InvestSMART Performance Update: February 2025

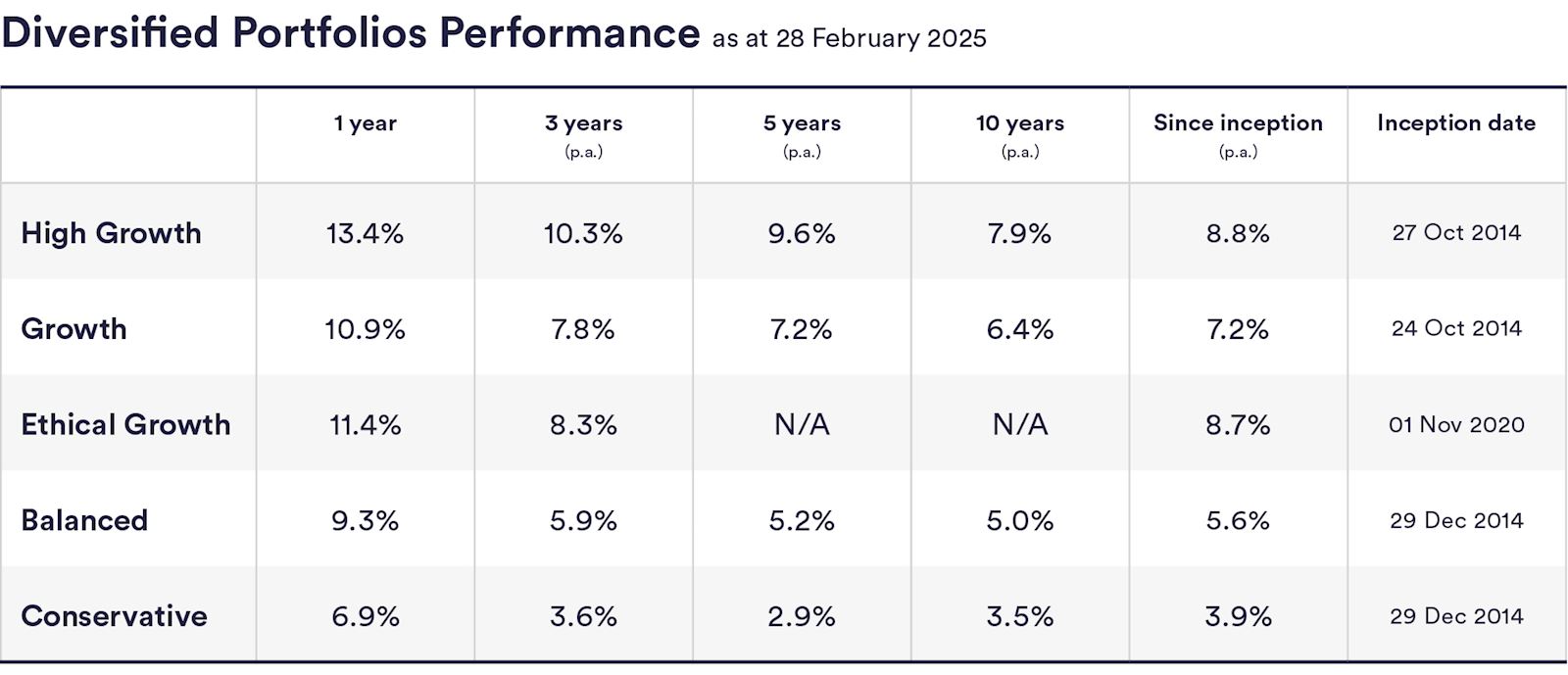

InvestSMART's diversified ETF portfolios have delivered solid results over the past 12 months, returning between 6.9% and 13.4% to the end of February 2025. Our low fees and use of broad-based passive ETFs have allowed us to outperform the majority of our competitors over the long term. Of course, past performance is not an indication of future performance.

