InvestSMART Performance Update: March 2025

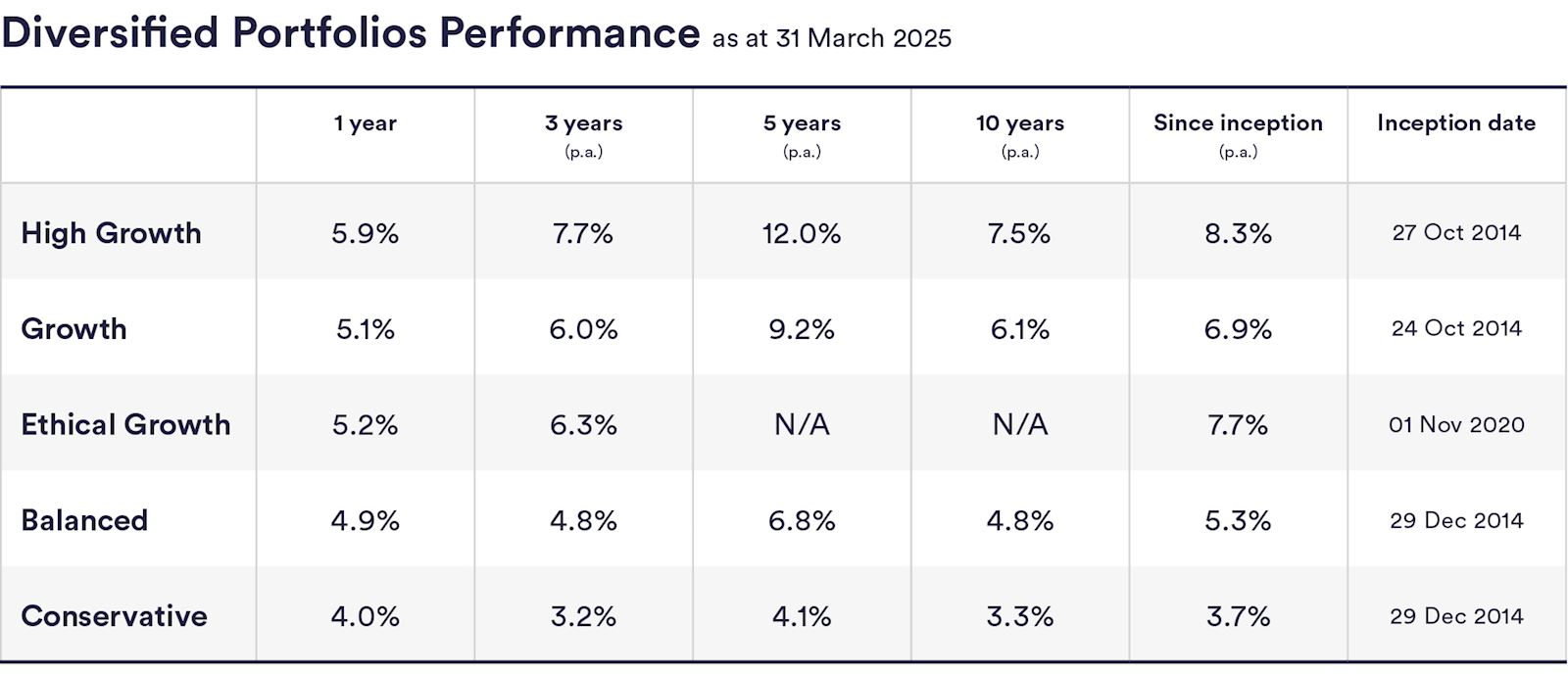

InvestSMART's diversified ETF portfolios returned between 4.0% and 5.9% in the 12 months to the end of March 2025. These lower-than-usual annual returns are to be expected given the market volatility over the past few months. That's why it's so important to take a long-term view when investing.

