How home owners are coping with higher rates

We are always told to save for a rainy day, but the kitty is starting to run dry for many Australians. Research by RFI Global shows that over the last six months, savings have been in decline as consumers juggle a cost of living crunch and successive interest rate rises.

While some of us have been more impacted than others, Aussies have, on average, eaten into their total liquid savings by about $1,000.

|

How savings are changing |

|||||||

|

|

Under 35 years |

35-54 years |

55 years |

Total 18 years |

|||

|

|

Mortgage |

None |

Mortgage |

None |

Mortgage |

None |

Overall |

|

Liquid assets – May 2023 |

$64,000 |

$33,000 |

$67,000 |

$57,000 |

$57,000 |

$83,000 |

$61,000 |

|

Change since Nov 2022 |

-$2,600 |

-$4,600 |

-$900 |

$800 |

-$2,500 |

$1,800 |

-$1,000 |

|

Source: RFI Global |

|||||||

Young consumers relying on savings

As the table above shows, a story is emerging of younger consumers finding it more difficult to cope – regardless of whether they have a mortgage – and as a result are relying more on savings to make ends meet than older consumers.

The alarm bells definitely start ringing when households have to dip into savings to get by. No one has a bottomless pit of spare cash, so it’s a short term strategy at best. And the more personal savings are depleted, the less we’re able to weather financial storms such as unexpected or emergency bills.

What’s interesting is that despite the fiscal challenges, a Canstar survey found almost half (47%) Australian mortgage holders are using a variety of strategies to manage higher home loan repayments.

The top move is cutting back extra repayments (35%). This is closely followed by stopping extra repayments altogether (29%), tapping into redraw or offset funds to help with repayments (26%), refinancing to a lower rate loan (22%) and extending the loan term (12%).

Other changes include switching to interest only payments (10%), and more drastic moves such as selling the home (7%) or an investment property (4%).

How different strategies could impact your loan long term

On one hand it’s great that almost half of Australian borrowers are finetuning their home loan strategy. Many borrowers have also used the low interest era through the pandemic to prepare for higher rates by making extra repayments, or growing the balance of their offset account.

Fast acting on their finances may be why one in two (50%) borrowers say they are coping okay right now, and 8% say they’re thriving. Of course, this could all change once the full effect of the rate hikes to date is felt by households, and if the Reserve Bank continues to slog borrowers with further rate rises.

The catch with changing the way we manage our mortgage is that it can have long term repercussions.

Let’s take a look at five of the main mortgage strategies in terms of immediate savings and also the possible downsides over time:

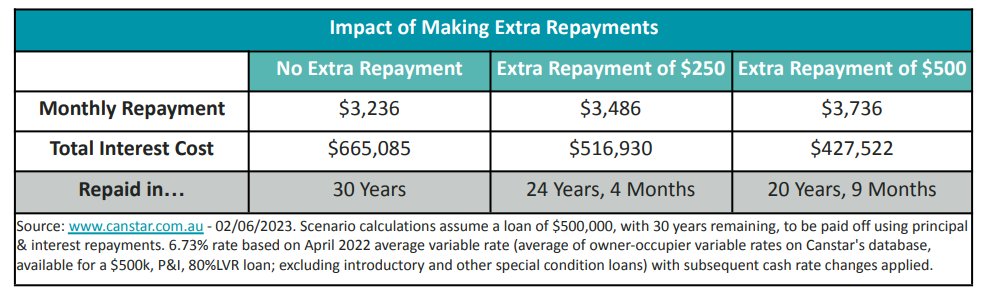

1. Reducing or stopping extra repayments

Culling extra repayments of $250 per month on a $500,000 loan with a term of 30 years, can cut monthly repayments to $3,236. However, by stopping or reducing extra repayments, borrowers are not getting ahead on their loan.

Borrowers who want to save interest and pay off their loan sooner should ideally top up their repayments again once they’re in a position to do so.

