InvestSMART Performance Update: January 2024

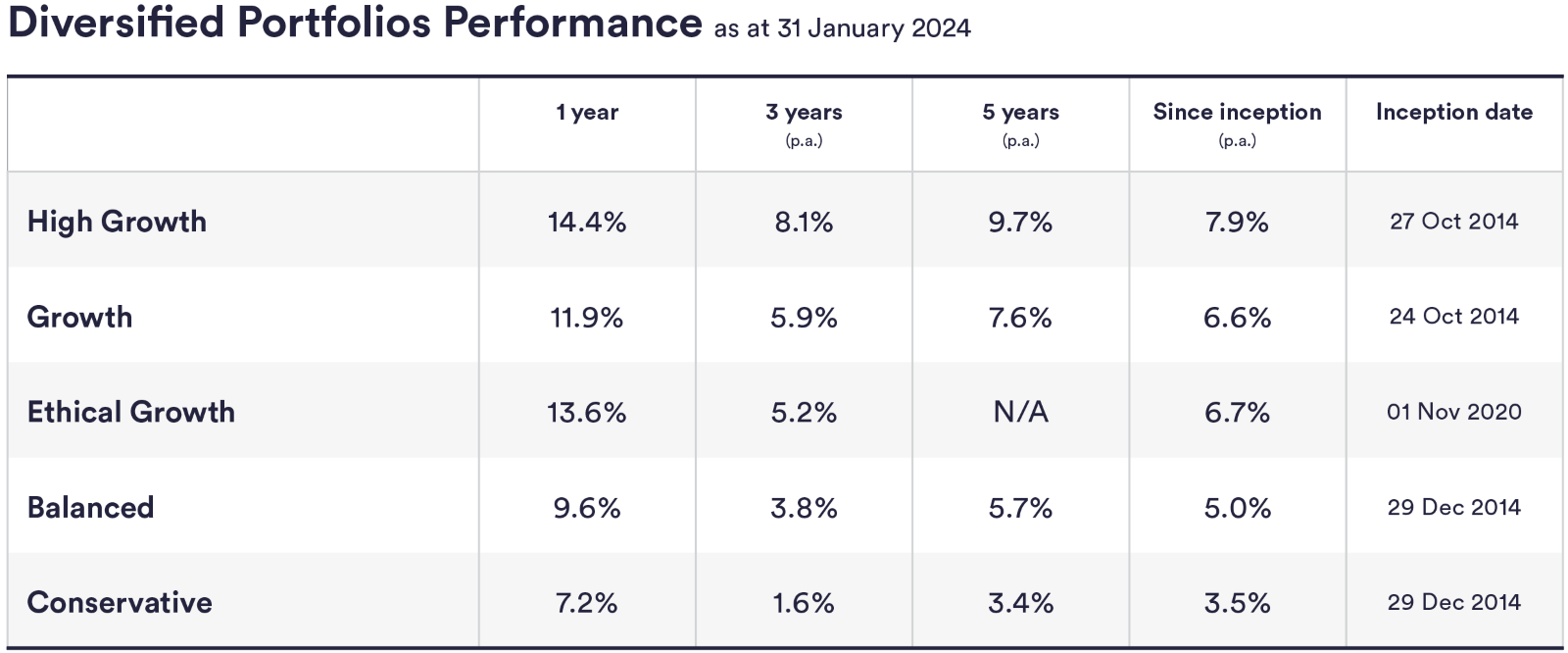

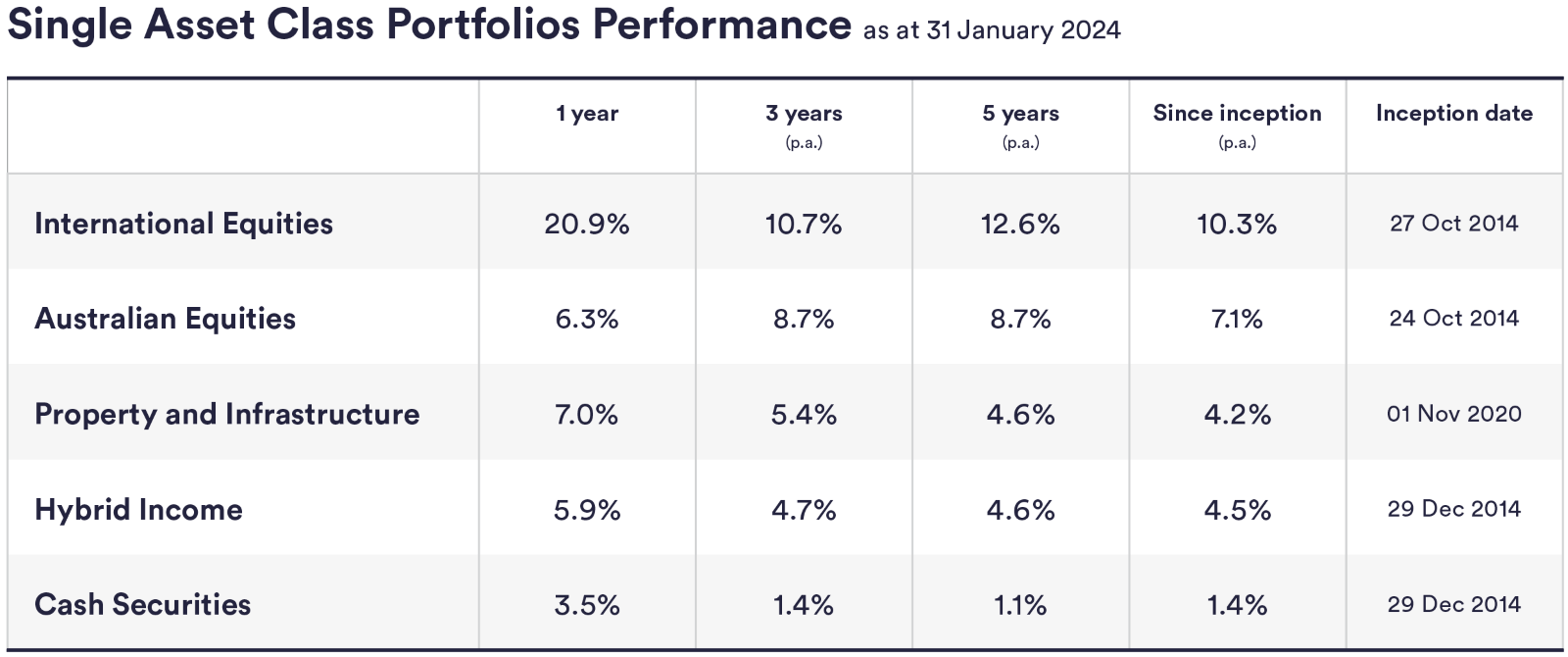

The InvestSMART diversified ETF portfolios returned between 14.4% and 7.2% and the InvestSMART Single Asset Class Portfolios returned between 20.9% - 3.5% to the 12 months ending 31 January 2024.

January wrap up

The first month of the year was positive for Australian and global shares, and for bonds. This happened for several reasons. Investors continue to be buoyed by the outperformance of share markets at the end of 2023. Inflation figures fell again, and all indicators point to a ‘soft landing’ aka recession avoidance. In Australia the annual consumer price index inflation was 4.1%, down for the fourth consecutive quarter. In short, the economy is looking reasonable for 2024.

With this generally positive outlook it’s worth revisiting the concept of asset allocation when you invest. During positive times investors (of all levels of experience) tend to herd into higher return growth investments like shares and do the opposite during downtimes, moving into bonds or cash; asset allocation and long-term strategy becoming a distant thought.

We’ve written a lot about not chasing market returns and the emotions of investing. Knowing and understanding your asset allocation in your portfolio can be helpful during times of temptation to buy up big or sell it all down.

InvestSMART’s five diversified ETF portfolios are designed around asset allocation. They range from conservative asset allocation ie: more defensive assets like bonds, to high growth asset allocation, ie: more growth assets like shares.

You can read more about how InvestSMART approaches asset allocation and dive deeper into the portfolio performance report here.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios returned between 14.4% and 7.2% for the 12 months ending January 31, 2024.

The InvestSMART Single Asset Class Portfolios returned between 20.9% and 3.5% for the 12 months ending January 31, 2024.

The positive performance was driven by the outperformance of share markets at the end of 2023, falling inflation figures, and indicators pointing to a 'soft landing' or recession avoidance.

The annual consumer price index inflation in Australia was 4.1%, marking a decrease for the fourth consecutive quarter.

Asset allocation is crucial because it helps investors maintain a balanced approach, avoiding the temptation to chase high returns during positive times or move entirely into bonds or cash during downturns.

InvestSMART's diversified ETF portfolios are designed around asset allocation, ranging from conservative allocations with more defensive assets like bonds to high growth allocations with more growth assets like shares.

Investors should focus on understanding their asset allocation and long-term strategy to avoid the temptation of buying or selling based on market emotions.

You can read more about InvestSMART's approach to asset allocation and explore their portfolio performance report on their website.