InvestSMART International Equities Portfolio Adjustment

You can’t control your returns, but you can control your costs. By minimising your costs, you will have a much better chance of increasing your wealth. Most funds underperform because of their high fees.

Our philosophy is simple. By charging low fees and delivering market returns, over the long run, we will outperform our peers. This belief is based on the fact that over time, the majority of funds underperform the market.

This is evident in the recent SPIVA data. The below table highlights the percentage of International Equity Funds that underperformed the S&P Developed Ex-Australia Large/Mid Cap index (the comparison index) across various periods to December 2017.

|

One Year |

Three Year |

Five Year |

Ten Year |

Fifteen Year |

|

52.51% |

80.93% |

90.86% |

88.26% |

87.10% |

Source: SPIVA Australia Scorecard, 31 December 2017.

With these thoughts in mind, we’re making an adjustment to the portfolio to ensure we continue to achieve our objectives. We are selling our holding in the Vanguard all-world ex US Shares index ETF (VEU) and replacing it with the Vanguard MSCI Index International Shares ETF (VGS).

VGS is a market cap weighted ETF that provides exposure to the performance of 22 of the world’s 23 developed equity markets (ie, ex-Australia). The index covers approximately 85% of the free float adjusted market capitalisation of each country and comprises over 1,500 securities.

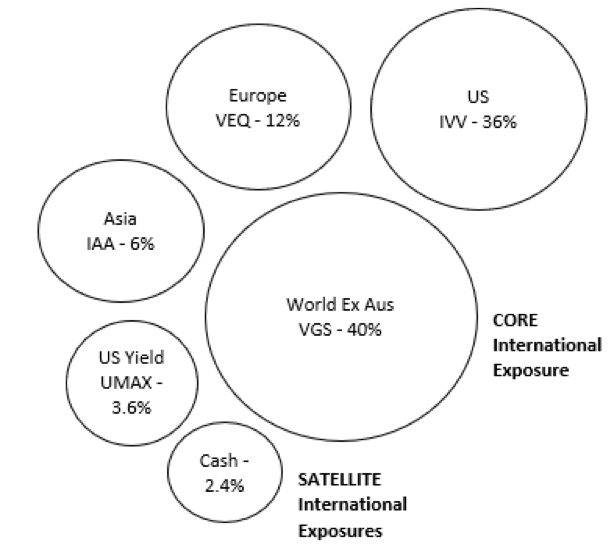

VGS will deliver broad based international equity exposure and form the ‘core’ of our International Equity Portfolio. Outside of this, we are invested across several ‘satellite’ positions, each providing exposure to a different geography allowing us to tilt the portfolio exposure where required.

To find out more on the InvestSMART International Equities Portfolio, click here.

Frequently Asked Questions about this Article…

Controlling investment costs is crucial because high fees can significantly reduce your returns. By minimizing costs, you have a better chance of increasing your wealth, as most funds underperform due to their high fees.

InvestSMART believes in charging low fees and delivering market returns. Over the long run, this approach is expected to outperform peers, as most funds tend to underperform the market due to high fees.

According to SPIVA data, a significant percentage of International Equity Funds underperform the S&P Developed Ex-Australia Large/Mid Cap index. For example, over a ten-year period, 88.26% of these funds underperformed the market.

InvestSMART has recently adjusted its portfolio by selling its holding in the Vanguard all-world ex US Shares index ETF (VEU) and replacing it with the Vanguard MSCI Index International Shares ETF (VGS) to better achieve its objectives.

The Vanguard MSCI Index International Shares ETF (VGS) is a market cap weighted ETF that provides exposure to 22 of the world's 23 developed equity markets, excluding Australia. It covers approximately 85% of the free float adjusted market capitalization of each country.

VGS was chosen because it delivers broad-based international equity exposure and forms the 'core' of the International Equity Portfolio, allowing for diversified investment across developed markets.

'Satellite' positions in the portfolio are investments that provide exposure to different geographies, allowing InvestSMART to adjust the portfolio exposure as needed to achieve better diversification and returns.

For more information about the InvestSMART International Equities Portfolio, you can visit their website and explore the details of their investment strategies and portfolio adjustments.