Is the door closing on investment property?

|

Summary: Property investors should keep an eye on both market conditions as well as potential efforts by regulators to further tighten the strings on property lending. |

|

Key take-out: While Sydney and Melbourne are still running hot, other capital cities aren't enjoying anywhere near the same level of growth and some have gone backwards. The big question for investors is, has the property boom gone on too long? |

|

Key beneficiaries: General investors. Category: Economy. |

It has never been more difficult for Australians to save a deposit and enter the property market.

That might seem like a big claim but it is backed up by recent data from the Australian Bureau of Statistics (ABS) that confirms that property valuations, as a share of income or rent, are well and truly in uncharted waters.

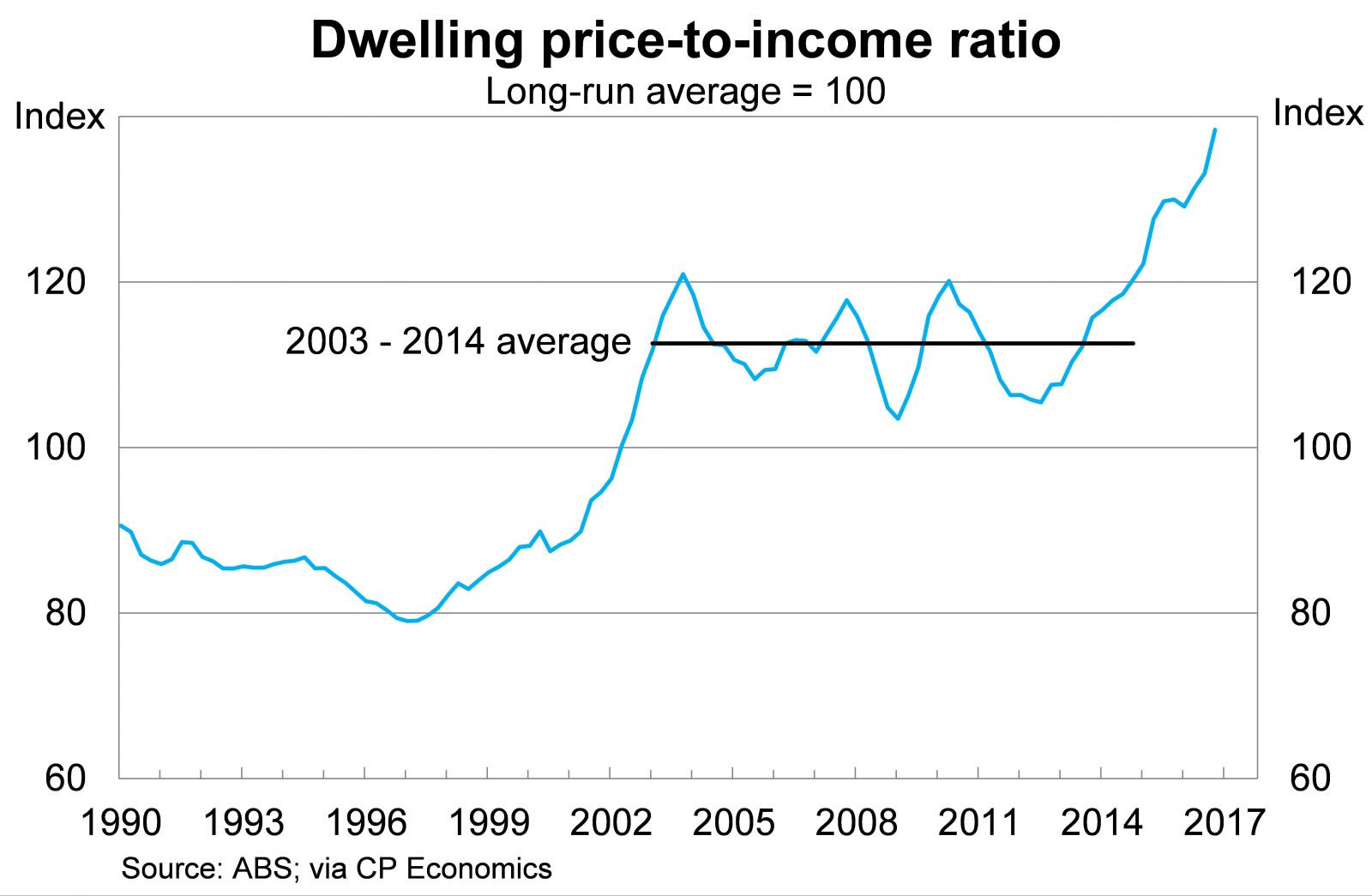

Australia's dwelling price-to-income ratio – a useful proxy for housing affordability – rose to its highest level in history in the December quarter and is likely to have pushed higher again in the months since.

The measure is currently 23 per cent above its average level from 2003 until 2014. That period was viewed as an era of consolidation for the property market. Big gains occurred in the late 1990s and early 2000s and then property valuations fluctuated as a share of income for over a decade.

There has been a clear decoupling in recent years as low interest rates and historically weak wage and income growth has sent property valuations into new territory. For the ratio to return towards that 2003-2014 average it will require a housing crash the likes of which few Australians have ever experienced.

The dwelling price-to-income ratio, however, is not a comprehensive measure of housing affordability. It doesn't incorporate interest rate payments, which helps to explain why it tends to increase when interest rates decline, but it does provide some insight into how difficult it is to save a deposit. It is, in other words, an excellent measure of the barriers first-home buyers face when entering the market.

