Getting the most from LICs

| Summary: The variety of LICs is a welcome relief to investors frustrated by traditional fund managers. Free of the constraints imposed by the open ended format, good LIC managers can pick stocks and deploy interesting investment strategies which would be difficult for most retail investors to manage themselves. |

| Key take-out: Beware of buying LICs when they are priced at a strong premium to their net tangible assets – but keep your eye on your favourites, which may become better value when their price returns closer to par, or when market conditions change. |

| Key beneficiaries: General investors. Category: Investment Portfolio Construction. |

The big ticket item for David Murray’s Financial System Inquiry should be to question the prevalence of “benchmark aware” traditional fund managers on the investment menu of our major banks and life companies.

The majority don’t even beat their benchmark – which is a sharemarket index and hence irrelevant anyway for most investors. This leads to what Alan Kohler berated recently as the “socialisation of investing” – buying shares in patterns which hug the index and using an active trading approach to try to beat the market (and often failing to do so). Thankfully, the vibrant Listed Investment Company (LIC) sector has been championing a different approach for decades – typically buying and holding quality stocks to generate long-term growth and the potential for rising dividends to boot. Not all LICs are created equal – with a growing number offering specialist investment mandates under the umbrella of a listed product – so let’s take a look at three different LICs covering a wide spectrum of investment styles.

Why are LICs “closed ended” and what does that mean for investors?

Many investors will be familiar with the long-standing favourites in the LIC space: Argo, AFIC and Milton (these three account for nearly 80% of the total value of LICs traded last month). Each of these invests in the large cap end of the ASX and by picking wisely, and they have a long-term track record of growing profits and rising distributions. Each has its own formula for identifying good stocks, with the common feature that profits realised when a position is sold down are reinvested into new holdings.

Unlike actively managed funds which pay out their trading gains, these traditional LICs retain profits and look to growing dividends on investments to fund distributions to their investors. They use what I call the “Landlord Effect” – where the income from the investment is the primary driver of returns.

LICs can avoid the temptation to peg their returns and investment philosophy to a sharemarket index because, unlike traditional managed funds, LICs are “closed ended.” Once their IPO has closed their shares are listed on the ASX: investors use the ASX for liquidity and aren’t able to request the LIC to redeem their shares. So, unlike traditional “open ended” managed funds, which are permanently in fear of the potential of a run on their fund (and have to invest with liquidity as a primary objective), LICs can safely adopt the long-term, buy and hold style. LICs lend themselves to using concentrated portfolios, so instead of spreading their investments across more than 100 different stocks like traditional managed funds, they may hold 20-30 different stocks which they turn over infrequently.

Lots of LICs were founded by broking houses, and never bought into the “perfect market” fairytale that is the other driver for the index-hugging style of traditional managed funds – which assumes that share prices are an efficient gauge of value (and hence by following the index with minor tweaks, “optimal” returns can be achieved).

The closed ended approach is both liberating, as well as frustrating for many LICs: which often trade at large premia or discounts to their net tangible asset backing, in line with the vagaries of market demand for them. This doesn’t need to be fatal for investors, who can benefit by buying an LIC when it’s trading below its net tangible assets (NTA) – so let’s turn to an analysis of three “category killers” that you may want to add to your investment radar.

Djerriwarrh – an equity income favourite

Djerriwarrh (ASX Code: DJW) is one of the most popular LICs, which unfortunately for incoming investors translates to its current premium of 31.6% to NTA. For new investors this means that only 68.4% of their investment is put to work in the underlying strategies employed by Djerriwarrh. Djerriwarrh is an equity income style LIC and its success and popularity of this theme is the main reason for its strong premium to NTA. Its yield is currently around 5.7% per annum plus franking and, expressed as a return of NTA, this shows the company is generating a yield of around 8.3% pa on its underlying investments.

Financial Summary | ||||||||||||||||||||||||||||||||

|

The company spreads its investments across ASX stocks, which typically also have exchange-traded options listed in respect of them. It uses the “buy-write” style of selling call options to enhance its income, such that distributions are comprised of cash dividends received on portfolio holdings plus additional income from the option premia generated through the buy-write approach.

