Four takeover themes for the year ahead

Summary: I expect takeover activity in a variety of categories this year, especially financial services, agribusiness, utilities and resources. I'm watching annuities and funds management specialist Challenger after a recent share price fall. Mortgage Choice's share price has fluctuated, but CBA will eventually look to increase its holding. In agriculture, I like Nufarm, Graincorp and Bega Cheese. Yield stocks such as Transurban and Spark Infrastructure are real targets. |

Key take-out: Prices for oil, gas and iron ore have collapsed recently. But from a takeover perspective, the only resources company I'd consider right now is Rio Tinto. |

Key beneficiaries: General investors. Category: Shares. |

2015 is shaping up as a lively year for takeover activity. Looking at the ASX from a broad perspective I see both positive and negative indicators for mergers and acquisitions action in the months ahead.

On the plus side, equity markets remain firm, the A$ has weakened substantially (good for foreign predators) and interest rates are at record lows. This latter factor ensures the “hunt for yield” remains well and truly alive.

On the minus front, the prices of oil and iron ore have collapsed to multi-year lows. The wars for market supremacy being waged by the Saudis against American shale producers (oil and gas) will cause trouble. Not to mention the specific efforts of Rio Tinto, BHP Billiton and Vale against just about everyone else in iron ore which will also leave casualties in their wake.

Across the board I am expecting takeover activity in a wide variety of market categories, though four areas stand out: financial services, agribusiness, utilities and the wider resources business led by oil and gas.

Here are my targets to watch:

Challenger (CGF)

This company runs both a life insurance business specialising in annuities and a funds management arm. It is leveraged to both the growth in superannuation assets (almost guaranteed by Australia's rising super levy), and the increasing number of baby boomers looking to fund retirement using their accumulated savings.

Recently CGF's share price fell after one of its annuity products was adversely affected by a Department of Social Services ruling. In the longer term this hiccup shouldn't affect Challenger's core business. In addition it's highly likely the David Murray-chaired Financial System Inquiry will encourage greater reliance on retirement income products – especially in the aforementioned era of ultra-low interest rates.

Mortgage Choice (MOC)

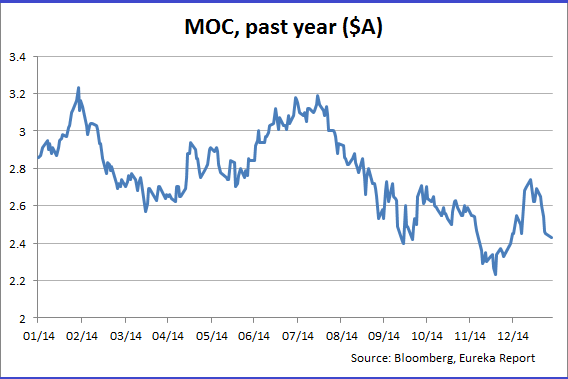

Since I wrote about this company in Eureka Report last year (see Three hot takeover buys, January 29, 2014), MOC's share price has risen, fallen and risen again. I still think this stock remains a takeover target for one of the major banks looking to grow in the super-competitive mortgage space. Although customers prefer their mortgage brokers to be independent of the banks whose loans they sell, MOC's major competitor (Aussie Home Loans) manages to prosper as a wholly-owned subsidiary of a Big Four bank.

At present MOC has on its register the Commonwealth Bank (CBA also controls Aussie Home Loans with an 80% interest). Eventually CBA will look to increase this ownership, which under Australian takeover rules can only occur with a bid for all the outstanding shares.

Nufarm (NUF), Graincorp (GNC) and Bega Cheese (BGA)

Agricultural stocks are a good place to be right now. Weather patterns generally have been favourable in key Australian farming regions and Asian demand for Western foodstuffs (e.g. wheat, beef and dairy) continues to grow.

The three listed companies I like in this sector are Nufarm (agricultural chemicals), Graincorp (grain handling) and Bega Cheese (a dairy business based in, er, Bega NSW). NUF is the pick-and-shovel seller to the sector. Japan's Sumitomo owns a large minority stake in the company, and will eventually look to take it over completely.

Twelve months ago newly-installed treasurer Joe Hockey declared a generous bid by US predator Archer Daniels Midland (ADM) for GNC contravened Australia's national interest. Since then ADM has maintained its 20% stake in GNC, and thanks to a bone thrown by Mr Hockey has permission to increase this shareholding to 25%.

Eventually I think ADM will present the treasurer with a restructured bid for GNC.

While the original GNC bid was being fought, Warrnambool Cheese and Butter shareholders enjoyed a competitive takeover ultimately won by Canadian dairy giant Saputo. Since then Bega Cheese shares have traded in a tight range of $4.80 to $5.40 as investors speculate on a similar bid.

With a market cap of $770m, Bega is only a fraction of Warrnambool's size. Listed dairy companies are, however, few in number, making BGA a definite target for another foreign bidder.

Transurban (TCL) and Spark Infrastructure (SKI)

Just six months ago it seemed the next move in Australian interest rates might be up. Since then, however, the European Central Bank has embarked on a program of money printing, China has slowed and the Australian economy is weaker.

As a result of these factors interest rates are steady and may even fall further. In this environment shares with predictable cash yields are highly sought. Telstra (TLS) has been a prime recipient of this “hunt for yield” with its share price hitting multi-year highs recently.

While I doubt TLS will be taken over, other yield stocks such as Transurban and Spark Infrastructure are real targets.

TCL has received bids in the past, primarily from infrastructure-loving Canadian pension funds. Fortunately for TCL shareholders, the company's board rejected such overtures and its shares have continued to rise. At a cash yield of 4.1% (plus some franking), Transurban isn't cheap – but any debt used to finance its potential purchase is far cheaper.

Spark is a regulated energy utility with highly predictable cashflows. Its yield hovers around 5.2% unfranked (the latter due to its trust structure), with gradual payout increases forecast for years ahead.

The same longer term pension funds looking at Transurban may eventually cast their eyes over Spark. Around the developed world the aforementioned bulge of retiring baby boomers need stable incomes to support them in their twilight years. Thus providers of annuities (CGF) and generators of cashflow (TCL and SKI) are attractive businesses.

Oil, gas and iron ore

The recent collapse of prices for these commodities has been well covered in Eureka Report. From a takeover perspective, is it time to catch the falling knife and buy quality producers at bombed-out prices? Well, right now the only significant resources company I'd consider a key target is Rio Tinto.

Oil and gas producers have been hard hit by the war for market dominance between Saudi Arabia and the North American “frackers” i.e. the American fracking specialists which have greatly boosted US oil capacity.

Because Saudi is a state and not a company, it's capable of pumping excess oil for years to destroy the competition. For this reason it's too early to expect takeover action at the likes of Santos or Woodside whose share prices have already suffered.

Iron ore prices have slid because of output increases from the likes of BHP, Brazil's Vale, Gina Rinehart's Hope Mining and Rio Tinto. Casualties of this production war include Atlas Mining and Fortescue Metals, neither of which are making any money with ore below $US70 per tonne.

Last year Rio received a merger proposal from Swiss-based Glencore. While this was never put to shareholders, Glencore will be watching Rio's reaction to the iron ore price slump with great interest. Should these two companies merge, around $4bn in synergies could be extracted from the deal.

In the meantime, Rio's low cost of production means it remains healthily cashflow positive at a time when smaller producers are struggling. Eventually rationality will re-emerge amongst the big iron ore miners, and Rio will be one of the survivors. Therefore it remains a target.

Tom Elliott is a director of Beulah Capital and MM&E Capital.