How to plan for a market disaster

Last week one of our readers asked for some more tangible and we presume actionable advice on how to weather the current market ‘storm’. Our observation had been that so far what we had seen was more of a blip compared to what could happen if things really went wrong.

Giving ‘actionable’ advice creates a problem in that we don’t think anyone (ourselves very much included) can really tell you with any credibility what will happen in markets for the rest of the year. However, we think it is a fair question and so in this article we will consider a worst-case scenario, and how to prepare for it, versus the potential upside over the next few years described by two more likely scenarios.

RED DOOR, BLUE DOOR, GREEN DOOR

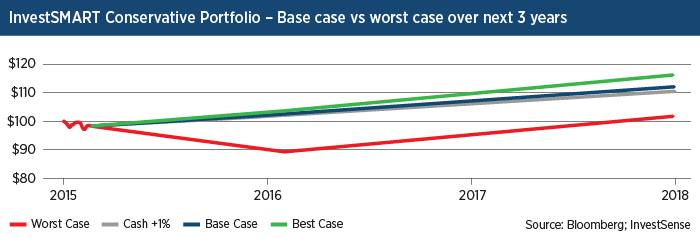

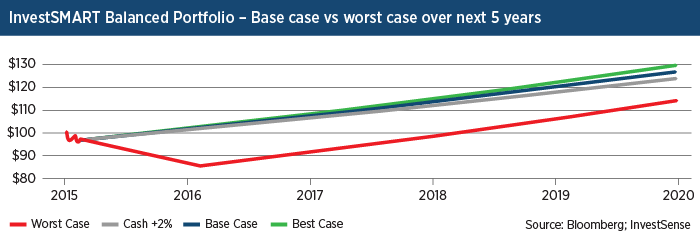

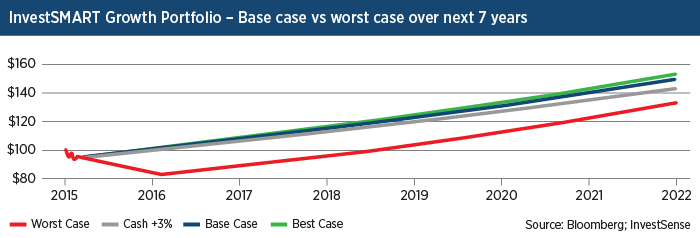

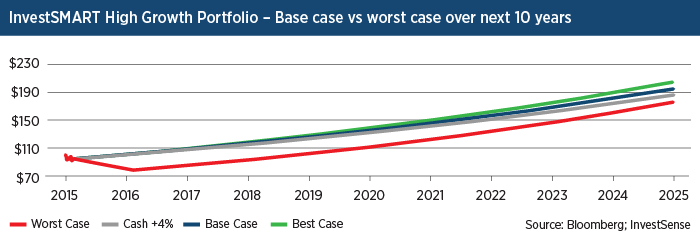

To make sense of it all, we have put these observations in the context of InvestSMART’s Diversified Portfolios, their objectives (cash plus 1% for the Conservative portfolio, cash plus 2% for the Balanced portfolio, cash plus 3% for Growth and cash plus 4% for High Growth) and the time horizons that might be suitable for each of these portfolios (three, five, seven and 10 years). We have reconfigured our Valuation Dashboard into a forward-looking scenario analysis tool that will give you an insight into potential scenarios for each of the Diversified Portfolios: best case, worst case and our current base case.

- The red line shows what might happen in a ‘GFC Mk 2 or worse’ scenario, but one in which bonds fall in value (quite the opposite happened in the GFC). In this context, the 2% or so drop for the Conservative Portfolio so far this year is really not such a big deal (that’s the little squiggle at the start of the chart on the left). Here, the ‘worst case’ scenario really is quite pessimistic in that it describes a situation where interest rates start rising not for the traditional reason (that the economy is doing well), but because inflation is rising despite recessionary conditions and many hard-pressed companies can’t borrow (think of the 1970s or Brazil now).