It was no surprise then that housing affordability has once again become a hot topic. As I explained last week though, most of these measures proposed by state and federal governments are actually beneficial to investors since they increase the purchasing power of first home buyers and the benefit of that accrues mainly to existing property owners (Affordability plans won't dent house prices; 14 March).

Perhaps more concerning is the increased speculation that the Australian Prudential Regulation Authority (APRA) may step in and reduce the speed limit they have applied on investor credit growth. Currently limited to 10 per cent annual growth there is speculation that this could be reduced further to 5 per cent, which if enacted clearly limits both the availability of credit for investors and the potential capital returns. A speed limit of this nature would see investor credit stabilise as a share of nominal GDP.

Such regulations are not implemented with an eye on housing affordability but with an eye on financial stability. APRA is effectively arguing that such a high level of investor activity poses a significant financial and economic risk for Australia; it would argue that it is saving investors from themselves since the regulator is better placed to see the big picture.

Higher funding costs for our banking sector is another issue that could prove difficult for investors. We have already seen NAB and Westpac raise mortgage rates by 25 and 23 basis points, respectively, in response to the Federal Reserve rate hike last week.

The Federal Reserve is expected to raise rates another 50 basis points this year. Our local banks, who borrow a great deal from foreign banks in the United States, will pass that on in the form of higher mortgage rates. If you haven't fixed your home loan it may be the time to get around to it.

Perhaps the biggest risk though is that this upswing in Sydney and Melbourne property prices has lasted a lot longer than could reasonably be anticipated given the ongoing weakness in wage growth. Disposable income per household has, over the past two years, been rising at its slowest pace in at least a quarter century.

History suggests that the longer the upswing within the sector, in this case due to investor activity, the greater the eventual correction when it does arrive. Whether it occurs now or two years from now, I'd argue that there is currently greater risk in the housing market than at any point since the beginning of the global financial crisis.