The market capitalisation of Djerriwarrh is just over $1 billion at current prices and the company’s website discloses its current top holdings: http://www.djerri.com.au/. Around 70% of the total value of the company was invested in 20 stocks (as at January 2014 – last data publically available) and these closely resemble the ASX 20 index. Management fees for the year ended June 30, 2013 were 0.39% – a great rate in comparison to more expensive managed funds.

One of the strong features of the company is that it is an active manager of the buy-write strategy. This is a notoriously difficult strategy to master, especially for retail investors – requiring skills not just for the initial evaluation of trades but also in the ongoing position management – where the aim is to limit the frequency of options becoming exercised against the seller. In this regard, the company states that it actively monitors option market conditions to balance the income it generates by selling options, against the opportunities for medium to long-term capital growth. As a result, the amount of the portfolio against which options are sold ranges between 20% to 50% pa.

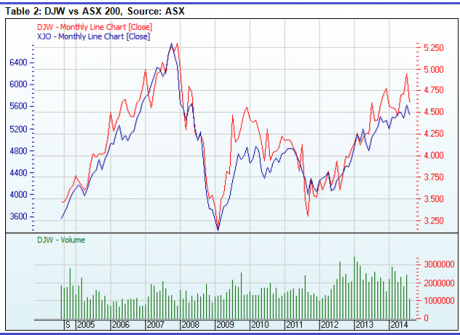

This approach is consistently successful, with a long-term history of outperformance vs the ASX 200 (of course, performance calculations will vary from the data shown below depending on the price at which an investor enters the stock):

Cadence Capital – Combining Fundamentals and Technicals

Cadence Capital (ASX Code: CDM) overlays fundamentals with technical analysis, and a variety of techniques including limited short selling to enhance the way it invests in stocks. CDM uses a concentrated approach with stock picking based on fundamentals, and with timing of entry and exit into and out of positions guided by momentum and volume metrics.

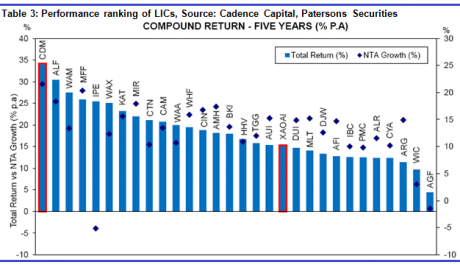

It does its job well, ranking as the best performing LIC over the last five years:

One of the problems with the long-term, buy and hold approach is that markets don’t always trade based on the fundamentals of stocks. Graham and Dodd were the academic pioneers of the “fundamentals” approach, and Warren Buffett is perhaps their greatest advocate. Long-term investors can hope to weather financial market storms and underpin their portfolio construction by using fundamentals to identify good stocks. But markets increasingly are dominated by “hot money” – primarily the leverage added to hedge funds by their prime brokers, and principal traders who dominate derivatives markets.

Hedge funds and traders operate within a simple risk management environment – when the prices of their investments fall, they sell down their positions to keep within the risk limits imposed upon them by their backers. Whether they are operating in futures markets like the Chicago Board of Trade, or with leverage provided by prime brokers, their “value at risk” limits are set by the amount of capital they use to back their positions – such that a falling asset price which increases the Value At Risk (VAR) will trigger a forced sale (irrespective of the “fundamental” value of the asset/s).

We saw in the global financial crisis how contagion in exotic credit assets quickly spread into other major asset classes – driven by traders and hedge funds liquidating solid investments to cover the margin calls being made against their exotic assets.

