InvestSMART Performance Update: January 2025

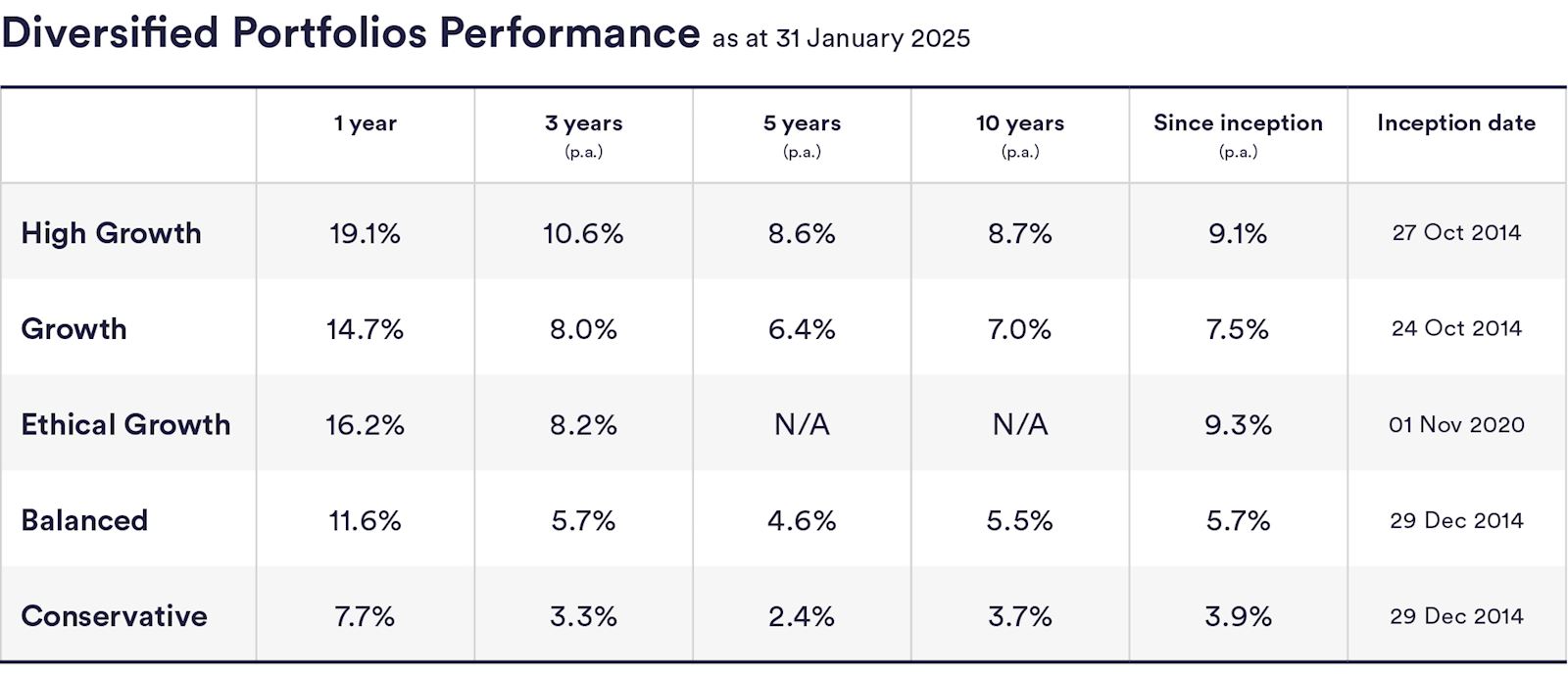

InvestSMART's diversified ETF portfolios continue to deliver strong results, showcasing the benefits of strategic diversification and disciplined management. The portfolios achieved returns between 7.7% and 19.1% for the 12 months to the end of January 2025. Of course, past performance is not an indication of future performance.