City by city

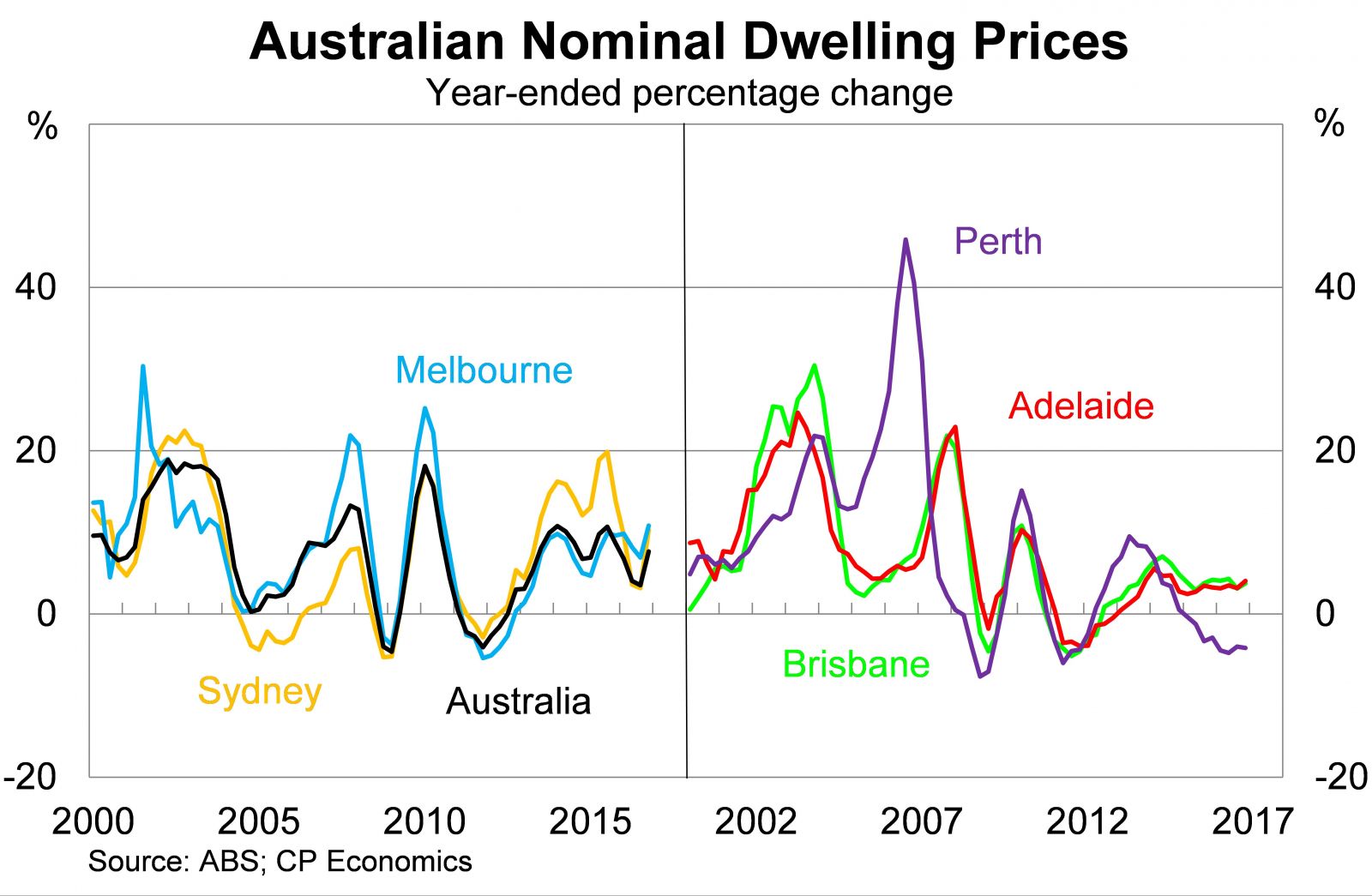

Conditions, however, differ significantly from city to city. We tend to focus a great deal on Sydney and Melbourne, and much of my earlier discussion reflects that, but conditions have actually been quite weak across the other capitals.

Prices are rising by between 10 and 11 per cent in Sydney and Melbourne; however, prices continue to decline in Perth and growth remains quite moderate in Brisbane and Adelaide.

