InvestSMART Quarterly Performance Update: June 2024

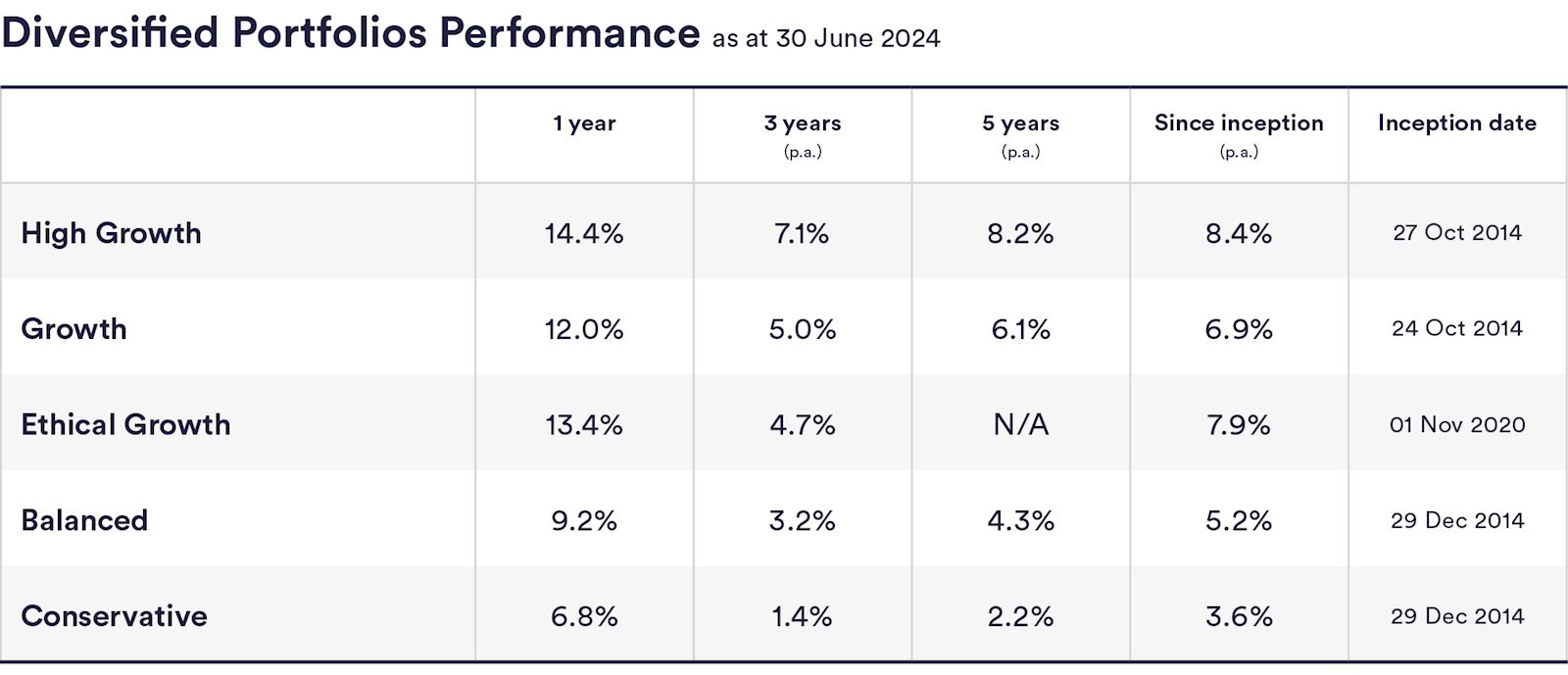

InvestSMART's diversified ETF portfolios returned between 6.8% and 14.4% in the 12 months to 30 June 2024.