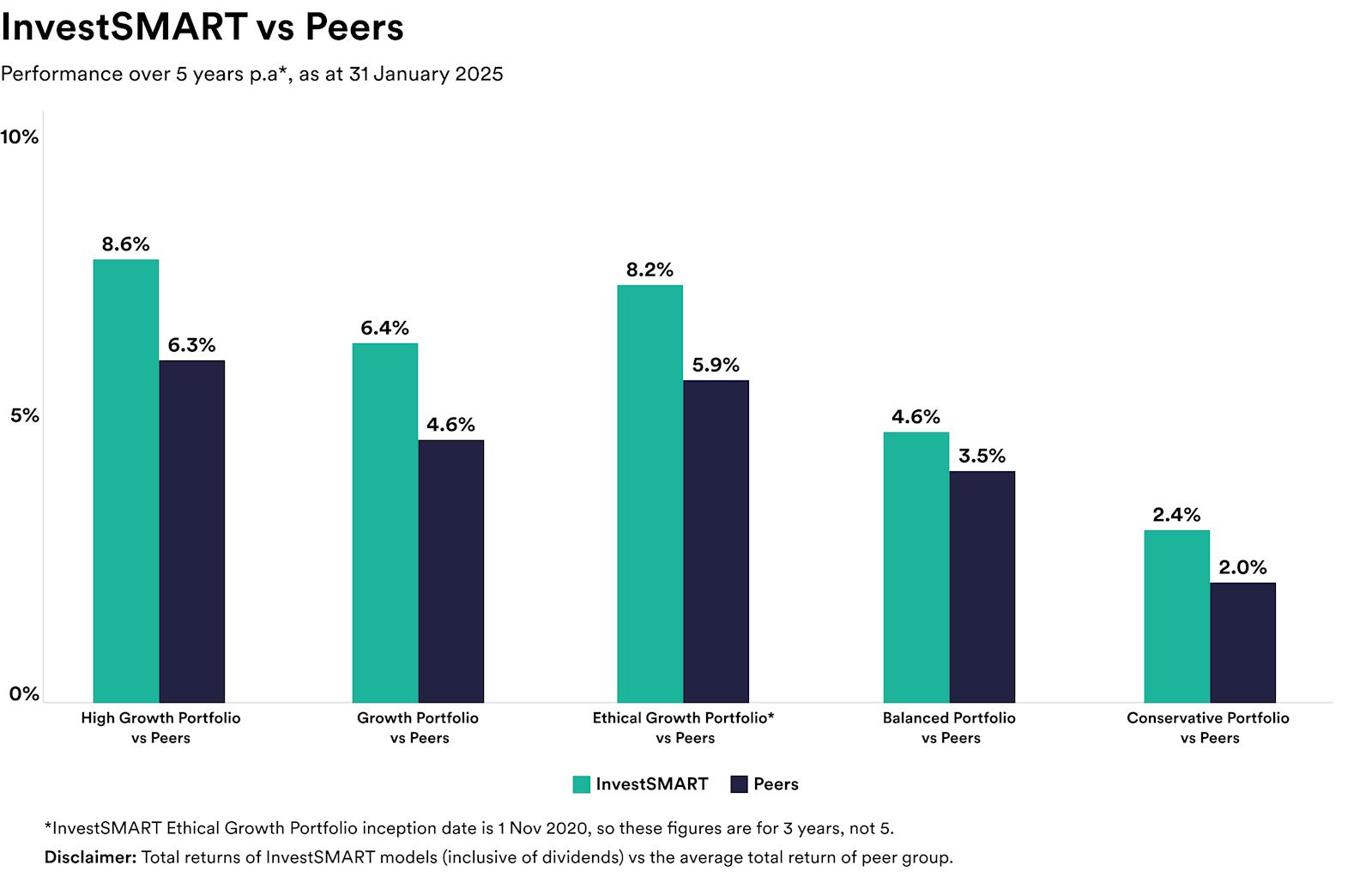

Over five years the diversified portfolios have delivered annual returns of between 2.4% and 8.6% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. As you can see, our High Growth portfolio has returned 8.6% a year over five years, outperforming similar options by an average of 2.3% over that period.

