,” Hancock says.

Chairman Charles Goode held a little more than one million shares in AUI when its annual report was released on August 25, including shares held by entities in which he had a relevant interest, and shares held under the directors' entitlements share plan. The corresponding report for DUI shows he held 4.6 million shares in the fund turning its attention overseas.

“We are cautious on the current share market in view of the current levels and volatility of world share markets, the prospect of rising interest rates next year, an ageing world population, government budgets that are in deficit and need balancing, and world tensions especially in the Middle East,” Goode told the DUI AGM.

“We are, however, comforted on a longer term view by the high levels of liquidity throughout the world, the attractive dividend yields relative to interest rates, and the longer term consumer spending that will come from the increased middle class in Asia.

“James Bond orders his martinis to be shaken but not stirred. In respect of the share market, we are stirred but not shaken.”