How the 10/30/60 rule adds up

|

Summary: Over a 40-year working life, an individual can substantially extend the financial results from their standard Superannuation Guarantee contributions by following a rigid investment formula during their accumulation and retirement phases. |

|

Key take-out: Adding additional superannuation contributions can deliver even stronger financial results over time, and the younger those contributions begin the better the returns. |

The 10/30/60 rule of retirement planning is based on research from 1989 from Don Ezra.

The rule states that the source of a retirement fund can be approximated as coming 10 per cent from contributions while a person is working, 30 per cent from investment earnings during the contribution/working phase and 60 per cent from investment earnings during the retirement phase.

The original research looked at ‘defined benefit' retirement plans, however subsequent research has looked at ‘defined contribution' superannuation funds. This is what most people in Australia currently have, with a compulsory superannuation contribution of 9.5 per cent (less 15 per cent contribution tax).

The aim of this article is to see how applicable the 10/30/60 rule is in the Australian superannuation system, and then to think about the implications of this rule in the Australian context.

10/30/60 rule in the Australian context

The first step is to model a lifetime superannuation fund in Australia, from the very start of a person's working life through to the end of their retirement. Some of the assumptions I have used include:

- A 40-year working life (say aged 22 to 62) followed by a 30-year retirement (age 62 to 92).

- For the first 10 years the person earns an income equal to 80 per cent of AWOTE (average weekly ordinary time earnings) followed by 20 years of earning AWOTE and then 10 years before retirement where they earn 20 per cent above the rate of AWOTE. The AWOTE used was the most recent figure of $79,716 per year.

- Superannuation contributions equal 9.5 per cent of income, less the 15 per cent contributions tax.

- I have calculated after-tax investment returns from the latest 20-year data from the ASX Russell Long-Term Investing Report, using a 70 per cent Australian shares/30 per cent cash asset allocation and subtracting a 0.5 per cent management cost (this is a very low cost, but given that I am only using index returns it approximates an index manager fee in a superannuation environment). This gives a return of 4.24 per cent per year after inflation in the superannuation phase, and 4.67 per cent per year after inflation in the pension phase.

- All figures are in today's dollars (this is primarily done by using after inflation investment returns in the calculations).

- When the person retires, they withdraw a pension from their fund equal to 4.5 per cent of the balance of their fund each year (in previous Eureka Report articles I have justified this as a reasonable withdrawal rate from a pension fund: read How to build an “expansive” retirement income).

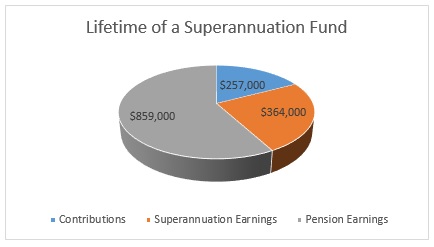

The ‘show me the money' summary of this modelling is interesting. Over the working lifetime, this hypothetical person makes contributions of $257,000. During the 40 years that they are contributing to superannuation, their superannuation fund earns $364,000 (after fees and tax). By the time they retire, having just made the standard superannuation contributions and earned an income of plus or minus 20 per cent of the average full-time income, they will have a starting retirement balance of $621,000.

Using a retirement drawing rate of 4.5 per cent per year, that provides the person with an initial retirement income of $28,000 a year. It should be noted that this is not significantly more than the single age pension. However, if this is one member of a couple with similar superannuation balances, then doubling the income to $56,000 provides a more expansive potential retirement. It is also worth keeping in mind that no extra superannuation contributions were made in this model.

Over the 30-year retirement the person withdraws a total of $847,000 in today's dollars. While they are doing that, their fund earns $859,000 in investment earnings. As the 10/30/60 model would predict, the $859,000 is the most significant source of return over the lifetime of the superannuation/pension fund, followed by the earnings of the fund before retirement, followed by the contributions.

The following table and graph set out this result:

| Contributions | $257,000 | 17.36% |

| Superannuation Earnings | $364,000 | 24.59% |

| Pension Earnings | $859,000 | 58.04% |

This does not exactly approximate the 10/30/60 rule, however it shows that in the Australian superannuation and retirement context, it is reasonably close.

Making some adjustments for ‘realism'

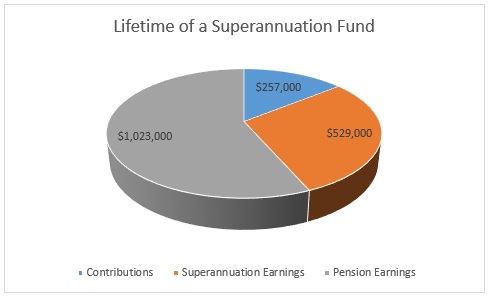

While I am happy with the assumptions I made behind the model used to test the 10/30/60 rule, I think there are a couple of ‘tweaks' that should be made for the sake of realism. There are two that I want to propose, and both relate to the figures used for investment returns.