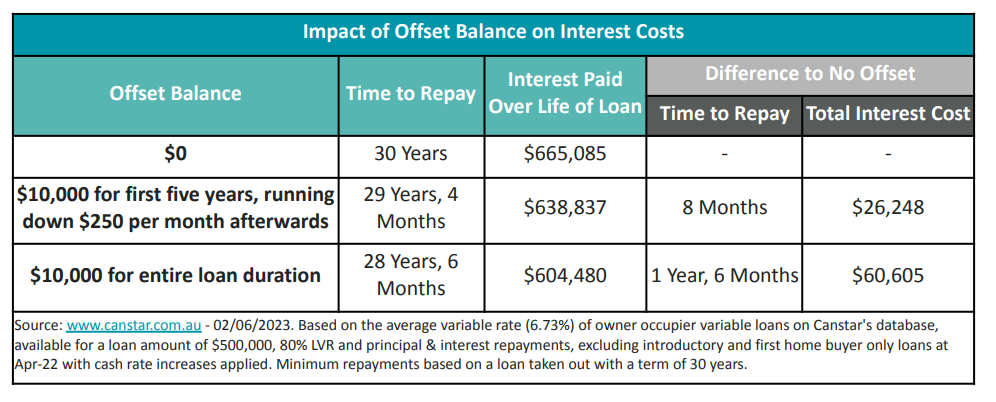

2. Tapping into offset accounts

Offset balances reduce the monthly interest charged to the loan and shorten the life of the loan. Progressively raiding the balance of an offset account will return the loan term closer to the original timeframe.

A borrower with a $500,000 loan over 30 years who has, say, $10,000 in their offset account for the life of the loan, will likely repay their loan one year and six months earlier and save $60,605 in total interest when compared to having no offset balance.

However, if five years into the loan the borrower progressively dips into the $10,000 offset balance to cover rising repayments, they will repay the loan only 8 months earlier and save $26,248 in interest compared to if they didn’t have any money in their offset account during this time.

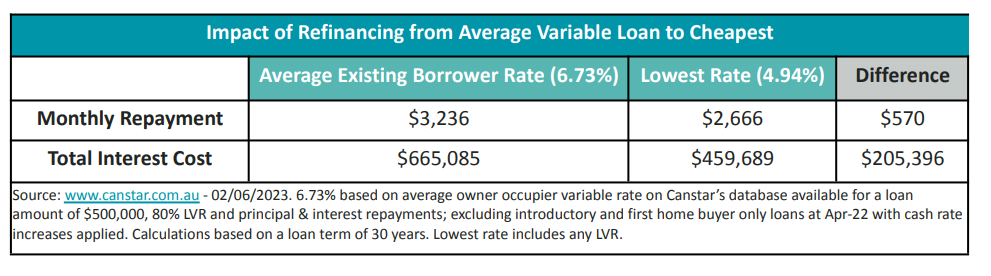

3. Refinancing: Is it still an option?

Refinancing into a lower rate loan can be one of the least painful ways to cope with higher interest rates. Borrowers who switch to some of the lowest rate loans on the market can potentially save around half the repayment increases that have come through in the last 12 months.

As a guide, switching from the average variable rate of 6.73% to one of the lowest variable rates – 4.94% with The Mutual Bank, can cut monthly repayments on a $500,000 loan over 30 years by $570. It’s a strategy that can help home owners cope with rate increases without drastic changes to their lifestyle.

That said, refinancing is not for everyone. Those who purchased a home around May last year before the Reserve Bank embarked on its rate tightening cycle, likely paid high property prices, often requiring a larger loan. Many of these borrowers may find the option to refinance is no longer open to them. Alternatives can include finding savings in household budgets, supplementing income in some way to cover higher repayments, or contacting a lender to discuss hardship variations.

These variations tend to be available to borrowers who have exhausted their own resources. The two strategies listed below can bring financial relief though they both come with costs.

