Is property still the Australian Dream? Rethink the dream so you can live yours

For today’s first home buyers, getting into the property market can be a hard slog.

It can mean scrimping and saving for years to grow a deposit, followed by taking on a debt measured in hundreds of thousands of dollars, often to buy a suburb located so far from the city centre that a good chunk of each weekday is spent commuting.

Adding insult to injury, home owners are then at the mercy of Reserve Bank rate hikes, which can derail even the best laid plans for financial security.

Buying a home is still a worthwhile goal. But for many Australians, poor housing affordability has seen home ownership become too hard.

This is driving an evolution in what it means to be wealthy.

In an AMP report[1], demographer Bernard Salt notes that our concept of ‘wealthy’ is no longer solely linked to home ownership.

Rather, being wealthy is about freedom – being able to live the life we choose without being “unbearably burdened by the costs of everyday life”.

A new plan for a new dream

There is a way to lead the life you want to live.

All worthwhile goals call for a blueprint to follow. So, we’ve drawn up a roadmap for you (you’re welcome).

Here’s the plan:

- Start a high growth investment with the savings you have built up to date.

- Grow your investments by regularly topping them up.

- Watch as the dividends roll in.

- Use those dividends to enjoy great experiences.

What’s in it for you?

Our plan helps you grow your wealth – and enjoy it while you are still young.

Better still, as your balance grows, so too will your investment income. So those rewarding life experiences can get bigger and better every year.

A closer look at your plan

Let’s break down what this plan looks like in action:

1. Put your current savings to work

You most likely have savings. Now it’s time that money got a job.

Ideally, look for a high growth investment option. This is best-suited to building wealth over the long term – and that means 7-years plus. If you are likely to get cold feet after a year or so, this strategy may not be the best option for you.

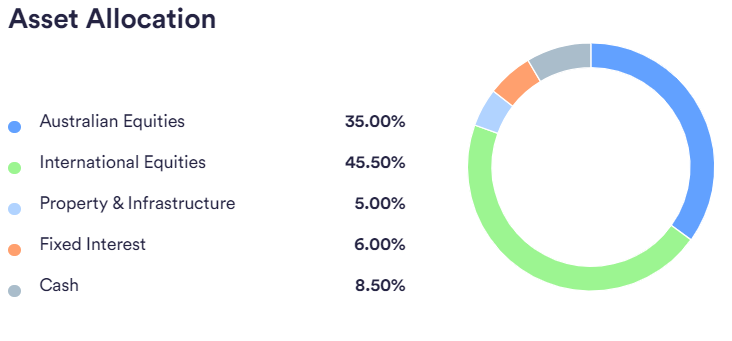

A high growth portfolio includes both Aussie and global shares, property, infrastructure, cash and bonds.

It can sound like a tall order. But a low fee managed option like InvestSMART’s High Growth Portfolio makes it easy. The portfolio will be managed for you so you don’t need to do a thing.

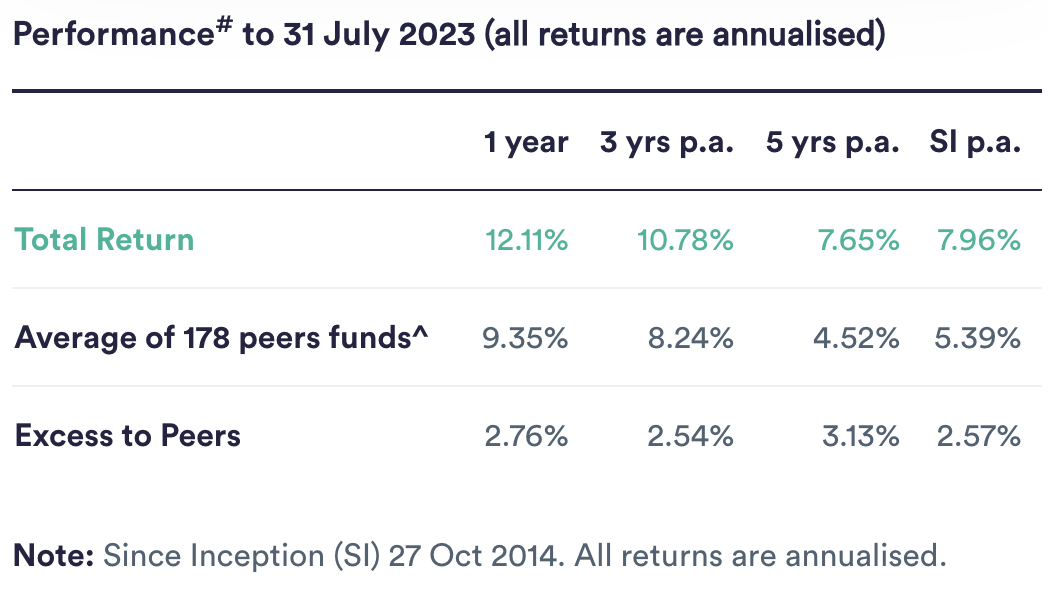

When you open this type of investment account, your cash immediately buys a diversified basket of investments. Past returns are no guide for the future, but since 2014 InvestSMART’s High growth portfolio has notched up annual returns averaging 7.96%.

2. Maintain the momentum

With your investment set up, it’s worth keeping your savings habit going by regularly adding to your account.

This offers two big pluses. First, your nest egg is continually building. Second, you don’t have to worry about what investment markets are doing, or try to sort when is a ‘good’ time to invest. Just stick to your game plan. It’s that easy – every dollar you add goes towards future capital growth and dividends.

How often should you invest? That’s up to you. Contribute weekly, fortnightly, monthly or quarterly. Bear in mind though, each time you buy shares you may pay brokerage. So it may make sense for you to invest a larger amount each month or quarter rather than fortnightly.

3. Enjoy the dividends

Your diversified investment portfolio will earn you dividends paid from your InvestSMART portfolio. This payment is in the form of cash distributions. You can choose to reinvest this money by buying more units to grow your investment. Or you can decide to spend the money. The choice is yours.

More good news - unlike returns on some other investments, distributions can be very tax-friendly.

When you first start out, your distributions may be small. But the more units you hold, the bigger your payment. So as your investment builds, so too can your distributions.

4. Fund the lifestyle you want

You’re free to use distributions to fund the lifestyle you want. Initially, they may be enough to celebrate a night at your favourite fine diner. Go ahead, enjoy yourself!

Over time, distributions will build as your investment increases.

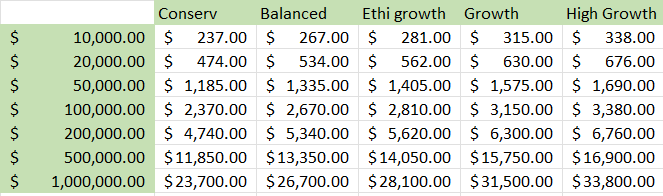

The table below illustrates just how rewarding those distributions can be. With a regular savings strategy, your investment could see you switch from evenings at a local café, to sipping champagne on the Champs-Élysées.

Cash distributions per year based on estimated income per IS Portfolio:

It’s all about letting your savings build a nest egg, so you can let your investment fund your lifestyle.

[1] https://www.amp.com.au/content/dam/amp-au/documents/financial-hub/bernard-salt-report-what-wealthy-means-to-australians-in-2023.pdf