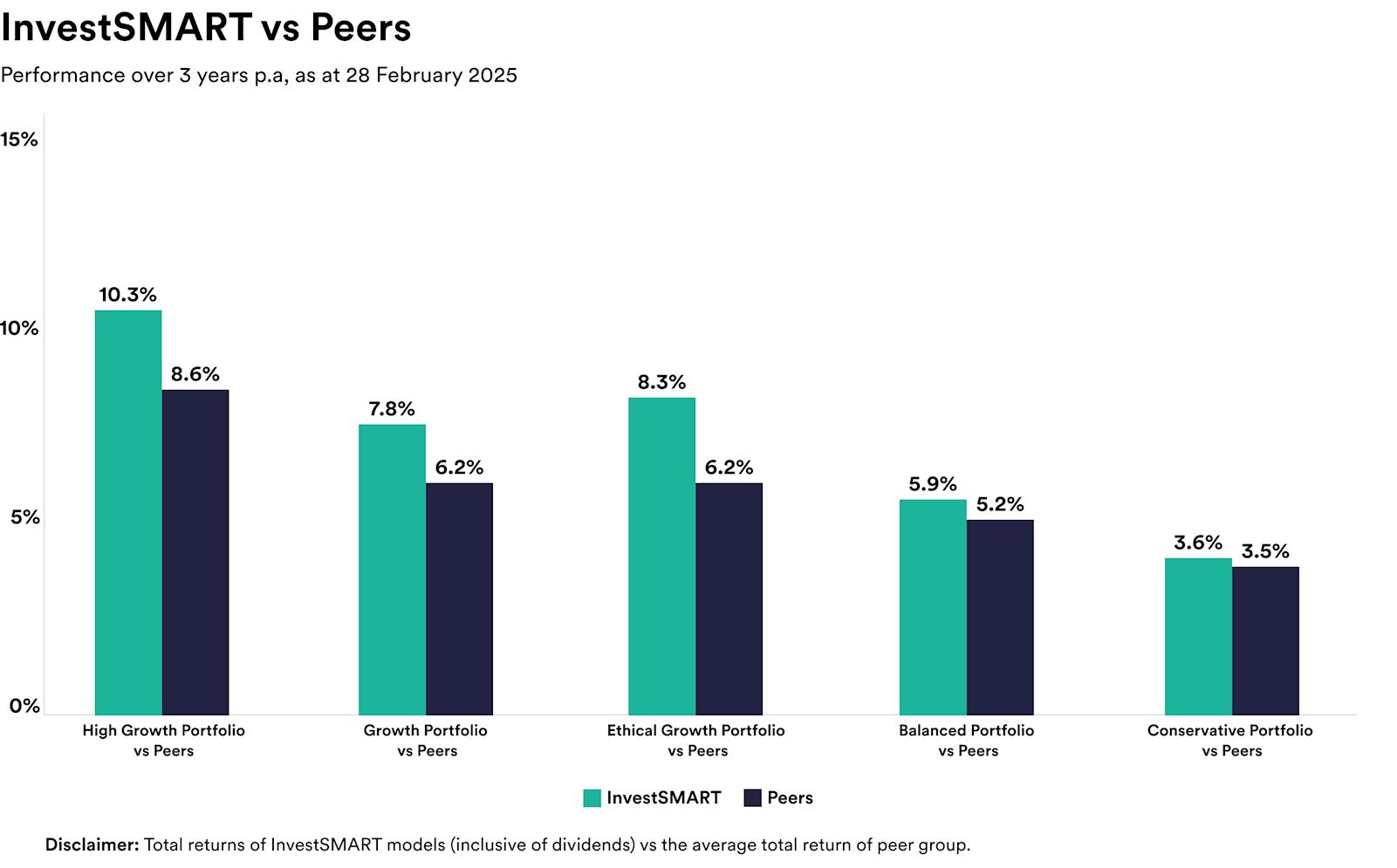

Over three years the diversified portfolios have delivered annual returns of between 3.6% and 10.3% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over three years. As you can see, our High Growth portfolio has returned 10.3% a year over three years, outperforming similar options by an average of 1.7% over that period.

