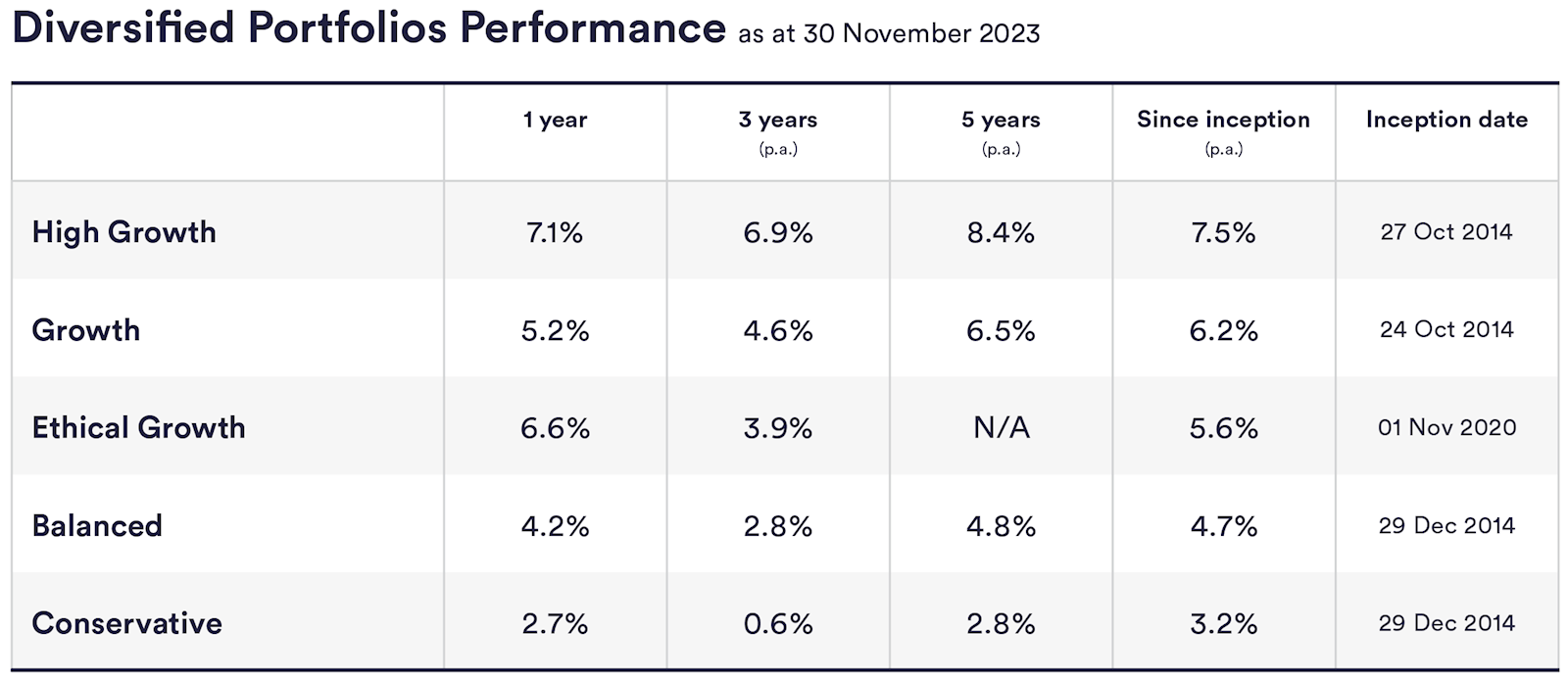

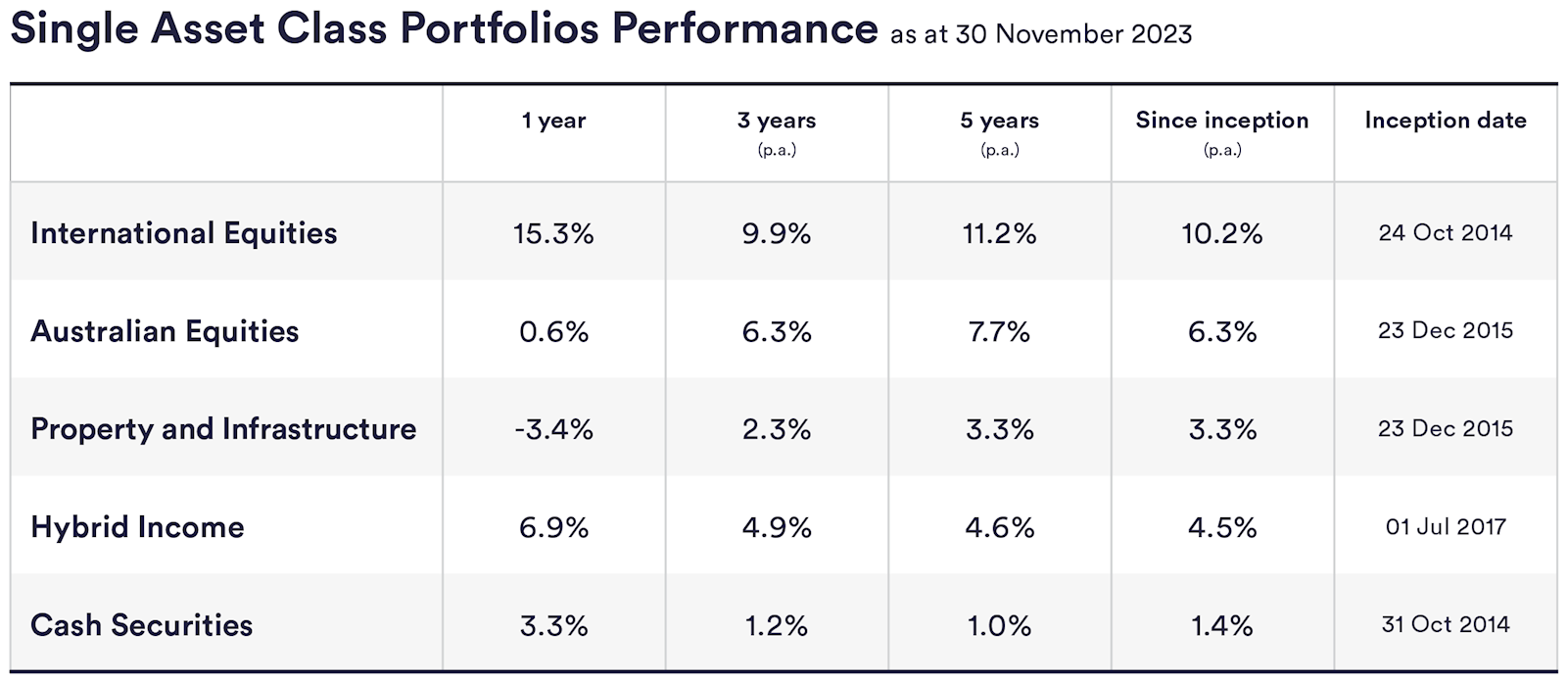

InvestSMART's performance for the month of November

This month the InvestSMART diversified portfolios returned between 2.67% and 7.10% and the InvestSMART single asset class portfolios returned between –3.4% and 15.3% to the year ending 30 November 2023.

Why the November recovery is a good lesson in not timing the market

November was a strong month for equities with iShares Core S&P/ASX 200 ETF (IOZ) increasing 5% and Vanguard MSCI Index International Shares ETF (VGS) returning 4.4%, driving most gains in the InvestSMART diversified portfolios.

The recovery of equity markets in November is a good reminder that we can never predict when these strong returns will happen. Staying invested over the long term is a key principle for successful wealth creation, and several studies have analysed the impact of missing the best days in the market on overall investment returns.

The cost of missing the best days

This historical analysis shows that a significant portion of market gains occur during a handful of the best days. Investors frequently trading, chasing returns or trying to avoid losses are at risk of missing these days and missing out on potential returns.

For example: A Hartford Funds study found if you missed the S&P 500's 10 best days over the past 30 years, your returns would have been cut in half. Missing the best 20 days would have reduced your returns by 73%. If you missed the best 30 days would have resulted in a staggering 83% reduction.

Another study from J.P. Morgan Asset Management found that just the top 10 days of the S&P 500 between 1992 and 2021 would have reduced your annualised return from 9.85% to 5.1%.

Get comfortable with being uncomfortable

Market timing is notoriously difficult. Investors who try to time the market by frequently entering and exiting, risk missing out on these crucial moments, which can undermine overall returns. Additionally, transaction costs and taxes can further erode investment returns.