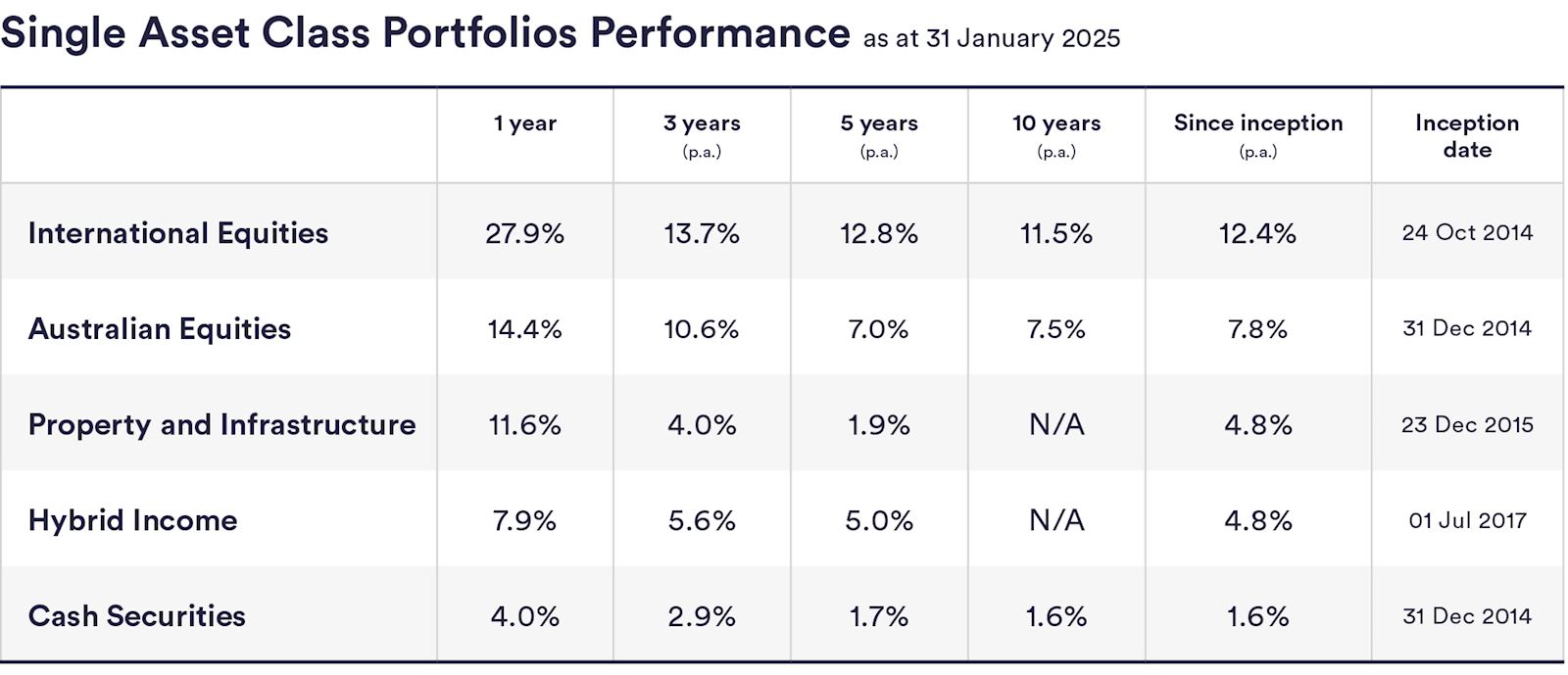

InvestSMART's single-asset portfolios returned between 4.0% (cash securities) and 27.9% (international equities) in the 12 months to the end of January 2025, and between 1.7%p.a. and 12.8%p.a. over five years.

January wrap-up

The Aussie share market started the year strong, outperforming global equities and US stocks in January. The S&P/ASX 200 ended the month 4.6% higher, while the MSCI World ex-Australia Index was up 3.9% and the US S&P 500 rose by 2.7%. Aussie bond yields remained relatively steady throughout January.

The best-performing sectors on the ASX 200 in January were consumer discretionary (7.1%), financials (6.1%), and real estate (4.7%).

With the ASX reporting season underway, the Reserve Bank potentially cutting the cash rate, and US President Donald Trump's new tariffs, February is shaping up to be an interesting month.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered strong returns ranging from 7.7% to 19.1% for the 12 months ending January 2025, highlighting the benefits of strategic diversification and disciplined management.

Over the past five years, InvestSMART's High Growth portfolio achieved an annual return of 8.6%, outperforming similar options by an average of 2.3% during that period.

In the 12 months to the end of January 2025, InvestSMART's single-asset portfolios returned between 4.0% for cash securities and 27.9% for international equities.

The Australian share market had a strong start to the year, with the S&P/ASX 200 ending January 4.6% higher, outperforming global equities and US stocks.

In January 2025, the best-performing sectors on the ASX 200 were consumer discretionary with a 7.1% increase, financials with a 6.1% rise, and real estate with a 4.7% gain.

February 2025 is expected to be an interesting month with the ASX reporting season underway, potential cash rate cuts by the Reserve Bank, and new tariffs introduced by US President Donald Trump.

InvestSMART's portfolios have shown competitive performance, with the High Growth portfolio outperforming similar options by an average of 2.3% over the past five years.

Over five years, InvestSMART's diversified portfolios delivered average annual returns ranging from 2.4% to 8.6%.