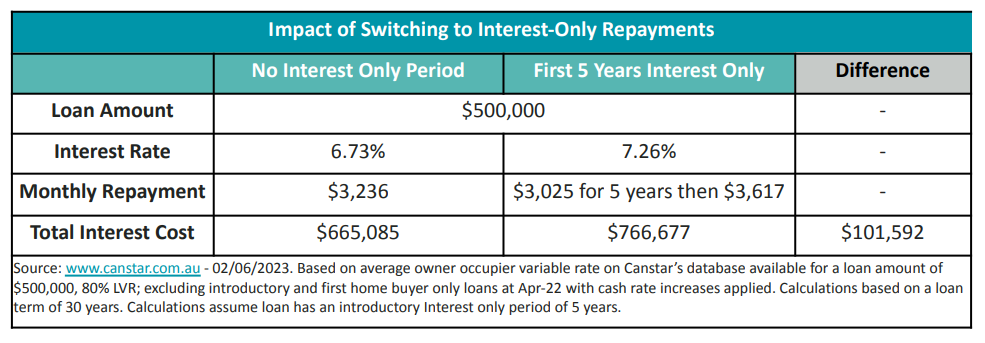

4. Switching to interest only repayments

Moving from principal plus interest to interest only repayments will reduce the repayment burden. Unfortunately it really only kicks the can down the road. When the interest only period ends, the repayment is not just restored to the former level but goes up to compensate for the period of zero reduction of the loan balance.

For context, switching to interest only payments for a 5-year period on a $500,000 loan over 30 years can cut monthly repayments by $211. However, the combination of a higher interest rate and making up principal loan repayments for the remaining 25 years will increase the total interest costs by over $100,000.

5. Extending the loan term

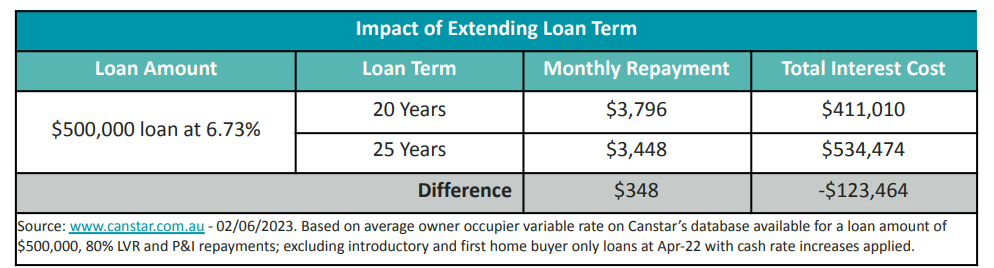

Extending a loan term by five years up to 25 years on a $500,000 loan could cut monthly repayments by $348. The trade-off for this immediate respite is that the total interest paid by the end of the loan term jumps by a whopping $123,464.

The solution is to increase loan payments once you’re financially able to, in order to get the loan back to its original trajectory.

If you are struggling with mortgage repayments, the important thing is to act fast and speak to your lender. Do this before the loan becomes too big a problem to manage, and the only way out is to sell.

Frequently Asked Questions about this Article…

Many Australians are adjusting their financial strategies to cope with higher interest rates. This includes cutting back on extra mortgage repayments, tapping into redraw or offset funds, refinancing to lower rate loans, and in some cases, extending loan terms or switching to interest-only payments.

Higher interest rates have led many Australians to dip into their savings to manage increased living costs and mortgage repayments. On average, Australians have reduced their liquid savings by about $1,000 over the past six months.

Mortgage holders are employing various strategies such as reducing or stopping extra repayments, using offset accounts, refinancing to lower rates, switching to interest-only payments, and extending loan terms to manage higher repayments.

Refinancing to a lower rate loan can be an effective way to manage higher interest rates, potentially saving borrowers significant amounts on monthly repayments. However, it may not be an option for everyone, especially those who bought homes at high prices recently.

Switching to interest-only payments can reduce immediate repayment burdens but increases total interest costs over the life of the loan. Once the interest-only period ends, repayments will increase to cover the principal, leading to higher overall costs.

Extending a loan term can lower monthly repayments, providing short-term relief. However, it significantly increases the total interest paid over the life of the loan, making it a costly long-term strategy.

If you're struggling with mortgage repayments, it's crucial to act quickly. Contact your lender to discuss possible hardship variations or other solutions before the situation becomes unmanageable.

Younger Australians are finding it more challenging to cope with the current financial climate, often relying more on their savings to make ends meet compared to older consumers. This reliance on savings is a short-term strategy that can deplete financial reserves.