InvestSMART Performance Update: April 2024

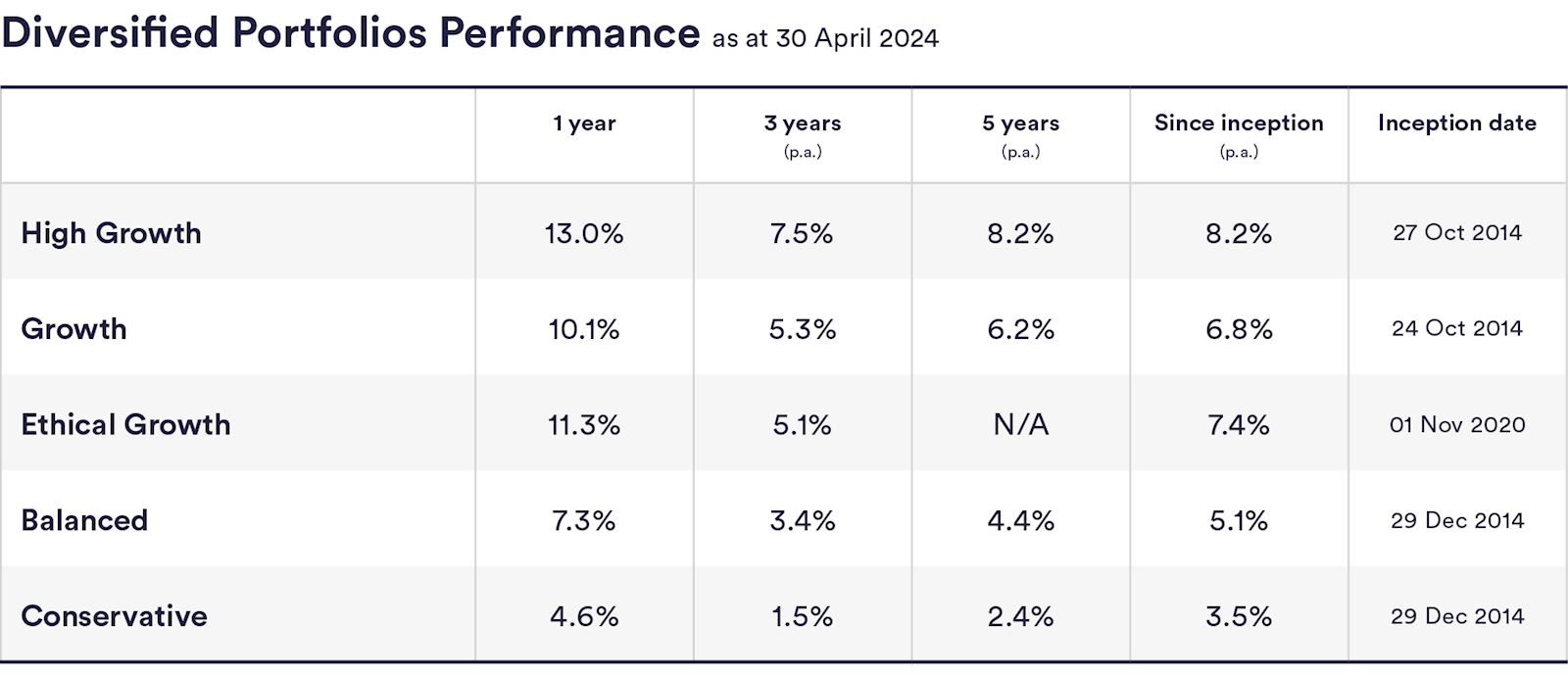

The InvestSMART diversified portfolios returned between 4.6% and 13.0% over the 12 months to 30 April 2024. The InvestSMART diversified portfolios have provided excellent returns for investors over both the short and long term.

For example, our High Growth portfolio achieved a return of 8.2% a year since its inception in October 2014. This is 2.5% more than similar high growth funds, which achieved an average annualised return of 5.7% over the same period.

Let's illustrate this in money terms: $10,000 invested in the InvestSMART High Growth portfolio when it launched, would be worth $21,223. However, $10,000 invested in a similar fund returning the average of 5.7% a year would be worth $16,901, after fees. Quite a difference!