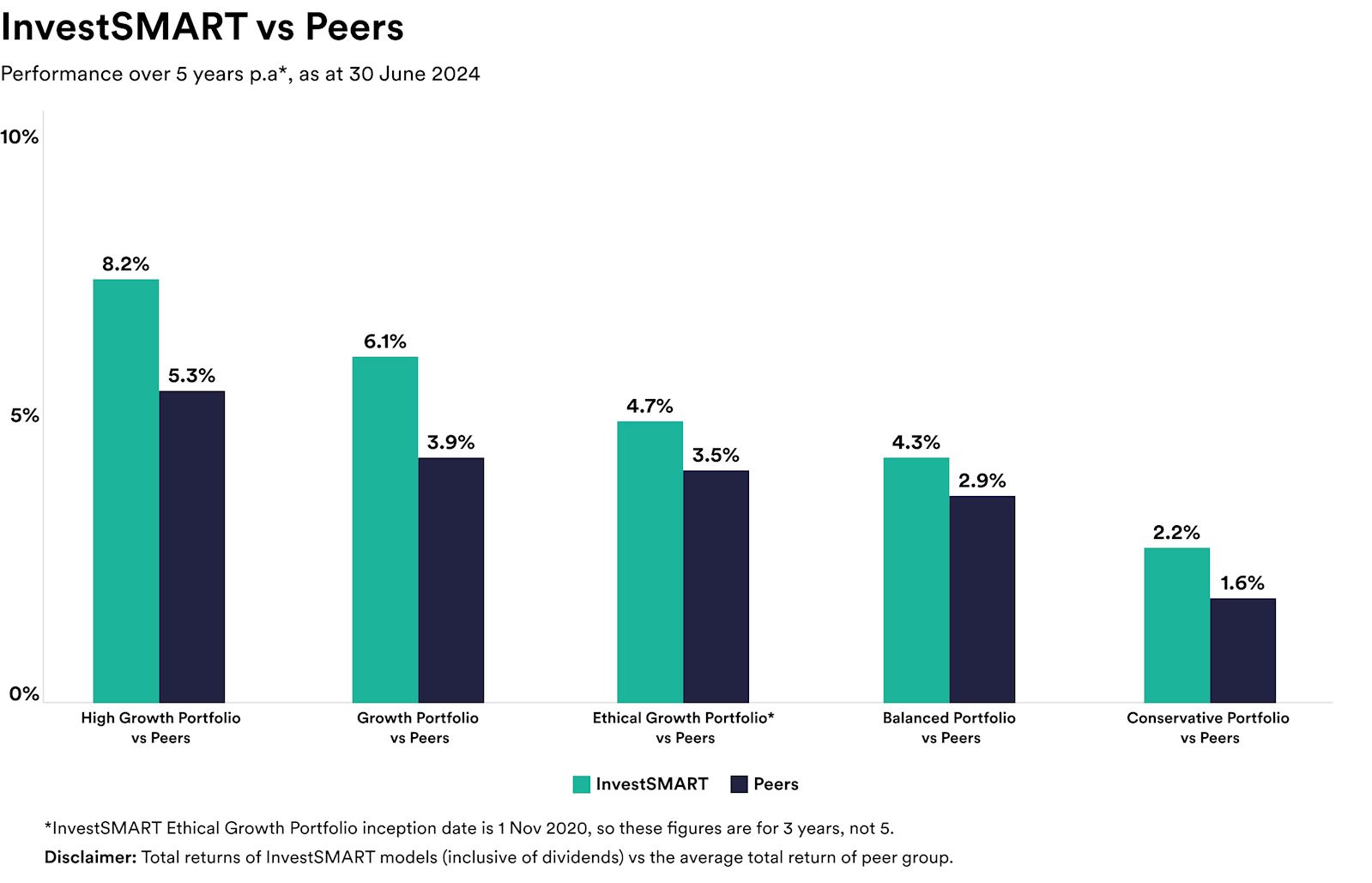

Over five years the portfolios have returned on average 2.3% to 8.2%, outperforming competitor funds by an average annualised return of 0.7% to 2.9%. The table below illustrates how InvestSMART's portfolios compare to similar funds over five years. For example: our High Growth portfolio has returned on average 8.2% over five years. It has outperformed similar funds categorised as 'high growth' by an average of 2.9% over the same period. A significant contributor to InvestSMART's ongoing outperformance is due to our low management fee which is capped at 0.55% a year.

InvestSMART's single asset portfolios returned between 3.9% (cash securities and 21.6% (international equities) in the 12 months to 30 June 2024, and between 1.3% and 12.6% over five years.

June quarter wrap up

While most asset classes ended the June quarter with muted returns, the past year still capped off an excellent 12 months for investors. International shares, Australian property, and Australian shares all delivered strong performances.

The Australian share marke experienced growth between 7.8% and 12.1% over the past financial year. However, the June quarter saw a slight decline. Technology, financials, and consumer discretionary sectors were the best performers.

Despite positive performance, the ASX lagged behind the US market, which grew by 23% in the last 12 months. This disparity can be attributed to the strong showing of US tech stocks and artificial intelligence (AI) companies.

Several factors contributed to the ASX's underperformance compared to global markets. The lack of prominent tech giants on the ASX and a downturn in the resources sector played a role. Additionally, ongoing uncertainty surrounding inflation and interest rate hikes impacted investor confidence.

Read more about InvestSMART's portfolios and the performance of the ETFs in our portfolios here.

Value of diversification

After trading sideways for several years, the share market both locally and internationally has performed strongly over the last 12-months, climbing the proverbial 'wall of worry'. In coming years, however, it may be the turn of other asset classes to perform well.

The returns across all the above InvestSMART portfolios, highlights the value of a diversified portfolio and taking a long-term approach. It's difficult to predict year by year which of the asset classes will perform the best, a diversified portfolio, of broad-based ETFs, combined with a long-term view, will, in our view, help to reduce risk and provide better long-term returns.

Investing is a psychological game. A diversified portfolio and a long-term perspective also reduce the temptation to panic sell during periodic downturns when they occur, which can unfortunately turn a paper loss into a real loss. Maintaining a clear focus on what your financial goal is and reminding yourself that markets go up, down and sideways, will help you stay disciplined and avoid rash decisions.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 6.8% and 14.4% in the 12 months to 30 June 2024, showcasing strong performance for investors.

Over the past five years, InvestSMART's portfolios have returned on average 2.3% to 8.2%, outperforming competitor funds by an average annualised return of 0.7% to 2.9%.

A significant contributor to InvestSMART's ongoing outperformance is their low management fee, which is capped at 0.55% a year.

InvestSMART's single asset portfolios returned between 3.9% (cash securities) and 21.6% (international equities) in the 12 months to 30 June 2024.

In the Australian share market, the technology, financials, and consumer discretionary sectors were the best performers over the past financial year.

The ASX underperformed compared to the US market due to the lack of prominent tech giants, a downturn in the resources sector, and ongoing uncertainty surrounding inflation and interest rate hikes.

InvestSMART emphasizes that a diversified portfolio, combined with a long-term view, helps reduce risk and provides better long-term returns, as it's difficult to predict which asset classes will perform best year by year.

A long-term investment perspective helps reduce the temptation to panic sell during downturns, maintaining focus on financial goals and avoiding rash decisions, which can turn paper losses into real losses.