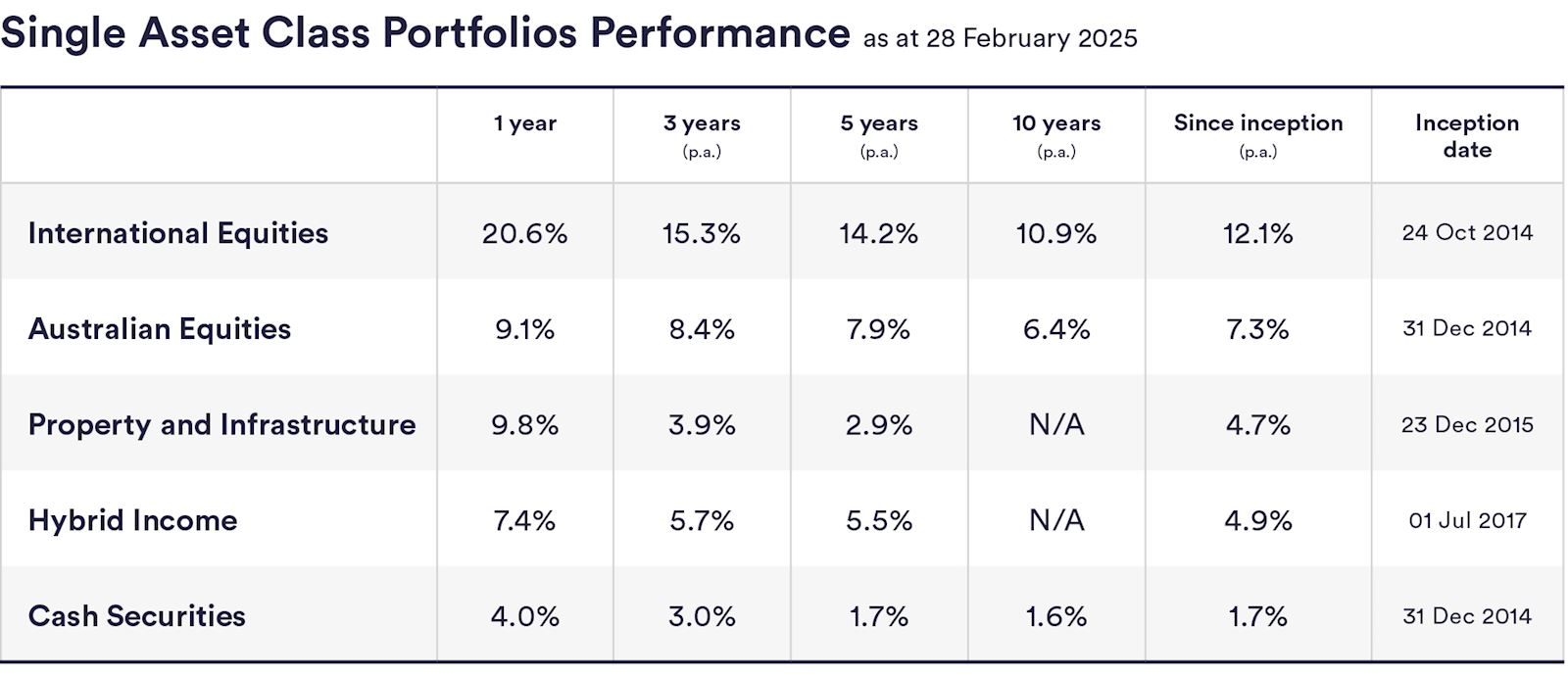

InvestSMART's single-asset portfolios returned between 4.0% (cash securities) and 20.6% (international equities) in the 12 months to the end of February, and between 1.7%p.a. and 14.2%p.a. over five years.

February wrap-up

The Aussie share market kicked off the year strong, with the S&P/ASX 200 gaining 4.6% in January. However, it took a step back in February, dropping by 3.8%.

US stocks and international shares also took a hit, though the drop was smaller. The US S&P 500 fell 1% in Aussie dollar terms, while the MSCI World ex-Australia Index ended February 0.36% lower.

Defensive sectors including utilities ( 3.2%) and consumer staples ( 1.5%) had a solid month. On the flip side, technology (-12.3%), healthcare (-7.7%), and property (-6.4%) were the worst performers on the ASX 200 in February.

March has been a bit rocky for many markets, mainly due to talks of a US recession and concerns over tariffs.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered solid returns over the past 12 months, ranging from 6.9% to 13.4% by the end of February 2025. This performance is attributed to low fees and the use of broad-based passive ETFs.

Over three years, InvestSMART's diversified portfolios have achieved annual returns between 3.6% and 10.3% on average. The High Growth portfolio, in particular, has outperformed similar options by an average of 1.7% over this period.

In the 12 months to the end of February, InvestSMART's single-asset portfolios returned between 4.0% for cash securities and 20.6% for international equities. Over five years, these portfolios have delivered returns ranging from 1.7%p.a. to 14.2%p.a.

The Australian share market started strong in January with the S&P/ASX 200 gaining 4.6%, but it declined by 3.8% in February.

In February 2025, US stocks and international shares experienced declines. The US S&P 500 fell by 1% in Aussie dollar terms, and the MSCI World ex-Australia Index ended 0.36% lower.

In February 2025, defensive sectors like utilities and consumer staples performed well on the ASX 200, with gains of 3.2% and 1.5%, respectively.

Technology, healthcare, and property were the worst-performing sectors on the ASX 200 in February 2025, with declines of 12.3%, 7.7%, and 6.4%, respectively.

In March 2025, markets have been rocky due to talks of a potential US recession and concerns over tariffs.