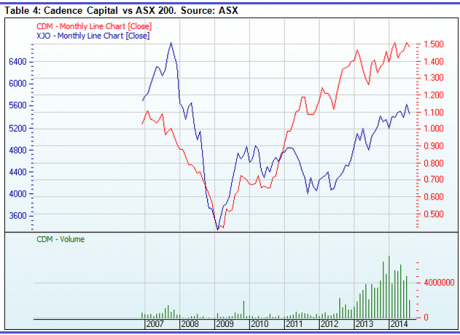

The technical techniques used by Cadence – which tracks momentum signals to limit exposure to positions that are under pressure – seek to overcome the problems caused by “hot money” traders.

Cadence is one of the up-and-coming LICs, with some impressive metrics recognising the sophistication of the stock picking approach it uses:

- Fund Under Management (FUM) of $270 million;

- One of the top five most actively traded Australian equity LICs on the ASX;

- CDM’s historic yield 7.9% fully franked (11.3% grossed-up) (as at January 31, 2014);

- 65% of current investors are SMSFs;

- 4,800 shareholders, 300% increase over 12 months.

Cadence charges a base management fee of 1% pa plus an outperformance fee. Details of its key portfolio holdings and tables showing the use of long and short positions are available at www.cadencecapital.com.au. Cadence uses a range of sophisticated techniques which would not readily be available to retail investors and has a strong record of outperformance compared to the ASX 200. At current levels it is trading at a modest premium to its NTA of 7.9%.

Van Eyk Blueprint Alternatives – Exotic and Uncorrelated

This LIC (ASX code: VBP) is not for the fainthearted but delivers a true to label “alternative” exposure to a wide range of relatively exotic alternative assets and trading strategies. Wrapped in the form of an ASX-listed unit trust it invests into an unlisted trust managed by one of Australia’s leading research houses, van Eyk Research. The portfolio is designed to be relatively uncorrelated with traditional asset classes and therefore would be expected by its promoters to perform well in periods of general market distress.

Unlike normal LICs the van Eyk Alternatives fund allows for direct unit issuance and redemptions, although liquidity via the ASX (with a T 3 settlement cycle) is enhanced compared to the T 10 settlement cycle quoted for off-market redemptions).

The van Eyk Alternatives fund is truly alternative: its current investment menu comprises “Absolute Return Strategies” and “Alternative Assets”:

Absolute Return Strategies

Global Macro - aims to profit from shifts in global economies;

Fixed Income Macro - long and short positions in global fixed income and currency markets;

Absolute Equities - directly linked to the performance of the equity market (directional) and those that are not (non-directional, such as “volatility” trading);

Alternative Beta – quant based, rules based trading strategies.

Alternative Assets

Commodities - Commodities funds can invest in both hard (metals) and soft commodities (agriculture);

Gold

Direct Property – including via listed securities and unitised property schemes in specialised sectors such as land, hospitality and tourism, aged care, health care and education. (Source: van Eyk).

The van Eyk Blueprint Alternative fund has underperformed the ASX 200 since the GFC and despite its wide range of assets – which do exhibit low internal correlation and correlation with major asset classes – has not been able to match the pace of recovery of the Australian equity market. That being said, alternatives funds can be a useful part of an overall portfolio and do have the potential to rally in turbulent markets. For example, the volatility trading strategies embedded within this fund would be expected to strongly outperform during periods of heightened equity market volatility, such as during a sharp market correction.

Conclusion

The variety of LICs is a welcome relief to investors frustrated with the “socialisation of investing” typical of traditional fund managers. Free of the constraints imposed by the open ended format, good LIC managers can pick stocks and deploy interesting investment strategies which would be difficult for most retail investors to manage themselves. Beware of buying LICs when they are priced at a strong premium to their NTA – but keep your eye on your favourites, which may become better value when their price returns closer to par, or when market conditions change.

Dr Tony Rumble provides asset consulting services to financial product providers and educational services to BetaShares Capital Limited, an ETF provider. The author does not receive any pecuniary benefit from the products reviewed. The comments published are not financial product recommendations and may not represent the views of Eureka Report. To the extent that it contains general advice it has been prepared without taking into account your objectives, financial situation or needs. Before acting on it you should consider its appropriateness, having regard to your objectives, financial situation and needs.