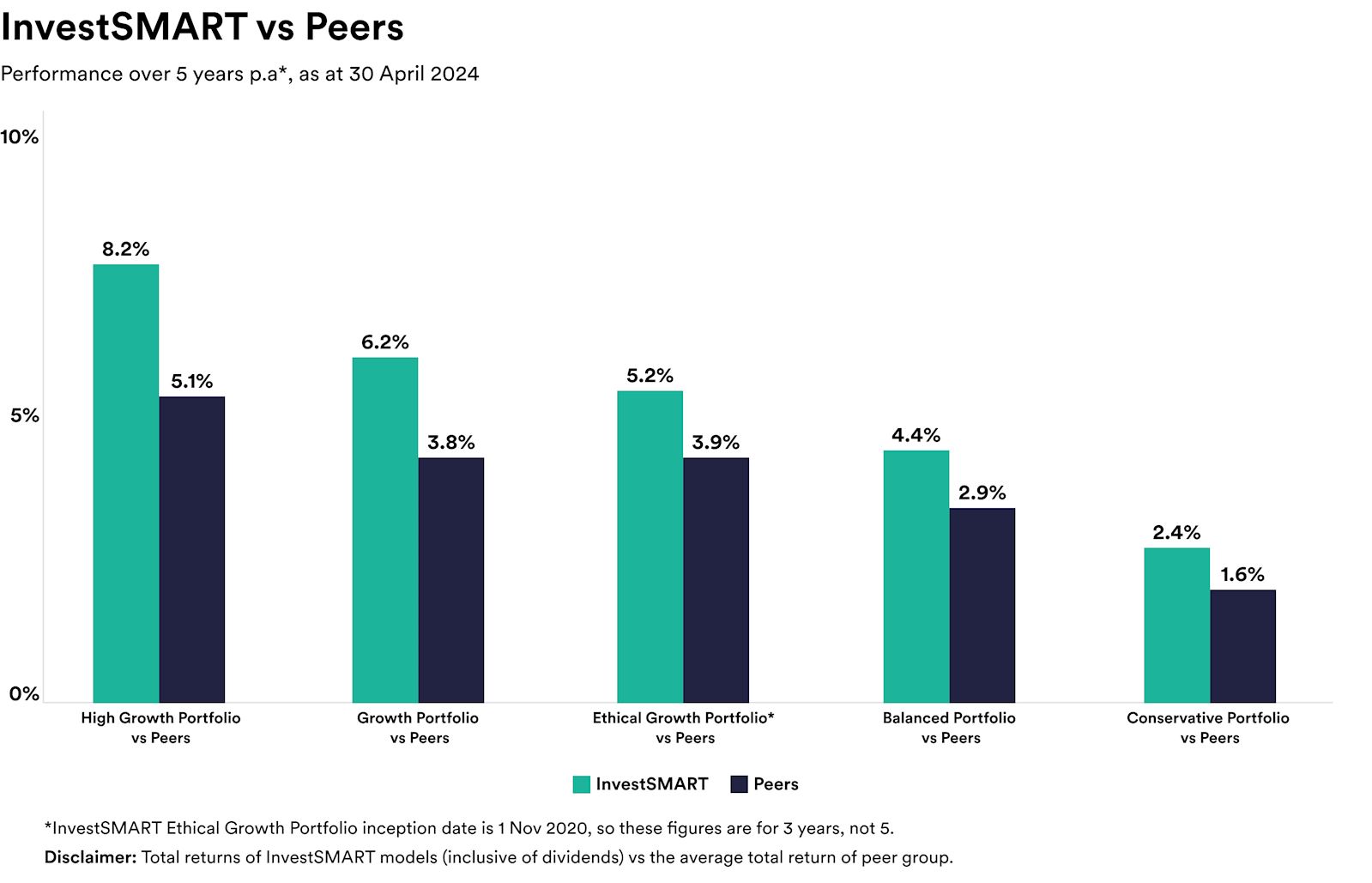

Over five years the portfolios have returned on average between 2.4% to 8.2%, outperforming the majority of similar funds. The chart below shows InvestSMART's performance over five years compared with the average annualised returns of our competitors' funds.

The InvestSMART single asset portfolios returned between 3.8% (Cash Securities) and 21.3% (International Equities) in the 12 months to 30 April 2024 and between 1.2% and 11.6% on average over five years.

single.jpg)

April wrap up

US share markets fell in April, affected by declining hopes of US Federal Reserve interest rate cuts this year, due to higher-than-expected US inflation rates. Additionally, tensions around the Middle East conflict weighed heavily on investors' risk appetite.

Similarly in Australia, the ASX fell on hard-to-shift inflation numbers and the likelihood of rate cuts being pushed back to 2025. Aussie shares lost 3% in April, their worst month since October 2023. The utilities and materials sectors were the only sectors to make gains in April, rising 4.8% and 0.6% respectively.

Do the April falls signal a downturn?

The April fall is off the back of all-time highs for share markets in March 2024. A slight fall after several months of growth is disappointing, however, most economists are saying it's a market correction.

The only guarantee in investment markets is that they will go up and down. Our best advice for jittery investors is to keep your long-term financial goals in mind and stay invested. Although past returns are not an indicator of future returns, the above tables detailing the performance of InvestSMART's portfolios over three, five and 10 years, are a good example of the types of returns you could expect from long-term investing.

Frequently Asked Questions about this Article…

InvestSMART diversified portfolios have returned between 4.6% and 13.0% over the 12 months to 30 April 2024, showcasing strong performance for both short and long-term investors.

The InvestSMART High Growth portfolio has achieved an annual return of 8.2% since its inception in October 2014, outperforming similar high growth funds which averaged 5.7% annually over the same period.

A $10,000 investment in the InvestSMART High Growth portfolio at its launch would be worth $21,223 today, compared to $16,901 if invested in a similar fund with an average return of 5.7%.

InvestSMART single asset portfolios returned between 3.8% (Cash Securities) and 21.3% (International Equities) in the 12 months to 30 April 2024, with five-year average returns ranging from 1.2% to 11.6%.

The decline in US and Australian share markets in April 2024 was due to higher-than-expected inflation rates, reduced hopes for US Federal Reserve interest rate cuts, and tensions in the Middle East.

Yes, in April 2024, the utilities and materials sectors in the Australian market made gains, rising by 4.8% and 0.6% respectively.

The April 2024 market fall is considered a market correction following all-time highs in March 2024. Economists suggest keeping long-term financial goals in mind and staying invested.

The best advice for investors during market fluctuations is to focus on long-term financial goals and remain invested, as markets naturally experience ups and downs.