How much do Aussies pay for financial advice?

Have you felt like you've been spending more for the same essential goods and services over the past several years? You would be correct.

Milk and cheese are both 35% more expensive than in 2019. Automotive fuel is up 47%. Even a visit to the vet costs an extra 30%.

With the cost of living continuing to climb, it's little surprise that the cost of financial advice is also rising.

The 2024 Australian Advice Landscape Report by Adviser Ratings revealed the median ongoing fee for financial advice increased by 7% from $3,710 to $3,960 over the past twelve months and is 58% higher than five years ago.

The uptick reflects inflationary headwinds in addition to the implementation of several regulatory, education and compliance obligations post the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Advice unaffordability has also been compounded by a 34% reduction in the adviser workforce.

Subsequently, the gap between what consumers are willing to pay, and the fees charged by advisers, continues to widen.

What Aussies are willing to pay for advice

Consumers are willing to pay an average of $911 for financial advice, according to the report. Among Aussies who don't have a financial adviser, this amount falls to $553 and is lower than the $651 consumers were willing to pay in 2022.

The net result is financial advice becoming increasingly inaccessible to a growing number of consumers, with the advised population falling from 13.9% in 2019 to 10.4% today.

The high cost of advice coincides with the cost-of-living crunch, as higher interest rates and inflation erode household purchasing power.

More than 50% of respondents reported being worse off or in the same position compared to one year ago. What's more, 43% said they did not have sufficient savings for an emergency fund.

Data from the Australian Bureau of Statistics confirms budgets are particularly stretched, with households saving less than 1% of their income after accounting for expenditure.

Before the pandemic, the percentage trended around or upwards of 5%.

"This financial pressure has a dual effect," the Adviser Ratings report said. "It heightens consumer awareness of the need for advice while simultaneously reducing their ability to afford it."

Advice demand remains robust

Notwithstanding the cost, demand for financial advice remains robust and growing.

The proportion of unadvised consumers considering seeking professional advice has increased to 24% (2.3 million Australians) - up from 20% in 2022.

Some of the topics clients are asking about include retirement income (63%), recession potential and the impact on their portfolio (36%), helping the next generation invest (22%), ETF investing (19%), ESG investing (17%) and cryptocurrencies (14%).

A separate report published by Deloitte and Iress forecasts the advice industry to grow 34% by the end of the decade. "What's clear though is that advice business models must evolve to capture this demand effectively, as well as adapt to better reflect the breadth of needs from consumers," Iress CEO Marcus Price said.

Low-cost alternatives

The need for affordable and effective financial advice has spawned several lower-cost digital solutions, such as InvestSMART, for investors to manage, trade and invest their savings.

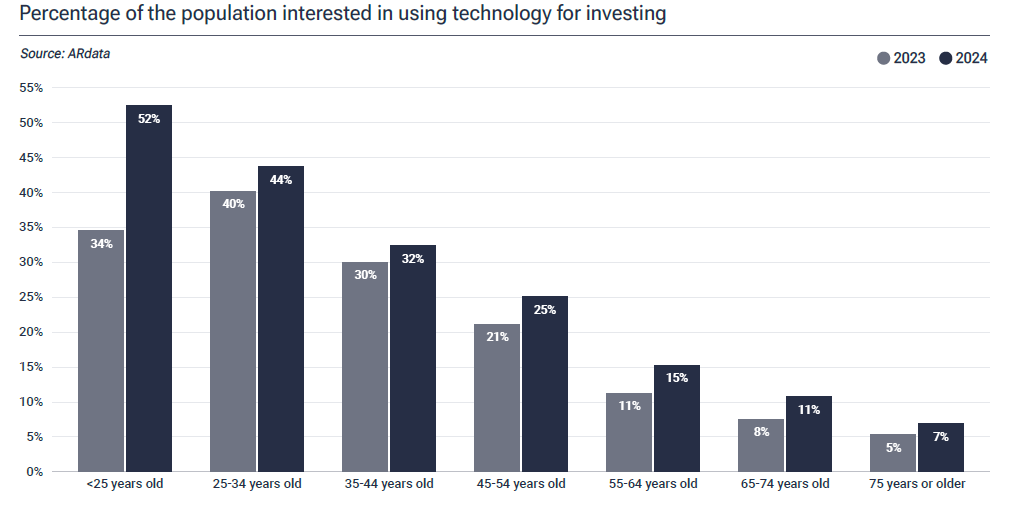

While less than one in three have adopted digital solutions, Adviser Ratings noted there is a clear annual increase in the intention to use these technologies across all age groups, but particularly among younger Aussies.

Source: 2024 Australian Advice Landscape Report by Adviser Ratings

Digital investing typically has significantly lower upfront and ongoing costs compared to a financial adviser, as well as less onerous minimum account balances.

Indeed, Adviser Ratings concluded that only 6% of advisers offer fees below $1,500 for new clients.

Other benefits include instant diversification and the ability to cater investments to your risk profile.

The 2023 Financial Advice Report from Investment Trends found that 76% of consumers prefer digital tools to a human adviser for fees up to $300. Close to 4 million Australians would be open to low-cost digital advice solutions if the right conditions were met, according to Investment Trends.

Frequently Asked Questions about this Article…

According to the 2024 Australian Advice Landscape Report by Adviser Ratings, the median ongoing fee for financial advice in Australia has increased to $3,960, which is 58% higher than five years ago.

The rising cost of financial advice in Australia is attributed to inflationary pressures, regulatory changes, and a reduction in the adviser workforce following the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

On average, Australians are willing to pay $911 for financial advice. However, among those without a financial adviser, this amount drops to $553, which is lower than the $651 they were willing to pay in 2022.

Despite the high costs, demand for financial advice remains strong, with 24% of unadvised consumers considering seeking professional advice, up from 20% in 2022.

Australians are particularly interested in topics such as retirement income, recession potential, helping the next generation invest, ETF investing, ESG investing, and cryptocurrencies.

Yes, there are several low-cost digital solutions available, such as InvestSMART, which offer significantly lower upfront and ongoing costs compared to traditional financial advisers.

While less than one in three Australians currently use digital financial advice solutions, there is a growing intention to adopt these technologies, especially among younger Australians.

Digital financial advice tools offer benefits such as lower fees, instant diversification, and the ability to tailor investments to individual risk profiles. They are particularly appealing to those who prefer fees up to $300.