There is little expectation that this will happen as we have become accustomed to being bailed out and that is exactly why it represents the worst-case scenario (markets would be very unpleasantly surprised indeed if inflation and low growth occur simultaneously). It is worth noting that even in this dire scenario an investor in the lowest risk option probably wouldn’t have done much better in cash after about three years. - The base case is a relatively stable ‘lower for longer’ scenario where interest rates are constant or rising gently and equity markets keep their cool (generating returns of 7-9% per annum on average). In this scenario we think the base case is quite achievable but we would also hope to improve on this outcome quite considerably by making asset allocation changes on the way through (we obviously can’t show that line as we don’t know what those changes will be yet).

- The green line would certainly be very welcome and would most likely be considered a success by the central banks. This might involve some more assertive intervention by both central banks and governments in the short term followed by a rise in economic productivity in a few years. It feels unlikely right now but again maybe that’s the point.

As bond yields loom low and equities still offer OK yields, the prognosis for the buy-and-hold investor steadily improves as you move out of the risk spectrum and allow yourself time to recover. The charts show the three scenarios over five, seven and 10 years compared with alternatives of cash plus 2%, 3% and 4%.

By the time we get to seven years and 10 years out respectively for the Growth and High Growth portfolios we think there is a fairly high probability the portfolios will exceed their objectives. Even better, the worst-case scenario does not leave you materially worse off as long as you stick to your guns and don’t crystallise those losses by bailing out at the bottom of the market if the worst happens.

THE HUMAN ELEMENT

In all the scenarios we’ve shown investors will at least do OK if they stick to their guns — but there is an even worse scenario! That is the one where an investor thinks they are OK with the risk shown here until they experience it.

There is great danger when investors follow markets down and then somewhere near the bottom they switch to cash and thus miss out on the upswing on the other side. That is why we think it is a good idea to consider the risks involved ahead of time and in a future article we will talk a little more about the psychological challenges the investor will face in those scenarios.

This may all sound like the usual ‘invest for the long term and she’ll be right’ mantra that we heard prior to the GFC and which doesn’t sound so credible these days. Not so. As we showed last week, the world looks very different right now: expected risk premiums for equities were not so favourable back in 2007 while bond investors literally couldn’t fail to outperform cash by several percentage points (given relatively high government bond yields).

REMEMBER THE LONG GAME

We’re all familiar with the downside risk lurking out there but if we see some of that pessimism dissipate thanks to better-than-expected news then the markets could do very well, as we have seen in recent weeks. Looking forward it is conservative investors that face the most difficult decisions. While bonds remain less risky than equities the risk/return trade-off looks increasingly unfavourable for bonds. Therefore those who face the toughest decisions right now are the conservative investors focused on the short term and with limited tolerance for risk.Frequently Asked Questions about this Article…

Everyday investors can prepare for a market disaster by considering worst-case scenarios and aligning their investment strategies with their risk tolerance. It's important to have a diversified portfolio and to avoid making impulsive decisions during market downturns.

InvestSMART’s Diversified Portfolios consider three potential scenarios: a worst-case scenario similar to a 'GFC Mk 2', a stable base case with constant or gently rising interest rates, and a best-case scenario with economic productivity growth. Each scenario has different implications for portfolio performance over time.

The worst-case scenario described in the article involves rising interest rates due to inflation despite recessionary conditions, leading to a challenging environment for borrowing. This scenario is pessimistic and would surprise markets if it occurred.

In the base case scenario, interest rates remain stable or rise gently, and equity markets maintain their composure, potentially generating returns of 7-9% per annum on average. This scenario is considered achievable, with opportunities for improved outcomes through asset allocation adjustments.

Sticking to an investment strategy during market downturns is crucial because it prevents investors from crystallizing losses by selling at the bottom. By maintaining their strategy, investors can benefit from market recoveries and achieve long-term objectives.

In the best-case scenario, central banks and governments may engage in assertive interventions to stabilize the economy, leading to increased economic productivity over time. This scenario is considered a success and is welcomed by central banks.

Conservative investors face difficult decisions because the risk/return trade-off for bonds is becoming less favorable compared to equities. With limited tolerance for risk, these investors must carefully consider their strategies in a low-yield environment.

Investors may face psychological challenges such as fear and panic during market volatility, leading them to make impulsive decisions like switching to cash at market lows. It's important to anticipate these challenges and remain committed to long-term investment goals.