InvestSMART Portfolios - July 2018 in Review

Diversified Portfolios

Movers and Shakers

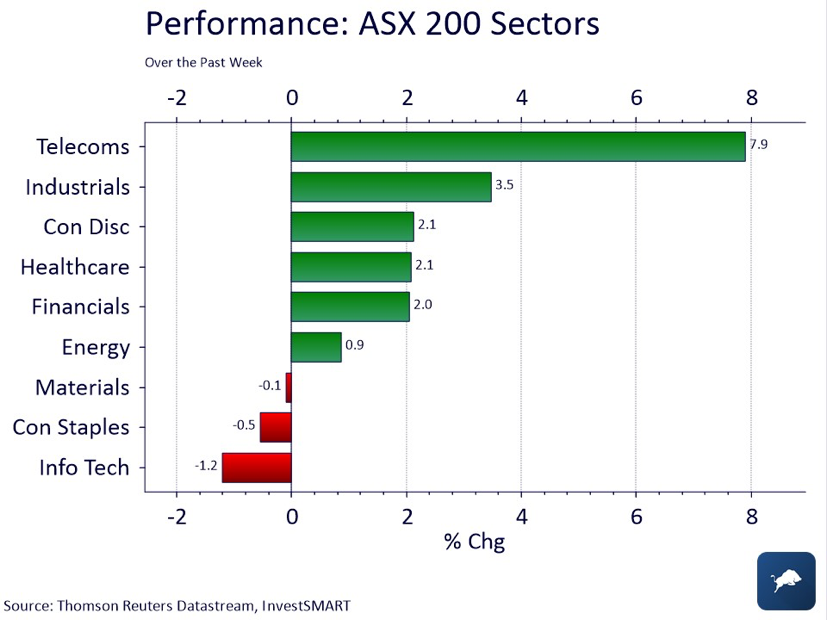

- The 1.4% gain in the S&P/ASX 200 over the month certainly helped maintain overall performance of most of our portfolios. July is traditionally known as ‘confession season’ as firms tend to downgrade guidance being the month before full year earnings season. However, this year’s confession season was light by historical standards. The ASX was also supported by stable iron ore and coal pricing offset by the declines in base metals, most notably copper.

The performance of the S&P/ASX 200 year-to-date has been solid – it is, however, the second-best index our portfolios have exposure to.

