InvestSMART Performance Update: July 2024

InvestSMART's diversified ETF portfolios returned between 7.8% and 14.7% in the 12 months to 31 July 2024. With the topic of interest rates remaining an ever-present concern for many people, it's important to note that all of InvestSMART's diversified portfolios have outperformed bank savings accounts and term deposits over the past 12 months.

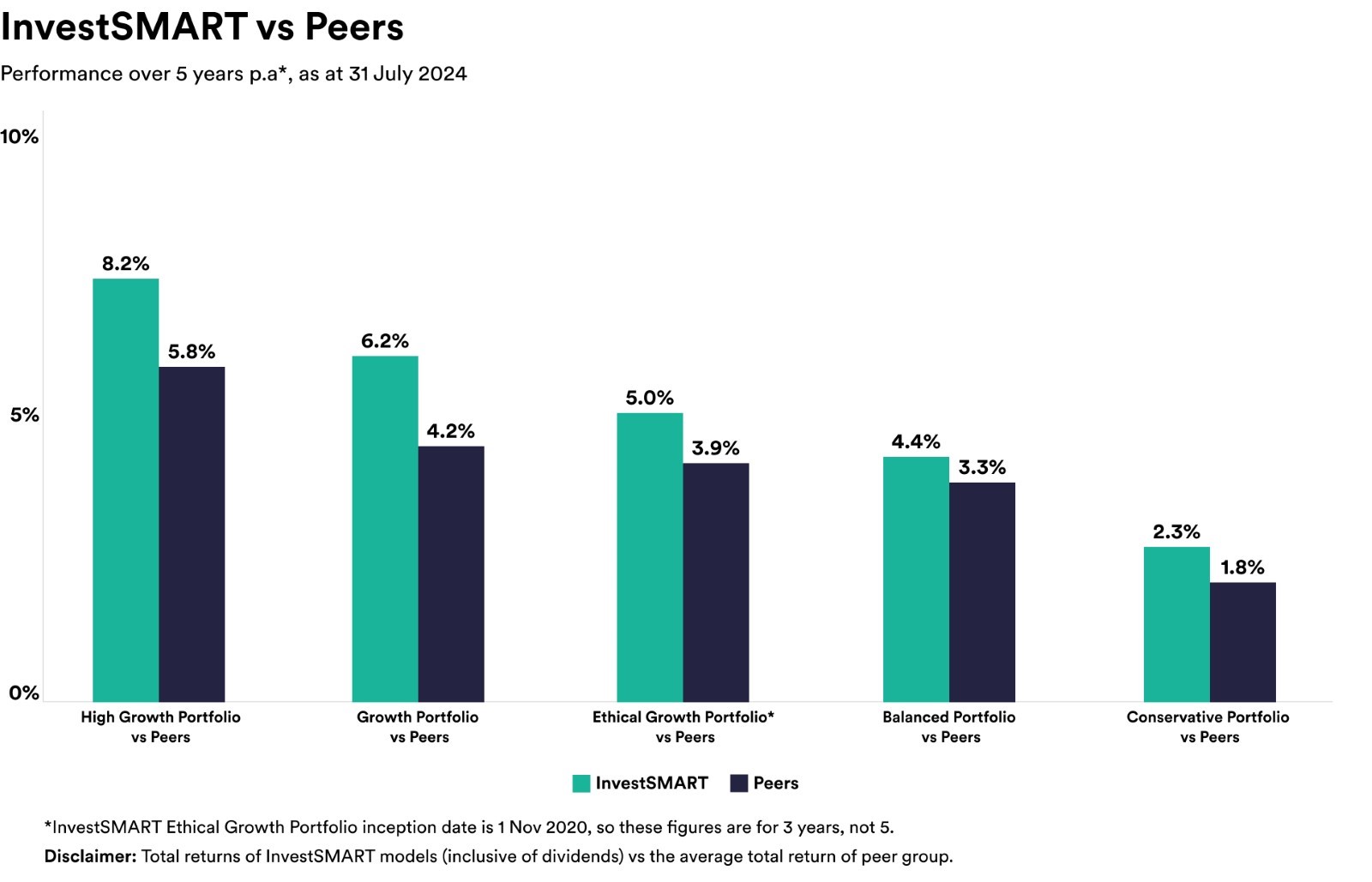

Over five years the portfolios have returned on average 2.3% to 8.2% p.a, outperforming competitor funds by an average annualised return of 0.5% to 2.4%.

For example, $10,000 invested in our High Growth portfolio five years ago would now be worth $14,830. The same amount invested in a competitor fund with the average return of 5.8% would be worth $13,256.

InvestSMART's single asset portfolios returned between 3.9% (cash securities) and 20.3% (international equities) in the 12 months to 31 July 2024, and between 1.4% and 12.3% over five years.

July round up and a market volatility

Both Australian and international share markets made significant gains in July, the S&P/ASX 200 rose 4.2% for the month and the MSCI World ex-Australia rose 4.1%.

The big news of course, was the market correction in early August. Recession fears, sharp declines in technology stocks and a surprise interest rate increase from the Bank of Japan fueled the August 5, Wall Street sell off. Aussie markets quickly followed suit with about a 3.7% drop. However, as quickly as markets fell, they rebounded again.

Depending on which economists you listen to, share markets may or may not be heading into a period of volatility. Regardless of market fluctuations, it's important for investors to remain calm and keep their long-term investment objectives in focus. A common mistake that investors often make is selling during market lows and reentering the market at higher prices, thus incurring a loss.

InvestSMART's portfolios are specifically designed to endure various market conditions. They include defensive assets, such as high-quality government bond ETFs, to provide a buffer during market downturns, alongside growth assets like Australian and international shares, to capitalise on market gains.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 7.8% and 14.7% in the 12 months to 31 July 2024, outperforming traditional bank savings accounts and term deposits.

Over five years, InvestSMART's portfolios have returned on average 2.3% to 8.2% per annum, outperforming competitor funds by an average annualised return of 0.5% to 2.4%.

A $10,000 investment in InvestSMART's High Growth portfolio five years ago would now be worth $14,830, compared to $13,256 if invested in a competitor fund with an average return of 5.8%.

InvestSMART's single asset portfolios returned between 3.9% (cash securities) and 20.3% (international equities) in the 12 months to 31 July 2024.

In July 2024, both Australian and international share markets saw significant gains, with the S&P/ASX 200 rising 4.2% and the MSCI World ex-Australia increasing by 4.1%.

The market correction in early August 2024 was driven by recession fears, sharp declines in technology stocks, and a surprise interest rate increase from the Bank of Japan, leading to a Wall Street sell-off.

Investors should remain calm and focus on their long-term investment objectives, avoiding the common mistake of selling during market lows and reentering at higher prices.

InvestSMART's portfolios include defensive assets like high-quality government bond ETFs to provide a buffer during downturns, alongside growth assets such as Australian and international shares to capitalize on market gains.