Helping the kids on the path to home ownership

“I’d really like to see you guys in your own home.” These were the words of my mother on her last trip down to Melbourne to see her first grandson. I could tell it meant a lot to her. For many, buying your first home is the financial goal that dominates the first half of your life. For parents, seeing their children with keys in hand to their own property is a dream.

With the state of Australian house prices, the reality of reaching this dream seems out of reach, and many parents ask themselves, “What can I do to help?”. InvestSMART Director Effie Zahos recently wrote this piece about whether you should help your kids and a few ways to go about it. Here, we’ll look at helping them invest and grow their own nest egg.

How much will I need?

How long is a piece of string? Of course, this amount is going to differ for everyone. As a (very) rough guide, here’s a table showing the average property value across the states from the most recent ABS data.

|

State |

Mean price |

20% Deposit |

|---|---|---|

|

NSW |

$1,177,700 |

$235,540 |

|

ACT |

$991,500 |

$198,300 |

|

VIC |

$938,900 |

$187,780 |

|

QLD |

$782,300 |

$156,460 |

|

SA |

$669,500 |

$133,900 |

|

WA |

$640,700 |

$128,140 |

|

TAS |

$685,000 |

$137,000 |

|

NT |

$542,100 |

$108,420 |

How long will it take to save?

The second 'how long is a piece of string' question. This will depend on your starting point, how much you can save and what you choose to do with those savings, e.g. term deposit, invest etc.

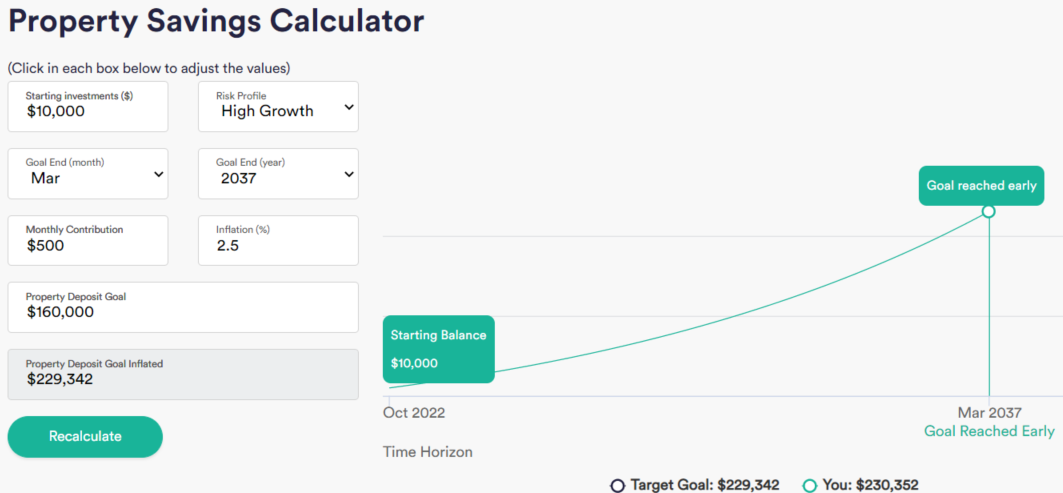

In our Property Savings Calculator below, I've put in a starting balance of $10K, a high growth profile and a $500 monthly regular contribution. Taking the middle ground in the table above, I’ve put down a deposit amount of $160K as my target. As you’ll see, with these inputs, you’ll hit the goal in 15 years.

The risk profile chosen here gives you an annualised return of the average high-growth investments available.

Of course, everyone’s circumstances will be different. Jump across to the Property Savings Calculator and see where you stand. Also, remember to prepare to be flexible. Your circumstances will change, and how much you can add month to month may change.

What are your investment options?

One of our most popular articles for the year was by InvestSMART Director Effie Zahos. In her article, 5 Ways to Start Investing for your Kids, Effie discusses savings accounts, bonds, direct shares and ETFs. Additionally, an InvestSMART Professionally Managed Account can put your investing on autopilot.

Set up with an adult as trustee for a minor, an InvestSMART PMA invests in a combination of ETFs selected and managed by our team. It rebalances automatically and has a set-and-forget regular contribution plan. When the child turns 18, you can transfer ownership. It’s common for parents or grandparents to set up an account with the family transferring in funds for birthdays etc. You can also read more about this account type and others in our Help Centre.

Fundlater

Another approach is using Fundlater. Fundlater uses the same account set-up and investment portfolios as the InvestSMART PMA, but instead of having to stump up $10K to get started, you can open an account for $4K, InvestSMART provides a loan of $6K, and you pay the loan back over the period of 20 months.

Unlike a margin loan, a Fundlater account is a non-recourse loan. We understand asset values ebb and flow and don’t penalise investors for this. InvestSMART Fundlater also has a Help Centre.

We have a number of clients who have opened accounts for their kids and have come up with novel ways to keep them engaged and progressing to building their wealth. Some go halves in the repayments, others put up the initial sum and the kids pay back the loan. Our CEOs daughter opened an account with her savings, and he pays the installments if she continues to pass her exams at uni.

Helping your children save for a deposit doesn’t always have to mean stumping up a large one-off sum, especially if you get the chance to start early and chip away at it. Have a play with the calculators, see the timeframe and set a plan up together.