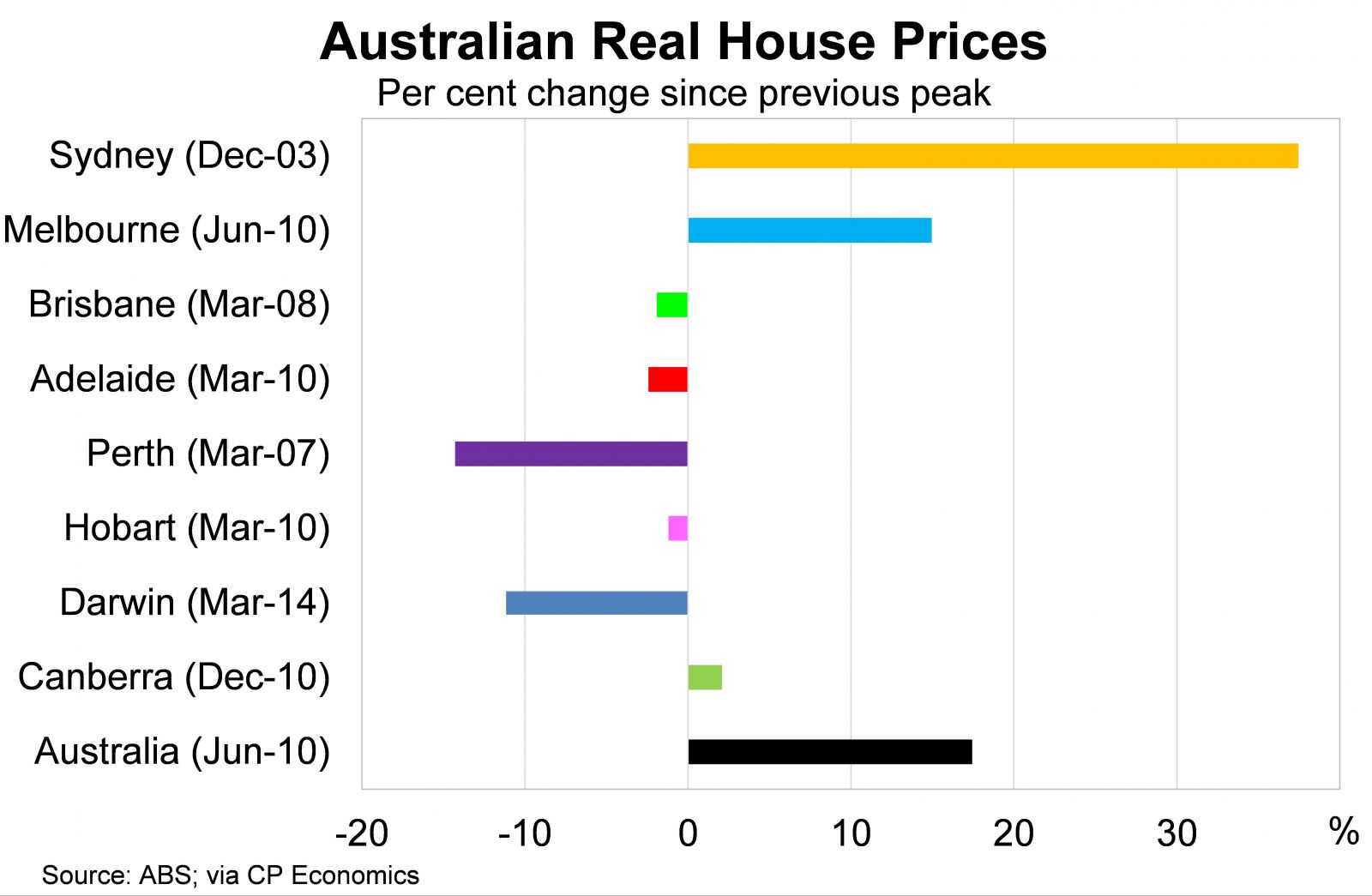

What I find quite interesting about the Australian housing market is that, outside of Sydney and Melbourne, capital city prices remain below their earlier peak after adjusting for inflation. Property has been hugely profitable in our two biggest cities but hit and miss in our other capitals.

Prices in Perth, for example, are 14.3 per cent below their peak almost 10 years ago. Prices in Brisbane and Adelaide are still below their peaks established in March 2008 and March 2010, respectively.

It is a useful reminder that property isn't always a sound investment. Property prices can fall and that weakness can plague investors over a number of years. Investors buying in Perth a decade ago would never have anticipated that they had made such a poor deal.

I have said for some time that investors have a lot to think about in the property space. Has the boom gone on too long? Are the potential gains worth the additional risks? And, are they sure that APRA won't spoil the party?

The answer to these questions will ultimately determine whether you want to enter the property market right now or expand your existing portfolio.