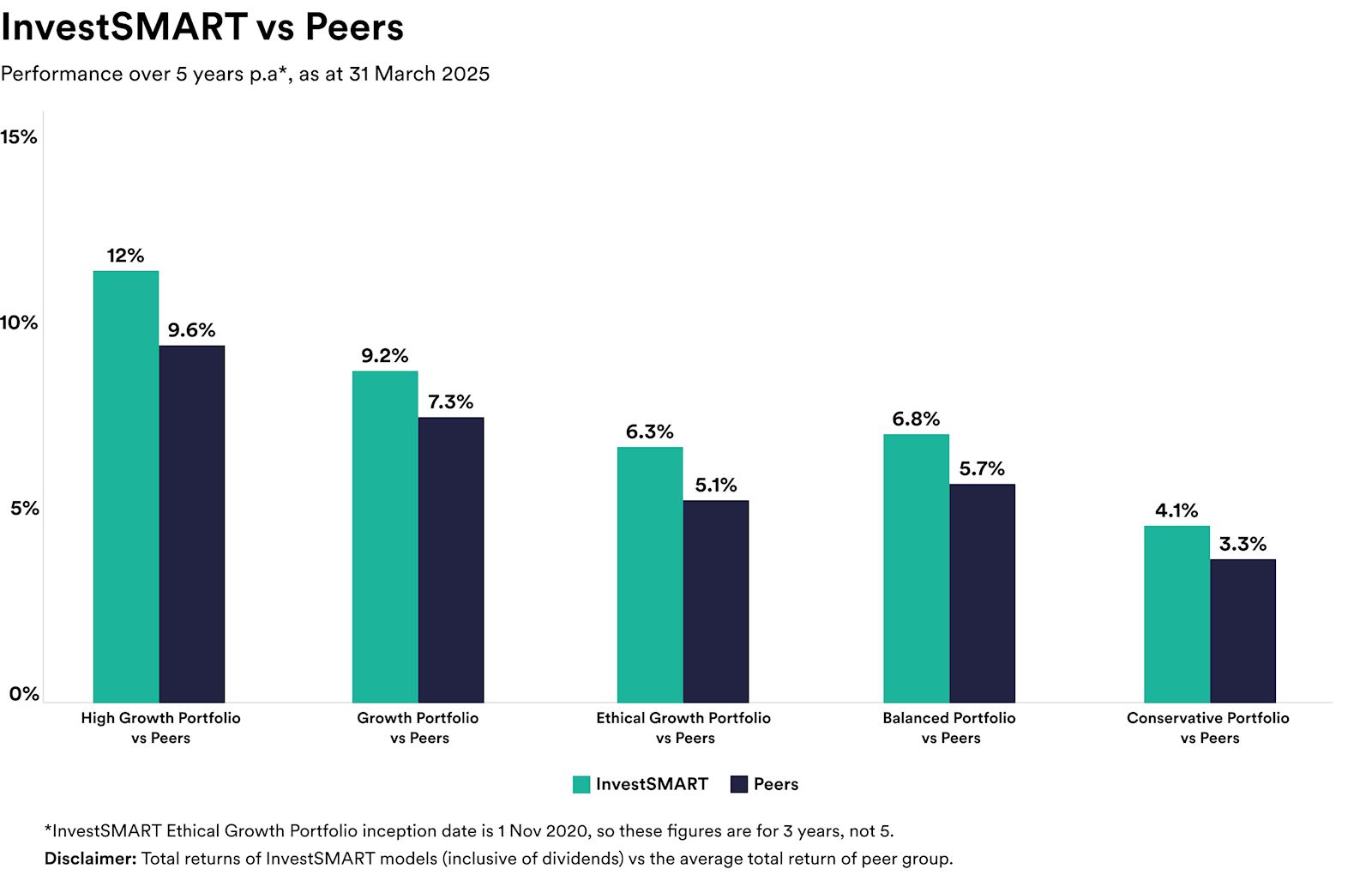

Over five years the diversified portfolios have delivered annual returns of between 4.1% and 12.0% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. As you can see, our High Growth portfolio has returned 12.0% a year over five years, outperforming similar options by an average of 2.4% over that period. Keep in mind, past performance is not an indication of future performance.

InvestSMART's single-asset portfolios returned between 2.1% (Australian equities) and 11.0% (international equities) in the 12 months to the end of March. Over five years our Australian Equities Portfolio has delivered returns of 12.2%p.a. and the International Equities Portfolio returned 14.7%p.a. over that same period.

.jpg)

March wrap-up

March was a tough month for markets. The Aussie share market had another negative month, with the S&P/ASX 200 dropping 3.4%. Over in the US, things were even worse, with the S&P 500 falling 5.8% in Aussie dollar terms. International shares also struggled, with the MSCI World ex-Australia Index down 4.7%.

These declines were mainly driven by ongoing concerns, including fears of a potential US recession and the risk of a global trade war.

The only sector on the ASX 200 to finish March in positive territory was utilities, which gained 1.5%. On the flip side, technology (-9.7%), consumer discretionary (-6.3%), and property (-4.9%) were the worst-performing sectors.

April has started off a bit rocky as well. It's normal to feel uneasy during times of market volatility, but it's important to stay calm, avoid knee-jerk reactions, and keep your long-term investment goals in sight.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 4.0% and 5.9% in the 12 months to the end of March 2025. These returns are lower than usual due to recent market volatility.

Over five years, InvestSMART's diversified portfolios have delivered annual returns ranging from 4.1% to 12.0% on average. Notably, the High Growth portfolio returned 12.0% annually, outperforming similar options by an average of 2.4%.

In the past year, InvestSMART's single-asset portfolios returned between 2.1% for Australian equities and 11.0% for international equities.

Over five years, InvestSMART's Australian Equities Portfolio delivered an impressive return of 12.2% per annum.

InvestSMART's International Equities Portfolio achieved a strong return of 14.7% per annum over the past five years.

In March 2025, the Australian share market saw a decline with the S&P/ASX 200 dropping 3.4%, while the US market experienced a larger drop with the S&P 500 falling 5.8% in Aussie dollar terms.

The utilities sector was the only one to finish March 2025 in positive territory on the ASX 200, gaining 1.5%.

During market volatility, it's important for investors to stay calm, avoid knee-jerk reactions, and focus on their long-term investment goals.