InvestSMART Performance Update: October 2024

InvestSMART's diversified ETF portfolios have continued to produce stellar results, returning between 12.2% and 24.7% in the 12 months to 31 October 2024. By keeping our fees low and using broad-based passive ETFs, we have been able to outperform the majority of our competitors over the long term.

.jpg)

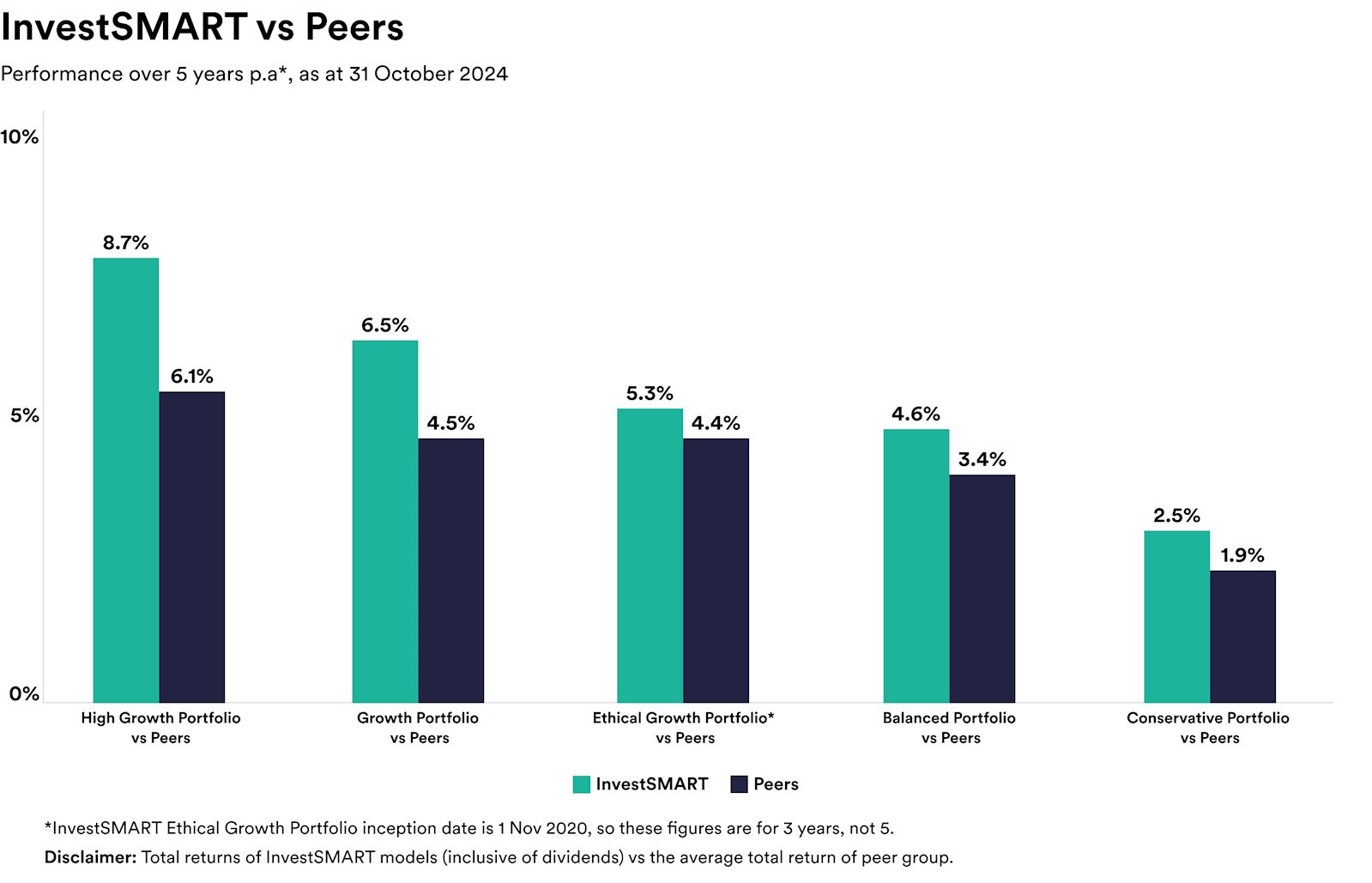

Over five years the diversified portfolios have returned between 2.5% and 8.7% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. As you can see, our High Growth portfolio has returned 8.7% a year over five years, outperforming similar options by an average of 2.6% over that period. Of course, past performance is not an indication of future performance.

InvestSMART's single-asset portfolios also performed well, returning between 4.0% (cash securities) and 30.9% (international equities) in the 12 months to 31 October 2024, and between 1.5% and 12.7% over five years.

October wrap up

After a series of monthly gains, the Australian share market went backward in October with the S&P/ASX 200 falling by 1.3%. Utilities and consumer staples were the weakest sectors, dropping by 7.2% and 7% respectively while a gain of 3.3% saw financials end the month as the best-performing sector. Despite not having a great month in October, Aussie shares are still up 20.3% over the year.

The Aussie share market wasn't the only market to end October with a negative result. The US fell by 0.9%, Europe was down 3.3% and China experienced a drop of 5.6%. Japan was the outlier, rising by 1.9% over the month.

The US election result saw many global markets bounce back. US shares ended the week up 4.7% and even Australian shares rose by 2.2% despite the Reserve Bank keeping the cash rate at 4.35%. It will be interesting to see what the rest of November holds.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios have delivered impressive returns, ranging from 12.2% to 24.7% in the 12 months leading up to October 31, 2024. This performance highlights the effectiveness of their low-fee, broad-based passive ETF strategy.

Over the past five years, InvestSMART's diversified portfolios have achieved average returns between 2.5% and 8.7%. Notably, the High Growth portfolio has outperformed similar options by an average of 2.6% annually during this period.

InvestSMART's single-asset portfolios showed strong performance, with returns ranging from 4.0% for cash securities to an impressive 30.9% for international equities in the 12 months to October 31, 2024.

In October 2024, the Australian share market experienced a decline, with the S&P/ASX 200 falling by 1.3%. Despite this setback, Aussie shares have still gained 20.3% over the year.

In October 2024, the utilities and consumer staples sectors were the weakest in the Australian share market, dropping by 7.2% and 7% respectively.

Global markets generally saw declines in October 2024, with the US down 0.9%, Europe falling 3.3%, and China dropping 5.6%. Japan was an exception, with a 1.9% increase.

Following the US election, many global markets rebounded. US shares rose by 4.7% and Australian shares increased by 2.2%, despite the Reserve Bank maintaining the cash rate at 4.35%.

While the article doesn't provide specific predictions, it notes that the US election results have positively influenced market performance, suggesting that investors should stay tuned for potential developments in November 2024.