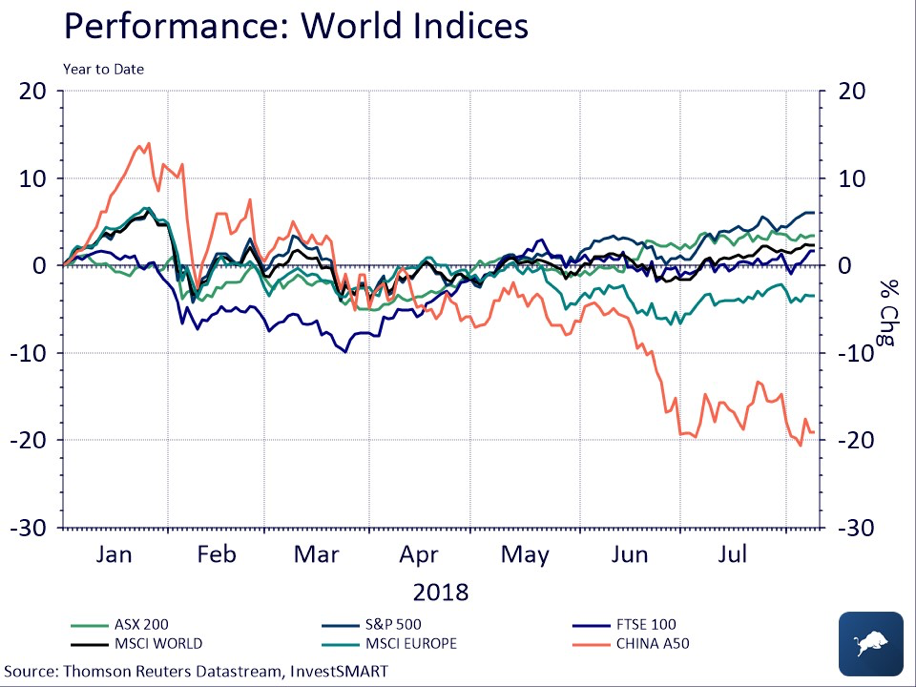

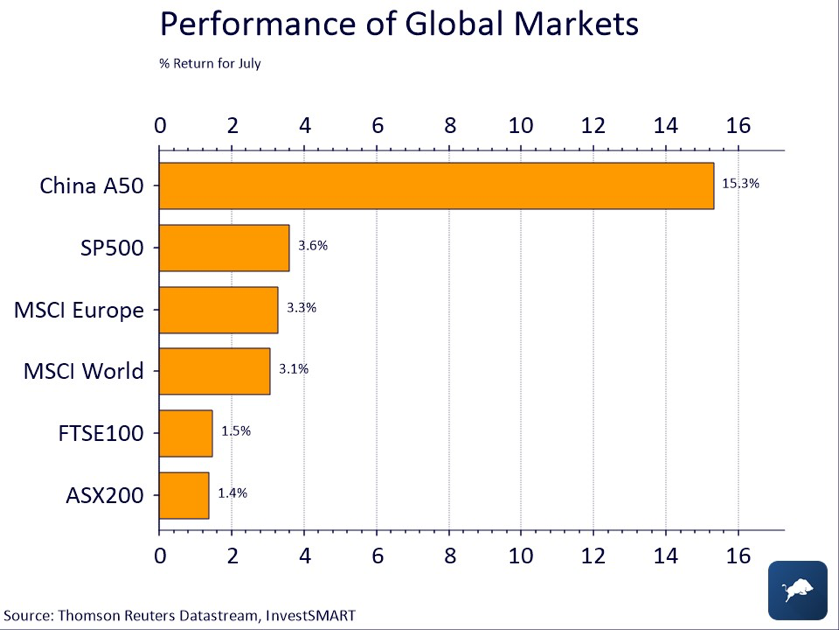

- The US continued to be the bright spot of global equity markets and July was no exception, up 3.6% off the back of the best reporting season in the US since the third quarter of 2010. Earnings-per-share growth was up 28% year-on-year and this is despite the fact some of the FAANGs (Facebook, Apple, Amazon, Netflix and Google) had rather disappointing quarterly earnings. The S&P500 is currently the best performing index exposure in our portfolios and has returned over 6% year to date. We see US markets outperforming over the coming periods.

- Emerging markets (EM) continued to suffer in July as US proposed an additional US$200 billion of tariffs on Chinese exports, on top of the US$50 billion of tariffs on Chinese exports that started on July 5. Our exposure to EM is through the China A50 index, an index that has felt the full force of the US-China trade war this year. Year to date, the index is down 18%, however, in July it bounced up over 15%. We have around 7.5% of direct exposure to the China A50 so the overall impact on the portfolio has been minimal but it does fit in with our risk profile some.

- European markets reacted positively in the back half of the month as the President of the European Commission, and US President released a statement about future EU-US trade and the possibility of a free trade agreement sometime in the future. The German DAX was the best performing EU market while our MSCI Europe index exposure snapped back from a negative June. Its year to date performance has been a touch disappointing on the back of potential US tariffs and political changes. However, overall, Europe is rebounding from its 2012-2013 lows and we continue to see this weighting as correct.

- The treasuries markets continued to hesitate on pricing in further rate hikes from the US Federal Reserve in July, the US ten year yield appreciated to its highest level since mid-June however it was unable to breach 3% despite the Federal Reserve all but confirming it will increase rates a further 50 basis points before year end. The flat treasuries market allowed for relatively stable fixed income markets.

- Property assets in Australia continued to fall with Melbourne overtaking Sydney’s house price declines to be down over 6% year-on-year. Rental yields were also a concern as Queensland and Western Australia saw rental yields actually decline year-on-year while Melbourne and Sydney saw the lowest rental yield growth in over 5 years.

To see more information on our Diversified Portfolios, click here.

InvestSMART International Portfolio

With US markets continuing to move higher, and with over 48% exposure to US markets in the international portfolio, the 2.29% return over July is down to this fact. The current returns confirm the diversification inside the portfolio is correctly weighted to each region and has allowed the portfolio to weather the volatility from US-China trade issues rather well.

We see the US as the core of our international portfolio in the current environment and we expect short-term volatility in global markets to continue for the remainder of the calendar year as geopolitical issues filters into equity markets. However, we also expect the underperformance of Europe and Asia to reverse over the medium term, so we continue to maintain exposures (28% and 7.5% respectively) to these regions.