Firstly, the last 20 years has included some fairly challenging investment scenarios including the GFC, and a period of abnormally low interest rates. I think that a slight adjustment to the superannuation investment return, from 4.24 per cent to 5.25 per cent after inflation, is not unreasonable. I think, for example, that there is a reasonable argument to support a long-term return from investing in shares of 7 per cent after inflation.

Secondly, I don't think most retirees continue to have as aggressive a portfolio balance, in this case 70 per cent growth and 30 per cent balanced, in retirement. Therefore, I am inclined to reduce the return we use for this phase of the superannuation fund to 4.5 per cent per year – reflecting a higher exposure of the portfolio to cash/fixed interest investments.

The table below sets out the adjustments to the calculations, and again provides evidence that the 10/30/60 rule is reasonable in the Australian context.

| Contributions | $257,000 | 14.21% |

| Superannuation Earnings | $529,000 | 29.24% |

| Pension Earnings | $1,023,000 | 56.55% |

The implications of the 10/30/60 model

I think that there are three main implications of the 10/30/60 model in the Australian context.

The first of these is that investment earnings matter. More than 80 per cent of the useful balance of a superannuation fund, under the assumptions I've looked at, came from after-tax, after-fee, after-inflation investment earnings. In a lot of ways this is a tough message – we have to think carefully about asset allocation, fees, volatility and inflation.

I quickly changed some inputs to look at what would happen to a highly risk averse investor who only invested in cash, providing a return over the past 20 years of 0.4 per cent above inflation in the superannuation phase and 0.9 per cent in the retirement phase. It was a disaster. They started their retirement with less than half the income of a person using a balanced fund, saw the amount they could withdraw drop every year in retirement and, at age 92, their fund was worth $91,000 in today's dollars compared to the 70 per cent shares/30 per cent cash portfolio that was worth $633,000 at age 92.

The second implication is that early contributions matter. The sooner money is in a pension/superannuation fund, the earlier it is helping to accumulate the more than 80 per cent of the impact of the fund that comes from investment earnings.

To demonstrate this in action, I modelled what would happen if a person could contribute an extra $5000 per year (after-tax) for each of the first five years of superannuation contributions, and then revert to their minimum 9.5 per cent contributions. The results are set out in the following table, showing that the extra $25,000 in early contributions leads to an extra $96,000 in earnings while the fund is in the accumulation phase, and then more than $450,000 in difference in earnings during the pension phase.

| Minimum Super Contributions | Minimum Super Contributions plus $5,000 per year in first 5 years | |

| Contributions | $257,000 | $282,000 |

| Superannuation Earnings | $364,000 | $458,000 |

| Pension Earnings | $1,023,000 |

$1,480,000 |

Keep in mind that most people aged 30 or more had exactly the opposite effect to early additional contributions happening. Contributions of 9.5 per cent are only very recent, and even the 9 per cent contribution level only ‘kicked in' in the 2003 financial year – most people over the age of 30 started with smaller compulsory contributions.

The third implication is that the asset allocation in retirement is hugely important, given that this is the biggest contributor to the value of a superannuation/pension fund over a lifetime.

The choice of asset allocation that both allows a mix of growth assets to provide an appropriate return, and defensive assets like cash to provide liquidity and dampen volatility, is crucial. Choosing to simply put retirement assets in cash and term deposits significantly impairs the potential investment earnings of a superannuation/pension fund at a time when earnings make their biggest contribution.

Conclusion

The 10/30/60 model works fairly well in the Australian superannuation context, although we need to keep in mind that ‘models' that assume regular contributions, steady earnings and no legislation changes, can only be used as rough guides.

The value of the model, however, is to focus our mind on the importance of investment returns over the course of a superannuation/pension funds life, and particularly to emphasise how important those returns are during the pension phase of a fund.

Frequently Asked Questions about this Article…

The 10/30/60 rule is a retirement planning guideline suggesting that 10% of your retirement fund comes from contributions while working, 30% from investment earnings during the working phase, and 60% from investment earnings during retirement.

In the Australian superannuation context, the 10/30/60 rule is reasonably applicable. It highlights the importance of investment earnings, which make up the majority of a superannuation fund's value over a lifetime.

Early superannuation contributions are crucial because they allow your fund to benefit from compounding investment earnings over a longer period, significantly boosting the fund's value by the time you retire.

Asset allocation is vital in retirement funds as it balances growth and defensive assets. A well-chosen mix can enhance returns and provide stability, while poor allocation, like investing solely in cash, can severely limit potential earnings.

Investment earnings are the primary driver of superannuation fund growth, contributing over 80% of the fund's value. This underscores the importance of strategic asset allocation and managing fees and inflation.

For everyday investors, the 10/30/60 model emphasizes the importance of maximizing investment returns, making early contributions, and carefully selecting asset allocations to optimize retirement fund growth.

Making additional contributions, especially early in your career, can significantly enhance superannuation outcomes by increasing the fund's investment earnings potential, leading to a larger retirement balance.

Challenges include fluctuating investment returns due to economic conditions, changes in legislation, and personal financial circumstances, which can all impact the effectiveness of the 10/30/60 rule as a retirement planning tool.