InvestSMART Performance Update: December 2024

InvestSMART's diversified ETF portfolios continue to produce great results, returning between 7.2% and 18.5% in the 12 months to the end of December 2024. Our low fees and use of broad-based passive ETFs have allowed us to outperform the majority of our competitors over the long term. Of course, past performance is not an indication of future performance.

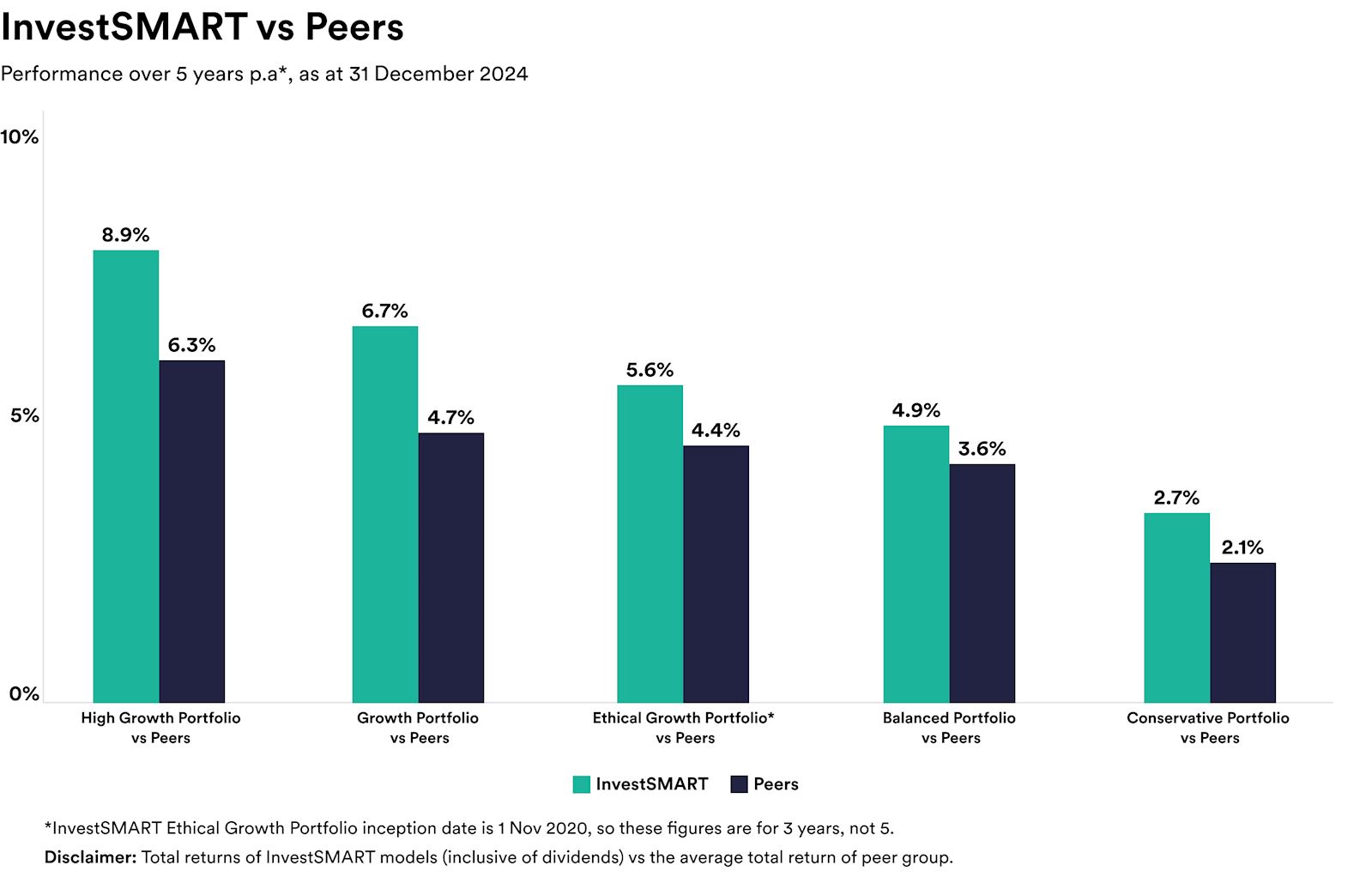

Over five years the diversified portfolios have delivered annual returns of between 2.7% and 8.9% on average. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. As you can see, our High Growth portfolio has returned 8.9% a year over five years, outperforming similar options by an average of 2.6% over that period.

InvestSMART's single-asset portfolios returned between 4.0% (cash securities) and 30.2% (international equities) in the 12 months to the end of December 2024, and between 1.6%p.a. and 13.1%p.a. over five years.

December wrap-up

Most share markets fell in the last month of 2024. The S&P/ASX 200 was down 3.2%, wiping out most of the 3.8% gains made in November. US stocks also took a tumble, with the S&P 500 falling by 2.4%, and global equities fared much the same. The MSCI World ex-Australia index was down 2.7% over the month.

Japanese stocks and emerging markets had a better month, both finishing December higher.

Overall, 2024 was a strong year for equities but no one knows for sure what the future holds.

One thing is certain: the best preparation for 2025 is a portfolio that is well-diversified across stocks and asset classes. This approach, combined with a long-term investment strategy, will help investors reduce risk and achieve healthy long-term returns.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered impressive results in 2024, with returns ranging from 7.2% to 18.5% over the 12-month period ending in December.

InvestSMART's low-fee strategy, combined with broad-based passive ETFs, has allowed them to outperform many competitors over the long term, providing investors with better value and returns.

Over the past five years, InvestSMART's High Growth portfolio achieved an average annual return of 8.9%, outperforming similar options by an average of 2.6%.

In 2024, InvestSMART's single-asset portfolios saw returns ranging from 4.0% for cash securities to 30.2% for international equities.

In December 2024, most global stock markets experienced declines. The S&P/ASX 200 fell by 3.2%, the S&P 500 by 2.4%, and the MSCI World ex-Australia index by 2.7%. However, Japanese stocks and emerging markets ended the month higher.

InvestSMART suggests that the best preparation for 2025 is a well-diversified portfolio across stocks and asset classes, combined with a long-term investment strategy to reduce risk and achieve healthy returns.

Diversification is crucial because it helps reduce risk by spreading investments across various asset classes and stocks, which can lead to more stable and potentially higher long-term returns.

While InvestSMART's portfolios have shown strong past performance, it's important to remember that past performance is not an indication of future results. Investors should consider a diversified and long-term strategy.