To see more information on our International Portfolio, click here.

InvestSMART Hybrid Portfolio

The total portfolio return was 1.05% for the month and 2.59% for the quarter. Due to the healthy 1.00% capital return this month, the expected yield to call on the portfolio has fallen from 5.40% to 5.20%.

Tighter trading margins translated into a positive capital growth of 1.00% with income solely of 0.05% from one security. The Income Return (including franking) was 0.05% for the month and 1.23% for the quarter, while the income return since inception (Sep 2015) is 5.14% p.a including franking. The capital growth for the month of July was 1.00% and 1.36% for the quarter. The main contributors to performance during the month were CGFPB ( 2.5%), CBAPD ( 1.7%), and CBAPE ( 1.7%). The only detractors to performance during the month were NABPB (- 1.2%) and NABHA (-0.4%).

To see more information on our Hybrid Portfolio, click here.

InvestSMART Interest Income Portfolio

The Australian 10-year bond moved through a 2-basis point range (2.63% to 2.65%) during July which saw minimum capital impacts on the floating notes inside the portfolio. The sovereign bond side of the portfolio looks even more stable on a forward-looking basis as the Reserve Bank of Australia is unlikely to shift the official cash rate over the coming 18 months. Adding further long-term stability, Australia’s AAA credit rating remains intact and is not under review by any of the rating agencies.

Looking to the corporate bond side of the portfolio and the slightly riskier profile came into focus. There were strong movements in the Bank Bill Swaps markets throughout July, and there is a link between corporate bonds and these markets. However, the corporate bond market remained relatively stable in July; in fact, it closed the month with a tighter spread than it began. This meant minimal movements on the capital side of the corporate bond exposures, coupled with higher yield.

The overall portfolio remains capital conservative and yield consistent.

To see more information on our Interest Income Portfolio, click here.

InvestSMART Diversified Property & Infrastructure Portfolio

Property security prices continued to fluctuate in July and ended up dragging down the overall performance of the portfolio. July saw both the domestic and international exposures flatlining and actually closing down slightly come the close of the month. Considering the overall weighting of property in the portfolio (approximately 48%), underperformance of the portfolio is mainly due to property’s underperformance in the month. Looking at possible future performance, the recent inflation report for Australia showed that rental yields have, for the first time in over a decade, remained unchanged year-on-year (YoY). We do not expect a price increase like that seen through May and June for the remainder of the year.

Infrastructure securities continue to produce the majority of the positive performance. Transurban and Sydney Airport provided solid returns and are due to report strong results in August. Infrastructure spending in 2018 and projected for year 2019 and 2020 remain strong, though below the historical highs of 2013.

To see more information on our Property & Infrastructure Portfolio, click here.

Frequently Asked Questions about this Article…

The S&P/ASX 200 gained 1.4% in July 2018, which helped maintain the overall performance of most portfolios. This gain was supported by stable iron ore and coal pricing, despite declines in base metals like copper.

Emerging markets, particularly the China A50 index, were affected by the US-China trade war. The US proposed an additional US$200 billion in tariffs on Chinese exports, impacting the China A50 index, which was down 18% year-to-date but bounced up over 15% in July.

US markets continued to be a bright spot, with the S&P500 up 3.6% in July 2018. This was due to the best reporting season since the third quarter of 2010, with earnings-per-share growth up 28% year-on-year.

The InvestSMART International Portfolio returned 2.29% in July 2018, largely due to its 48% exposure to US markets. The portfolio's diversification allowed it to handle volatility from US-China trade issues effectively.

European markets reacted positively in the latter half of July 2018, following a statement about future EU-US trade and the possibility of a free trade agreement. The German DAX was the best performing EU market during this period.

The InvestSMART Hybrid Portfolio achieved a total return of 1.05% for July 2018. The portfolio saw a 1.00% capital return, with the expected yield to call falling from 5.40% to 5.20%.

Property assets in Australia continued to decline in July 2018, with Melbourne overtaking Sydney in house price declines, down over 6% year-on-year. Rental yields also saw declines in Queensland and Western Australia.

The InvestSMART Diversified Property & Infrastructure Portfolio saw property security prices fluctuate in July 2018, leading to a slight underperformance. However, infrastructure securities like Transurban and Sydney Airport provided solid returns, with strong infrastructure spending projected for 2019 and 2020.