Investors are better off adopting a long-term investment approach and staying invested through market fluctuations. Allow the power of compounding to build returns over time, stay committed to your financial goals and maintain a diversified portfolio. The more years you stay invested, you’ll experience many ups and downs, and become more comfortable with volatility.

As the late, great Charlie Munger said: “The first rule of compounding is to never interrupt it unnecessarily”.

Frequently Asked Questions about this Article…

In November, InvestSMART diversified portfolios returned between 2.67% and 7.10%, while single asset class portfolios saw returns ranging from -3.4% to 15.3% for the year ending November 30, 2023.

Timing the market is challenging and risky. Missing just a few of the best days can significantly reduce your returns. Staying invested over the long term helps you capture these crucial gains and supports successful wealth creation.

The iShares Core S&P/ASX 200 ETF (ASX:IOZ) increased by 5% in November, contributing to the gains in InvestSMART's diversified portfolios.

Missing the best days can drastically reduce your returns. For instance, missing the S&P 500's 10 best days over 30 years could cut your returns in half, and missing the best 30 days could result in an 83% reduction.

A long-term investment approach allows you to benefit from the power of compounding, helps you stay committed to your financial goals, and makes you more comfortable with market volatility over time.

The Vanguard MSCI Index International Shares ETF (ASX:VGS) returned 4.4% in November, driving gains in the InvestSMART diversified portfolios.

Frequent trading can lead to missing out on the best market days, incurring transaction costs, and facing tax implications, all of which can erode your investment returns.

Charlie Munger famously said, 'The first rule of compounding is to never interrupt it unnecessarily,' highlighting the importance of allowing investments to grow over time without unnecessary interference.